Table Of Contents

What Is An Investment Partnership?

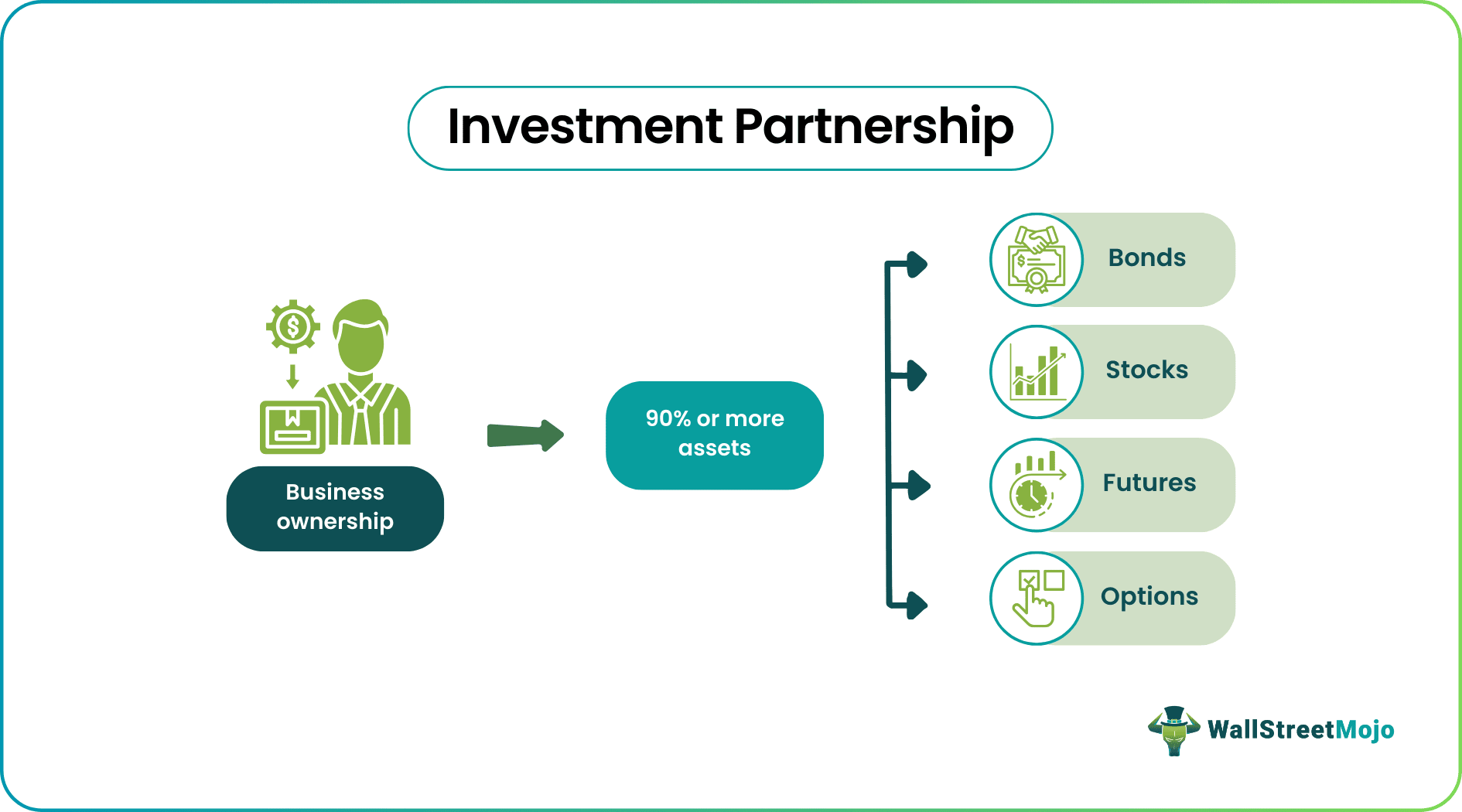

Investment partnership refers to any form of business ownership wherein there would be at least 90% of all of its investments that are held in financial instruments like bonds, stocks, futures, and options and the predominant income that is derived (usually>90%) would go on to have such financial assets as the source.

Investment partnerships tend to provide the necessary growth funding to the ventures that need it, apart from helping investors get great returns on the investments they have made. These partnerships undoubtedly facilitate greater efficiency in the financial markets by taking unconventional positions in the market, such as short positions.

Key Takeaways

- An investment partnership is a business ownership type where at least 90% of all investments are held in financial instruments.

- It includes bonds, stocks, futures, and options. In addition, the predominant income obtained may have such financial assets as the source.

- Hedge funds, mutual funds, private equity, venture capitalists, and portfolio management services are the types of investment partnerships.

- It provides essential required growth funding to the ventures besides helping investors obtain investment returns.

