Table of Contents

What Is A Reinsurance Broker?

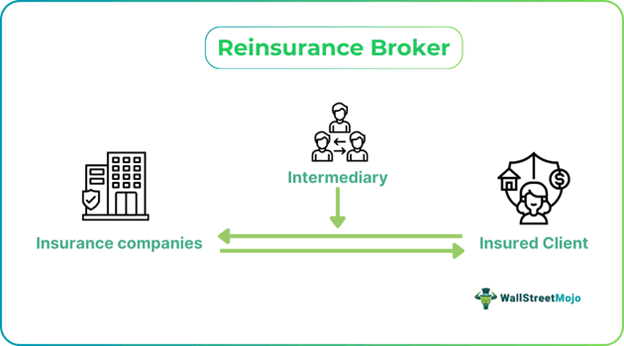

Reinsurance Brokers are individuals or entities that act as intermediaries between big insurance companies and insured clients and serve both parties for a fee or commission. They provide risk management services, claim consultancy and similar services to make a deal fruitful for both parties they are working on behalf of.

While an insurance broker sells insurance deals directly to customers, reinsurance brokers sell them to insurers instead of working with the public directly. Through reinsurance, an individual or entity protects insurance companies from the risks related to the insurance products, which they sell to the public. The brokerage duties include negotiating, advising, providing services and improving a company's profit prospects.

Key Takeaways

- A reinsurance broker is an intermediary individual or entity that acts as a bridge between the insurance companies and reinsurance providers.

- They earn fees or commissions by finding suitable clients and negotiating favorable contract terms. In certain cases, they help stabilize losses and limit liabilities.

- They maintain positive client relationships, promote services, review contracts and secure deals.

- Individuals interested in becoming intermediaries must possess an NAIC license and the desired amount of work experience, which differs between jurisdictions.

Reinsurance Broker Explained

A reinsurance broker is an individual or entity that connects reinsurance companies with insurance companies in need of reinsurance while providing coverage to the public. Reinsurance is a service whereby a larger insurance company takes the responsibility to tackle any risks that the insurance companies incur while handling claims from the public. In the process, the reinsurance broker becomes the bridge between the reinsurance and insurance company, which is its insured client. The process, hence, could be complex and time-consuming, but they help significantly place and prevent risk.

In short, reinsurance is simply an act of ensuring the insurance company is prevented from any loss arising from the claims. Brokers facilitate the purchase of reinsurance for risk management, and they charge a commission and/or a fee in exchange for the same. Reinsurance is sought for varied reasons. It could be for limiting certain liabilities, stabilizing losses and mitigating unfavorable events that a standard insurance company may incur.

After the establishment of contracts, these brokers help with drafting contracts, collecting payments and providing claim assistance while letting the insurance companies focus on their policyholders and their requirements. The presence of reinsurance brokers reduces risk exposure and operational costs, ensuring a profitable business for insured clients, who are insurance companies selling insurance products to the public.

Role And Responsibilities

Given below are some of the roles and responsibilities of such brokers:

- As intermediaries, they are the primary point of contact for certain clients. Their responsibility is to ensure that the client's needs and expectations are fulfilled.

- They are coordinators. They are responsible for coordinating service delivery by the standards and coordinating them efficiently.

- They are client relationship managers. Their responsibility is to maintain and develop positive long-term relationships with the clients.

- They are coverage advisors. Their responsibility also lies in providing advice to clients regarding the coverage scope and assisting them with related matters.

- They are promoters. Their responsibility lies in promoting the products and services at various events and to people.

- They are deal securers. These brokers require expertise in reinsurance, a complicated, time-consuming process that is rewarding. They help companies secure the best deals in the market.

- They act as contract reviewers. These brokers help the company manage risk and select the best policy after negotiating the terms. They also offer advice on drafting new contracts.

Salary

They earn salaries similar to or better than those of insurance sales agents. The average reinsurance intermediary or broker earns $95,421 a year, and the average salary as part of employment can be around $70,914 per year.

How To Become?

There are no particular educational qualifications for becoming a reinsurance intermediary or broker. However, they must possess a license as an insurance producer. They shall intend to transact business as an intermediary for a minimum of three years before applying for such licenses. Individuals who are interested in getting licenses shall check for regional criteria.

- To register with the National Insurance Producer registry, you must complete a National Association of Insurance Commissioners (NAIC) Uniform Individual Application.

- The individuals shall then pay for state license fees and the state license application.

- This rule pertains to Kansas and could differ from one jurisdiction to another.

Massachusetts requires three years of experience. However, the period is also subject to jurisdictional changes.

Reinsurance Broker vs Direct Broker

Given below are some of the differences between both concepts

- A direct broker promotes insurance products from companies and suggests them on insurance products and services. Reinsurance brokers promote reinsurance products and services.

- Direct brokers represent the clients. Brokers of reinsurance can both represent the insurer and those who are insured.

- Reinsurance brokers are not connected to individual policyholders, and their duties extend only to insurance companies. Direct brokers are in touch with both the company and the individual policyholders.