Table Of Contents

What Is A Recoverable Amount?

The recoverable amount of an asset refers to the present value of the expected cash flows that are to arise from the sale or use of the asset. It is calculated as the greater of the two amounts, namely, the asset's fair value as reduced by the related selling costs and value in the use of such assets.

Explanation

The accounting standards require the companies to report the instances in the financial statements where the carrying amount of an asset is greater than its recoverable amount. Further, it is present in International Accounting Standard 36 ("IAS 36"). It provides provision for an impairment loss if the carrying value of an asset is more than its recoverable amount. The carrying value of an asset means its book value. On the other hand, the recoverable amount of an asset refers to the maximum amount of cash flows that are expected to be obtained from the asset. The cash flows can either arise by selling the asset or by using it.

Recoverable Amount Formula

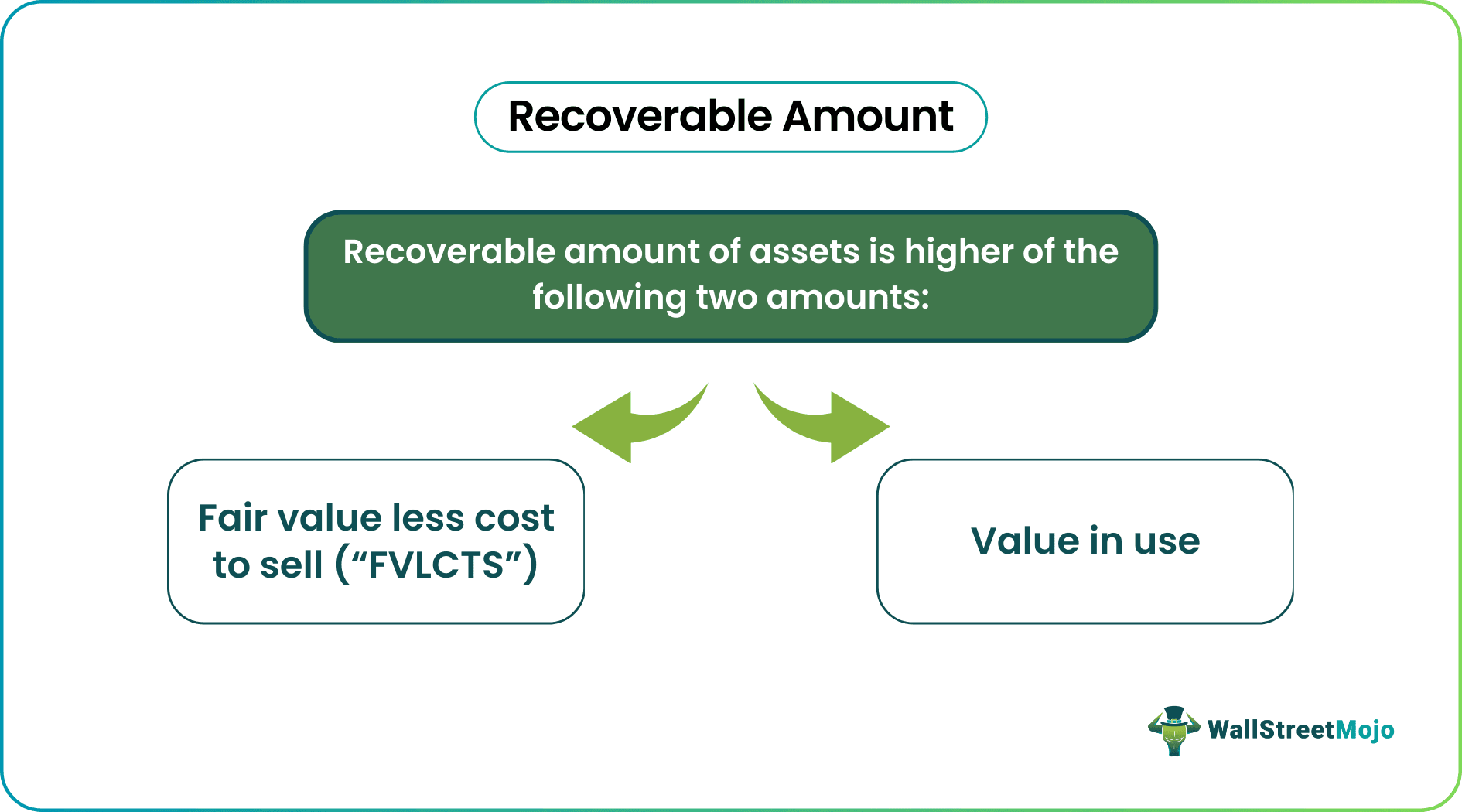

The recoverable amount of an asset is the higher of the following two amounts-

- Fair value less cost to sell (abbreviated as “FVLCTS”)

- Value in use

As we know, the calculation depends on FVLTS and Value in use. Let us understand the meaning of these two terms.

#1 - Fair Value Less Cost to Sell (“FVLCTS”)

Fair means the value at which the asset can be sold. It refers to the economic benefits that are expected to arise due to the sale of such. It has to be determined by reducing the expected cost of selling the asset from the asset's fair value. The expected cost of selling the asset means the transaction costs related to the asset's sale.

#2 - Value in Use

It refers to the present value of the expected cash flows that are to accrue due to the use of the asset. The same can be calculated by determining the weighted average of probability-based projected cash flows of the asset under consideration. A weighted average of probable cash flow shall be stated at its present value using the appropriate discount rate.

Example

Now, let us look at an example for a better understanding.

For machinery, the details are given below. Open market value of the machinery = $62,000.There is a 30% probability that the cash flows will accrue to an amount of $30,000 in the future, and there is a 70% probability that the cash flows will accrue to an amount of $20,000 in the future for three years. The appropriate discount rate is 10%.

Solution:

Fair value will be -

- Fair value = $62,000

Calculation of Value in use will be -

- Value in Use =20930 + 19090 + 17250 = 57270

The recoverable amount will be -

Thus, the recoverable amount of the machinery shall be higher than the FVLCTS ($62,000) and the Value in Use ($5,7270). Accordingly, the recoverable amount comes to be FVLCTS, i.e., $62,000, higher than the two amounts.

Note: Please refer above given excel template for a detailed calculation of the recoverable amount.

Recoverable Amount vs. Salvage Value

- The salvage value of an asset refers to the residual value of an asset at the end of the useful life of the asset. It is a management expectation of the value at which such an asset would be sold at the end of the useful life of the asset. It is also known as scrap value. Salvage value is useful in calculating depreciation on an asset and in considering the viability of purchasing the asset. A higher salvage value will effectively reduce the overall cost of the asset since the asset can be sold at the salvage value at the end of its useful life of the asset.

- On the other hand, the recoverable amount is the maximum cash flow expected from the asset, either by its sale or by its regular use. It is calculated as the higher of the fair value and the value in use of an asset. It is useful in determining the impairment loss, if any, by comparing the same with the asset's carrying value.