Table Of Contents

What Is A Shell Corporation?

Shell corporation refers to a dummy company whose existence is confined in documents and has no physical presence, no office, and no employees. It has no active business operations running with no tangible assets or plat, property, or equipment in its possession. In addition, any products and services don't trade on the stock exchanges.

Shell companies are also set up to hide and protect the business owner's assets or illegal income to prove the same in front of legal authority. They may be used only as special purpose vehicles to ward off the assets being generated with illegal sources.

Key Takeaways

- Shell corporations are non-tangible businesses with no physical existence, just registered firms on paper. Such corporations have no office, no operations, and no employees.

- Such corporations are set up to hide the real method of owners’ incomes, avoid taxes, and usually generate from illegal means.

- The United States Security Exchange Commission (SEC) requires such corporations to be registered, even if it is just on paper, to maintain fair means of business.

- In the absence of real sources from which it has generated the economic sources, it is very difficult or impossible to ascertain the explicit owners of the money in such firms.

Shell Corporation Explained

Shell corporations are generally established for legitimate business operations. Business owners set up shell corporations to handle the assets of original entities to mask the real identity of the owners who are providing the financial resources. For instance, for around $900, any individual can find an associate company to create a shell company for them offshore. Due to the aftermath of the Panama Papers leaks, the number of shell corporations was disclosed, which were used to divert the illegal income of wealthy business owners, including politicians.

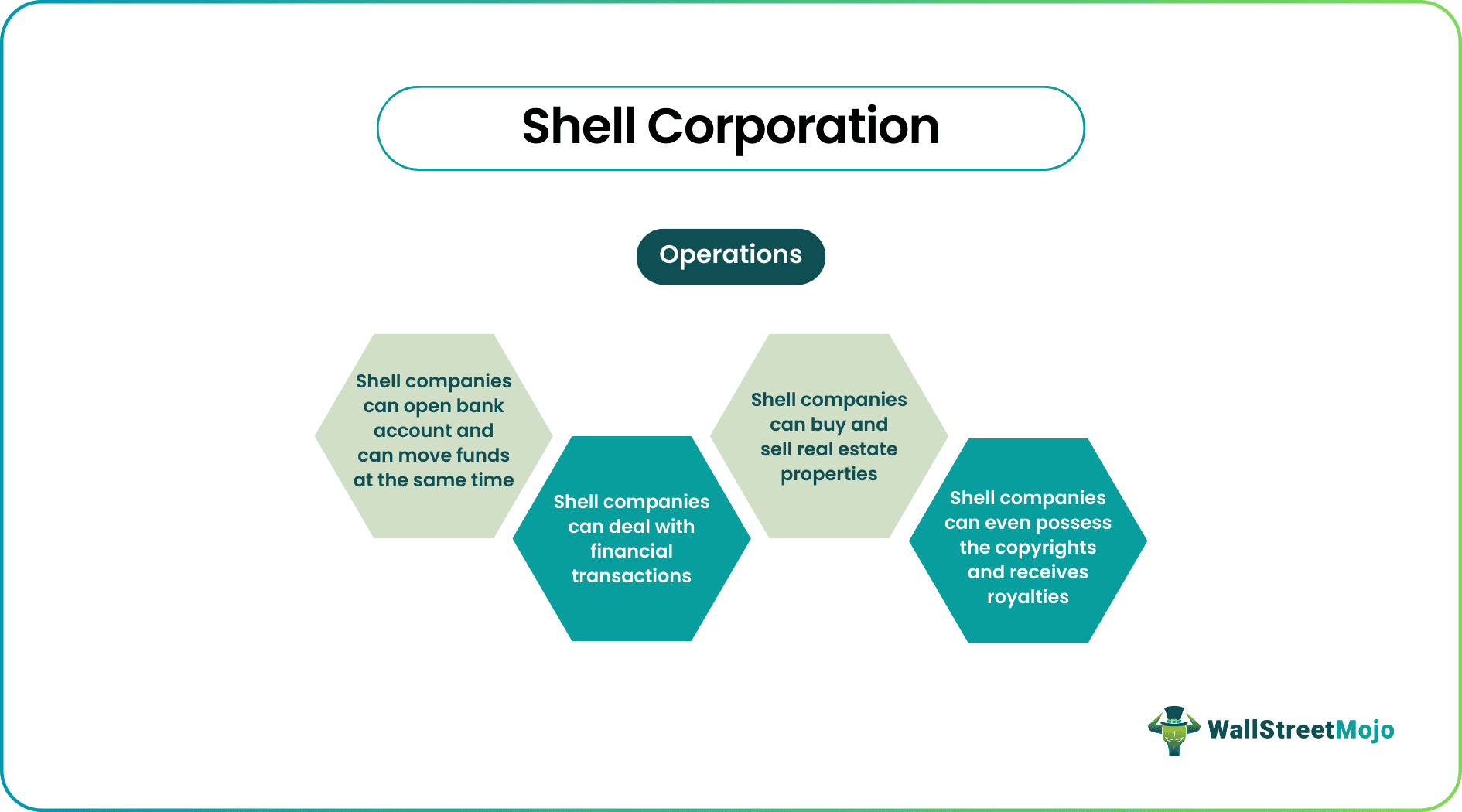

Shell corporations can do the following operations:

- They can open bank accounts and can move the funds too.

