Table Of Contents

Difference Between S Corporation and C Corporation

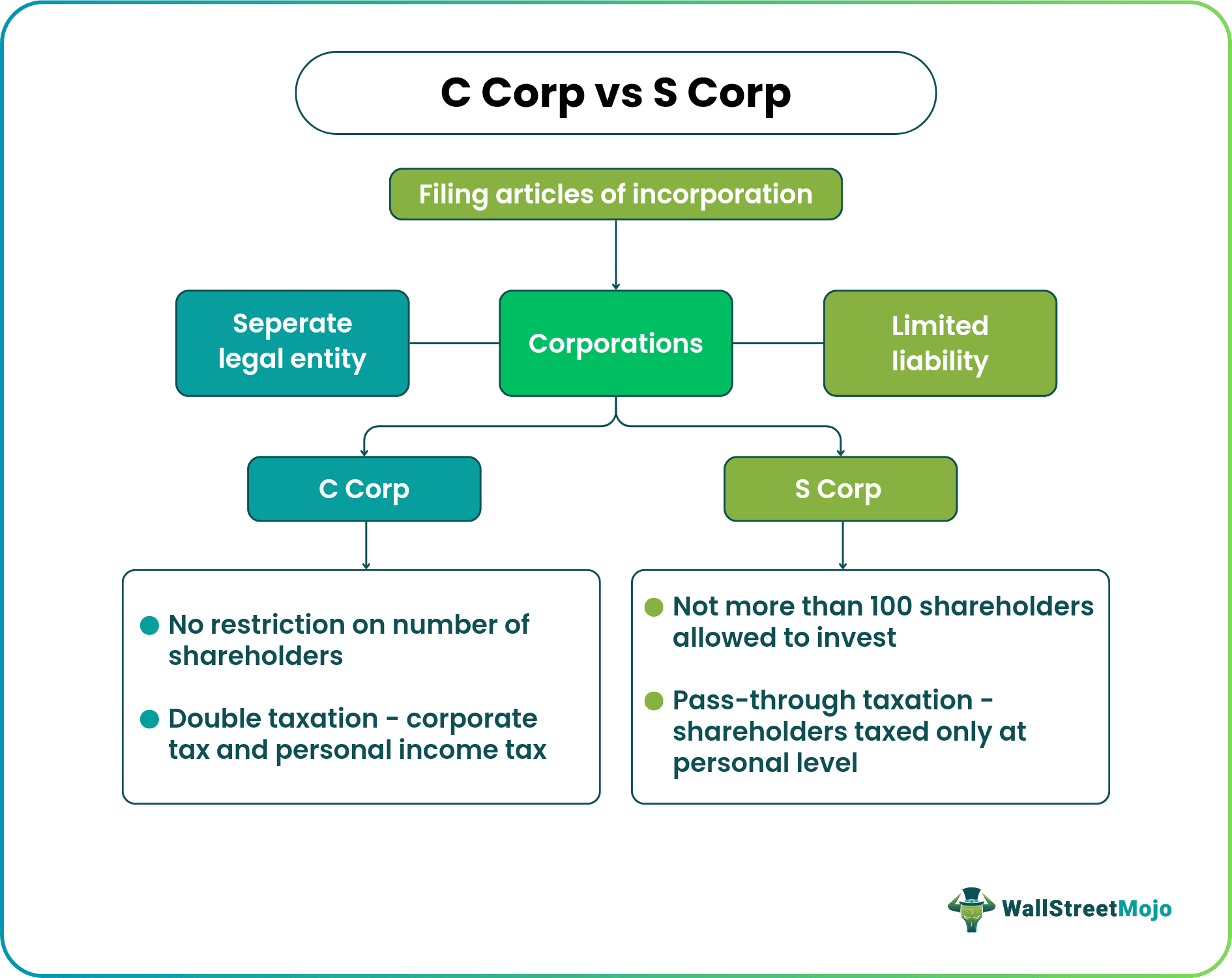

As per the I.R.S., C Corp is the default nature of companies, i.e., they have to pay regular income tax on profits, and any dividends made shall also be taxed accordingly. In contrast, S Corp will follow a pass-through taxation procedure under which its profits shall be taxed only once, but it has to follow stricter rules which can act as limitations for the economic growth of that company.

If you are looking to set up a business by incorporating an entity in the U.S., you will be required to decide between C Corp and S Corp. The question now arises why? The answer is per Internal Revenue Code (I.R.S.) where it defines S Corporation as any business that chooses to pass on tax liability on its shareholders.

