Table Of Contents

Get in Touch with our Experts!

Absolute Return Meaning

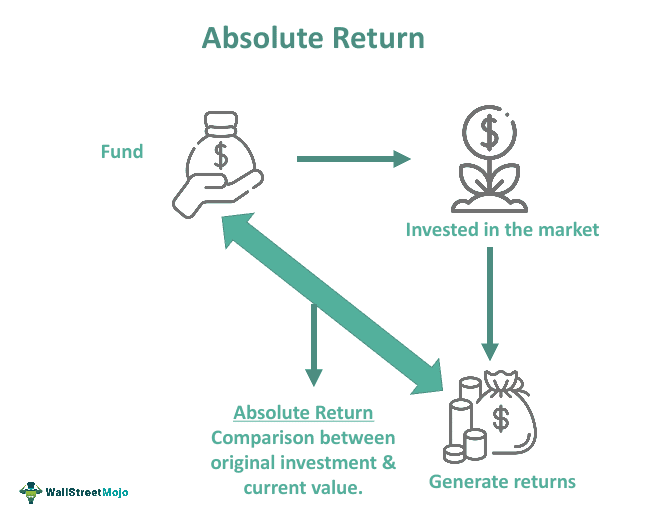

Absolute return refers to the percentage of value appreciation or depreciation of an asset or fund over a certain period. Such assets include mutual funds, stocks and fixed deposits. Thus, it signifies or calculates the amount of gain that the investor has earned.

Here we only talk about a single asset, and the return generated and do not take any consideration of any benchmark or compare itself with any set metrics. It can also be negative depending on the return it generates, but we cannot claim that it is dependent on market activities. Absolute return in no manner has any kind of correlation to market factors.

Key Takeaways

- Absolute return represents the percentage increase or decrease in the value of an asset over a specific period, such as stocks, mutual funds, and fixed deposits.

- Unlike relative returns, absolute returns are not dependent on any benchmark or standard. They focus on an asset's actual growth or decline rather than comparing it to a specific benchmark.

- Absolute return fund managers prioritize risk management and identify and mitigate potential downsides. Their approach differs from fund managers, who seek opportunities for positive returns.

Absolute Return Explained

Absolute return calculates the profit or loss an investor gets from an investment portfolio. The result is expressed as a percentage value. In the process, the actual investment value is compared with the current value, and the growth experienced over the period is the absolute gain or loss.

Absolute return is a very safe approach to calculate returns but has some drawbacks too, as, on a long-term view, it excludes several factors that may affect our investment or related to our investment. It is a good and simple way to calculate returns, but when it comes to the real scenario, it should be coupled with other types of returns, too, like total returns or CAGR techniques. The very aim of adding the absolute return funds to the portfolio is to enhance the risk-adjusted return of our portfolio, coupled with a higher level of return at the expense of the least volatility.

Formula

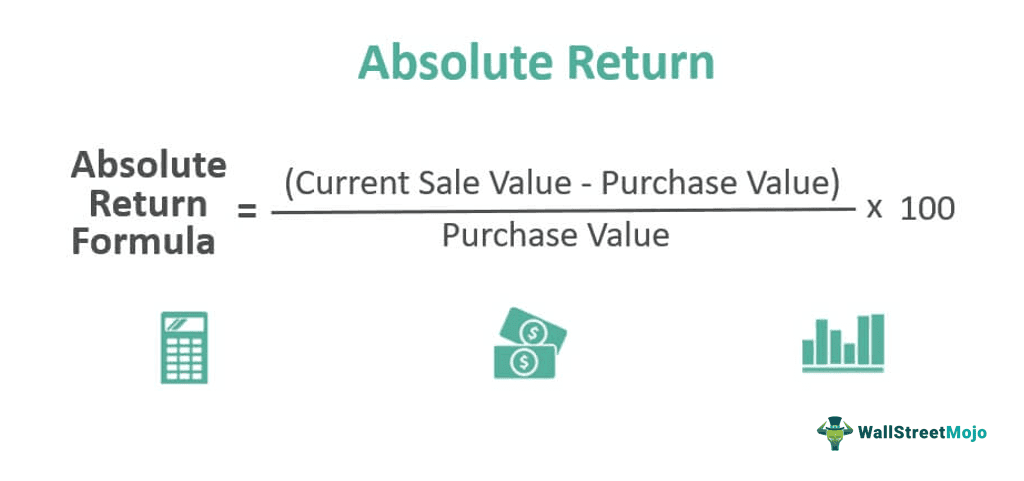

The below mentioned formula shows how to calculate absolute return for an investment.

