Table Of Contents

What Is A Variable Interest Entity?

A variable interest entity (VIE) generally refers to an entity in which a public company has a controlling interest even though it doesn't own majority shares. Therefore, the public company can direct the VIE's significant activities and control the flow of profits/losses.

The variable interest entity structure normally comprises investors who do not possess much resources to support the operational activities for the businesses. Common activities of a VIE are generally a transfer of assets, leases, hedging of financial instruments, R&D, etc. Common activities of a VIE are generally a transfer of assets, leases, hedging of financial instruments, R&D, etc.

Variable Interest Entity Explained

A variable interest entity is a legal business structure with investors having controlling rights over it even when they do not have a majority of voting rights. The rights are exercised by the entities under a contract and not because of any ownership dominance. Such business structures come into existence when the investors run short of resources to fund, finance, or provide any support to the operational processes of a business.

A VIE is an entity that prevents businesses from legal actions, creditors, and other issues, but they do not have any contribution to residual profits and losses. The businesses with VIEs must reveal the holding of these entities in the latter’s balance sheet. In the 10-K Forms, it is mandatory for public companies to reveal their bond with these entities.

For consolidation, variable interest must be identified, determine whether the entity is a VIE, identify the primary beneficiary of the VIE, which will consolidate the transactions of VIE in its books and thereby present the consolidated financials of all different legal entities which are under common control so that stakeholders can get the correct view of the financial position of the company as a holistic economic entity.

Examples

Let us consider the following examples to understand the variable interest entity definition in detail:

Example #1

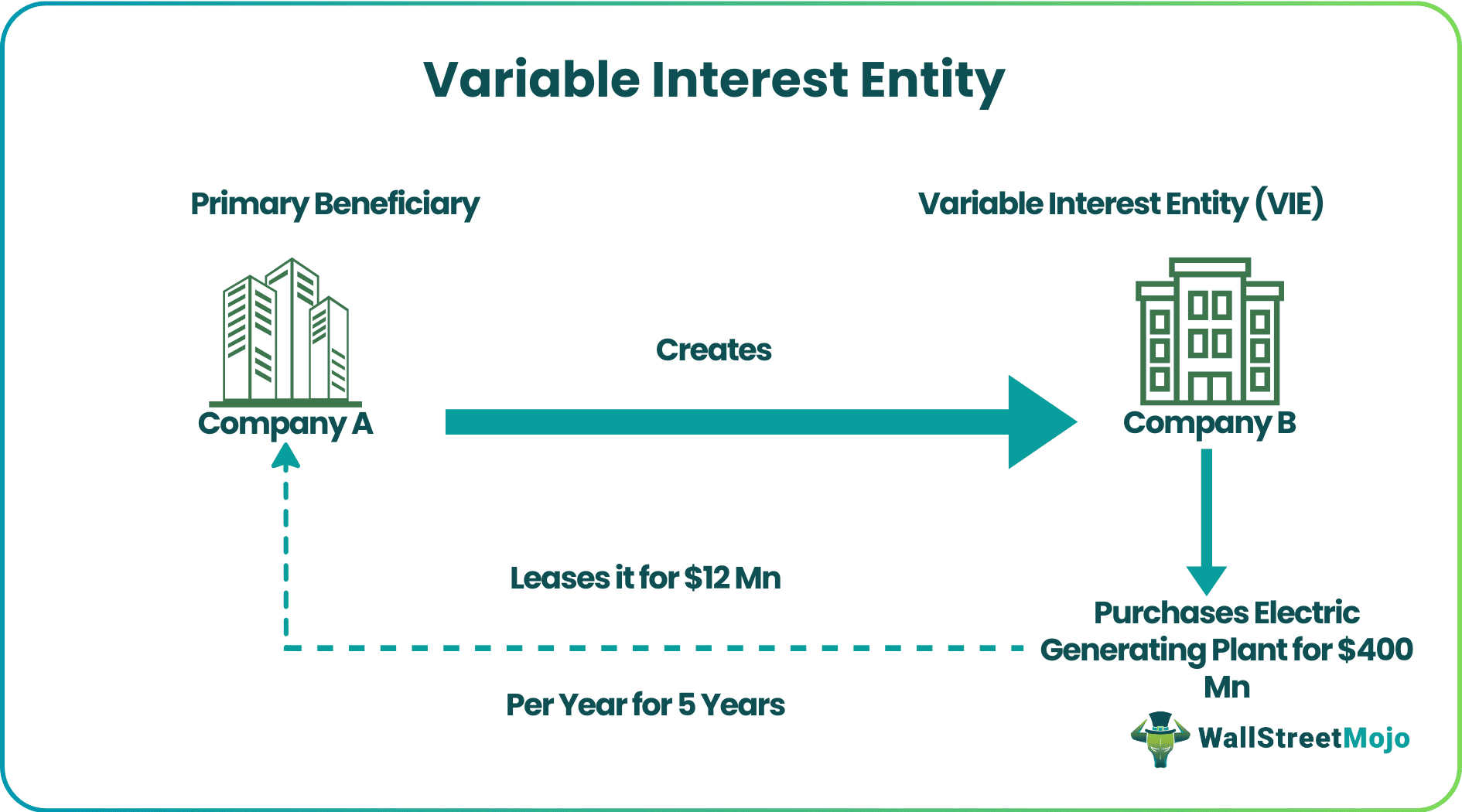

'A,' an Electric company, creates 'B,' a power finance co. B issues 100% non-voting stock for $ 16 Million to an outsider investor and issues debt securities to A for $ 384 million. B then purchases an electric generating plant for $400 million and leases it to A for $ 12 million per year for five years.