- In addition, these partnerships facilitate greater efficiency in the financial markets through unconventional positions like short positions.

Investment Partnerships Explained

An investment partnership is a kind of entity that has the business of investment in different types of assets like bondsm real estate, stocks, or any other profitable investment opportunity They commonly pool the fund of different investors and use it to invest in assets of the above type. They are typically managed by managers or general partners.

They also invest in exotic products, which the layman investor won't have much information about. However, the lack of transparency in such investment partnerships will keep investors in the dark, especially about the company's financials.

Further, the heavy competition in investment partnership agreement will push the weakling as investors seek to redeem from such loss-making investment firms. However, investment partnerships have built enormous wealth for the investors and the community as a whole.

The services of such private investment partnership firms are normally accessed by client who have a very high net worth, or they are institutional investors. For that reason, these firms have a large amount of fund in their portfolio to manage and invest on behalf of their clients.

It is necessary for the clients to understand the working and terms and conditions of agreements of these partnership firms if they want to participate in the investment opportunities that the firms identify for them. The risk and return strategy should be properly evaluated before investment.

Examples

Given below are some of the examples of investment partnership agreement-

- Hedge Funds

- Mutual Funds

- Private Equity

- Venture Capitalists

- Portfolio Management Services

Advantages

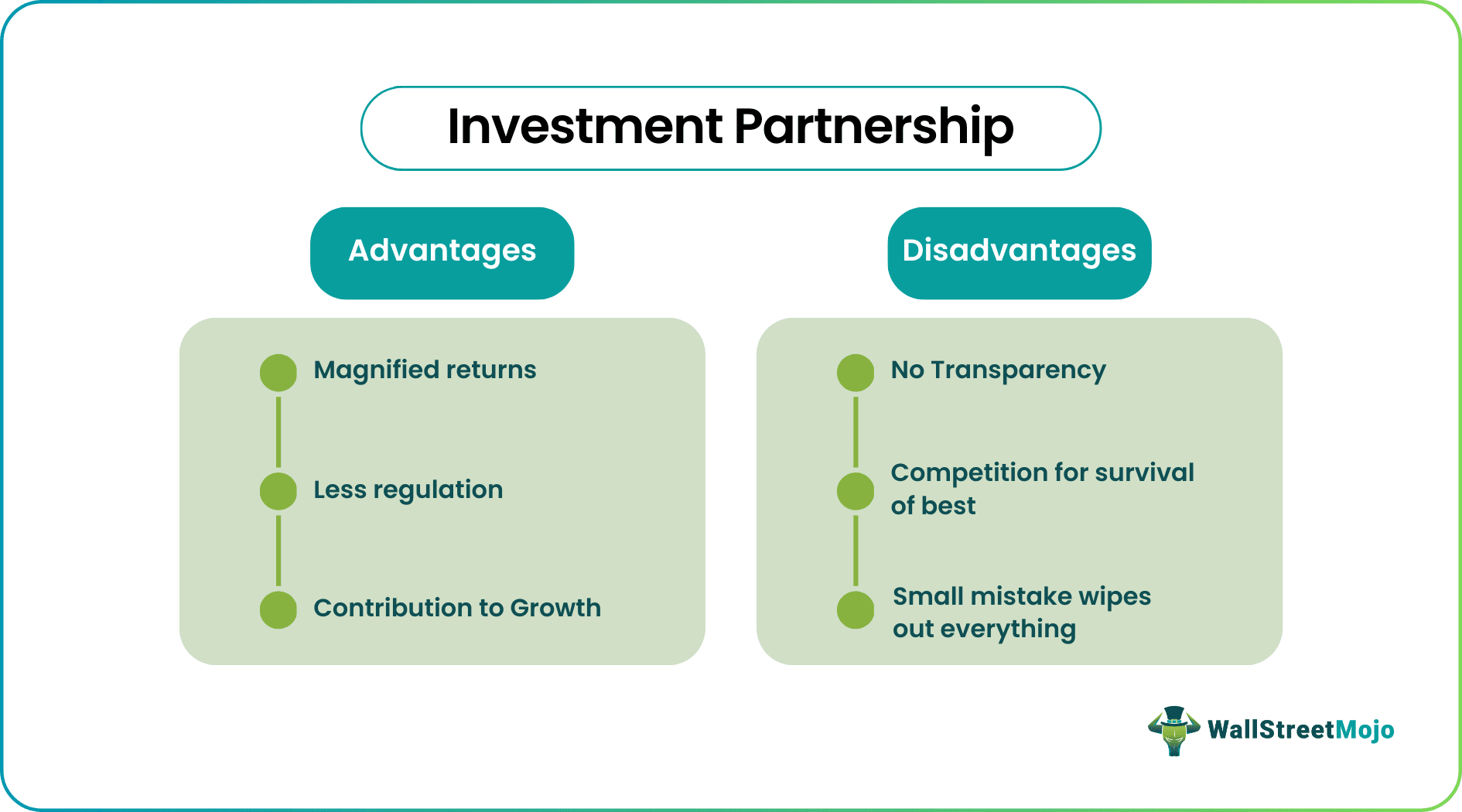

To understand the concept of investment partnership accounting, it is necessary to evaluate the advantages and disadvantages of the same. Let us identify the advantages first.