Absolute Return = {(Current Sale Value – Purchase Value)/Purchase Value}*100

Here the current sales value is the actual price the asset owner is selling the asset after including the appreciation or depreciation of the asset, and purchase value is the cost of procuring the asset at the initial point of purchase

Example

Let us understand the concept of absolute return funds through an example.

A simple scenario is where a person is investing in fixed deposits to generate a return and make some money based on the interest generated. Now, suppose a person has invested a sum of $10,000 in fixed deposits at a certain bank. After a span of a year, when we want to claim back, the money has grown to $12,000 after an accumulation of the interest earned on the fixed deposit.

Thus the gain made over the investment was $12,000 – $10,000 = $2000, which is explained in percentage terms as 20% of the original sum invested. Thus, this can be stated as the absolute return, and the calculation can be as follows: ($2000/$10,000)*100 = 20%. They are very effective only when we have a set period to calculate or like when we know the start date and the end date of the investment.

Strategies

One key strategy for absolute return is that they are not dependent on any standard or benchmark. Most funds that operate in the market have always defined their performance relative to some other benchmark. Thus if a fund does better than the benchmark, it is considered to be good even if the return generated by it is negative and similarly, if the same fund is not performing well compared to the benchmark, it is considered to be bad even if the fund itself is meeting its objective set and generating a good return Thus, it does not take into account any of the benchmark or standard set. It is only considered about its own performance and returns generated.

The other strategy that can be linked to calculating how to calculate absolute return is that they are generally perceived as the one who worries about the portfolio. While other fund managers are concerned about what can go right, fund managers considering absolute returns are worried about what can go wrong and thus manage the risk based on it. This offers them a scope of diversification of the portfolio where fund managers invest in a diverse set of avenues blindly by seeing options that provide positive returns and have the least volatility.

Lastly, users are always in a lookout of returns, which have the least correlation as compared to traditional stocks and bonds. Correlation is the measure of the magnitude of how much two sources of return are dependent on each other and to what extent. Thus lack of correlation at times can be useful because when the market goes to a downside trend, not all elements of a absolute return portfolio will be impacted.

Advantages

Some of the advantages of absolute return approach are mentioned below.

- The exposure of the portfolio is minimized: The volatility factor which any portfolio can be exposed to is reduced by using this technique of calculation return.

- Expanding the investment return sources: We can take into account multiple sources or platforms to generate a return from when absolute return calculation comes into play.

- Diversification of portfolio: As we are free of any tradition benchmark, we are free to diversify our portfolio and invest in multiple platforms

- The risk-adjusted return of the portfolio is enhanced: The improvement of the risk-adjusted return is a key factor that comes into play for every investor when one uses this methodology

- Setting a stop-loss limit: The main advantage is that we can limit our losses and check if our investments are in wrong avenues, which are generating no return at all.

Disadvantages

These are some of the disadvantages of absolute return approach.

- It is not a suitable measure when there is a need to compare different time frames.

- When comparison is to be made across various assets, then it becomes difficult.

- Since the return does not take into account the inflation of the assets, the final return may show a negative figure even though the absolute return is positive,

- It takes into account all kinds of investments which includes both high risk and low risk ones. Since risk is an important factor in any investment, if it is ignored, the return does not show an authentic value.

- It does not compare the return against any benchmark, which makes the result difficult to compare.

- It does not give the investors any idea about te fund manager’s performance.

Absolute Return Vs Total Return

Absolute return can be classified as a period to period return where we have a fixed starting point and a fixed ending point. It is very handy when we want to calculate either a 3-month return or six months or annual or three years or 5-year return. Generally, when the period is more than a year, it is advisable to use the CAGR formula. So, absolute return is like we have an investor who has invested a sum of $10,000 in shares. After a span of a year, when we want to sell his shares, the money has grown to $12,000. Thus the gain made over the investment was $12,000 – $10,000 = $2000, which is explained in percentage terms as 20% of the original sum invested. Thus, this can be stated as the absolute return, and the calculation can be as follows: ($2000/$10,000)*100 = 20%.

The same, when explained on the basis of total return, is almost the same as absolute return, just with a small difference where the role of dividend comes into action. The total return also takes into account the dividend paid by the company one has invested. Suppose the company has given $30 s the dividend on and above the $2000 gain, the total gain here becomes $2030, and thus the total return is calculated as ($2030/$10,000)*100 = 20.3%. So the total return is slightly here, which is 20.3%.