Table Of Contents

Key Takeaways

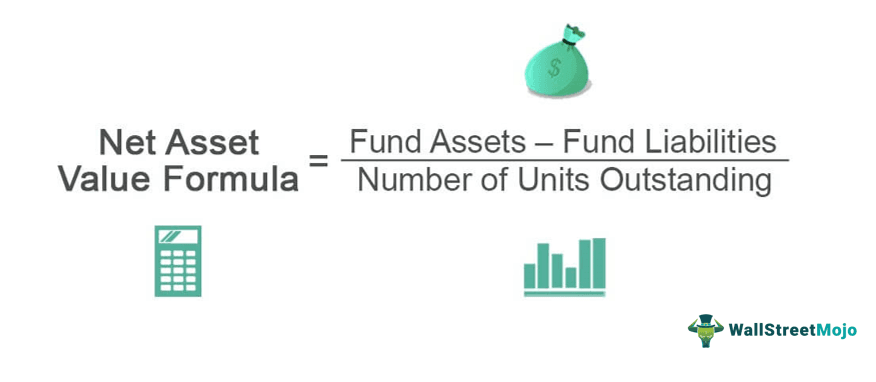

- According to the formula, net asset value is determined by deducting the total value of liabilities from the full value of assets of the entity and dividing the resulting amount by the total number of outstanding shares.

- This formula is primarily used by mutual funds to determine the unit price of a specific fund at a particular time.

- If you want to take advantage of more significant returns, select sectors to develop substantially quicker than the other industries.

Example

The Onus Fund has the following information. You need to find the NAV of this fund –

- Market Value of Securities held by the fund – $450,000

- Cash & Equivalent Holdings – $50,000

- Liabilities of the funds – $200,000

- Number of Outstanding Shares – 10,000

By using the formula of NAV, we get –

- Net Asset Value = (Market Value of Securities Held by the mutual/close-end fund + Cash & Equivalent Holdings – Liabilities of the fund)/Number of Outstanding Shares

- Or, = ($450,000 + $50,000 – $200,000) / 10,000

- Or, = $300,000 / 10,000 = $30 per share.

Interpretation

- In the net asset value formula, we first need to find the market value of the shares.

- To find out the market value of the shares held by the fund, we need to apply formula –

- The market value of the shares = Market price per share * Number of outstanding shares.

- If the market price per share is $10 per share and the number of outstanding shares is 1000, then the market value of the shares would be = ($10 * 1000) = $10,000.

- The second component of the formula is cash and equivalent holdings. We will add this item because it is an asset.

- The third component of the formula is the liabilities of the fund.

- To find out the actual value of a fund, we need to look at the difference between the total assets and the total liabilities.

- Finally, we need to divide the difference by the number of outstanding shares to get NAV per share.

Use and Relevance

Let's say that you would like to invest in a mutual fund. What would you look for?

Many financial analysts argue that it is wiser to look at NAV rather than looking at the individual market price of the share. Here’s why.

- They think that when you look at NAV of funds, you get the misconception that NAV dictates the future benefit of the fund. This, according to them, is utterly false.

- That’s why these financial analysts mention that you should look for the quality of funds and not the NAV. Yes, NAV is important, but as an investor, you shouldn’t put too much faith in the higher or lower NAV because that doesn’t make any difference in how much return the portfolio under the fund would generate.

- Suppose you want to take advantage of higher returns, select industries that have been growing much faster than the other industries. Let’s say if you choose to invest in the IT industry instead of other industries, you will be able to generate much higher returns on your investments.

Net Asset Value Calculation in Excel (with excel template)

Let us now do the same example above in Excel.

This is very simple. You need to provide the Four inputs of Market Value of Securities held by the fund, Cash & Equivalent Holdings, Liabilities of the fund’s Number of Outstanding Shares.

You can easily calculate the net asset value in the template provided.