Table of contents

What Is A Sales Ledger?

A sales ledger is a ledger entry that records any sale in the book of records, even if the payment is received or not yet received. They record sales and sales returns, which is a negative entry since the product that was sold is returned. The typical sales ledger format contains information like the date of sale, invoice number, amount of sale, products sold, customer name, tax information, freight charges, etc. The general ledger records the cumulative amount, summarized systematically in the sales ledger; it is posted in the sales account. It records the sales and the cash as and when received and how much is owed to the business.

Example of Sales Ledger Format

Let’s take an example.

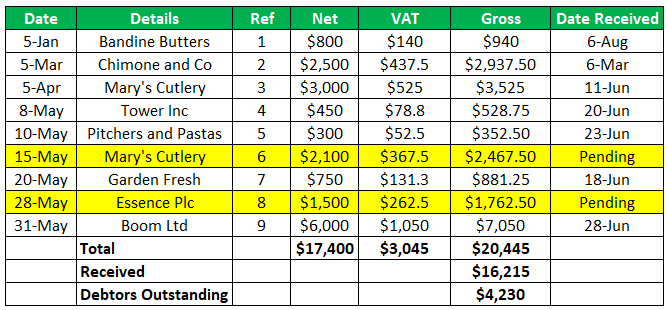

Ryan’s Inc deals in industrial kitchen products business and only makes one product. A sales ledger for Ryan’s inc is placed in the grid below. It shows the sales done between January to June. And the payments received and pending. All invoices except two (highlighted) have been settled by the end of June. A sales ledger format for these transactions is shown below:

The sales ledger format shows the date at which the sale was made, along with the actual sale amount and the VAT information. It also shows the gross amount to be paid by the customer. The last column shows the date of receipt of payment from the customer for the products sold. The sales ledger in the above example shows the actual sale amount, which is $20445. It also shows the amount that the customers paid for the sold products, i.e., $16,215. The remaining $4,230 is still pending to be paid by the customer.

This way, it becomes easy for a business to keep track of all its sales and accounts receivables owed to the business. Furthermore, this ledger enables the business to record the sale of its products along with the buyer’s information and the amount owed. In addition, it aims to provide detailed information regarding the sale and any information regarding sales returns, discounts, and payment information.

Advantages of Sales Ledger

Some of the advantages are as follows.

- owed to the business. Furthermore, this ledger enables the business to record the sale of its products along with the buyer’s information and the amount owed. In addition, it aims to provide detailed information regarding the sale and any information regarding sales returns, discounts, and payment information.

- Auditors can dig deep into this ledger and can verify if the sales reported by the business is legitimate.

Revenue vs Sales Explained in Video

Disadvantages

Some of the disadvantages are as follows.

- It requires effort, knowledge, and skills to maintain it.

- It records a transaction even before the payment is received; hence a pending payment is tracked until the customer makes payment.

- The sales account has cumulative information on the sales ledger and, therefore, might not be worth the effort unless something goes wrong.

Important Points

- Its amount can be posted in the sales account as frequently as every day or recorded once a month (month-end closing).

- The general ledger does not contain detailed information on the sales account since it will be a lot of information for the general ledger regarding one account. Instead, they will have all the minute details regarding sales information.

- Initially, They were maintained manually, but it is an offbeat term with technological advancement. Although users can search for a particular sale using the sale information like invoice number or amount or the sale date, they are accessing the sales ledger.

- It is a relevant information provider when detailed information regarding a particular transaction is required.

- It is a relevant information provider when detailed information regarding a particular transaction is required.

- Auditors tend to peep into the sales ledger by looking at random sales invoices to investigate the company’s reported sales figures.

Conclusion

- It contains all the information regarding any sale done, regardless of the payment status.

- They also record information regarding sales returns; any sale that the customer has returned for whatsoever reason needs to be recorded in the sales ledger.

- A sales account in the general ledger has a cumulative value or information regarding the actual sales ledger.

- By looking at this ledger, detailed information regarding the revenues can be obtained.

- It contains essential information like date of sale, invoice number, name of the customer, and amount of sale, to name a few.

- They record sales, sales records, payments, and discounts.