Table Of Contents

Joint-Stock Company Definition

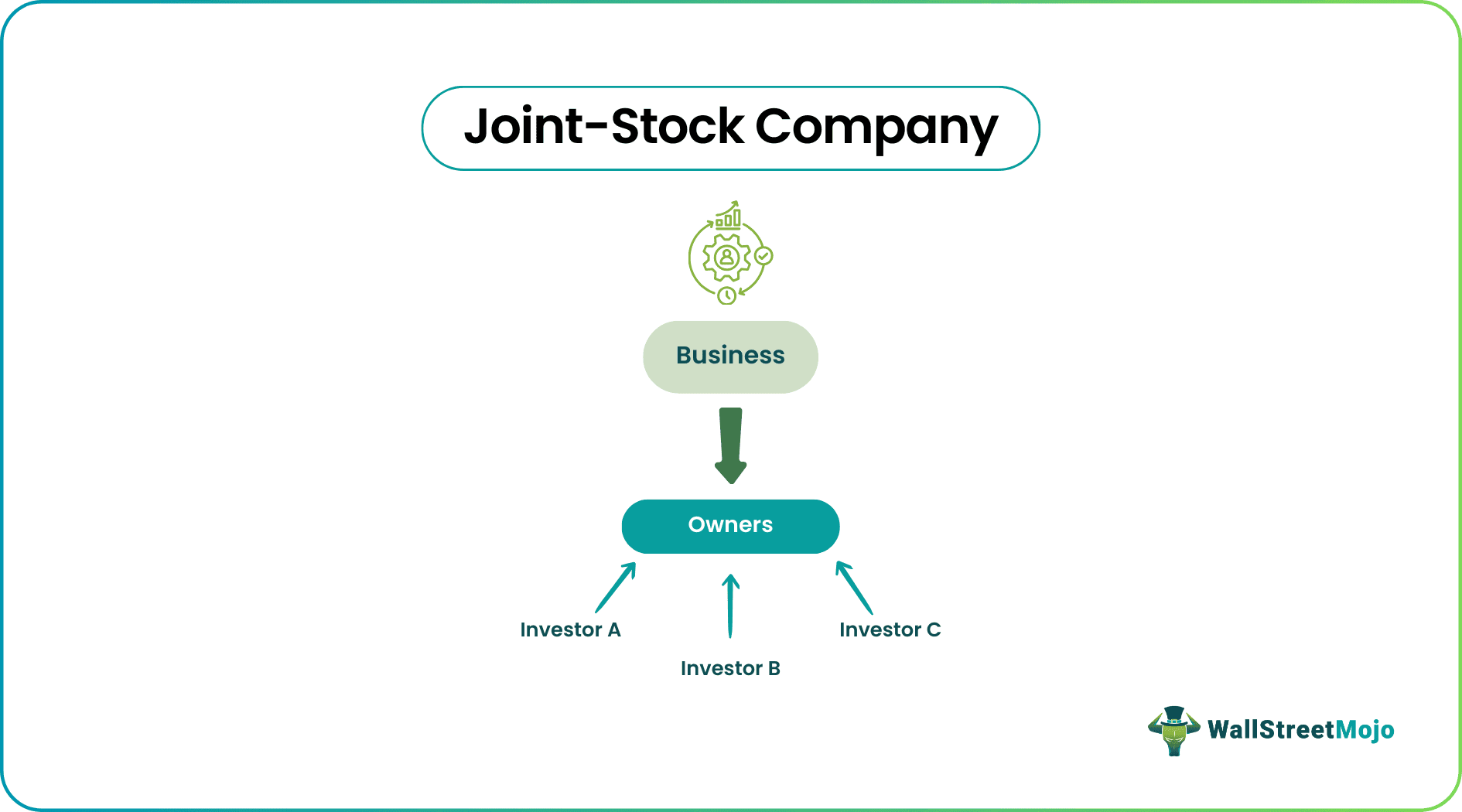

A Joint-Stock Company is co-owned by its shareholders. A shareholder's stake depends on the number of stocks owned by them. They are liable only to the extent of shareholding. Also, stockholders can transfer their shares without any restriction.

