Table Of Contents

What Are Payback Period Advantages And Disadvantages?

Payback period advantages include the fact that it is very simple method to calculate the period required and because of its simplicity it does not involve much complexity and helps to analyze the reliability of project and disadvantages of payback period includes the fact that it completely ignores the time value of money, fails to depict the detailed picture and ignore other factors too.

In many businesses, capital investments are obligatory. Say, as an example, investment in plant & machinery, furniture & fittings, and land & buildings, to name a few. But, such investments do incur a lot of money outlays. And business homes certainly are going to be anxious to know when they will recover such an initial cost of an investment. Below we have discussed some examples of payback period advantages & disadvantages to understand it better.

Payback Period Advantages And Disadvantages Explained

The topic of payback period advantages and disadvantages has a lot of significance in the financial world because it clarifies what are the benefits and limitations of calculating the same and whether a business should do it at all while making any investment decision.

In this context of advantages and disadvantages of payback period, it is necessary to gain some knowledge about the term payback period. This term explains the time span needed to recover or get back the amount invested in a project. When a company makes an investment in any process, it will ideally do so with the aim of both multiplying the fund with return as well as bring some growth and expansion within the business. But every process takes time for not only the implementation but also getting the desired result.

In other words, the payback period refers to the time that the investment will take to reach its breakeven, beyond which it will give return in the form of profits. This length of tiem is very important because every company or individual make investment with this very objective in mind. Here it is obvious that a shorter period is always desirable, because it means the fund can be recovered within a very short time span.

It has innumerable uses in the financial market. It helps the investor to decide whether to go for the choice or there is a better opportunity elsewhere. However, it does not take into consideration a very important factor, which is the time value of money. The time value of money is that financial concept which explains that a sum of money at present is worth more than it will be at a future date, due to fall in its earning potential.

However regarding the advantages and disadvantages of payback period, every investors will have to possess detailed knowledge about the pros and cons of calculating the payback period because it is crucial that the business is able to select the correct investment avenue that will be the most profitable one. Thus, the payback period is what the financial analysts use to make investment selections.

Explanation of Payback Period in Video

Advantages

In this regard, we will learn in details the advantages and disadvantages of payback period method. Let us study the details of the same.

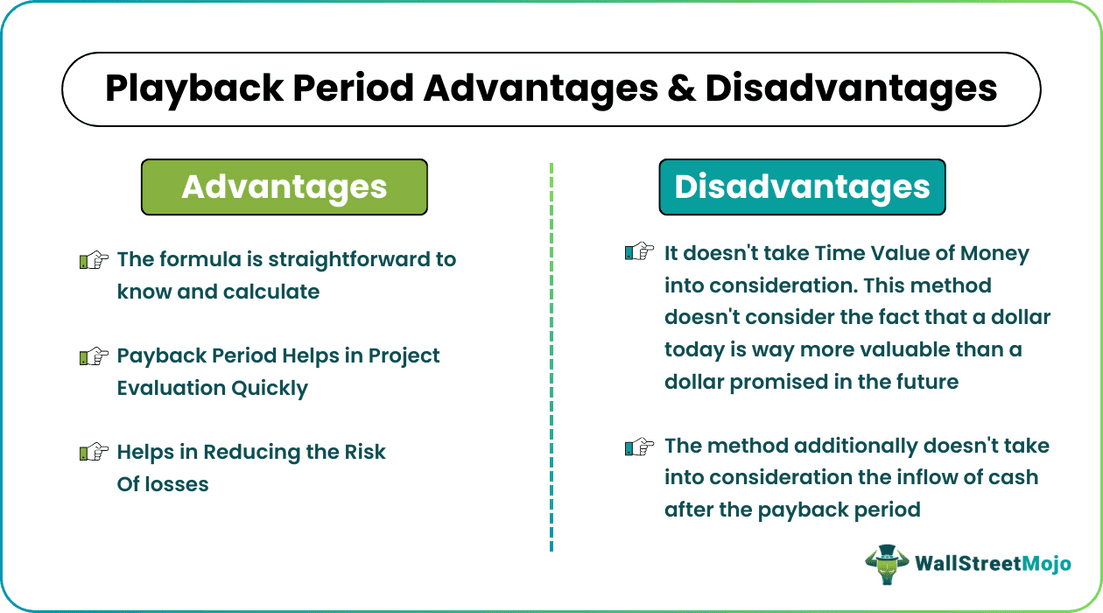

#1 - The formula is straightforward to know and calculate

The calculation of the payback period is a very simple process and does not involve lots of complicated calculation. Thus, since it is easy to understand, it can be used very well used for making quick comparison and assessment for the purpose of project selection.

#2 - Payback Period Helps in Project Evaluation Quickly

From the above point it can be very well derived that project evaluation and selection is very less time consuming, using this method.

#3 - Helps in Reducing the Risk Of losses

Such a concept of advantages and disadvantages of payback period method, contributes to control and reduction of losses. In this context, it should be noticed that an investor will invest money in a project after evaluation of all the possible projects in hand and select the one with least payback period. Thus, they will choose that option which will be the least risky in terms of return within a particular time span. In this manner, the possibility of loss can be reduced significantly.

#4 – Focused on Liquidity

This process has the main focus on liquidity. The cash flow data is used to calculate the period. Therefore, projects and business in which the cash flow will pay a critical role or maybe the project requires good amount of cash flow for its completion, this method becomes very useful.

#5 – Good For Small Enterprises

Small companies, which depend on simplicity of calculation and project selection method, can depend on this process. It is also to be noted that in case of projects where it is difficult to make an very close calculation of cash flow, this concept is very useful.