- Magnified Returns - Such kinds of business usually fall under alternative investment funds. They invest in risky securities wherein there is scope for a higher return potential. Hence there is a high probability of higher returns by investing in such partnerships.

- Less Regulation - For alternate investment fund categories like hedge funds, the regulation is also limited, and the funds are at their discretion about how they manage their investments. Hence they are free to adopt their strategy style to give maximum and optimum returns to the investors. There would not be much interference of any sort.

- Contribution to Growth - Such kinds of investment partnership accounting provide the necessary growth capital for a company that seeks to raise funds. This route will be a viable option for companies that seek to raise funds from institutional investors. The companies can fulfill the criteria required for certain holdings in the company as institutional investors when it first seeks an IPO. Moreover, some companies may avoid raising money through public issuers because of various regulations and formalities. In such cases, they adopt securing funding from hedge funds through a common procedure known as a private placement.

- Provides Seed and Angel Capital - Such a form of investment partnership to invest in amateur companies that are just starting up and thus help the companies secure their growth funding. Usually, venture capital firms buy a stake in such companies and then make the right exit after the company makes sufficient growth in a time frame of 5-10 years.

- Ability to Gain Access to Complex Products - By investing in an investment partnership, a retail investor can gain access by exposure to complicated products that hedge funds invest in, such as exotic derivatives like credit default swaps, etc. In their normal course, the retail investors would not have access to such products. Only through investing money in such partnerships, they gain access to markets for such products.

- Outsourcing Management of Money in Professional Hands - By providing money to such funds, the investors would now outsource the money management to professional money managers. Thus the retail investor is freed from worrying about which stock to buy or sell, which markets to monitor for opportunities, and so on. They are well assured that their money is being managed by professionals now.

Disadvantages

The disadvantages of the private investment partnership are given below.

- No Transparency- More often than not, information about the investment partnerships is unknown, especially regarding financial statements. The investors, though sophisticated, may not have enough knowledge and whereabouts as to how exactly the money is managed and where it is invested on a day-to-day basis, which is usually the case for hedge funds. Moreover, they are not obliged to declare their performance publicly and returns achieved overtime or year on year. Hence what lacks, in this case, is transparency for the public about how exactly the investment partnerships are managing their money.

- Competition for the Survival of the Best - When it comes to money, it is a natural tendency to look for the best regarding who gives the best returns. Hence, a constant check is kept on who performs the best in a year based on historical returns. Hence investors would tend to flock towards such funds that give them the best returns for the money. Financial media always highlights the performances and returns generated. In such scenarios, the funds that do not perform to the benchmark level do get pushed out, and investors may start redeeming and then pumping their money in funds that perform better.

- Small Mistake Wipes Out Everything - There have been instances where the top performer is not in the top charts for the upcoming year. More often than not, it is even noticed that the top hedge funds do liquidate after a certain period. A wrong strategy or wrong move into the wrong stock may wipe out wealth created over the years, and investors will begin to redeem. Even when it comes to private equity and venture capital, if they invest in companies that are currently not performing well like they once were, their valuation too will be downgraded. It impacts the returns of PE and VC funds.

Hedge funds and venture capital firms usually seek funding only from accredited and sophisticated investors, and small retail investors may not invest in them.

Investment Partnership Vs Hedge Fund

Both the above are two different types of investment structures where money is pooled from various investors where the capital is put together and invested in a diversified manner in different assets. Both have some differences as per their strategy and structure of working. Let us identify them.

- The former is in the form of limited partnership where the liability of partners are limited but are managed by both general or limited partners. In case of the latter, the structure is the same but they are managed by general partners.

- The qualified investment partnership focusses on various types of pooled investment vehicles which may include venture capital, private equity, etc. but the latter focus on equity, arbitrage and other macro driven strategy.

- The former often follow a particular type of investment strategy like funding startups, managing real estate, etc. but the latter often use derivatives, short selling, etc. to attain their objectives.

- The fee structure of the qualified investment partnership consists of management fee based on the amount of asset and performance fee based on return. But the latter also has the above fees but is comparatively higher.

Thus , we see that the above are some basic differences between the two. Both are pooled investment vehicles that diversify based on some special investment strategies. However, investors should carefully understand their own goals, liquidity levels and risk taking ability and then participate in any of the above services.