Table Of Contents

What is Pitch books in Investment Banking?

PitchBook is an information layout or presentation that the investment banks use, business brokers, corporate firms, etc. that provides the firm's main attributes and valuation analysis, which help the potential investors to decide whether they should invest in the business of the client or not and also this information is known as Confidential Information Memorandum which the sales department of the firm uses to help them sell products and the services to attract new clients.

Investment Banking Pitchbook is the word most dreaded by the Analysts and Associates in any investment bank. I must tell you that making a Perfect Pitchbook lies the secret behind bagging those million-dollar deals. And that is why Investment Bankers work for a hundred hours a week.

If you happen to go through the Typical day of an Investment banker, you will notice how they work day and night, putting all the numbers together for the perfect Pitches.

Table of contents

- PitchBook is an information layout or presentation commonly used by investment banks, business brokers, corporate firms, and others.

- It typically includes details about a firm's main attributes and valuation analysis, which can help investors decide whether to invest in a client's business.

- It is often considered a Confidential Information Memorandum (CIM) and is used by the Sales department to pitch products and services to potential clients.

- PitchBook can be used for various purposes, including as a marketing device, to provide clear investment actions and contribute to the investment bank's overall operations.

PitchBook Simple Example

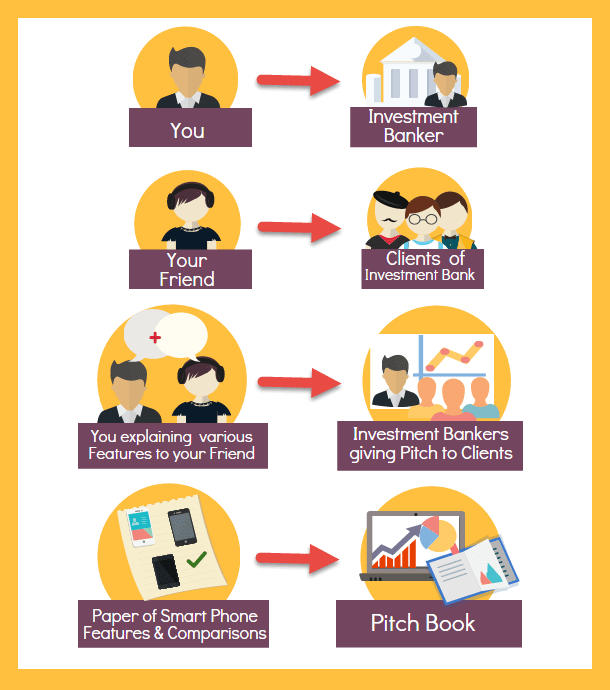

Suppose your friend wants to buy a new Smartphone. He is new to smartphones and is unsure of the configurations or comparisons. On the other hand, you are an expert in smartphones, and you like to keep yourselves updated with the latest trends, technologies, apps, pricing, features, etc.

They are now assuming that your friend seeks your advice on which smartphone to buy?

You agree to help your friend prepare a rough written draft writing down key features of the best 2-3 smartphones, their configuration, reviews, best buy price, etc. With this, your friend has a fair idea of which smartphone to buy; he can further decide to go for the suggested smartphone.

Let us compare this example to the Investment Banking example as follows:

You: Investment Banker (expert)

Your Friend: Client of Investment Banking firm (who needs advice, help)

Your explaining key features of a smartphone: Investment Banker Pitch

Paper of SmartPhone Features & Comparisons: Pitchbook

The investment bankers talk about how they are best in the industry and give clients all the data and information about a special deal through an Investment Banking Pitchbook.

Uses of Pitch Books

#1 - They are Marketing devices

- They act as a marketing device used by all the investment banks worldwide.

- It is indispensable to the investment banks while marketing themselves to the clients.

- It exemplifies valuable and comprehensive marketing material.

- They act as the starting point of the initial pitch or sales introduction for the investment bank when it is trying to seek new business.

#2 - Should have Investment Actions well specified

- It must have a diligent as well as proper analysis of the investment actions of the current or the potential client of the bank.