#6- Useful For Technological Industries

There are some industries and sectors who are highly sensitive to technological change and need to constantly evolve in order to keep up with the strict competition. A very good example is the electronics industry, which is constantly evolving. In such cases, this concept can play a very important role because it does not take into account the returns that will come after reaching the payback period.

Disadvantages

- It doesn't take Time Value of Money into consideration. This method doesn’t consider the fact that a dollar today is way more valuable than a dollar promised in the future. For instance, $10,000 invested for a period of 10 years will become $100,000. However, even though the amount of $100,000 may look profitable today, it won’t be of the same value a decade later.

- The method additionally doesn’t take into consideration the inflow of cash after the payback period.

Examples

We simply need the initial investment and the near term money flow information. The formula for calculating even cash flows or, in other words, the same amount of cash flow every period is:

Payback Period = (Initial Investment / Net Annual Cash Inflow)

Let us, now, see how easily it can be calculated under different circumstances –

Example #1

Caterpillar Inc. is considering the purchase of furniture & fittings for $30,000. Such furniture & fittings encompass a useful life of 15 years, and its expected annual cash inflow is $5,000. The company’s preferred payback period is 4 years. You need to find the payback period of the furniture & fittings and conclude whether or not buying such furniture & fittings is desirable?

The answer will be -

= ($30,000 / $5,000)

Payback period = 6 years

Thus, it may be concluded that the purchase of such furniture & fittings isn’t desirable as its payback period of 6 years is more than Caterpillar’s estimated payback period.

Example #2

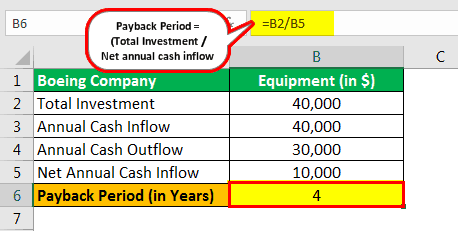

The Boeing Company is considering purchasing equipment for $40,000. The equipment has a useful life of 15 years, and its expected annual cash inflow is $40,000. But, the equipment has an annual cash outflow (including preservation expenses) of $30,000 as well. The aircraft manufacturer’s desired payback period is 5 years. Should Boeing purchase the new equipment?

- Total investment = $40,000

- Net annual cash inflow = Annual cash inflow – Annual cash outflow = $40,000 – $30,000 = $10,000

Answer will be -

= ($40,000 / $10,000)

Payback Period = 4 years

Hence, it may be settled that the equipment is desirable as its payback period of 4 years is less than Boeing’s maximum payback period of 5 years.

In the aforesaid examples, the various projects generated even cash inflows. What if the projects had generated uneven cash inflows? In such a scenario, payback period calculations are still simple! You just need to first find out the cumulative cash inflow and then apply the following formula to find the payback period.

Payback Period = Years before full recovery + (Not recovered cost at the beginning of the year / Cash inflow throughout the year)

Example #3

Suppose Microsoft Corporation is analyzing a project that requires an investment of $250,000. The project is expected to come up with the following cash inflows in five years.

Calculate the payback period of the investment. Also, find out whether the investment needs to be made if the management wants to recover the initial investment in 4 year-period?

Step 1

Calculation of cumulative net cash inflow –

Note: In the 4th year, we got the initial investment of $250,000, so this is the payback year.

Step 2

- Years before the full recovery takes place = 3

- Annual cash inflows during the payback year = $50,000

Calculation of not recovered investment at the beginning of the 4th year = Total investment – Cumulative cash inflows at the finish of the 3rd year = $250,000 – $210,000 = $40,000.

Therefore, Answer will be -

= 3 + ($40,000 / $50,000)

Payback Period = 3.8 years.

So, it can be concluded that the investment is desirable as the payback period for the project is 3.8 years, which is slightly less than the management’s desired period of 4 years.

A project with a short payback period indicates efficiency and improves the liquidity position of a company. It additionally means the project bears less risk, which is significant for small enterprises with restricted resources. A brief payback period also curtails the risk of losses caused due to changes within the economic situation.

Example #4

There are two varieties of equipment (A and B) within the market. Ford Motor Company wants to know which one is more efficient. While equipment A would cost $21,000, equipment B would value $15,000. Both the equipment, by the way, has a net annual cash inflow of $3,000.

Thus, in order to find efficiency, we need to find which equipment has a shorter payback period.

Payback Period of Equipment A will be -

= $21,000/$3,000

Payback Period = 7 years

Payback Period of Equipment B will be -

= $15,000/$3,000

Payback Period = 5 years

Since equipment B has a shorter payback period, Ford Motor Company should consider equipment B over equipment A.

- Any investments with a short payback period to ensure that adequate funds are available soon to invest in another project.

Example #5

The management of a firm is failing to understand which machine (X or Y) to buy as both of them need an initial investment of $10,000. But, machine X generates an annual cash inflow of $1,000 for 11 years, whereas machine Y generates a cash inflow of $1,000 for 10 years.

The answer will be -

Payback Period = 10 years

The answer will be -

Payback Period = 10 years

Therefore, just by looking at the annual cash inflow, it can be said that machine X is better than machine Y ($1,000 ∗ 11 > $1,000 ∗ 10). But, if we tend to apply the formula, the confusion remains as both the machines are equally desirable, given that they have the same payback period of 10 years ($10,000 / $1,000).

Despite its shortcomings, the method is one of the least cumbersome strategies for analyzing a project. It addresses simple requirements such as how much time period is needed to get back the invested money in a project. But, it’s true that it ignores the overall profitability of an investment because it doesn’t account for what happens after payback.