Table Of Contents

Difference Between Investment and Commercial Banking

Investment banking primarily acts as a broker between entities who want to get into a financial arrangement like dealing in the purchase and sale of the stock, Mergers, acquisitions, and helping in the initial public offer. In contrast, commercial banking provides services concerning taking deposits and giving loans to individuals and companies.

It is the 1st part of the 9 part overview series on Investment Banking.

- Part 1 - Investment Banking vs. Commercial Banking

- Part 2 - Equity Research

- Part 3 - AMC

- Part 4 - Sales and Trading

- Part 5 - Private Placements of Shares

- Part 6 - Underwriters

- Part 7 - Mergers and Acquisitions

- Part 8 - Restructuring and Reorganization

- Part 9 - Investment Banking Roles

In this Investment banking video tutorial, we discuss primarily three things.

- What is an Investment Bank?

- What is a Commercial Bank

- Investment Banking vs. Commercial Banking.

Let us now look at the below video to understand these in detail.

Table of contents

Investment Banking Vs. Commercial Banking Video Transcript

Investment Banking Overview

Hello, friends; welcome to EDU CBA's program and investment banking overview. In this short introductory program on investment banking overview, you will learn about the key roles and responsibilities or different functions within an investment bank.

Say, for example, what is research? What is the sales and trading division? How do banks help in terms and raising capital for various companies? What are these jargons? What is underwriting? What is market-making? Conclusion and let's say why investment banking M & M&A activities are the core and heart and soul of the investment banking division. We will also try to answer questions regarding what is restructuring and reorganization? And how banks help in terms of doing that so as you may have understood that you know I was referring investment banks and banks as one term, now these two things are kind of very confuse lot reason being that you know commercial banks have different work all together as well as you know when we talk investment banking, there is kind of very different from each other, so the first thing that let us understand Investment Banking vs. Commercial Banking.

Explanation of Investment Banking vs Commercial Banking in Video

What is a Commercial Bank?

Let us now look at what is a commercial bank? Now commercial banks are referred to sometimes as retail banks ok, and an example of a commercial bank or retail bank could be something like Barclays JP Morgan Chase Bank, then we can also include HSBC. There would be a list of you know commercial banks, but the primary question here is what is the commercial bank, and what are their responsibilities? How do they earn money? So let me put it this way in a very-very crude way.

Let’s assume that this is a commercial bank, and you know there are two different sets of involved parties. A bank is a place where they collect money from various depositors. Think of you and me; when we have excess cash, you know we kind of deposit that money in the bank. So we are essentially depositors. So depositors can be individuals, or they can be corporates as well, a business guy. So essentially, what we are saying is that the bank collects dollars from these depositors.

So what does a depositor get in return? One is that the money deposited is safe, and second, what they earn is something called an interest rate. So let’s call this interest on the deposit. So if you have deposited $ 100 and the interest rate is 5 %, the bank at the end of one year will pay you not only $ 100, which is your initial amount but in your account, you will also see $ 5, which is corresponding to the interest payment. So you will have $ 105 at the end of one year if you deposit 100 $ in the bank. Now, this is one side where the bank sources money. The second is where they deploy the set of money.

So think about your known loans. Loans in the form of, you know, home mortgage loans. You know they could be individuals who would like to have car loans. You know it could be personal loans or any other format of loans. So this may be concerning individuals, but we may also see some parts of loans given to corporations. So what we are essentially saying is that the bank collects money from the depositors and gives it to those guys who need money. So what do they charge for the benefit of the bank here? The benefit of the bank is that they earn again interest, which we will call that as let’s assume unknowns, and you know this is their interest income, and this is their interest expense.

So the bank earns money by ensuring that the interest on loans that they earn is greater than the interest on the deposits that they give. So this is interest income, and on the other side, this is an expense. So if a bank can manage this, the bank will be profitable. So traditionally, the banks have been doing this kind of a business where they are giving loans, and you know this is something like a low-risk kind of a business, and it’s called a commercial or retail bank. So with this understanding of a commercial bank, let us now move a forward.

What is Investment Banking?

So let us now look at what is investment banking? First, please note that investment banking differs from traditional or commercial banking, which we have earlier referred to. So investment banking doesn’t take your deposits the way banks do. Neither do they pay our act as a guarantee for safekeeping the depositors' money? So investment banks do not do that. So let’s see what investment banks do?

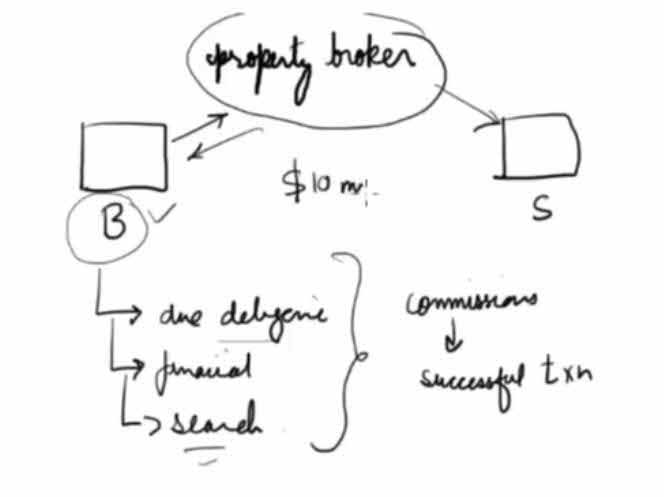

The analogy of a property broker

So to understand investment banking better, let me give you an analogy concerning a property broker. Let’s assume that on one side, there are buyers, buyers of an apartment, and then on the other side, there are sellers of the apartment. Now, who is a property broker?

