Table of Contents

What Is Insurance Regulation?

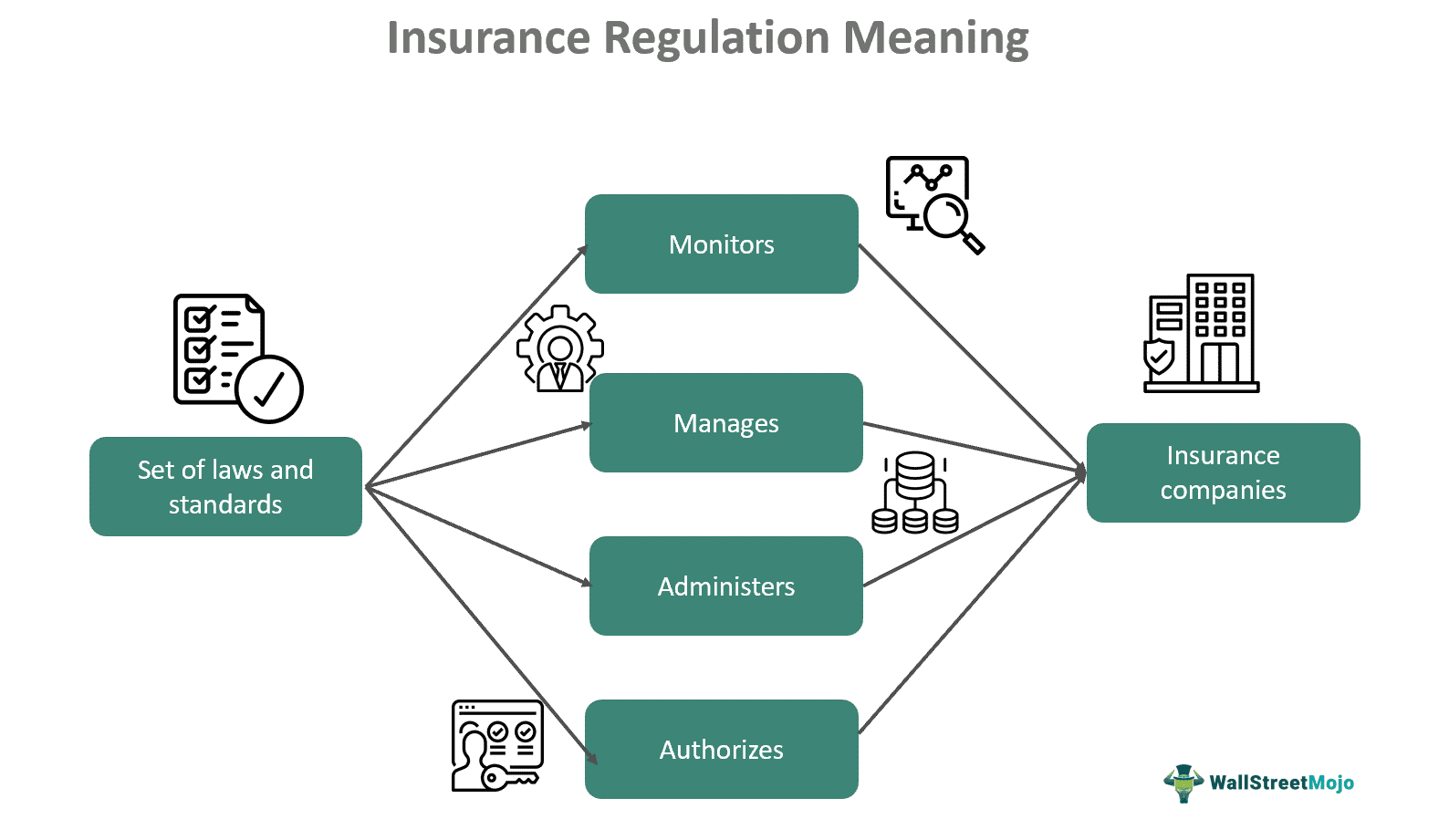

Insurance regulation refers to the system and legal framework that administers, authorizes, monitors, and manages insurance companies, policies, rules, and the entire industry. The regulation is responsible for democratizing insurance and, at the same time, preventing any mishaps, frauds, scams, and malicious practices.

In the United States, the state government regulates the entire insurance industry. It has the power to create laws and provide licenses to companies and people willing to be associated with the insurance sector professionally. It covers all aspects of the insurer and the insured to settle grievances and disputes. However, there is federal government intervention from time to time.

Key Takeaways

- Insurance regulation represents the entire body of laws, rules, and policies that manage and support the entire insurance industry and sector.

- In the US, not the federal government, each of the 50 states has its own set of regulations for the insurance sector directed by the state department of insurance.

- The history of insurance regulations goes back to Babylonia's legal text called the Code of Hammurabi, which seafaring merchants used to protect their shipments.

