Table Of Contents

Examples of Ledger Account

The following Ledger accounts example provides an outline of the most common Ledgers. The ledger accounts are the separate records of the business transactions carried by an entity prepared using the reference of the daily journal entries and are related to a specific account, which can be an asset or a liability, capital or equity, expense, or revenue item.

- A ledger account is a record that contains all the transactions for a specific budget in a company's financial records.

- Ledger accounts track the balance and activity of individual accounts, such as cash, accounts payable, and accounts receivable.

- Ledger accounts are an essential part of the accounting system and are used to prepare financial statements and monitor a company's financial performance.

- Under a ledger account, fixed assets are held for a long term and are not expected to convert into cash in a short time.

A ledger account contains information about a particular account's opening and closing balances and the periodical debit and credit adjustments based on daily journal entries. A ledger account's most important information is the periodical (usually annual) closing balances about a specific item or charge. The ledger accounts are essential in the formation of trial balances and the company's financial statements, often incorporating payment software for seamless transaction tracking.

Common Examples of Ledger Accounts

Some common examples of ledger accounts are:

- Cash

- Inventory

- Fixed Assets

- Accounts Receivable

- Capital

- Debt

- Accounts Payable

- Accrued Expenses

- Sales or Revenue

- Dividend

- Interest Income

- Opex

- Administrative Expenses

- Depreciation

- Taxes

Journal vs Ledger Video Explanation

Practical Examples of Ledger Accounts

To better understand the working of ledger accounts, let's discuss some ledger accounts examples:-

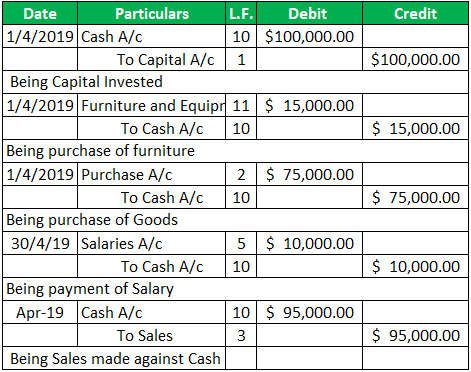

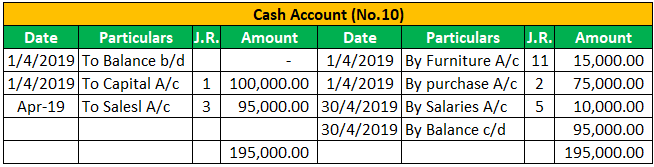

Example #1

Mr. John Wick wants to start a new clothing business. He has a total sum of $100,000 in his savings that can be invested. In addition, he owns a small shop at a primary location that can be used to start a retail clothing outlet. He purchased furniture, including shelves, a counter desk, and other equipment for the store for $15,000. He also hires a staff of two for customer support and other office work for $5,000 each.

Mr. Wick decided to start with men's clothing and purchased a complete range of clothes from the wholesale market, which cost him around $75,000. The initial purchase got sold in not more than one month for $95000.

Mr. Wick wants to journalize these transactions and create ledger accounts for April 2019.

- Journal Entries

- Ledger Accounts Example

Example #2

David Baker wants to start a forging factory, where he can manufacture high-quality chef and military knives. On January 1, 2018, he invested a sum of $1,000,000 as capital and started The Damascus Forging Works. He took a bank loan of $750,000 at 5% PA and invested the remaining amount of $250,000 from his savings. He opened a current account and deposited $800,000.

Afterward, he made the following transactions.

- On January 2, he rented a factory in the nearby industrial area for $20,000 per month and deposited $100,000 in advance by cheque.

- On January 4, Mr. Baker purchased the necessary machinery for $500,000, paid by cheque.

After setting up the factory, he started production on 5thJan, and the following transactions took place during the 1st year:-

Since Mr. Baker maintained all the accounting records himself, he wants our help to create ledger accounts for the firm.

The ledger accounts:-

Frequently Asked Questions (FAQs)

What is the purpose of a ledger account?

The purpose of a ledger account is to record and track all the transactions related to a specific budget in a company's financial records. Therefore, this allows businesses to monitor the balance and activity of individual accounts and prepare financial statements based on accurate and up-to-date information.

Ledger accounts can broadly be classified into?

Ledger accounts can be classified into real accounts, also known as permanent accounts, and nominal accounts, also known as temporary accounts.

When are ledger accounts balanced?

These accounts are balanced at the end of each accounting period, typically at the end of the month, quarter, or year. Balancing a ledger account involves verifying the total debits equal the total credits for the account. Balancing this account is vital because it ensures that it is accurate and complete.