At the end of the lease term, A must renew the lease for five years, purchase the generator for $ 400 million, or sell the electric generator plant to a third party. Also, if B cannot repay the equity investor, then A pays $ 16 million to an equity investor.

In the above example, the below factors point that company B is a VIE, and company A is the primary beneficiary.

- Equity owners do not have the power to direct the entity's operations.

- A has bought debt securities of B, which constitutes a majority of the investment.

- A has the power to direct the activities of B, which is to lease the electric generating plant to A.

- A is exposed to the variable returns as A must absorb the losses or receive returns from the lease agreement, which is the significant activity of B.

- B receives only a fixed fee.

Hence here, A has to consolidate the Financials of B along with itself.

Example #2

Before the Enron scam, US GAAP considered only voting interest entities (i.e., entities with majority voting power) for determining controlling financial interest for consolidation purposes. However, Controlling financial interest may be achieved through arrangements that do not involve voting interests.

Let's see the example of Enron, which used certain arrangements to avoid consolidation of financial statements, thereby depriving the users of financial statements to have a true and fair view of the state of affairs at Enron.

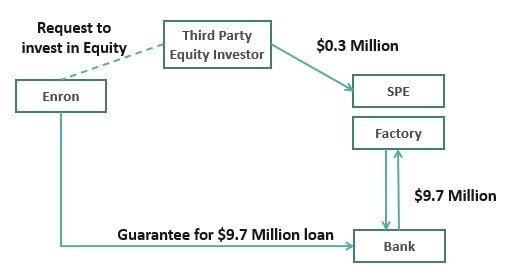

Let's say Enron wants to build a factory for which it needs to invest capital, say $ 10 Million. Now, instead of borrowing money and building a factory through the legal entity of Enron, it created another entity called a special purpose entity (SPE) to build the factory.

Now, SPE will go to a bank and ask for a loan of $ 10 million. Enron will guarantee the loan for the SPE. Bank will lend $ 9.7 million to SPE (net of equity investment) based on the guarantee of Enron. For balance equity investment, Enron would request third parties interested in the project or affiliates of Enron to invest $ 0.3 million.

In this arrangement, an Equity investment of $ 0.3 million is 100% outside of Enron and thus would make SPE independent of Enron, and hence it would no longer have to consolidate the SPE in their books. But the value of Equity investment is minuscule compared to the project cost (3% of $ 10 million), and Enron is financing 97% of the deal by guaranteeing the debt. Hence Enron is practically controlling the SPE.

In this way, Enron could move bad assets out of their balance sheet into the SPE and even book gains on selling assets to SPE (which is essentially its own company).

By such arrangements entered, some companies avoided reporting bad assets and liabilities for which they are responsible and delayed reporting losses incurred or report illusory gains.

Thus, due to the above, the concept of the variable interest entity was introduced as a consolidation requirement so that stakeholders can see the fair picture of the company's financials.

Consolidation Rules

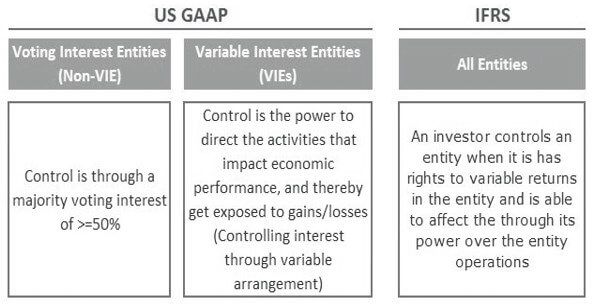

It is important to determine control to prepare consolidated financial statements. US GAAP provides two models for consolidation of controlling financial interests, while IFRS provides a single consolidation model.

Disclosure Requirements

The status of Variable Interest Entity(VIE) is to be reviewed at the end of each reporting year credit Edit date and time on the occurrence of specific reconsideration events. The following events are to be reviewed for ascertaining the status of VIE:

- Change in the structure of VIE through a change in arrangements/ contracts, resulting in a change in the quantum of equity investment at risk.

- Change in the proportion of risk faced by investors by way of change in the entity's equity and debt structure, resulting in a change in the exposure of gains/losses flowing to the primary beneficiary.

- Change in variable return received by the primary beneficiary from the VIE due to additional activities undertaken by VIE after the initial set up of the structure of VIE.

- Change in profits/losses of VIE due to the change in investment structure or change in business activities of VIE, leading to an insignificant proportion of return flowing to the primary beneficiary.