Table Of Contents

Multinational Company (MNC) Meaning

A multinational company (MNC) is defined as a business entity that operates in its country of origin and also has a branch abroad. The headquarter usually remains in one country, controlling and coordinating all the international branches.

Depending on the size of the MNC, there could be several branches and subsidiaries in multiple nations. For example, Amazon started in 1995 from a garage near Seattle and today, as a multinational company, it operates in over 30 countries.

Key Takeaways

- A multinational company has its headquarter in one country and a branch or subsidiary in at least one foreign country.

- The global business operations are managed and controlled centrally, i.e., from the head office located in the home country.

- Regional offices abroad manage business operations as per the established norms of the headquarter.

- There could be several branches, subsidiaries and outlets as per the size of the entity.

- Multinational corporations can be categorized into four different types: decentralized multinational corporations, centralised global corporations, international companies, and transnational enterprises.

- While the first purpose of multinational corporations is profit maximization, these companies also diversify their business operations to seek cost advantage and acquire enriched resources and cheap labor.

- Many MNCs are a source of economic development, employment generation and community development.

How Does Multinational Company Work?

A company is called a multinational if it functions in its country of origin and has a branch in at least one foreign country. A business merely conducting exports without any offices in a global market will not fall under the definition of a multinational company. MNCs can have several international branches and subsidiaries depending on their size.

Usually, MNCs extend themselves into other nations by introducing products suited to the local needs and culture. If Amazon had offered goods central to Seattle buyers, it could have hardly tapped in potential buyers from other continents such as Asia, which has distinct needs.

Features of a Multinational Company

What differentiates an MNC from other corporates? We will take you through some features that set a multinational company apart from others.

- Centralized Control: Usually, a company sends along trained officials to conduct business in the foreign land. The MNCs are mostly run, managed and coordinated from their headquarters. Certain companies also shift their headquarters abroad either due to a merger or to avail lower tax rates using corporate inversion. In 2014, it was reported that American Company Burger King would shift its tax domicile to Canada after buying the Canadian brand Tim Hortons Inc.

- Customized Expansion and Operations: MNCs operate in a foreign country either through a branch or a subsidiary. Most brands use local resources like land, labor and current stock to create goods and services. Some brands also import peculiar raw materials to maintain their signature style.

- Glocalization: Oversea expansion comes after striking a balance between local and global needs. For example, Disney theme parks across different nations are suited to the local and global taste.

- Focused on Enhanced Quality and Tech Upgradation: The focus remains on specialized teams to improve offerings and process constantly, thus ensuring premium quality products or services. Well-performing brands keep up with technological changes.

- Huge Assets and Turnover: Since these companies have assets in various nations, it compounds a considerable net worth. Also, they sell the products or services worldwide, generating massive turnover. Through mergers or acquisitions, or expansion, MNCs keep growing their business operations, sales and profitability.

- Global Marketing and Advertising Strategies: MNCs spend aggressively on the worldwide marketing campaigns and advertisements to stay ahead in the competition.

- Hybrid Skill Deployment: Such companies hire the best and talented resources for the managerial positions. Many also train the local talent. A combination of indigenous and global skills creates world-class products and services.

Examples of MNCs

Gradually, MNCs have expanded globally, especially in Asian countries. Many multinational companies identify immense growth opportunities in South Korea, India, Philippines, Malaysia, Bangladesh, etc. As per a report issued by the Confederation of Indian Industry (CII) and Ernst & Young (EY), India is highly desirable amongst multinational companies due to the abundant labor and policy reforms.

Coming to performance, in 2020, Walmart, Saudi Aramco, Apple Inc., Microsoft were listed as some of the top-performing multinational corporations as per Fortune Global 500 ranking. The list features worlds best multinational companies. In 2019, together they generated $33.3 in revenues and employed 69.9 million people around the globe.

One of the world’s largest payment system, Visa Inc., came into existence in 1958. Headquartered in San Francisco, California, the company revolutionized digital payments with enhanced safety and user-friendly features. Resultantly, it extended business in 200+ countries.

Types of MNCs

Given below are the four main kinds of multinational corporations we across every day:

- Multinational Decentralized Corporation: Every branch office has a decentralized management structure with no central chain of command for decision making.

- Global Centralized Corporation: A centralized firm manages and controls the international units from the headquarter in the home country.

- International Company: In this, the global branches adhere to the parent company's technology or R&D. All the research work for new product development and improvisations occurs in the headquarter.

- Transnational Enterprise: It is a blend of all the above three forms of MNCs. The parent company guides but not controls the functioning of its global branches.

