Table Of Contents

What Is A Delaware Corporation?

Delaware Corporation refers to a company registered in the state of Delaware. However, they have the flexibility to operate their business from anywhere in the world. It will benefit the newly set up organization because it is easy to register in Delaware compared to other states.

In addition, there are various tax advantages to the company, its directors, shareholders, and members. The primary purpose of this arrangement is to attract business investments from big states like New York, and the comfortable corporate-friendly environment of the place has made it further possible.

Key Takeaways

- Delaware Corporation is a company registered in Delaware state. Still, they have the flexibility to function their business from anywhere in the world.

- It benefits the newly created organization since it is easier to register in Delaware than in other states.

- Moreover, numerous tax advantages exist for the company, its directors, shareholders, and members.

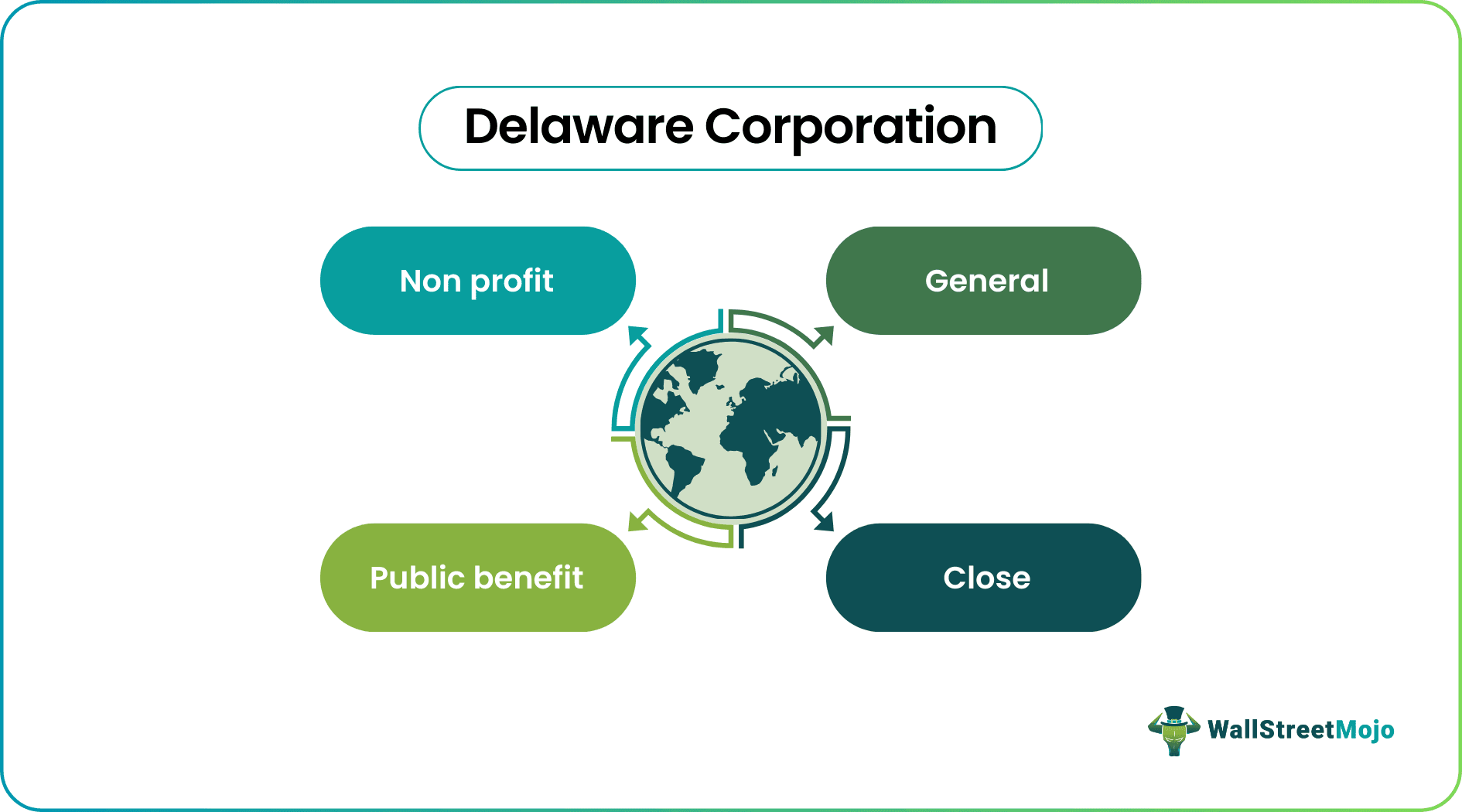

- The Delaware Corporation types are a general, close, public benefit, and non-profit corporations.

- Delaware law is very transparent, and many cases have already been decided. Therefore, settling any future dispute and forecasting the case results is easy.

Delaware Corporation Explained

Delaware corporation is a business entity established in the state of Delaware and is legally registered there. However, it can operate in any state. The primary objective is to attract businesses from other big states like New York and use its corporate-friendly atmosphere to work.

The financial institutions incorporated under the Delaware corporation law become very profitable over there because ethe place allows them to charge higher interest rates compared to other states and at the same time, allowing the freedom to operate without much stricter laws. A company incorporated in Delaware can operate using the same rules in other states also.

Thus, the other states are also following the path of this type of entity and using its rules and regulations to operate so that they are able to compete with Delaware entities and run their own business.