- Without insurance regulations, there will be no code of conduct, protocols, or body of work associated with and overseeing the insurance industry. Hence, it is relevant and crucial.

Insurance Regulation Explained

Insurance regulation defines the set of laws and frameworks that guide the entire insurance sector. Like stock, real estate, and currency markets, there is an insurance market that abides by these regulations. Each country has its own system and official body, which is responsible for insurance laws that are applicable to every participant in the insurance sector. In the US, the Office of Insurance Regulation can be referred to the National Association of Insurance Commissioners (NAIC), which administers industry standards and serves as the regulatory support organization. The chief insurance regulators govern this entity from all 50 states. Each state has its own set of rules but is a member of the NAIC.

The insurance regulations by state include everything from licensing, policy creation, taxation, price requirements, and limitations and guide the whole system, irrespective of whether it is an insurer or policyholder. This means that the regulations cover the interests of both parties and that policy buyers are treated fairly. In fact, one of the primary objectives of the regulations is to protect consumers.

Two official bodies oversee insurance regulation in the UK: the Prudential Regulatory Authority (PRA), which is a section of the Bank of England responsible for promoting the safety, protection, and awareness of policyholders, and the second one is the Financial Conduct Authority (FCA) which regulates them.

New and revised regulatory changes have been introduced in these insurance regulations to keep the entire insurance industry relevant and updated with changing times and market demand. Without the presence of these regulations, the whole insurance market can collapse, and every regulation must be acknowledged and exercised by the market participants.

History

The history of insurance regulation dates back to the first physical evidence from 1755-1750 BC to the legal text of Babylonia called the Code of Hammurabi. During those times, the seafaring merchants would take loans to complete their shipments; they would offer the lender an added fee. The lender would agree to cancel the loan in case of any unfortunate events such as loss or theft.

Since then, insurance and the purpose of regulation have mostly stayed the same. In the US, the National Association of Insurance Commissioners (NAIC) was founded in 1871 to promote, encourage, collaborate, and protect customers from any form of unethical behavior. The history of some of the critical events in insurance regulations follows:

- In 1945, the McCarran Ferguson Act gave birth to the state-based regulatory framework.

- In the 1950s, the restrictions on multi-line underwriting were lifted.

- In the 1960s, the Wisconsin Insurance Security Fund was enacted.

- During the 1970s, the Fair Credit Reporting Act solidified the work operations of the insurance industry.

- It was followed by the period of the 1980s, in which the Financial Standards and Accreditation Program was launched.

- During the 1990s, the National Insurance Producer Registry was created to maintain a database of insurance agents and brokers provided by state departments of insurance.

- In the 2000s, the Producer Licensing Model Act was introduced.

- The 2010s marked the establishment of the Dodd-Frank Wall Street Reform and Consumer Protection Act.

Each of the following incidents and acts plays a crucial role in defining the insurance regulation that exists today.

Examples

Below are two examples to help you understand the concept better:

Example #1

Suppose a local town where people have never subscribed to insurance. Soon, a group of friends started a new insurance company and started selling different types of insurance to the townspeople. Since it was a new concept, people started buying insurance and giving their money to them. Almost everyone bought insurance, some for their property, some for their health, and some for their cars. Only Peter, who was a young blood of the town, thought that such an enormous operation could not be done so quickly.

Upon researching, Peter found that there is a complete insurance regulation framework. The group of friends has no license, no authority, and no permission to open an insurance company. Pricing restrictions, solvency standards, credit risks, and taxation have been established.

Peter reported them to the local police and got all of them imprisoned. It is a simple example of insurance regulation, which defines how there are rules and regulations for the insurance market, licensing, permissions, certificates, and a whole system to be followed. No one can easily open an insurance agency. Later, Peter also propagates the importance of insurance and the purpose of regulations among the townspeople.

Example #2

In September 2023, California's insurance regulation reforms were applauded as they moved in the right direction. Although the reform proposals are yet to be finalized, the Department of Insurance was seen making amends and taking control to fix property insurance issues in the state and, at the same time, revising some of the old regulations to allow insurance companies to hike rates.

There are, in total, three extensive reforms that would allow the use of forward-looking risk models. The first one is reinsurance, which is the biggest expense insurance carriers face when dealing with catastrophe-affected areas. The second most significant change is the ability to use forward-looking models instead of carriers being linked to historical loss data. The third change is the carrier requirement, which includes participation in at-risk areas defined by the state.

Importance

The importance of these regulations are:

- Operates as a managing body and rulebook for the insurance industry.

- They are established in the interest and protection of insurance market participants and, most importantly, policyholders.

- Every country has a different authority or governing body to regulate and monitor every aspect of the insurance regulations.

- Without these regulations, the entire market will collapse with no supervision, rules, or guidance to follow and oblige.

- Due to such regulations, only a policyholder can expect transparency of information and data and hassle-free settlements.

- Spreads awareness and promotes insurance about the rights and benefits that policyholders are mostly unaware of in the market.