Table of Contents

501(C) (3) Organization Definition

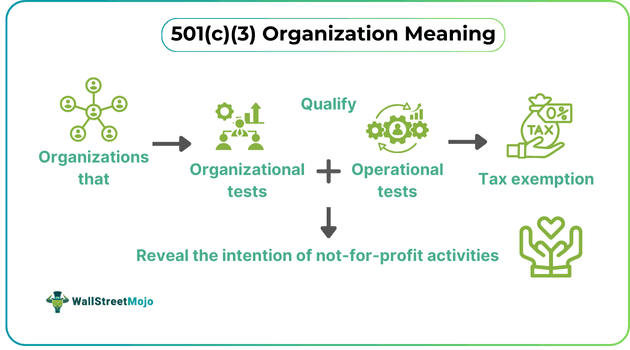

501(c) (3) Organizations are organizations categorized under the Internal Revenue Code (IRS) as charitable organizations. They are authorized to receive tax-deductible contributions as mentioned in Code Section 170 with an exception for action origination. The organizations have restrictions on their political and legislative activities.

These organizations attain exemption status for engaging in religious, charitable, scientific, and public safety testing and fostering international and national amateur sports competitions. Organizations engaging with literary and educational endeavors and prevention of cruelty to animals and children are also included. They are provided with exemptions from the IRS's federal income tax and have tax-deductible contributions.

Key Takeaways

- 501(c) (3) Organizations are organizations categorized under the Internal Revenue Code as charitable organizations and are authorized to receive tax-deductible contributions.

- These organizations focus on public welfare. They face challenges such as funding, recruiting, and mission drift. They receive exemptions as part of the IRS's efforts to encourage such activities.

- The entities shall first establish themselves as under the section, apply for IRS exception, file the required documents periodically, and comply continuously to acquire exemption status.

- They shall receive grants and reductions in tax liability. They face complex procedures, heavy fees, and the authority’s regulatory incompetence.

How Does A 501(C)(3) Organization Work?

501(c)(3) organizations are entities that carry on activities of public good and are eligible for exemption from IRS's federal tax liabilities. These organizations focus on public welfare and often face many hardships. They face challenges in raising funding, recruiting volunteers, attracting and retaining the required human capital to function, and mission drift. They receive exemptions as part of the IRS's efforts to encourage activities and establishment of not-for-profit activities. A tax reduction is one way that the government can reduce the burden of these organizations. This invariably contributes to the welfare of the nation.

These organizations are often categorized as charitable organizations because, in the generally accepted legal sense, they work on providing relief to specific sections of society. It includes the distressed, the poor, and the underprivileged, those working for religious advancement, construction, and maintenance of public buildings, works or monuments, reduction of local issues, and discrimination. They also work on advancement in fields of science and education, protection of civil and human rights, juvenile crime, and combating societal and community deterioration.

As per the 501(c) (3) organizations rules, they have to undergo an operational and organizational test to qualify under section 501(c) (3). Organizational test limits the purpose of the organization to exempt purposes. It states that the assets of the organization must be dedicated to the exempt purpose as mentioned in the section. The operational test is done on the initial application, and this also restricts principal activities of the organizations under exempt purposes and refrains them from prohibited activities, etc.

How To Establish?

Given below are steps to establish these organizations:

The significant steps required for establishing such organizations are given as follows:

- Establishment: Create an organization under the law. For instance, a person who wants to open an animal rescue should acquire it from state agencies as it is a state-level classification. The next vital step to be done is organizing documents based on laws. These shall limit the organization's purpose and have a dissolution clause where assets are dedicated to exempt purposes under section 501 (C) (3). They also shall have bylaws. For federal tax qualifications, organizations shall acquire an employer identification number (EIN). This is a requirement even if the establishment does not initially have any employees. It acts similarly to a social security number for individuals, which the IRS uses to identify businesses. EIN can be applied online or through faxing form SS-4. EIN shall be allocated within 4 days.

- Applying To The IRS For Exemption: IRS exemption can be applied through Form 1023 from the pay.gov website. The IRS will provide the designated organization with an exempt status after approval. This is communicated through a determination letter.

- Required Filings: These are regular requirements and compliance is critical. Most of these organizations need to file annual exempt organizational returns, while some need to report unrelated business income tax filings and other returns and reports. Forms 990, including 990-EZ, 990-PF, and any 990-T forms, are used for this purpose.

- Ongoing Compliance: Organizations must comply with the rules laid down. Payment of employment taxes, fulfillment of public disclosure requirements, and other ongoing compliance issues shall also be made and checked regularly.

Examples

Given below are a few examples to understand the topic better

Example #1

Let’s talk about a hypothetical example of an Individual who wants to set up a charitable organization.

Dan is an animal lover. Recently, Dan came across a road accident where a dog was injured. To his disbelief, nobody in the vicinity had come to help the animal. However, being a considerate human, he took the dog to a veterinary doctor and treated it. From the doctor, he heard that this was not the first case, and many animals died because there was no rehabilitation space for the injured animals. Dan, moved by the cause, chooses to open an animal shelter for injured animals. Dan now has to look into local laws to set up animal shelters and apply for charitable organization status. This would save him from being burdened with taxes and allow him to focus on rescue activities through the funds he receives.

Example #2

The determination letter was sent to the Board of Trustees of the local pension and retirement fund from the IRS. The contents of the letter are discussed below.

The IRS, in this case (the location is Cincinnati), approves the request of the board of trustees local pension fund to be classified as a (C) (3) organization. However, the determination letter sent to the organization mentions that the status applies only to the current plan communicated. The letter mentions that any changes of qualification, guidance issues, or statutes enacted that are brought into effect after the dates mentioned in the request shall not be applicable. The letter also specifies documentation and presentation of such official communications for future use.

Exemption Requirements

The IRS tax code recognizes charitable organizations, churches and religious organizations, and private foundations as the three main types of nonprofit organizations that qualify for tax exemption.

Given below are some of such exemption requirements:

- The organizations must be operated and organized as per the defined exempt purposes.

- They shall not utilize the business earnings for the benefit of any individual or shareholders.

- These organizations shall not participate in political campaigns against candidates or attempt to influence legislation through their activities.

- They shall not operate for private interests, and any deviation from public welfare shall initiate penalization.

- The organization shall not engage in excess benefit transactions with individuals of substantial influence. The excise tax shall be imposed under violation.

Pros And Cons

Given below are some of the pros and cons of these originations.

Pros

- They are provided with an exemption from the IRS's federal income tax for activities that qualify with given requirements.

- They are eligible to receive public funding and grants as and when necessary.

- The nature of their activity makes them eligible for corporate sponsorships.

- They are eligible to receive discounts from various public agencies and private corporations.

- There exist no personal liabilities for involved parties (employees, members, or directors)

Cons

- They may be complex to establish.

- Obtaining IRS approval may be complex, expensive, and hence challenging to obtain.

- There may be regulatory incompetencies from public authorities.

- The organizations must comply with public disclosure requirements.

- Heavy dependency on grants and donations.

- Existence of prohibitions on participation in political activities.

- The application fee required may be high, depending on annual contributions.