Types

Let us look at the types of entities under the Delaware corporation law.

#1 - General Corporation

It is the most attractive type of corporation. In this corporation, company owners sell their shares to the public and raise funds from the public. In this structure, shareholders own the company and its shares, whereas directors will handle day to day operations of the company. It is just like a public limited company.

#2 - Close Corporation

It is similar to a general corporation structure but very restricted. In a public corporation, the company can sell its shares publicly but can sell shares to a specified number of shareholders in a close corporation. It means only outsiders can buy these shares. If anyone wants to sell their shares to an outsider, there should be the refusal of the entire existing shareholder.

#3 - Public Benefit Corporation

These are legally registered in Delaware, and certificates of incorporation of these companies are marked as these are operated only to benefit the public, society, and environment, not to maximize shareholder profit. These companies will act morally, ethically, and responsibly toward the community and the public.

#4 - Non-Profit Corporation

These do not have shareholders like the other three corporations. Instead, this will have a member with voting rights. These members can appoint directors by casting their votes. Generally, activities of this type of corporation are non-profitable. Therefore, they are not required to pay any income tax but must file the return with all the required information.

Formation

Let us look at the steps to register Delaware corporation.

- Decide the corporation’s name, and it should be unique and not familiar with the other company already operating in Delaware is the first step while forming a Delaware corporation.

- File certificate of incorporation with all the details like name of the company, address, authorized capital, and other required information.

- Appoint an agent registered in Delaware who will act on behalf of the corporation.

- Prepare corporate books to keep essential papers like share certificates and meeting minutes.

- Prepare internal company policies to follow during business operations.

- Appoint initial corporate directors who will sign all the incorporation papers and serve on the board till the directors are elected in the first annual meeting of shareholders while forming a Delaware corporation.

- The first board of directors meeting will be held in which the directors will take corporate officers, corporate banks, policies, authorization of issue of shares, and the necessary decisions.

- Shares will be issued to the public and raise funds.

- Comply with the Delaware annual report requirement, franchise tax requirement, and other regulatory requirements.

Thus, the above are the steps to register Delaware corporation.

Example

Let us assume Star Industries has been established in the state of Delaware after following the Delaware General Corporation Law (DGCL). This unique name has been decided by the founder members who then registered the corporation by filing the Certificate of Incorporation and appointing an agent who would act on the company’s behalf.

This agent will be responsible to keep the important documents like share certificates, details of all meetings, etc. Then the rules and regulation regarding operation has been made along with the appointment of the board of directors. The required steps and legal formalities are met to issue share to the public and meet the other regulatory requirements.

Dissolution

Dissolution of business that is incorporated in the state of Delaware requires the stockholders to vote in a meeting as per the Let us look at the types of entities under the Delaware corporation law. The board of directors should first pass a resolution to close down the company and then submit the resolution to the stockholders. Then a meeting will be conducted where a majority of the shareholders should approve to the process. The notice for the meeting should be send at least ten days before the actual meeting.

The Delaware General Corporation Law (DGCL) also provides the option to shareholders to give their written consent in order to dissolve Delaware corporation. Each voter can consent separately or sign a document stating that they agree to the dissolution. Small Delaware enterprizes find it easy to dissolve the business due to less number of shareholders or the shareholders are mostly the directors themselves.

After the above process to dissolve Delaware corporation is complete, the Certificate of Dissolution is filed using either the short form, which is possible only if the business has no assets, the tax is minimum and has no pending tax or fees, or use the standard format, which will require the name of the business, directors and their addresses, dissolution date, and incorporation date.

The final winding up take some time and is handled by some designated offcers of the company. They need to handle tasks like winding up any legal cases, paying off pending liabilities, property disposal, claim distribution to creditors and shareholders etc.

Benefits

- Delaware corporation is beneficial for start-up and venture capital firms because it helps raise funds.

- The law of Delaware is very transparent, and there are so many cases already decided. Therefore, it is easy to settle any future dispute and predict the outcomes of those cases.

- Delaware Corporation law/statute provides flexibility in the organization and rights and duties of directors and shareholders. For example, only one person can act as a director, shareholder, and member of the company in Delaware. It is also not required that directors and company members reside in Delaware.

- There is greater privacy and anonymity in a Delaware Corporation. Also, there is no need to disclose the name of directors and company members publicly like others.

- Delaware is a tax haven for the company registered in the state because it provides various tax advantages. For example, corporate tax is not applicable if a company is registered in Delaware but doing business in another state. No royalty is chargeable on intangible assets and many other advantages.

- The value of companies registered in the state is generally higher than those registered in other states.

Limitations

- Registration costs of Delaware Corporations are usually higher than in other states.

- If the company is operating in other states, it needs to pay double franchise tax – the Delaware franchise tax and the franchise tax in the state where it operates.

- It has more paperwork for compliance with regulations compared to others.

- Legal cost is high in Delaware because companies hire only registered agents to receive legal advice and Delaware corporate lawyers for court cases.

Delaware Corporation Vs Limited Liability Company(LLC)

- The tax structure and tax liabilities are different in case of both of them.

- The corporation cannot have more than 100 owners whereas the LLC has no such limitation.

- The Corporation is not a separate entity and therefore is liable for any financial or legal obligation. But the LLC has no personal liability.

- Forming a corporation in Delaware is more time consuming and needs more paperwork than an LLC.