So there are buyers as well as sellers of the apartment. Now obviously, they would like to transact and make this market happen. Now on one side, when the buyers who are individual buyers are seeking the sellers you know sometimes or, in fact, many times, it becomes very difficult for the buyers to do all the due diligence concerning the apartment or maybe you know, look at the financial considerations and negotiate them.

So, the important thing is that searching is also a problem for them. So what happens is that these buyers may get in touch with people called property brokers. Now, these property brokers will do a couple of tasks you know they would identify how many sellers are there in the region you know they would communicate and make a check-list on the legalities associated with the apartment they will do the complete due diligence you know what are the financial considerations and research and depending on the requirement of the buyer they would suggest the properties. So a property broker is someone in between who is doing all these tasks.

Now, how do these property brokers normally make money? Through commissions, they earn, and commissions are primarily on successful transactions. So let’s say if a buyer has bought a flat from a seller at $ 10 million. So a certain percentage will be part of the property broker as commissions or fees. So this is how a property broker functions—now, having understood how a property broker functions, now think about investment bankers.

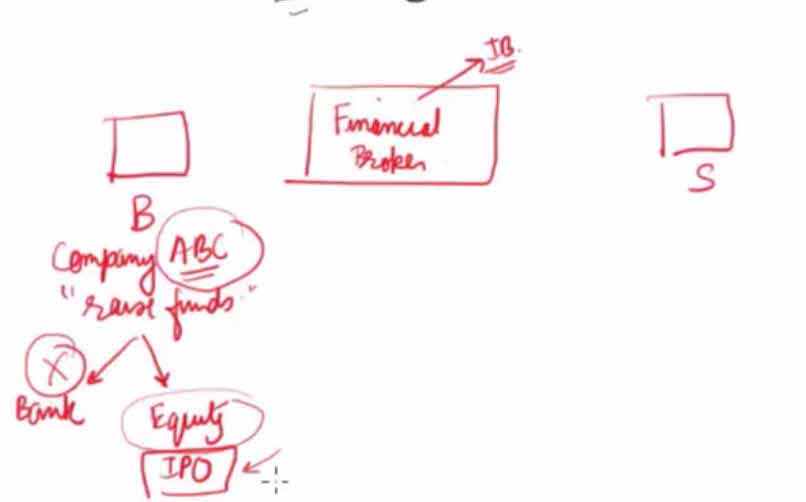

Now I quickly change the definition of buyers and sellers in this context because I'm talking about investment banking here. I'll call an investment banker a financial broker. So instead of a property broker, I'm calling this the financial broker. His job is essentially to make the buyers on one side, and the sellers meet somehow.

- Now think about the company instead of a buyer or a seller. I’m talking about the company. Now this company, let's say this company's name is ABC, and they want to raise funds. Raise funds means that you know they have a requirement of raising funds because they will invest and expand largely from a very small city to you know they want to have a global presence altogether. So for that, they require funds. So obviously, there are two approaches to doing that one is that they can approach a bank, and the second is that they can raise equity from the market, and we call that an IPO. So doing an IPO, you know they can raise money from the market. So let's assume that they don't want to go to the bank to raise further funds. So the option that they are evaluating is through equity dilution. So what they mean is they are ready to give a share of their company to certain investors who would be willing to do that via an initial public offering. Now, suppose company ABC may want to go ahead and make this initial public offering. In that case, they will find it tough because many things will happen. There are legalities associated with it then if you talk about it, you know how to be aware of the processes. You know they may not even know that. Third, at what valuations? You know all these things. They may not be equipped to do that. So what they essentially do is that you know they contact someone called an investment banker.

The role of the investment banker is to do all these tasks, check at the legal options, you know, look at the processes, talk about the valuations, and what this brokerage does is that he identifies all the set of investors for this IPO. So "S" would mean investors here in this case, and the investment bankers are sophisticated financial brokers. They are connected with the investors, help these companies raise funds, and understand the checklist of, you know, raising through an IPO. So this was a small example where you know investors are on one side, and the company is on the other side. - So how do the investment bankers earn money? Investment bankers earn money from commissions like the way you know the property brokers used to earn these guys commissions on the number of funds raised for this company ABC. So this is how investment banks earn money.

- So this was one of the ways you know, the other set of examples could be related to mergers and acquisitions. So let's say there is a company called ABC and they want to merge with another company called DEF. Now the problem with these two sets of companies would be that they may not be equipped enough to handle all the regulatory aspects of the merger as well as come to the appropriate calculations in terms of valuations or prepare financial models.

So what investment banking firms do is they come in between and advise on the merger possibilities. Why should it happen? What are the possible synergies, and in fact, the key critical aspect of investment banks is the health lisle concerning negotiating a price? So you know if the price is high, you know how to talk to the clients to make the two buyers and sellers meet at one point. So they are expert negotiators, and for that again, they charge commission. - So a certain amount of commission, 1 %, 2 % just as an example, can be understood from the point of view of investment banking. So, in a nutshell, think about property brokers and the property broker’s role just to kind of help the buyers, and the sellers identify and in between property brokers actually, add a lot of value by helping with the buyer search as well as the sellers also to identify the buyers.

- I now hope you can appreciate the differences between what is an investment bank and what is a commercial bank. So they are adding a lot of value in between. Likewise, investment banking also does the same while the companies are looking to raise funds, or you know they are looking at mergers and acquisitions. So investment banks do many other things as well, so we'll discuss all of these in our following lectures.