- It should be designed and crafted so that it is successful in securing a deal with current or potential clients.

- The approach of the investment banks while making the sales is highly formalized and official. Often they follow a tailored and highly effective sales strategy.

- It offers the bank a chance to show and prove why the clients should choose them among the wide variety of financing and other sources of capital.

#-3 Contributors

- Many contributors to the Investment bank help in the process of pitch book preparation. It involves analysts, associates, vice-president, senior vice-president, head of the team, and the managing director.

- Managing Directors are the ones who will bring the initial idea for a pitch. The aim here is to give financial solutions to clients by offering banks products and services.

- Due to the many ideas for an Investment Banking Pitchbook that comes from the Managing Directors, the lower level of the Investment banks is loaded with a tremendous amount of work.

- It means that the analysts have to make sure that they include the latest company and industry information in this with no analytical or typographical errors.

Step by Step Guide to Creating an Investment Banking PitchBook

Let us first see one sample PitchBook Example

#1 - Capabilities and Qualifications of the Investment Bank

- In this section, the Investment Bank will stress why they are the best in the industry.

- The information about how they rank concerning their competitors regarding the products and services will be given here.

- You can find the Ranking information for mergers and acquisitions, debt, equity, and other derivative products.

- In comparison to other Investment Banks firms, this ranking table is known as the league table rankings.

#2 - Market Updates

This section gives the client information about the current market trends and the environment.

- Why this section has so much importance as in market turmoil, clients seek the Investment Banks’ thoughts on the direction of the market or the optimal time to do a transaction.

Investment banks need to have a smart perspective about the market situations.

#3- Transaction Section

This section gives the client the bank’s perspective on the following:

- Potential buyers and sellers in Mergers and Acquisitions

- Amount of capital that can be raised and it's pricing

- Timing and Process for the transactions

- Valuations for sale or acquisition targets

The following is the primary analysis that you may find in the Transaction section:

a) Comparable Analysis

- This analysis includes benchmarking the client against its peers.

- The statistics that are considered in the comparative analysis are sales, earnings, valuation multiples like PE Multiple, PBV multiple and other trading multiples, etc.

b) Financial Model

- The most important skill for an analyst is to Build a financial model. It is the most crucial analytical tool used by the deal team to perform some important analysis.

- Financial Models are used for Accretion/Dilution analysis in the case of Merger & Acquisition Pitch.

- In the case of the Debt Issuance Pitch, Financial Modeling is used to show how a debt issuance can be serviced and repaid.

- In IPO Pitch to see the show, the company’s financial profile will look after an IPO transaction.

Types of Investment Banking Pitch books

#1 - Main PitchBook

These types of pitch books include all the details and information about the investment banking firm. Also, the statistics related to recent deals, profits, successful investments, recent trends, and deals in the market are demonstrated in the pitch book. Hence such a pitch book needs to be updated regularly.

Contents

- Organization details- This contains slides, which display the organization details of the respective investment bank, like its vision and mission statement, history, global presence, key management personnel, and size of the company.

- Deals & Client Lists- Further, it also contains information about the recent deals, sector-specific client list as well as the services provided to them.

- It may also contain slides portraying the firm’s ranking as compared to competitors.

- Market Data- This will also include important aspects of the market overview, such as competitor’s performance, current trends & deals in the market.

#2- Deal pitch book

It is created specifically for a particular deal. Such a presentation demonstrates how the investment bank can specifically cater to their client's financial and investing needs.

It is used to explain details of mergers & acquisitions (M&A), IPO’s & debt issuance. The deal pitch book may also list down the bank’s prominent achievements and clients, to assure acceptability and potential partnership.

Contents

- Detail Specific- This book has information on specific details that make an investment bank look attractive and efficient.

- Usage of Graphs- The data is supported by graphs that show market growth rate, the firm’s positioning overview, and valuation summary. It helps in making a valiant representation of the firm’s potential to serve its client. Do check out these Awesome Investment Banking Graphs.

- Financial Models- It must be attached to relevant financial models, graphs, and statistics wherever necessary.

