Table Of Contents

Zombie Company Definition

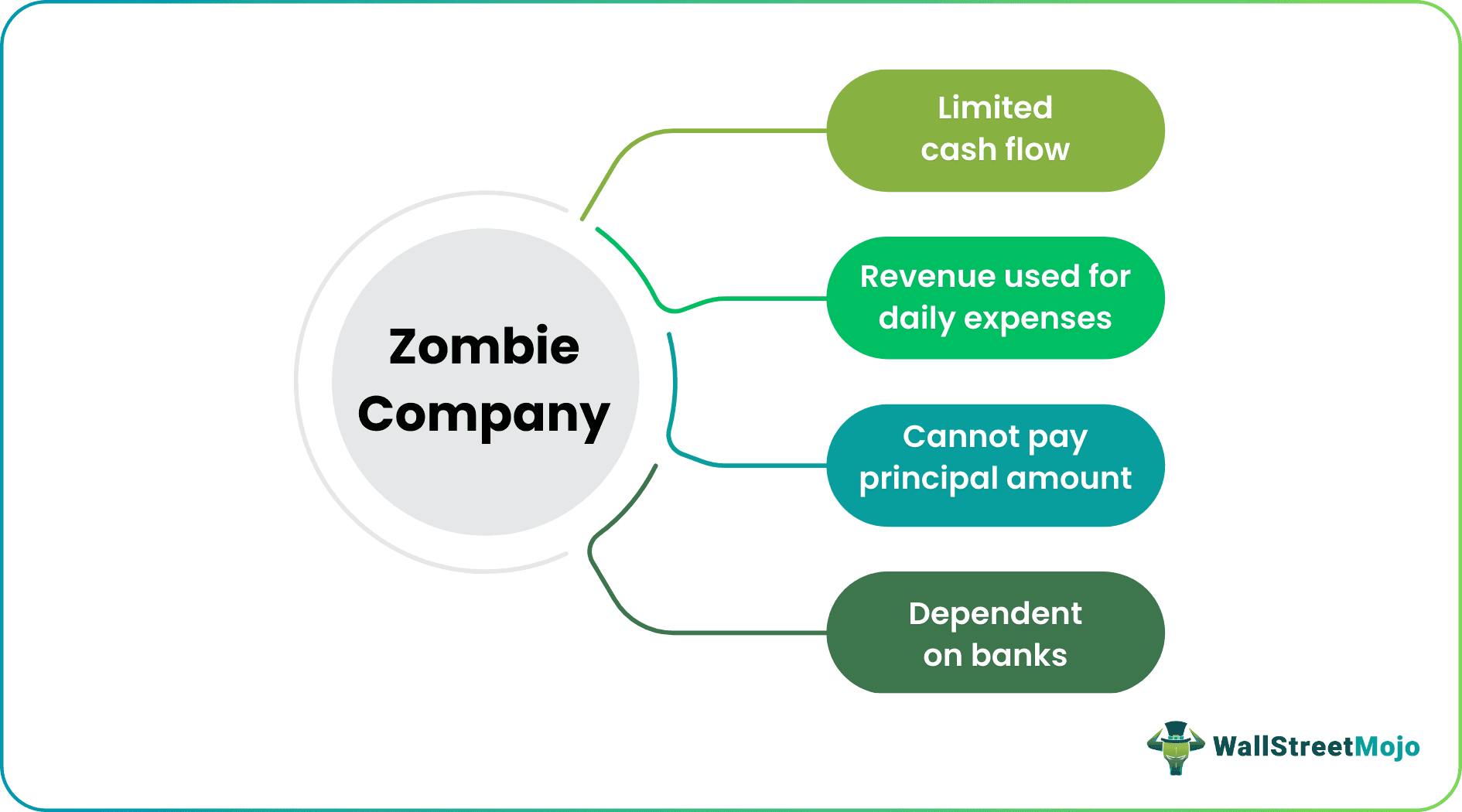

A Zombie Company is a corporate entity with very limited cash flows, only sufficient to pay the interest on the debt borrowed but not the principal amount of the loan. The revenue generated by the business operations only covers the fixed routine & operating costs, and thus a Zombie Company is dependent on the bank for its bailout.

In COVID19, many companies came to the situation of being a zombie company. The supply chain should stay intact to bring economic stability to the country. If the country's residents start using domestic goods and/services, it will help the zombie companies to refurbish themselves. At these crucial times, the government's support is very important for the corporate entities (since these entities are employment providers and tax generators for the country).

