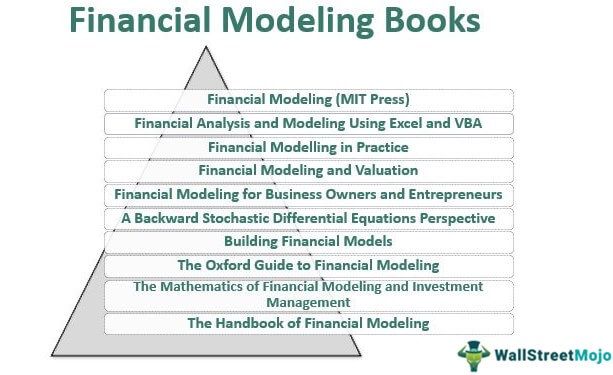

10 Best Financial Modeling Books [Updated 2025]

Books are the windows of opportunities. Through books, people who have already walked the path would guide you to make better decisions and acquire new skills. Below is the list of 10 financial modeling excel books to read in 2025 –

- Financial Modeling (MIT Press) ( Get this book )

- Financial Analysis and Modeling Using Excel and VBA ( Get this book )

- Financial Modelling in Practice: A Concise Guide for Intermediate and Advanced Level ( Get this book )

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private Equity ( Get this book )

- Financial Modeling for Business Owners and Entrepreneurs: Developing Excel Models to Raise Capital, Increase Cash Flow, Improve Operations, Plan Projects, and Make Decisions ( Get this book )

- Financial Modeling: A Backward Stochastic Differential Equations Perspective (Springer Finance) ( Get this book )

- Building Financial Models (McGraw-Hill Finance & Investing) ( Get this book )

- The Oxford Guide to Financial Modeling: Applications for Capital Markets, Corporate Finance, Risk Management, and Financial Institutions ( Get this book )

- The Mathematics of Financial Modeling and Investment Management ( Get this book )

The Handbook of Financial Modeling: A Practical Approach to Creating and Implementing Valuation Projection Models ( Get this book )

This topic opens up many avenues for further exploration. If you’re intrigued by these concepts, you might find this Investment Banking Mastery Program (IBMP) provides additional insights and hands-on experience

Let us discuss each of the Financial Modeling excel books in detail along with its key takeaways and reviews.

#1 – Financial Modeling (MIT Press)

by Simon Benninga

If you are new in the field, you need a textbook to learn the fundamentals. Why not pick up this book? This textbook is considered the best book in financial modeling.

Book Review

According to the readers of the Book, this is the only Book you need to read cover to cover if you want to learn Financial Modeling. This is particularly useful for people who don’t know financial Modeling and want to understand Financial Modeling as demand for their profession. Other than beginners, even people who know VBA, Advanced Excels, and complex financial Modeling should read this Book as a refresher.

Best takeaways

- Once you pick up this Book, you don’t need to read any other book; because in the latest edition, this Book has included separate chapters for complex Monte Carlo methods and the Nelson-Siegel model.

- You will also learn VBA from a basic level, and you will know the advanced level too. The idea is to understand the concepts first if you are a beginner and then learn the technical aspects.

- The new edition of the book comes up with an access code which will help you download excel worksheets and the solutions to the end-of-the-chapter exercises.

Learning financial modeling processes and methodologies allows businesses to make approximate projections, thereby encouraging them to frame strategies accordingly. If you wish to explore the different aspects of the process, this Financial Modeling Course for you.

#2 – Financial Analysis and Modeling Using Excel and VBA

by Chandan Sengupta

This book is a comprehensive financial modeling book. If you want to learn this concept in depth, this is the book you should pick up.

Book Review

Many readers mentioned that this Book is one of the most comprehensive books for novice students. It explains every concept in detail. It is more than 700 pages, and within the pages, you will learn excel and VBA. But don’t expect too much from this book if you’re an advanced professional. It’s written for beginners and would act as a great reference book for novice learners of Financial Modeling.

