Table Of Contents

What Is The Full Form Of LLC?

The full form of LLC stands for Limited Liability Company. A limited liability company combines a partnership or sole proprietorship structure and a company structure that has evolved in the US. The liability of the owners or investors is limited either by the amount of stock they hold or by any other defined means. However, such a company's income is the owner's income.

So, overall we can say that the LLC is a form of organization that combines the benefits of partnership and corporation formats to provide greater flexibility to the owners and investors. It can be a boon to the economy if not abused because of lower costs and quicker formation. In addition, it could help people gain the courage to start independently without having to shell out huge fees and spend hours on paperwork.

Full Form of LLC Explained

The full form of LLC company is limited liability company. It is a very popular type of company structure. It is a combination of limited liability as well as the flexibility of sole proprietorship and partnership firms. The owners of LLC are called members, but they are protected from bearing the personal liability in case the business has a lot of liability or debt.

Since the members are shielded against the company debts, in case of any financial lawsuit, they are not at risk. Even in case of filing tax returns, it is done in the individual member’s tax returns. The management is more flexible and informal in their approach. All rules and regulations of running the business is outlined in the agreement framed for the purpose.

It is very simple in its features and is a great choice of business which are small or medium in size. However, the rules and regulations for setting up and running an LLC may vary depending on the laws of the country and jurisdiction where they want to operate. It is important to know these rules before establishment of the same. Therefore, full form of LLC company is a situation of the best of both worlds if it doesn’t get affected by ill-intent and the owners fulfill their fiduciary duties properly.

Purpose

Let us try to understand the purpose of setting up this kind of business entity.

- Limited liability implies that the owners' assets can't be attached to pay off the company's debts if the company's assets are not sufficient. It makes an LLC similar to a private limited company.

- When the income is considered personal income, it avoids double taxation because it is taxed only once in the owners' hands and doesn't get taxed at a corporate level. This feature is called pass-through taxation. It makes it similar to the partnership or proprietorship format.

Characteristics

The following are the characteristics of a full form of LLC in google.

#1 - Governed by State Legislature

The rules for forming an LLC vary from state to state except for a few generic ones, which are common for almost all states. The state's default rules automatically apply to the LLC formed in a given state unless otherwise specified in the formation documents and approved by the governing authority.

#2 - Flexibility

LLCs are subject to lesser regulations and disclosure-related requirements. Therefore, this structure provides a more flexible environment to work in. It is popular with smaller organizations to create this structure due to restrictions on funds and workforce.

#3 - Protection of Personal Assets

LLC protects the owner's assets more than in a corporation format.

#4 - Fiduciary Duty

The Delaware LLC Act 2013 ruling established that the owners have a Fiduciary duty towards the LLC and its members, which implies that they have to act in the best interest of the LLC and its members. It protects the LLC's rights from the ill intent of owners who want to misuse this organization structure's limited liability protection.

#5 - Operating Agreement

Similar to a partnership agreement, it is important to create an operating agreement for an LLC to avoid disputes in the future and ensure smooth operations over the long term. Such an agreement contains the contribution made to the capital by the owners, the reward-sharing ratio, and the company's organizational structure.

#6 - Legal Registration

A state-specific registration is required for an LLC to start transacting. It is somewhat similar to a certificate of commencement of business. Likewise, the formation of the LLC is similar to receiving a certificate of incorporation. Still, before the LLC can begin the business, it must register per the state's guidelines.

#7 - Taxation

If there is only one LLC owner, then it falls under a disregarded entity and is taxed as per the individual tax rate. The income or loss specified in Schedule C of individual tax returns. If there are multiple owners, it is taxed per partnership taxation rules, and the individuals mention the income per the reward ratio specified in the operating agreement. However, an LLC can register itself as a corporation for taxation purposes if it feels this is appropriate.