A company chooses this structure to raise extensive capital—by issuing shares and debentures to the public. These organizations resemble a corporate structure but, at the same time, relish privileges of limited liability. In this form the business can not only raise capital but also manage ownership and operate among multiple individuals.

Key Takeaways

- A joint-stock company is a separate legal incorporation—owned by stockholders. The ownership is proportionate to each stockholder’s contribution.

- These companies are governed by the laws of the relevant Companies Act. They must file financial reports with the Registrar of Companies. They are required to disclose their financial position to the public.

- In order to change the ownership structure, the Memorandum of Association needs to be amended.

Joint-Stock Company Explained

A joint-stock company is a firm owned by its investors. Contemporarily, numerous businesses have opted for this ownership structure. This way, the business can scale up—amassing capital from numerous shareholders. A private company can become a public company by completing the required legal formalities.

The main purpose of creating a joint-stock company is profit. Shareholders acquire profits in proportion to the stocks held by them. Similarly, their liability is also restricted to the extent of their capital investment. These shares of different kinds of joint stock company can be transferred without the consent of the other shareholders—transfers do not affect the continuation of the company. Also, the retirement, death, or insanity of a particular shareholder does not affect the business. In order to change the ownership structure, the Memorandum of Association and Articles of Association need to be amended.

The emergence of this ownership structure of simplified joint stock company can be traced back to 13th century Europe. In 1606—the Virginia Company of London was formed. It was America's first joint firm. It came into existence when King James I granted the company exclusive rights for establishing the colony of Virginia.

Features

This ownership model of different kinds of joint stock company differs from other structures due to its characteristics:

- Limited Liability: In this ownership model, shareholders have limited liability. Even if the business suffers massive losses, shareholders’ personal wealth is insulated from it.

- Separate Legal Entity: The identity of the business is independent of its members.

- Voluntary Association: There is no restriction on the entry and exit of shareholders.

- Stock Transferability: Shareholders can sell their stocks to new investors—no permission required.

- Perpetual Succession: These companies are separate legal entities; therefore, the retirement, insolvency, or death of a member does not impact business continuity.

- Incorporation: The formation is a lengthy process—legally compliant with the Joint-Stock Companies Act 1844. It, therefore, requires extensive documentation.

- Number of Members: The minimum number of members required is one—there is no upper limit.

- Capital Acquisition: The company can issue shares and debentures —to raise capital.