Best takeaways

- It would be best if you bought this book because of its comprehensiveness. Very few books on financial Modeling have in-depth analyses of concepts.

- This Book has a special section on forecasting. You can buy the Book even for this section alone.

- This book has not scratched the concepts. It’s very detailed and you will learn the basics of excel and VBA as well.

#3 – Financial Modelling in Practice:

A Concise Guide for Intermediate and Advanced Level

by Michael Rees

As the title suggests, this book is not for beginners in financial modeling. If you have some fundamental knowledge in financial Modeling, you can pick this Book up.

Book Review

This book is well balanced. You won’t find a book on Financial Modeling, which has included both concepts and applications in the proper ratio. Moreover, the examples used in the book are invaluable for professionals in the field. This book will take you to the next level. If you already have fundamental training in financial Modeling, then you should pick this Book up to go beyond your comfort zone. If you’re a beginner, it’s advised not to read this Book before reading something more basic.

Best Takeaways

- This Book is free of fluff. Thus people who are in the financial domain would be able to extract a great amount of stuff out of it. If you read and apply everything you learn from this book, you will see a fundamental difference in approaching financial Modeling.

- You will also get a CD-ROM with the Book, which will enable you to get access to excel models and more practical problems.

- You will learn excel and statistical functions very well after reading through this Book.

#4 – Financial Modeling and Valuation:

A Practical Guide to Investment Banking and Private Equity

by Paul Pignataro

If you have ever faced any difficulty in financial Modeling and valuation, pick this Book up to learn.

Book Review

This beginner’s Book on Financial Modeling is written so that even dummies in finance can understand. So it’s not precisely aimed at advanced or intermediate students. If you are a beginner, this is the perfect place to start. Moreover, you will also learn to excel while learning the concepts. However, you may feel bored if you have some knowledge of Financial Modeling because this Book doesn’t skip any step. So if you want to learn financial Modeling and valuation and don’t want to spend a lot, this is the perfect go-to-guide for you.

Best takeaways

- You will learn every conceivable financial model in this Book. You will know the Balance Sheet, Income Statement, Cash Flow Statement, Balance Sheet Balancing, Depreciation Schedule, Working Capital Schedule, and many more.

- You will also learn the valuation technique in detail. You will learn DCF Analysis, Precedent Transactions Analysis, and many more techniques.

- You will also get to relate to many case studies given in the book as you learn financial modeling and valuation.

#5 – Financial Modeling for Business Owners and Entrepreneurs:

Developing Excel Models to Raise Capital, Increase Cash Flow, Improve Operations, Plan Projects, and Make Decisions

by Tom Y. Sawyer

This book is as practical as it can be; because it will directly help entrepreneurs to do the most difficult things in business.

Book Review

Significantly few books have come from the place of linking business thinking with Financial Modeling. Financial Modeling is a technical skill for sure, but entrepreneurs who are new in the field don’t know anything about the technicality of business. This Book has bridged the gap for new entrepreneurs. You will not only learn to develop excel models to raise capital, increase your profits and revenues; you will also learn valuable project management skills from this Book.

Best takeaways

- For an entrepreneur analyzing ROI may be a gigantic task. But if he picks up this Book, it may not seem as daunting as it usually seems. Moreover, as an entrepreneur, you will also plan projects and new initiatives backed up by financial models.

- You will not only learn Financial Modeling, but you will also learn business situations and strategic moves you need to make while launching new products or start-ups.

- It will help you avoid traps and obstacles of the business by being aware of the loopholes and by being able to create operational and functional models for your business.

#6 – Financial Modeling:

A Backward Stochastic Differential Equations Perspective (Springer Finance)

by Stephane Crepey

This is a book that is written for intermediate and advanced students of financial modeling and you need additional knowledge in mathematical frameworks.

Book Review

Until you learn the basics, it’s better not to pick up this Book. Backward Stochastic Differential Equations (BSDEs) provide information on how you can solve pricing and risk management issues. You need to understand mathematics and statistics to be able to appreciate the value of the Book.