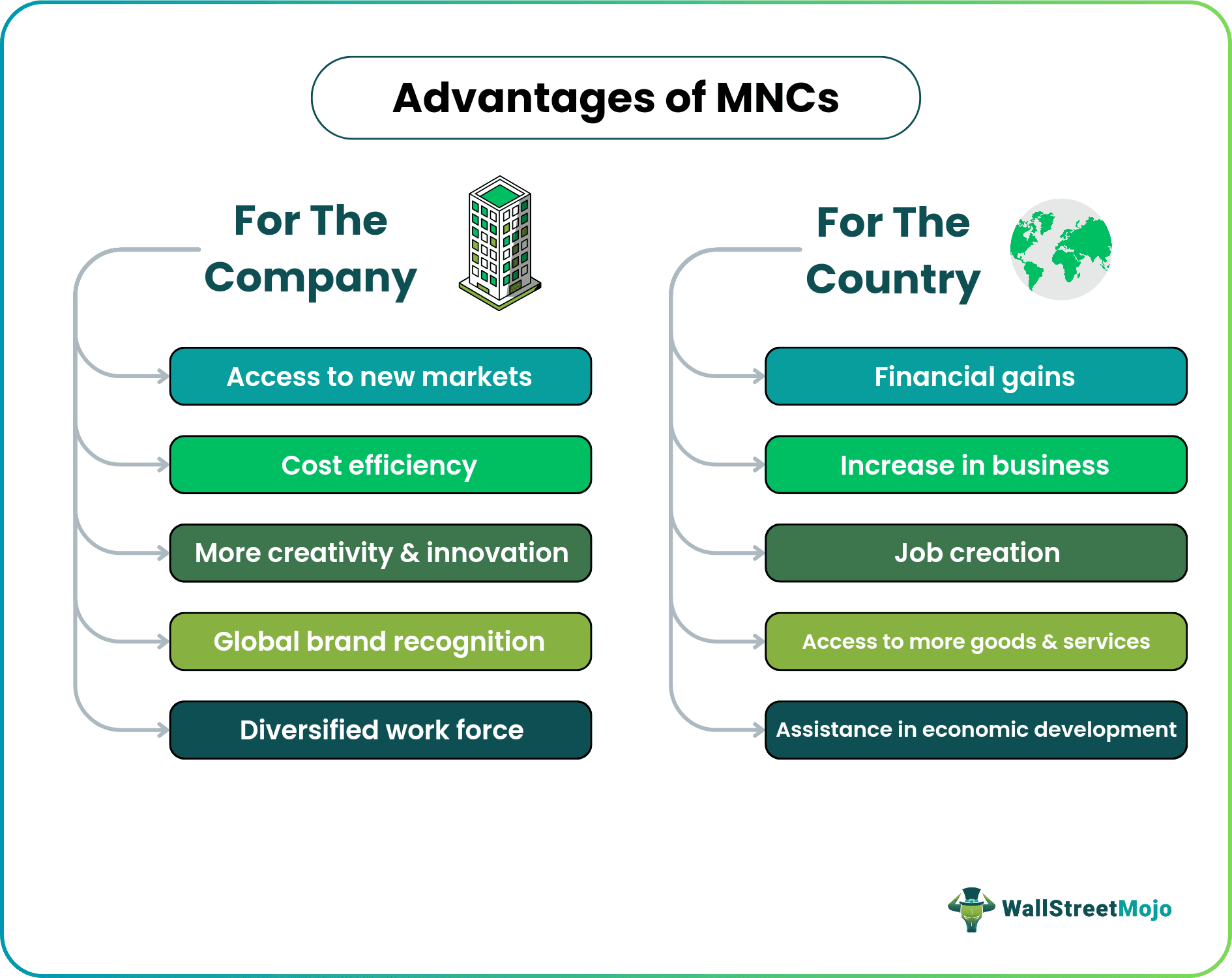

Advantages of a Multinational Company

- Goods and Services: MNCs bring goods and services to the foreign country, thus giving the local customers variety. Besides, they also bring in innovative products suited to local needs that serve their requirements better.

- Job creation: multinational companies create jobs whenever they enter new borders as they employ the local workforce. Top multinational companies in the US, such as Apple, Amazon, Microsoft, etc., gave jobs to over 1 million people between 2000-2018.

- Growth and Development: Especially due to CSR requirements, MNCs also uplift the societal makeup by contributing to the country’s income, development and growth. Developing countries and MNCs often team up with foreign direct investments (FDIs). It has financed many development projects to eliminate poverty and job shortage.

- Cost Efficiency: Companies eye foreign countries where the labor and raw materials are cheap. Some countries have lower tax rates; together, it brings down the cost.

- Business Expansion: The obvious benefit for the company is the massive business extension by allowing access to a willing new market. Coupled with cost-efficiency, it makes their empire grow immensely.

- Global Brand Recognition: The presence across several countries improves brand image and identity among the worldwide consumers. With higher product demand, consumer satisfaction and wide acceptability, the price of the product rises.

- Diversified Work Culture: An MNC has a cosmopolitan work culture since the employees belong to different parts of the world but work together for attaining the company's goals and vision.

Criticisms of MNCs

Many multinational companies are often criticized for exploiting the cheap labor in foreign countries by paying meagre wages. Moreover, back home, it causes a shortage of jobs.

There have been accusations of flouting workplace safety and environment protection norms. Some researchers say MNCs account for nearly a fifth of carbon emissions globally. A few years ago, many American companies shifted their headquarters to a country with a lower tax rate to pay fewer taxes. It had troubled policymakers, urging them to find a quick solution.

From the company’s perspective, many of them struggle to flourish if the foreign land has high duties and tax rates. Moreover, any political and economic disturbances could shake their foundations too. Besides, if there is volatility in the currency of the two countries, the company could face loss.