Table Of Contents

What Is The Treasury Stock Method (TSM)?

The Treasury Stock Method (TSM) helps a company determine how many new shares of stock it can create from in-the-money warrants and options available to be exercised. The corporation can further utilize these to repurchase common shares at the average market price.

The TSM calculates the potential increase in the number of shares outstanding as a result of potentially dilutive securities. These new shares can also be used to calculate the company's diluted earnings per share (EPS). This approach enables analysts and investors to ascertain how stock options and convertible securities could affect the financial situation of a firm.

Key Takeaways

- The Treasury Stock Method is a way to calculate the number of new shares of stock a corporation can issue from unexercised in-the-money warrants and options.

- The proceeds from the warrants and options are used to repurchase common shares at the average market price.

- The formula for a net increase in the number of shares is -

- In-the-money options - Shares repurchased using hypothetical funds

- This becomes a metric to help companies know the impact of varied stock options and other convertible assets on their financial health.

Treasury Stock Method Explained

The treasury stock method is used to calculate the potential dilution of EPS that could occur from outstanding stock options and warrants. This method assumes that the proceeds from options and warrants can be used to repurchase its shares at the average market price.

Upon exercising the options or warrants, the company receives the following amount of proceeds: exercise price of the option x number of shares issued to holders of the options or stock warrants. The company will then use the proceeds from the exercise of options and warrants to buy back common shares at the average market price for the year. Thus, the net change in the number of shares outstanding is the number of shares issued to holders of the options or warrants less the number of shares acquired from the market.

Below are the three primary steps used in the Treasury Stock Method:

- In-the-money options and warrants are assumed to be exercised. These include dilutive securities of in-the-money options and warrants.

- The proceeds from the exercise are assumed to purchase common stock at the average market price during the period.

- The incremental shares (number of shares outstanding - number of shares assumed to be purchased) will be included in the denominator for diluted EPS calculation.

Thus, the Treasury Stock method formula for a net increase in the number of shares:

Some assumptions for the Treasury Stock Method are as follows:

- If the exercise price of the option or warrants is lower than the stock's market price, dilution occurs.

- If higher, the number of common shares is reduced, and the anti-dilutive effect occurs. In the latter case, exercise is not assumed.

Video Explanation Of Treasury Stock Method

Examples

Let us check the following instances to understand the concept and how it works:

Example 1

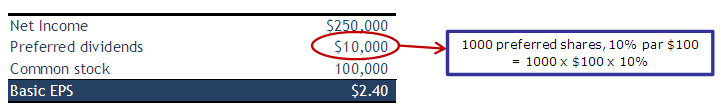

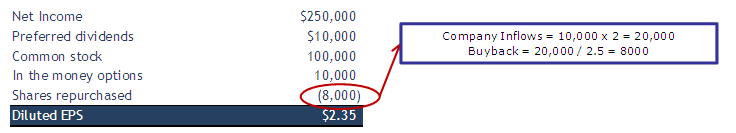

During 2006, KK Enterprise reported a net income of $250,000 and had 100,000 shares of common stock. During 2006, KK Enterprise issued 1,000 shares of 10%, par $100 preferred stock outstanding. In addition, the company has 10,000 options with a strike price (X) of $2 and the current market price (CMP) of $2.5. Calculated the diluted EPS.

Assume tax rate - 40%

Basic EPS Example

Diluted EPS

Denominator = 100,000 (basic shares) + 10,000 (in the money options) – 8,000 (buyback) = 102,000 shares

Example 2

Let us look at how Colgate has accounted for such Stock Options while calculating the diluted EPS.

Source - Colgate SEC Filings

As you can see from above, for the year ended 2014, only 9.2 million were considered (instead of 24.946 million). Why?

The difference is 24.946 million - 9.2 million = 15.746 million shares.

The answer lies in Colgate 10K - it mentions that diluted Earnings per common share are calculated using the "treasury stock method. We may assume that 15.746 may be related to the buyback using the Option Proceeds.