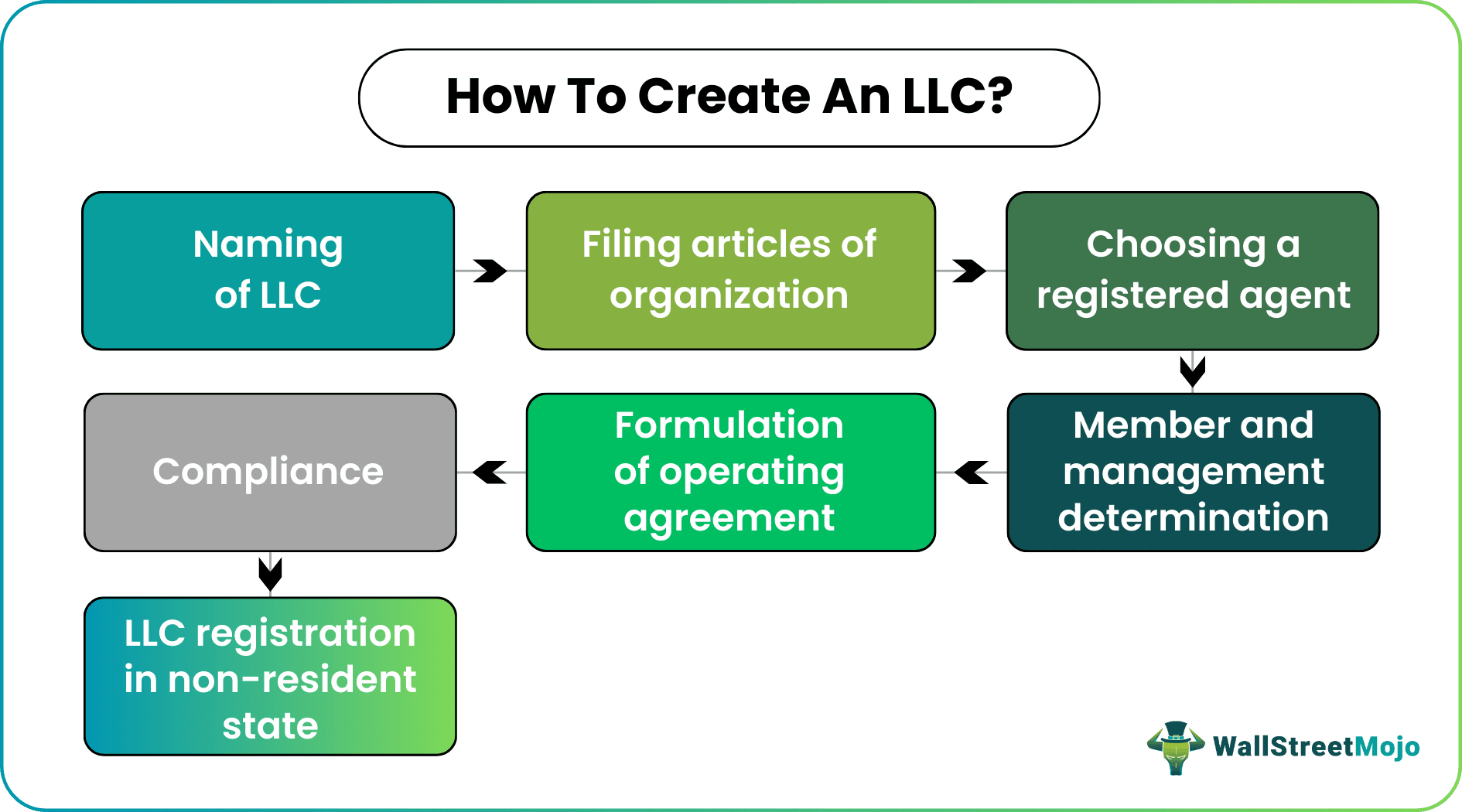

How To Create An LLC?

The process is shown in the below SmartArt:

Let’s elaborate on how to create an LLC:

Naming of LLC

- An LLC should have the words ‘LLC’ written at the end of it, either in full form of LLC in google or an abbreviated form

- The chosen name should not be similar to that of another LLC in the given state

- It is advisable to reserve the name for a small fee till the time the registration of the LLC is not completeFiling Articles of Organization

- Filed with the secretary of state in most states or any equivalent authority.

