Table Of Contents

Conglomerate Meaning

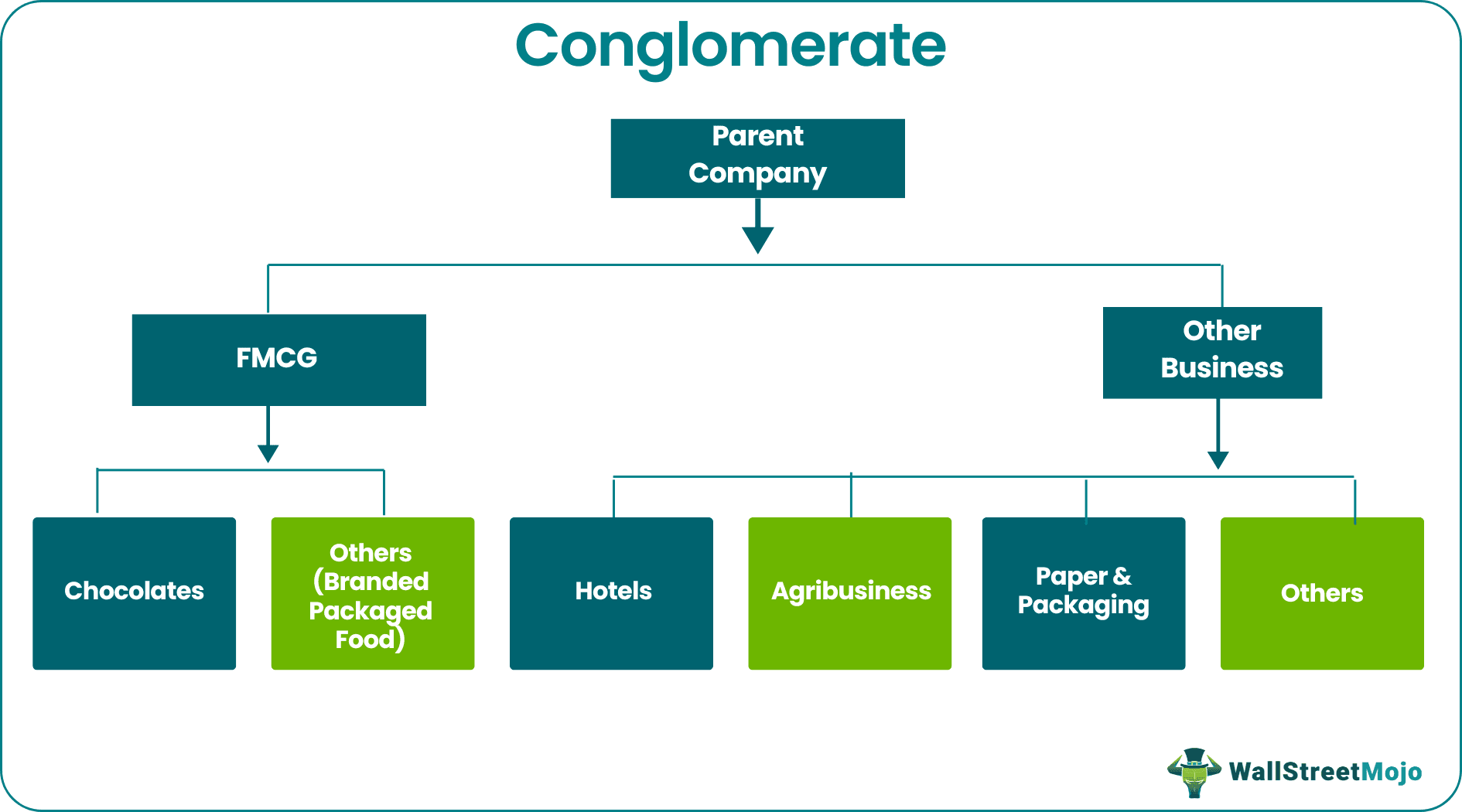

A conglomerate in business terminology is a company that owns a group of subsidiaries conducting business separately, often in distinct industries. It reflects diversification of operations, product line and market to allow business expansion.

For example, tech giant Samsung is a globally renowned South Korean conglomerate that offers many electronic goods. However, Samsung is also efficiently conducting business across unrelated sectors such as heavy industry, construction, insurance, advertising, etc.

Key Takeaways

- A conglomerate is defined as a company that owns many smaller businesses operating in unrelated industries such as food, medicine, clothing, technology, etc.

- It helps in lowering business risks by reducing reliance on single products or market.

- Each business functions independently with separate CEOs who are responsible for profits. Usually, they all report to the parent company that owns them all.

- Expansions typically arise out of acquisitions, and mergers. Many family businesses turned into a conglomerate with mergers and acquisitions as well as by establishing seperate businesses.

- Conglomerates were a rage in 1960s, slowly losing popularity to antitrust laws, mismanagements arising out lack of focused growth and high overhead costs.

- Some oldest business groups that have survived the changing course of popularity are Berkshire Hathaway General Electric, Siemens, and Samsung among others.

Understanding Conglomerates

Conglomerates imply business expansion by diversification to avoid relying on a single product for income. For example, suppose a company started as a cement provider and gradually expanded into sectors such as home décor, electronics and education industry. Inevitably, it became a conglomerate by diversifying from its core business of cement generation towards many unrelated businesses. Some companies expand within the same industry.

