Table Of Contents

What Are Other Current Assets?

Other current assets are the business's not very common and significant assets, like cash & cash equivalents, inventory, trade receivables, etc., and are expected to be converted into cash within 12 months of the reporting date. Since the other current assets list is not very significant or is hardly ever recorded, the balance on the OCA account is generally very small.

In simple words, it is a balance sheet line item that represents all the short-term assets that are considered to be too insignificant to be recognized individually. They are denoted as "other" because they are either inconsequential or fairly uncommon, unlike typical current assets like cash & cash equivalents, accounts receivable, marketable securities, inventory, and prepaid expenses.

Other Current Assets Explained

Other current assets are a category on a company's balance sheet that includes short-term assets that do not fit into more specific categories like cash, accounts receivable, or inventory. These assets are expected to be converted into cash or used up within a relatively short time frame, typically within a year.

Some annual reports provide the detailed breakup of these items in the notes to the financial statements. Therefore, one should always refer to the notes from the other current assets forecast if the figures exhibit significant variation or are significantly large enough in their entirety (although not significant individually). Other current assets are important because they provide a more complete picture of a company's liquidity and short-term financial health. These assets can be quickly converted into cash or used to cover current liabilities.

However, it's also important to monitor these assets closely as they can represent unique risks, such as potential write-offs, loss of value, or changes in the underlying conditions that could affect their value or recoverability. In essence, other current assets contribute to a company's financial agility, risk management, operational efficiency, and overall financial stability.

Video Explanation Of Current Assets

Formula

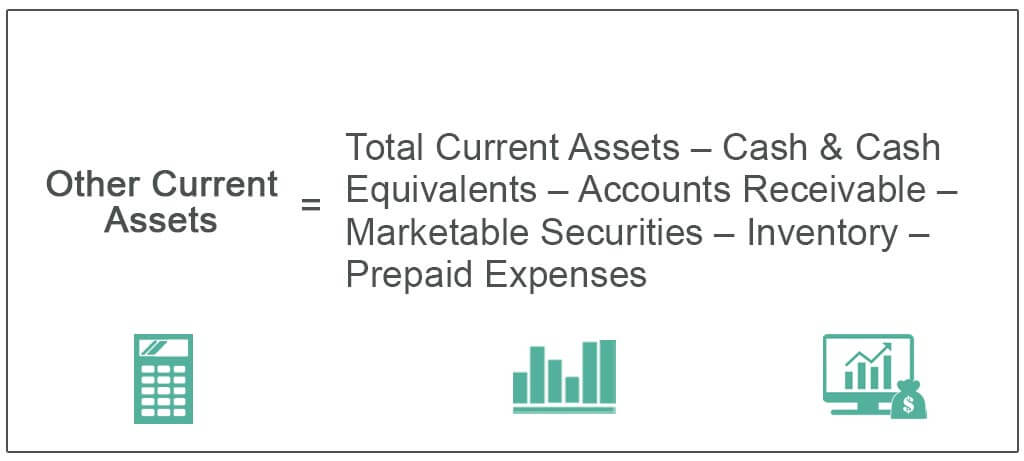

The OCA formula is calculated by deducting the major asset classes under current assets, such as cash & cash equivalents, accounts receivable, marketable securities, inventory, and prepaid expenses, from total current assets.

Mathematically, the formula to calculate an other current assets list is represented as,

OCA = Total Current Assets - Cash & Cash Equivalents - Accounts Receivable - Marketable Securities - Inventory - Prepaid Expenses

How To Forecast?

While it can be challenging due to the diverse nature of these assets, here are steps to consider for other current assets forecasting:

- Review past financial statements to understand trends in other current assets. Identify any seasonality, patterns, or changes in these assets over time.

- Understand the factors that contribute to changes in other current assets. For example, if prepaid expenses are a significant component, consider factors that might impact prepaid expenses, like upcoming rent increases or insurance premium changes.

- Research industry benchmarks and trends to gain insights into how other companies in your sector manage their other current assets. Industry-specific factors can influence the composition and growth of these assets.