Types

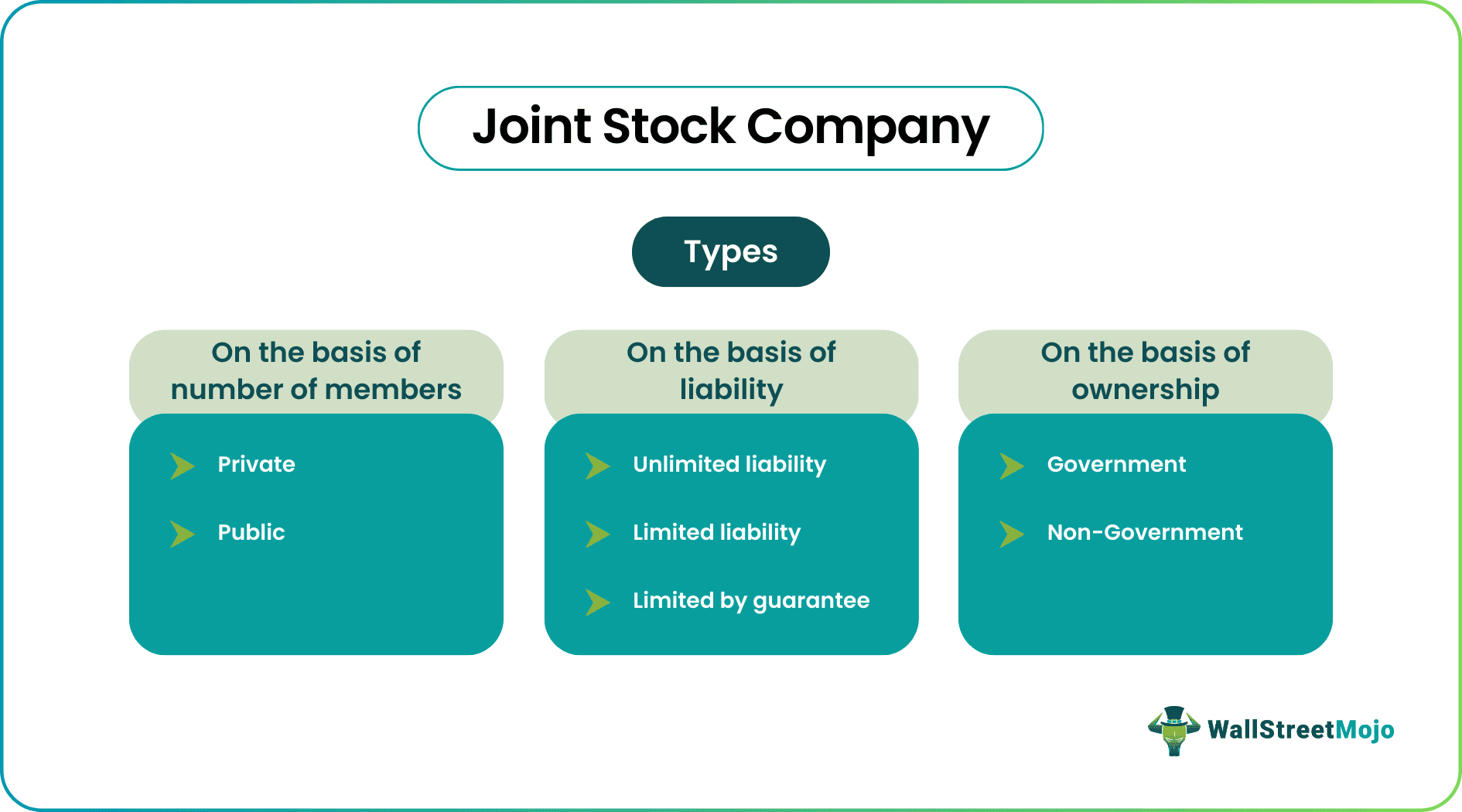

Joint-stock companies are classified based on the following criteria:

#1 - Based on Incorporation

- Registered Company: Any corporation incorporated under the Companies Act of a particular state is called a registered company.

- Chartered Company: It is incorporated under the royal charter duly signed by the king of the state where it is formed. These companies enjoy special privileges in executing commercial business operations. The East India Company is one such example.

- Statutory Company: When the Parliament passes a special act in a company’s favor, it is called a statutory company. These companies facilitate public utilities and amenities. The act documents company's rights, responsibilities, powers, and objectives.

#2 - Based on the Number of Members

- Private Company: A private limited company satisfies three conditions: a) It limits the number of members—specified in the relevant Companies Act b) It restricts the right to transfer shares and c)prohibits any invitation to the public—issuance of shares or debentures.

- Public Company: Generally, there is no upper limit on the number of members in a publicly-traded company. Shareholders are free to purchase and sell company shares. In addition, these companies can issue shares or debentures to the public.

#3 – Based on Liability

- Unlimited Liability Company: In such a company, shareholders’ liabilities extend to personal property and assets.

- Limited Liability Company: This is the most common business ownership model. The liability is limited to the extent of the value of shares held by shareholders.

- Company Limited by Guarantee: The shareholders have to pay a fixed amount in the event of liquidation. The specific amount is documented in the Memorandum of Association.

#4 – Based on Ownership

- Government Company: It is a company in which not less than 51% of the shares are held by the central or state government or a combination of central or state governments.

- Non-Government Company: The majority stake is owned by private individuals or institutions.

Examples

Let us look at some examples of joint stock company formation to understand the application of this ownership model.

Example #1

Smith & Co. needs capital to carry out its expansion—It issues 1,000 shares. Each share is valued at $10, with a share premium of $5 per share. Now, calculate the total amount of proceeds raised by Smith & Co.