Key Takeaways

- A Zombie Company refers to a corporate body with minimal cash flows, sufficient only to pay the interest on the borrowed debt but not the principal loan amount.

- In the 1990s, the Japanese asset price bubble busted, and the period was said to be a "lost decade."

- As a result, Japanese banks supported the weaker or loss-making firms in need. At that time, the term "Zombie Company" was first used.

- This company can raise funds by offering directors a guarantee certificate.

- However, no country wishes to have this company as it lowers the productivity of their economic environment.

Zombie Company Explained

A zombie company is an organization that is in a dire financial situation where they are only able to pay interests and need bailouts from banks or other sources to survive.

In general terms, zombie means someone who is unconscious but is controlled by someone else. A zombie is a dead person who is brought back into life but who cannot speak or move easily.

Similar terms have been crafted for a zombie company, and thus, it can be said to be living dead.

It always needs a bailout, and it depends on banks to survive. Thus, the debt liability will not reduce with time as the company is paying only the interest component. However, one should note that if the floating interest rate increases, the funds will be short of paying the routine fixed costs.

Video Explanation Of Zombie Company

History

Zombie company growth depends heavily on a bailout. The emergence of the terminology, theory, and emergence of such companies are important to understand to fully understand the concept. Let us do so through the discussion below.

- In the 1990s, when the Japanese asset price bubble collapsed, the period was said to be a "lost decade." In the said period, Japanese banks continued supporting the weaker or loss-making firms at the time of need. It was the first time the term "Zombie Company" was used.

- Again in 2008, when the United States’ Troubled Asset Relief Program was starting to provide support to the weaker section of the corporates, the concept started reviving again.

- Even from 2008 to the latest 2018, the non-corporate debt of China has increased four times. The Chinese government has bailed out many zombie companies, resulting in overcapacity in many sectors.

Examples

Let us understand what it takes for a company to feature on a zombie company list with the help of a couple of examples.

Example #1

- As you can see, the Calendar year 2017 was the last year in which the organization had enough demand to meet all its expenses, including interest & was still left with enough surplus before tax.

- After the economic slowdown (say 2018), the demand reduced & the company strives hard to survive since the fixed routine expenses cannot be reduced below a certain level. As you can see, the EBIT is barely sufficient to pay off the interest component.

- Thus, they need support from banks for lowering the interest rate to survive for the near long term. This way, commercial banks are required to provide credit to such companies.

Example #2

In 2021, a study found that 10% of publicly listed companies in the United States of America were termed zombies.

After the 2008 financial crisis, the feds concentrated heavily on creating demand and in turn, completely missed focusing on supply in the economy and created a breeding space for more zombie companies to emerge. It is not completely Feds’ fault. However, the situation where the natural interest rate is virtually zero, creditors are encouraged to renew their financial agreements when there are high chances that the company might not be able to repay the debt in full.

How Does It Get Fresh Funding?

Since every company on the zombie company list are already debt-ridden & have a lower credit history, it isn't easy to raise new funding.

However, if the company has enough production capacity to raise its revenue, some banks/organizations may give fresh funding by the following means:

- The company may raise finance for each sale invoice they raise. It gives confidence in business operations to the banks.

- Another way is to take finance from the companies which are non-zombie in the same sector (for example, raw material supplier company, distributor company, etc.). It isn't easy, yet business relations among peer companies can happen.

- The zombie can raise finance by giving directors a guarantee certificate. As the company is an artificial company, banks often have confidence in the management skills of the director of the said company.

- Existing assets may be used for refinancing by way of top loans.

Effects

It is an obvious thought process that no organization or economy wants to breed such a company. In fact, they would only want to concentrate on zombie company growth. Let us understand what effect it has on the economy.

No country wishes to have zombie companies in their economic environment because of their lower productivity. It entails the lower growth of the country. They also restrict the growth of the most useful resources. They also acquire a figure out of total market share, and thus, such companies are often called “Uncompetitive Survivors.” Their existence is of no importance to the government of the land.

However, they are also providers of jobs to many people, and this is the only reason the government has to bail out such companies. Even if they weaken the economic growth, for a few years, at least, the government has to bail out such companies.

Since productivity is lower, it also pinches the government with lower tax revenues.

Conclusions

In COVID19, many companies can come to the situation of being a zombie company. The supply chain should stay intact to bring economic stability to the country. If the country's residents start using domestic goods and/services, it will help the zombie companies to refurbish themselves. At these crucial times, the government's support is very important for the corporate entities (since these entities are employment providers and tax generators for the country).