- Consider how macroeconomic conditions might impact other current assets. Economic growth, interest rates, inflation, and regulatory changes can affect various components within this category.

- Analyze internal factors such as changes in business strategies, expansion plans, or shifts in product lines that could impact short-term asset requirements.

- Collaborate with different departments like finance, procurement, and operations to gather input on factors that might influence other current assets.

Examples

Now that we understand the basics, formula, and how to forecast an item from other current assets list, let us apply that knowledge to practical application through the examples below.

Example #1

Let us take the example of company XYZ Ltd had recently published its annual report. The following excerpt of the balance was made available:

- Cash & Cash Equivalents – $50,000

- Accounts Receivable – $100,000

- Marketable Securities – $15,000

- Inventory – $80,000

- Prepaid Expenses – $25,000

- Total Current Assets – $300,000

Determine the OCA based on the given information.

The Calculation of OCA can be done by using the above formula as,

= $300,000 - $50,000 - $15,000 - $100,000 - $80,000 - $25,000

= $30,000

Therefore, as per the available information on the balance, the OCA of XYZ Ltd stood at $30,000.

Example #2

Now, let us take the example of Apple Inc.'s annual report as of September 29, 2018. The following information is available and, based on that, determines the OCA change during the last year.

The OCA as on September 29, 2018, can be calculated using the above formula as,

= $131,339 - $25,913 - $40,388 - $23,186- $3,956 - $25,809

= $12,087

Again, the OCA as on September 30, 2017, can be calculated as,

= $128,645 - $20,289 - $53,892 - $17,874 - $4,855 - $17,799

= $13,936

So, the OCA for Apple Inc. has decreased from $13,936 Mn to $12,087 in the last year. However, the variation is not known as we do not have a detailed breakup.

Advantages

Other current assets forecasting offers several advantages to a company's financial operations and overall health:

- Liquidity Enhancement: Other current assets can be quickly converted into cash, providing a buffer for short-term financial needs and obligations.

- Diversification of Assets: These assets can diversify a company's portfolio beyond the more common categories like cash, accounts receivable, and inventory, reducing risk and increasing financial flexibility.

- Favorable Financing Terms: The presence of certain other current assets, like short-term investments or marketable securities, can improve a company's creditworthiness and help negotiate better terms with lenders.

Disadvantages

Despite the advantages mentioned above and other sections of this article, there are a few disadvantages of forecasting and accounting for other current assets list. Let us understand them through the points below.

- Lack of clarity as some companies do not provide a detailed breakup of the items included.

- Any asset item that has outgrown the period of one year or one business cycle should be reclassified under any long-term asset class. However, there are occasions when such assets are overlooked and erroneously continued under OCA, which are its major disadvantages. The working capital requirement increases in such a case.

- At times, an increase in one asset is offset by a decrease in another asset within the OCA. In such a scenario, there will hardly be any significant variation in the totality, and as such, the variation in the individual assets is overlooked.

Other Current Assets Vs Other Assets

Other current assets and other assets are categories on a company's balance sheet that encompass different types of assets. While they both include assets that don't fit into more specific categories, there are differences in their fundamentals and implications. Let us understand the differences through the comparison below.

Other Current Assets

- These are short-term assets that are expected to be converted into cash or used up within a year, typically as part of the company's regular operating cycle.

- Examples include prepaid expenses, short-term investments, deferred tax assets, advances to suppliers, and other miscellaneous assets with a short-term nature.

- The main focus of other current assets is on assets that can quickly impact a company's liquidity and short-term financial health.

- They play a role in managing working capital, meeting short-term obligations, and providing flexibility in day-to-day operations.

Other Assets

- "Other assets" generally refer to long-term assets that do not fall under more specific categories like property, plant, equipment, or intangible assets.

- These assets have a longer expected useful life and are not intended to be converted into cash or consumed within a year.

- Examples include long-term investments, certain non-current receivables, and other assets that are not easily classified.

- The focus here is on assets that contribute to the company's long-term value and operations.

- These assets might include items with relatively less frequent transactions, making them less directly linked to a company's immediate liquidity concerns.