Each business functions independently with separate CEOs who are responsible for profits. It allows specialization of business operations by employing a specialized workforce and knowledge. Usually, subsidiaries report to the parent company that owns them all. Subsidiaries must act in line with the parent company's reputation. Some business empires hold over 50 companies, many of which are listed separately. Their individual earning reports are consolidated with the parent company’s SEC filings.

How Does a Company Expand?

Merger or acquisition is perhaps the most widely used methodology to become a conglomerate. It will take years for a firm if it starts from scratch. As such, established entities often acquire smaller businesses with a considerable customer base to enter a new market or industry for a strong footing.

Many multinational companies are conglomerates. Acquisitions brought them new markets, lower risks and joined profits. Additionally, a company can also become a conglomerate by splitting itself to diversify seperate business plans. It allows a company to launch itself into distinct industries by establishing new businesses without any mergers/acquisitions.

In simple terms, this can be understood as splitting the company into various divisions based on distinct business lines with independent CEOs. Many family businesses have expanded their empire using a combination of organic expansion, mergers and acquisitions.

Example of Conglomerates in Business

#1 - Expansion by Acquisition

Berkshire Hathaway, America’s one of the oldest conglomerates, was originally a part of a textile business. Then, in 1965, legendary investor Warren Buffet overtook its reins by acquiring major stocks of the firm. Today, it is a $632 billion company after Buffet invested heavily in many stocks under Hathaway.

The company owns more than 60 companies. Its subsidiaries are prospering in unrelated businesses across sectors such as insurance, energy, utility, manufacturing, freight rail transportation, retailing, etc. In addition, Berkshire holds substantial stakes in Apple, Coca Cola, American Express, Bank of America, etc.

#2 - Organic expansion

Google’s corporate restructuring made it a part of a conglomerate not by integration but when it split itself from its other businesses. In 2015, Google’s co-founder Larry Page announced that Google would become a subsidiary of Alphabet.

The move was intended to separate Google’s core business of search, YouTube, advertising and Android from other business aspirations undertaken by Google. The separation was rooted in the idea of dedicating focused attention to Google’s core business and other initiatives.

As part of other projects under Other Bets, Alphabet has been working towards several ambitious projects such as venture capital, self-driving cars, healthcare plans, etc. Google’s business and revenue expanded over the years. In 2020, Alphabet hit $1 trillion in market capitalization.

#3 - Expansion of a Family Business

A household name in India is that of the Tata Group. Jamsetji Tata founded it in 1868 as a trading company. The company slowly built itself by establishing new industries and through acquisitions.

For example, in 1945, the Tata group established Tata Motors as Tata Engineering and Locomotive Co. Limited, which is amongst India’s largest automobile firms. It was introduced to manufacture locomotives and many engineering products. In 2002, Tata Group acquired the beloved England beverage brand Tetley which was founded in 1837.

Today, Tata Groups owns 100s of companies in over 100 countries. Many of them are listed with Tata Sons Ltd as the principal holding company of the Tata Group. Some of the subsidiaries and joint ventures of the Tata group, which gives it the stature of a conglomerate, are listed as under.

| Sector | Name |

|---|---|

| Insurance | Tata AIG |

| Finance | Tata Capital |

| E-commerce | Tata Cliq |

| Communications | Tata Communications |

| IT | Tata Consultancy Services |

| Consumer | Tata Global Beverages |

| A subsidiary of Tata Global Beverages | Tetley |

| Automobile | Tata Motors |

| Automobile | Jaguar Land Rover |

| Consumer | Tata Starbucks |

| Jewellery | Tanishq |

| Watch Making | Titan |

| Retail | Trent |

| Airline | Vistara |

| Hospitality | Taj Hotels Resorts and Palaces |

Fall and Rise of Conglomerates

Conglomerate structures dominated the United States for several years, from roughly the 1950s. It became easier to multiply profits by buying firms from unrelated businesses. Although, from the 1980s, troubles ensued when investors showed discontent. Companies lacked focused control over subsidiaries, with many falling into a loss.

As per a study by American Sociological Association, antitrust laws eliminated monopoly coming through expansion. Monopoly restricts the entry of new players. As a result, the popularity of conglomerates fell in favor of less diversified focused businesses. Multidivisional structures took over to manage multiple businesses. Only reputed names survived, such as Berkshire Hathaway, General Electric, Disney, etc., by adapting themselves to the changes.

People started to assume business groups were a thing of the past until the world of tech giants unfolded itself. Amazon, Apple, Facebook are referred to as conglomerates by many owing to their diversified business. For example, Amazon has come a long way from delivering books. Apart from an exponential widening of the online delivery business, it offers streaming services, cloud computing, gadgets and payment medium, among others. Moreover, it has acquired many companies to expand its business, with the recent name being MGM Studios.

Asian Dominance

In Asian countries such as South Korea, India, China, Japan, etc., conglomerates have been thriving for several years. As per a McKinsey Study, in 2013, the sales of these business giants rose to 23% in China and India and 11% in South Korea. Popular names include Tata Group, Mitsubishi, Doosan and Jardine Matheson.

Several pieces of research have been conducted to identify the reason behind their survival. As per Harvard Business Review, diversification, greater involvement of ownership and management, and hiring professionals for managing the family business have helped in the survival of business groups in Asian countries.