- They can deal with financial transactions.

- They can buy and sell real estate properties.

- They could even possess the copyrights and receive royalties.

How To Start?

Shell companies usually come into existence to hide the identity of their business owners or the business in which they are dealing. However, they have their address and identity as per the regulatory requirement. For instance, in the United States, the Securities Exchange Commission (SEC) requires every shell company to be registered with SEC to be at least in existence on documents, if not physically.

Here we learn how to create a shell corporation. These companies are mostly established in tax havens regions and countries. Business owners or individuals set up such companies to avoid spending on huge tax payments that can hide the source of illegal income and access the global markets at the same time. The above steps explain how to create a shell corporation.

Examples

Let us look at some examples to understand the shell company background.

To avoid the tax obligations, business owners set up shell corporations in the tax havens, for example, in Panama, so their tax liability is reduced to a maximum extent. In addition to Panama, there are other tax havens where corporations set their offshore accounts like Switzerland, Hong Kong, Cayman Islands, and Belize.

Following are the instances where shell corporations are used:

- In June 2013, Sega Sammy holdings bought Index Corporation, which went into insolvency and was bankrupt. Sega Sammy Holdings created shell corporation 'Sega Dream Corporation' in September 2013 to transfer the assets of Index Corporation.

- When the Hilco company bought HMV Canada, Hilco created a shell company called 'HuK 10 Ltd' to raise the required funds and minimize the liability at the same time. Later, the HuK 10 sued HMV Canada, resulting in Hilco subsequently repossessing the assets and selling the HMV Canada.

Thus, the above examples help us in understanding the shell company background better.

Uses

- To avoid tax liability: The major objective is to ward off tax liability towards the respective country's government. The progressive tax system, also referred to as tax brackets lure people to seek ways to save tax. Thus shell company tax evasion is a very important use.

- To protect assets: With the help of a shell company the original entity can easily transfer assets from a low profitable location or region to a place where return will be significantly higher and earn by investing the assets..

- SPV or Special purpose vehicle: They are used as a special purpose vehicle because many assets are transferred to this SPV to avoid the regulatory reporting requirements or for many other various reasons.

- To access global markets: They help their original counterparts access the international foreign exchange market very easily and make their favorable business opportunities available.

Benefits

There are several instances where active business owners and individuals set up shell corporations due to their benefits. For instance, a new business or company raises capital and transfers the same in a shell company even before launching its products and services to a customer. In addition, a company that is subject to merger and acquisition could transfer the assets and property to a shell company to ward off its assets from being transferred to the acquirer. In both the above cases, the owner of the entity uses shell company to hide the capital raised and to protect assets from takeover by the acquiring company.

There are also tax benefits for which these companies are being set up. For example, some countries and regions offer tax benefits with reduced or no taxes. This helps the owner save tax and use that fund for other productive purposes.

Companies also implement shell corporations for security reasons. For example, such companies could be used as a shield by the company associated with or doing business with the company having negative goodwill or in the region not so profitable. It is also beneficial for anyone going through a financial ordeal or divorce not to be called for to shell out on this diverted income.

Limitations

Shell corporations are more often created to hide the original entity's recognition so that assets can be easily diverted. It is very difficult or impossible to determine who owns the explicit money in such companies in the absence of real sources from which it has generated the economic sources. Shell corporations are created to iron out the tax bills of the concerned company.

Due to the rush to buy shell corporation, revenues are being reported lower as otherwise, which is subsequently lost to the respective countries that would have collected higher taxes on the same revenues. Shell corporations have decreased the tax collections in many countries, which seems a major source of government revenue, the absence of which would harm the growth of respective countries and its economy.

Shell Corporation Vs Shelf Corporation

- The former is not actively into any production or business operation, whereas the latter is registered for usage at present or in the near future.

- The shelf company will not have any kind of assets or liabilities in it but a shell corporation may have them.

- The main reason to buy shell corporation is to use it like a medium for the business of any other company but the latter is set up so that it is available in the market and can be purchased.

- The former helps in evading tax or hide any other negative consequence but the latter boosts the economy by giving entrepreneurs an opportunity to build businesses.