Table Of Contents

Headquarters

The IRDA's central office or headquarters is in Hyderabad, Telangana. This headquarters controls all the field offices.

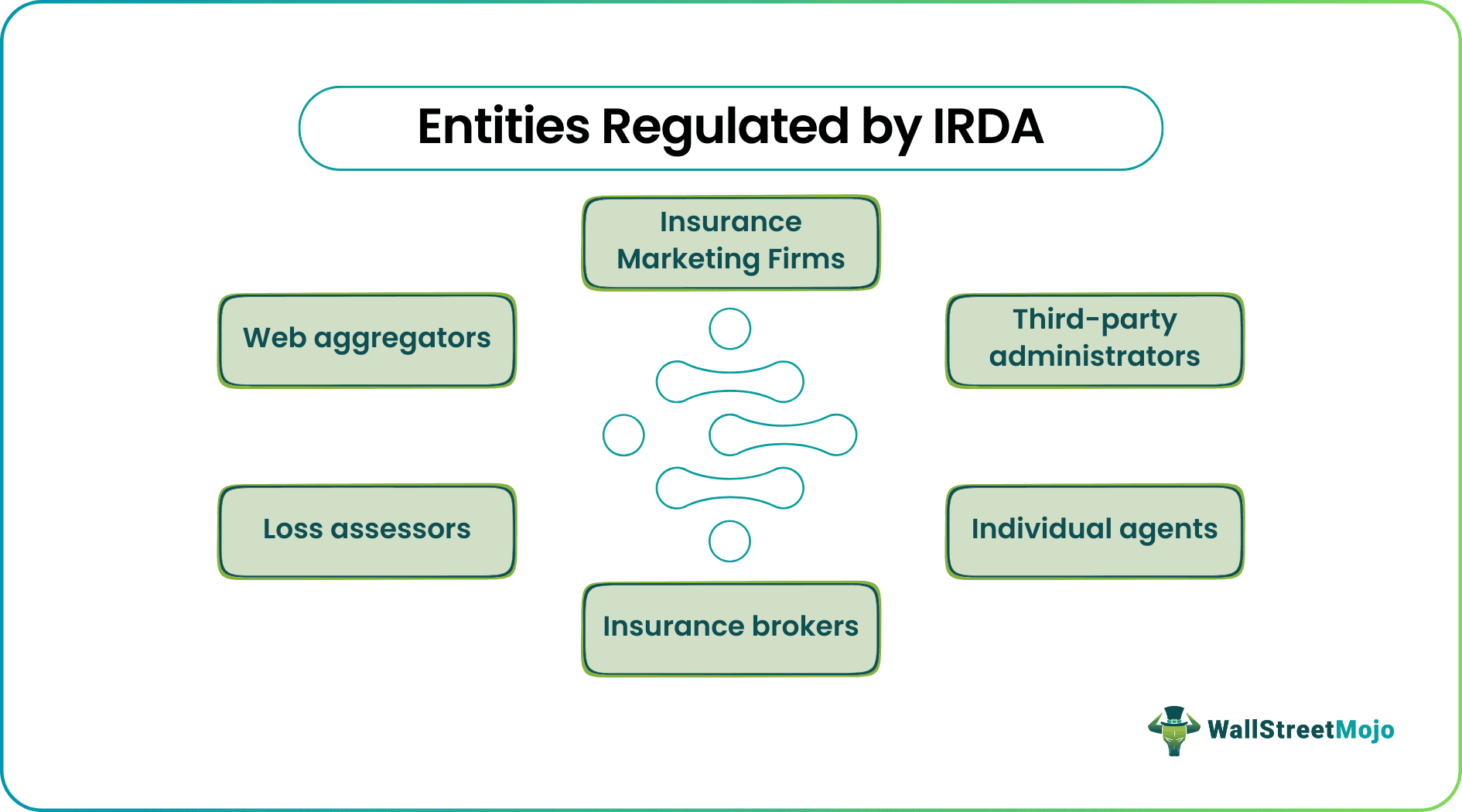

Entities Regulated by IRDA

Being an insurance regulator IRDA regulates many entities, which are as follows:

#1 - Insurance Marketing Firms

Insurance marketing firms are very important players in the insurance market. This entity aims to procure insurance products and distribute and service these products in the market.