- It can also be known as the certificate of organization or formation.

- The LLC should abide by the state-specific requirements for such filing

- Information such as name, name, and address of the registered agent, name of managers and owners, etc. need to be filled in the articles.

- The payment of the state-specific fee is the final step of this process.Choosing a Registered Agent

- The person entrusted with accepting legal notices on behalf of the LLC.

- It should have an address in the state where they formed the LLC.

- It can be a member of the LLC or a commercial third party who renders such services to various LLCs in the state.Member and Management Determination

- Members take care of day-to-day operations, while owners may only invest capital if the LLC is very large or its spread operations.

- It might also be an owner-managed LLC in case of small operations.Formulation of the Operating Agreement

If this document doesn't exist, state law applies to the LLC. However, it is a better idea to have one to avoid disputes in the future.

Compliance

- Obtaining a license for conducting business.

- Completing tax-related formalities to define how the income will be taxed.LLC Registration in Non-Resident State

If an LLC plans to operate in multiple states, it must register itself in each state.

Examples

Let us try to understand the concept with the help of some suitable examples.

- To find an LLC company, we can go to the secretary of state website of a particular state and the database of business entities. We may search for the LLC company we want to know about or even do a keyword search.

- So, for example, BLACK ROCK CITY LLC is listed in California and falls under Nevada's jurisdiction. It has been active since 30th November 1999; its entity number is 199933510147.

- We can even look for its latest statement of information to see whether there is any change in the LLC's basic information. This particular LLC is in the event production business, and its registered agent is Ray Allen.

Benefits

Some benefits of the process are as follows:

- Avoids Double Taxation - The pass-through taxation mechanism leads to taxation only in the owners’ returns and not in the returns of the LLC. Thus, all the gains and losses are passed through to the members of the entity, which eliminates the problem of double taxation while filing returns. Therefore, the income is taxed only once

- Faster Formation - As the paperwork requirement is lower, one can formulate it quickly. It is easy to establish and operate compared to corporations. The documentation and filing requirements is relatively simple and so it is suitable for small or medium sized business.

- Cost-Effective - The fees required at various stages of formation and operation are very modest and nominal, and therefore, it is highly cost-effective.

- Protection to Owners - Owners' liability is limited, and one can't use their assets to pay the LLC's liability unless otherwise specified.

- Flexibility on profit distribution – The members have the freedom of decision regarding distribution of profits or losses among themselves, provided it is in alignment with the terms and rules mention in the operating agreement.

Limitations

Here are some limitations of the system.

- Appropriate for Smaller Organizations - If the ownership and vast operations are geographically scattered, the LLC form might not be efficient enough.

- Misuse of Flexibility - As the regulatory requirements are lower, there are greater chances of fraud, and the owners may not sustain their fiduciary duties to the LLC and its members.

- Tax for self employment – Members of the organization are subject to self-employment taxation for their own share of business profits leading to increase in the overall tax to be paid by individual members.

- Awareness about rules – It is necessary for members to be aware of the laws, regulations and compliance requirememts prevailing in the area of operation, which may vary depending of the state where the LLC has been formed.

Limited Liability Company Vs Limited Liability Corporation

Both the above are two different types of business organizations that operate in the market. However, there are some differences between them, as follows:

- Paperwork Requirement - The most important reason for forming an LLC instead of a corporation is that the disclosure requirements are lower in an LLC than in a corporation.

- Taxation - As discussed above, the LLC is a pass-through taxation entity. At the same time, in a corporation format, the corporation files its tax returns, not through the corporation's owners. Therefore, the income is taxed twice. Once as the corporation and once in the hands of the owners when they receive dividends. There are some exceptions to this, but most of the time, taxation relief is a big incentive for LLC formation.

- Cost - As an LLC has lower disclosure requirements and other paperwork, the cost associated with this also reduce.

- Size of the Organization - LLC format is preferred when the organization's size is smaller, and the owners are not geographically scattered. As a result, they can be held accountable for their actions. On the other hand, the corporation is more suitable for larger organizations with scattered ownership and divorce between management and ownership.