- Data of Buyers and Sponsors- Depending on whether an investment bank is making a pitch report for M&A or IPOs, the deal-pitch book must include a list of potential buyers, potential acquisition candidates, financial sponsors, and their detailed descriptions.

- Includes Recommendation- It contains a summary of the proposal and provides advice & recommendations, and information on the investment bank’s role and contribution in attaining the client’s goals.

#3- Management Presentations

When the client finalizes the deal with the investment bank, management presentations are used to pitch the clients to the investors. Details included in the management presentations are-

- Information on the client company

- Management details

- Specific project

- Key financial ratios.

- Client's goals and how the investment firm can help achieve them.

Contents of a Management Presentation:

- Client Specific- This is focused on the current client, and hence it is customized to be more client-specific.

- Provides Client-specific data- It provides more information about the Client Company, highlights, products and services, market overview, customers, organizational chart, financial performance & growth forecasts.

- Requires Client Interaction and feedback- Preparation of such a book requires detailed interaction with the client and regular feedback sessions.

#4- Combo / Scenario Analysis

- An investment bank prepares such a book when the client company isn’t sure whether it wants to go public or sell.

- It is created by stating both scenarios and showing the tradeoffs between the two.

#5- Targeted Deal PitchBook

- It is created when a buyer approaches your client company with an acquisition offer.

- In this case, it shows accretion/dilution under different scenarios.

#6 - Sell-Side M&A Pitch Books

- These are created when a client approaches an investment bank stating that they want to sell themselves and are looking for Potential Buyers.

- It is specifically customized, stressing the points why the clients should choose that particular Investment bank. These types of Pitch books are more exhaustive and long.

It contains the following information-

- Potential buyers for the client

- Bank Overview

- Positioning Overview (why the bank is more attractive than others)

- Valuation Summary

- Recommendations

- Appendix

#7 - Buy-Side M&A Pitch Books

It contains similar information like the Sell-Side M&A Pitch Books but differs on the following point-

- It contains information about the Potential acquisition candidates

- These are shorter than the Sell-Side M&A Pitch Books. Check out the Sell-side vs. Buy Side - Key differences

Points to remember

A pitch book is like a salesman for an investment bank. Hence it needs to be perfect, professional, and at the same time, it should be convincing enough.

Important points that must be incorporated here are-

Structure

- Strengths

- Show how your investment bank is different from others.

- Key Management personnel

- Must showcase the core competencies of the Investment Bank.

Length

- It should be concise – only detailing the important points

- May concentrate on a single concept per page

- Always make use of appendix

- Must be as crisp as possible

Case Studies

- Support your points with case studies wherever possible

Graphs & Charts

- Use Graphs & Charts to emphasize key points

Look and feel

- Please make a point to use colors wherever possible properly but do not overdo it.

- It should be professional-looking.

- Must leave a lasting impression on the clients.

Anatomy of a pitch book.

- All the details in the Pitchbook must be accurate and up-to-date.

- There is no scope for any mistakes that may negatively impact the client.

- The information should be brief and to the point.

- It should be simple but must have a professional layout.

Conclusions

I cannot tell you with 100% assurance that there is just one full-proof way to do a Pitchbook. It usually depends on how the Investment bank portrays a particular deal. But one point to remember is that customizing your message according to your client's Needs and Goals always works! If you want to be an Analyst or associate, you will spend most of your time creating the Perfect investment banking pitch book.

Frequently Asked Questions (FAQs)

PitchBook is not a CRM (Customer Relationship Management) tool. Instead, it is a financial data and research platform that provides information on private and public companies, investments, and deals.

Capital IQ and PitchBook are both financial data platforms, but their focus and coverage differ. Capital IQ is primarily geared towards investment banking and financial professionals, providing public companies with comprehensive financial data and analytics. At the same time, PitchBook focuses on private market data and is commonly used by private equity, venture capital, and investment professionals.

The choice between PitchBook and Crunchbase depends on the user's specific needs. PitchBook is known for its extensive coverage of private market data, including private company financials and valuation data. In contrast, Crunchbase is known for its focus on company funding and investment data. The better option depends on the user's specific use case and requirements.