Solution:

The total amount of proceeds raised by Smith & Co. is $15,000.

Example #2

Wright Inc. issued equity shares of $10 each at $15. This money is payable as follows:

- $4 on Application

- $6 on Allotment (including share premium)

- $5 on Final Call

Formulate journal entries for Wright Inc. Applications were received for 10,000 shares, and all the applications were accepted. Also, calculate the total proceeds from the issue.

Solution:

Now, let us calculate the total proceeds generated by the shares:

Therefore,

Importance

Let us look at some of the importance of this kind of company structure:

- Since the liability of te shareholders are limited to the amount they have invested in the business, their assets are protected and does not get involved in business related debts or legal problems, which encourages entrepreneurship.

- Since there is an encouragement for investment in business, this allows expansion and growth through access to funding and capital from the financial market. They can raise funds through stocks and bonds.

- Since these type of companies can be from any sector, investors can invest in many sectors at the same time, allowing diversification of portfolio.

- The growth of such companies allow creation of employment opportunities and fosters competition, innovation, growth and stability. This benefits consumers.

- This simplified joint stock company are subject to regulatory and reporting requirements that promote transparency and sustainaibility by creating trust and safeguarding investor sentiments.

- From the point it can be derived that this leads to business ethics and accountability. Such ethical business practices help in responsible conduct in the long run.

- This process helps in raising funds easily in large amount that facilitates investments in large projects and innovation, research, development, etc.

- The professional management of the company operations by the board who are actually by shareholders facilitate in strategic decision making and maintaining accountability. The management has specialized skill and knowledge to manage the day to day operations in the best way possible.

Thus, the above are some significant importance of joint-stock companies that helps in economic growth and development and brings a dynamic atmosphere in the global economy.

Advantages

A Joint-Stock Company structure has the following merits:

- Capital Accumulation: The company issues shares and debentures to the public—considerable capital is raised. The funds are used for business operations and expansion.

- Limited Liability of Members: In limited liability companies, shareholders are protected. Business losses cannot impact shareholders’ personal property or assets.

- Share Transferability: The stockholders can sell off their shares to the other investors without any restrictions.

- Shareholders' Rights: Stockholders have the right to elect the Board of Directors- they have a say in decision-making.

- Transparency: These companies disclose their financial reports and records to the public—to ensure complete transparency.

Disadvantages

This ownership structure and joint stock company registration has the following demerits:

- Excessive Legal Formalities: The incorporation and administration of a joint-stock company involve elaborate legal formalities.

- Costly Affair: The cost of formation and administration is quite high.

- Conflict of Interest: There may be disagreements and conflicts of interest between the stakeholders (owners, employees, the Board of Directors, lenders, etc.).

- No Confidentiality: Financial reports must be disclosed to the public. There is a lack of discretion.

- Double Taxation: Since the company's profits and dividends (when declared) are taxable, shareholders are subject to double taxation.

Joint-Stock Company Vs Partnership

Both the above are two separate types of business practices have some distinct features of their own. Let us study the differences as given below:

- The former is owned by shareholders who own shares of the company but for the latter the ownership is on the partners of the company who share all responsibilities.

- In case of the former, the shareholders are owners but do not handle the day-to-day operation. This is done by the Board elected by them. For the latter, the partners handle the daily operations.

- The liability in case of the former is limited to the amount the shareholders have invested but in case of partnership, the partners are liable for any loss, legal requirements, etc, where they need to compensate from their personal assets.

- During joint stock company registration, they are subject to a lot of complex legal formality, regulatory requirements and government rules. But a partnership firm is easy to form with less legal steps during profit sharing and dissolution.

- The former is also subject to a lot of scrutiny and obligations as compared to partnership firms who have a more flexible system.

- As the former is a separate legal entity, it is subject to pay corporate tax on its profits. The shareholders who receive dividends also need to pay tax on them. However, in case of the latter, the tax returns are filed at personal levels. The profits as losses are routed through the partners of the firm.

Therefore the above are some important differences between the two types of business.