Under a C Corporation entity is taxed separately from owners or shareholders. However, while incorporating the C Corporation, you will be noticing that – nowhere on its Articles of Incorporation does it mention these types of corporations. This is because the state corporation law you form under doesn't distinguish between C Corp or S corp. It's the I.R.S. that distinguishes, not the state corporate office.For S Corp, the owners, i.e., shareholders, are supposed to report their income and losses on their tax returns, where they will be assessed at an income tax rate at an individual level. When this occurs, the corporation's income is not taxed at the shareholder and corporate income levels, so double taxation is avoided. For example, Jacks, Inc. was formed as an S corporation in Florida, where Robert owns nearly 51% of the corporation, and Brenda owns nearly 49%.

C Corp vs S Corp Infographics

Let's see the top differences between C Corp vs S Corp.

Key Differences

- The major key difference is that S Corporation is a pass-through tax entity, whereas C Corp is taxable. Hence as mentioned earlier, C Corp faces double taxation, and for S Corporation, any tax due is paid at an individual level by the owners' pro-rata basis.

- The shareholder's limit is 100 for S Corp, while there is no limit for C Corp.

- C corporations will be required to hold at least one meeting every year for shareholders and directors. In contrast, S Corporation is also required to hold scheduled meetings of directors and shareholders.

- As per the I.R.S. requirement, foreigners can't be shareholders for S Corporation, while C Corp has no such need.

- Income and losses must be allocated according to the percentage of ownership for S Corp, whereas there is no such requirement for C Corporation.

- C Corporation is a type of structure where there are no limits on shareholders and allows issuance of multiple classes of stock and while for S Corporation, you can only issue one class type of stock.

- For S Corp, the taxable business income can be split into distribution income and salary income. Only the salary part will be liable to self-employment tax, thus helping in reducing the overall tax burden. No such differentiation is required in C Corp.

- Per I.R.S., 'Generally, an S corporation is exempt from federal income taxes except for the capital gains taxes and passive income. It is treated similarly as the partnership, in that generally, taxes are not required to be paid at the corporate level.' C Corp pays taxes on all income.

C Corp vs S Corp – Comparative Table

| Category | C Corp | S Corp |

|---|---|---|

| Eligibility | No specific criteria for the same however the first step in incorporating a C corporation is to choose an unregistered business name and register the same. According to applicable state laws, the registrant will file the articles of incorporation with the state Secretary. C corporations offer stock to its shareholders, who, upon purchase, will become owners of the corporation. | Must Meet Following requirements: 1) Domiciled in the US. 2) <=100 Shareholders 3) Only One Class of stock can be issued 4) Cannot include: Partnerships, certain financial institutions, insurance companies, etc. |

| Structure | A legal entity that is taxed separately, and which helps in protecting its shareholders’ assets from creditor’s claim | Operates like normal partnerships where profit and losses pass through the shareholders. |

| Corporate Formalities | 1) Must file Form SS-4 in order to obtain a unique employer identification number (EIN). 2) They are also required to submit income, unemployment, state, payroll taxes to the state. 3) To establish a board of directors in order to oversee its management and operation. | 1) After submitting an Article of association for incorporation certificate, all shareholders should sign and submit form 2553 2) Form the 1120S is required to file the U.S. Corporation Income Tax Return |

| Liabilities | C corporations could have multiple owners and shareholders, but it limits the personal liability of the directors, shareholders, employees, and officers. In this way, the legal obligations of the business cannot become a personal debt obligation of any individual associated with the corporation. The C corporation continues to exist even though its owners change and when members of management are replaced. | An S Corp has a lifespan that is independent. Its longevity is also not dependent upon its shareholders, whether they stay or depart, thus making it easy to do business. There is no personal liability for any shareholder and further no debts of the business also. Creditors also have no claim on the personal assets of their owners i.e. shareholders to settle the business debt. |

Conclusion

The choice of entity structure will have a huge impact on multiple aspects of your business, ranging from financing to taxes to growth strategies. Looking at the differences between your options may help you overcome a decision that best suits your business needs and goals.

Many U.S. companies use the S corporation structure's tax savings and limited liability. Compared with partnerships, S corporations have an edge on aspects like continuing business and transferring ownership. As a result, a C corporation can be a fruitful business setup. It provides limited liability for the business owners, allows comparatively more freedom of stock purchasing, permits tax breaks and other benefits.