#2 - Third-Party Administrators

The third-party administrators are active in the health market and provide services regarding health care insurance and claim to the policyholders.

#3 - Individual Agents

An individual agent is the authorized person by the IRDA who sells the policies to the public and provides the service regarding the claims. He got a license from the IRDA in any type of insurance like life insurance, health insurance, etc.

#4 - Insurance Brokers

An insurance broker is a mediator between the company and the policyholder. He advises the customer on which policy is beneficial for him, etc. He gets a commission from both sides per sale.

#5 - Loss Assessors

Loss assessors are the field officers who assess the claim file and check the party's loss during the incident, like fire and accidental loss. So, it is generally in general insurance cases.

#6 - Web Aggregators

Web aggregators are the persons who provide information about the different insurance policies on different websites. For example, they deal with clients who buy policies online through various websites.

Functions

It performs many types of functions. Some are below:

- The first and foremost function is to register the companies which perform insurance business in the market.

- There should be no maladministration to check the companies and their day-to-day conduct.

- To take action on the fraud and where proper standards are not maintained so that customers do not get looted.

- Another main function of the IRDA is to promote fairness and transparency in the industry to create a harmonious atmosphere.

- Ensure a speedy settlement of claims and no harassment with the companies' policyholders.

- To ensure the insurance industry's speedy and proper growth for the country's economy.

- To monitor and enforce the high standard of integrity and fairness in the industry.

- To keep a check on monopolistic activities.

How to Apply for the Exam?

IRDA conducts an online exam annually to recruit insurance agents from different insurance companies. This exam aims to scrutinize and choose the best candidate for the insurance market.

Eligibility:

The basic eligibility to sit in the IRDA exam is 12th from a recognized school/board. The minimum age to take an exam is 18. There is no upper age limit.

Procedure:

- Interested candidates who want to apply for this exam have two options: online and offline mode. First, if a candidate wants to apply online, he must visit the IRDA's official webpage and submit the online form with the correct information. Then, he has to choose an exam center and pay a fee of ₹200. After submitting the online form, he has to take a printout of that form and keep it for future reference.

- Those who are interested in filling out the form in offline mode have to download a detailed form. After filling every column of this form, one has to attach a fee slip (whether through challan in the bank draft), and that candidate has to send this form to the registered address of IRDA.

- After receiving the forms from different regions of the country, IRDA conducts a national-level exam in various centers across the country and prepares a merit list based on marks secured by the candidates. And at last, the successful candidates get the license to pursue their careers as insurance agents.

Usage

Many Insurance and reinsurance companies, including private and government, are in the market. The insurance market deals with customers' money, and there is a chance of fraud and other illegal activities, including money laundering and black money. To save the rights of the customer and companies, establish this regulator so that companies and customers feel secure. There should be no case of fraud, and there should be no mismanagement of the funds. Indeed, IRDA secures the policyholder's interest and provides a hassle-free insurance atmosphere.

Conclusion

IRDA is providing a fraud-free environment to the insurance industry in the country. It regulates all this industry's other affairs, including administrative, political, and economical. But this is no exaggeration to say that IRDA also faces some challenges and messes with some problems. For example, there is more political interference in the governing body of IRDA. The ruling parties in power appoint the members of the council. Also, there is a bias in appointing the members.

There are also cases of corruption in the IRDA because, in the market, some elite groups pursue malpractices but do not detain because they give bribes to the officials of IRDA. So there is a need for inspection from top to bottom in IRDA. Also, the duty of the government and the country's judiciary to provide freedom to IRDA in their conduct means there is a need for autonomy.