Best takeaways

- How would you solve nonlinear pricing problems? It would help if you had CVA computations. How to learn? Pick up this Book.

- BSDEs are more popular with academicians than with practitioners. The author wrote this book so that the practitioners can appreciate the value of BSDEs and can apply the perspective in their nonlinear pricing and risk management problems of financial derivatives.

- This book is written particularly for a graduate course, which includes both computational finance and Financial Modeling.

#7 – Building Financial Models (McGraw-Hill Finance & Investing)

by John Tjia

Financial Modeling is one of the most valued skills in the corporate world today. The main emphasis of this Book is one helping you build the skill of Financial Modeling.

Book Review

The chief issue of any instructional book is that the author seems to have less professional experience in the skill he guides the readers to learn. But in this case, it’s not at all the case as the author has years of experience in the relevant domain, and readers from all walks of life have recommended this book, especially to those who have little or no financial modeling experience. You will learn the skill you need to learn, and this book will be your guide all along the way. It’s crisp, instructional and full of fundamental concepts for you to master the skill of Financial Modeling.

Best takeaways

- In this book, you will not only learn about financial Modeling; rather, you will learn the basics of financial modeling – the accounting and finance concepts in detail. Even if you are new to financial Modeling, you won’t have any issue with learning from scratch.

- You will also learn how to create models using excel so that you can directly put your learning into work and see for yourself how much you have learned.

#8 – The Oxford Guide to Financial Modeling:

Applications for Capital Markets, Corporate Finance, Risk Management and Financial Institutions

by Thomas S. Y. Ho & Sang Bin Lee

This Book has drawn upon a striking balance between theory and practice of Financial Modeling. Let’s have a look at the review and the best takeaways.

Book Review

If you ever think of a book that will first teach you how to develop financial models and then it will show you in which cases you need to apply these models, this is it. This is the book you should pick up to learn financial Modeling comprehensively. This Book will not only cover the models; it will also add how these models are relevant in present business cases.

Best takeaways

- This Book presents the financial models and the contexts of each model, and you would also learn to use them whenever required.

- The width of the Book in terms of the curriculum is vast. It has covered financial Modeling in its entirety – from option pricing in the securities market to firm valuation in corporate finance.

- You would also get the assistance of the thomasho.com website to understand the financial models better.

#9 – The Mathematics of Financial Modeling and Investment Management

by Sergio M. Focardi & Frank J. Fabozzi

People who are into financial Modeling need to know the math behind the financial models if they wish to advance their career in financial Modeling. This Book will be the answer to all your mathematical questions behind financial Modeling.

Book Review

This Book is strictly not for beginners. The reason behind this is it’s written for people who already have some experience and fundamental knowledge in financial Modeling and especially in using the mathematical framework. This Book can be a great refresher for someone who wants to go back to the quants section of finance and revise the concepts. However, this Book will hold your hands and walk you through every possible concept you need to learn in quantitative finance.

Best takeaways

- You will not only learn the concepts of financial Modeling and quantitative finance, but you will also learn the practical examples which will crystallize your learning.

- You will learn arbitrage pricing, derivative pricing, credit risk modeling, interest rate modeling, and much more.

#10 – The Handbook of Financial Modeling:

A Practical Approach to Creating and Implementing Valuation Projection Models

by Jack Avon

This book will help you think from both perspectives – from the perspective of a financial modeler and the end-users.

Book Review

The Book is a gem. If it’s not overemphasis, the Book can be called the best textbook on Financial Modeling available as of now. The author has authority over the subject, and once you begin to read this book, you will not only learn financial Modeling better; instead, you will also start to approach your entire finance career in different ways. This Book is 504 pages and covers almost everything you need to learn and to apply in financial Modeling.

Best takeaways from this Book

- You will learn the logic behind thinking about end-users first while building the financial models.

- You will also learn the fundamental accounting and finance concepts you need to know to create financial models.

- You will get a map of planning, designing, and building a fully functional financial model.

Amazon Associate Disclosure

WallStreetMojo is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon.com