Table Of Contents

What is the Total Assets Formula?

Assets are defined as resources owned by the company from which future economic benefits are expected to be generated. Total assets are the sum of non-current and current assets, and this total should equal the sum of stockholders' equity and total liabilities combined.

The formula for Total Asset is:

Total Assets = Non Current Assets + Current Assets

Note:

- Current Assets: Current Assets are those assets that are expected to be converted into cash or cash equivalents within one financial year.

- Non-Current Assets: Non-Current Assets are those assets that a company holds for more than one financial year, which are not readily convertible into cash or cash equivalents.

Examples of Total Assets Formula (with Excel Template)

Let's see some simple to advanced examples of the total assets equation to understand it better.

Example #1

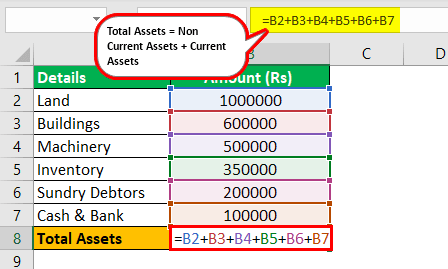

The following are the asset details of a small manufacturing company for the year ended 31st March 2019.

- Land = Rs.10,00,000

- Machinery = Rs.5,00,000

- Buildings = Rs.6,00,000

- Sundry Debtors = Rs.2,00,000

- Inventory = Rs.3,50,000

- Cash & Bank = Rs.1,00,000

Solution:

Use the following data for the calculation of total assets.

So, the calculation of total assets can be done as follows –

Total Assets = Land + Buildings + Machinery + Inventory + Sundry Debtors + Cash & Bank

Total Assets = 1000000+600000+500000+350000+200000+100000

In the above total assets formula, non-current assets are Land, Buildings & Machinery, otherwise known as fixed assets.

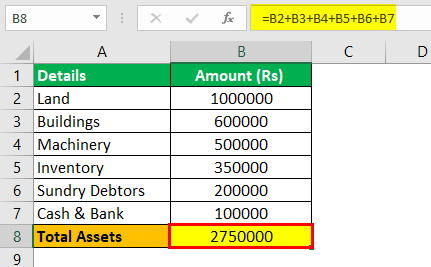

Total Assets will be -

Total Assets = 2750000

Hence, the total assets would be calculated as Rs. 27,50,000.

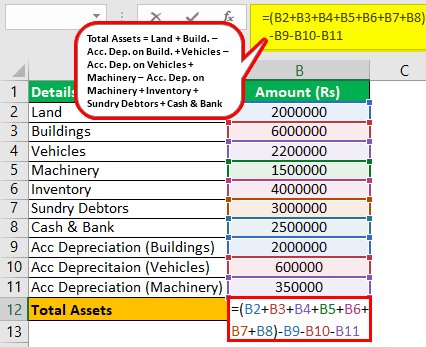

Example #2

The following are the asset details of a medium-sized company for the year ended 31st March 2019.

- Land = Rs.20,00,000

- Inventory = Rs. 40,00,000

- Buildings = Rs.60,00,000

- Sundry Debtors = Rs. 30,00,000

- Vehicles = Rs.22,00,000

- Cash & Bank = Rs. 25,00,000

Solution:

Note:

- Accumulated Depreciation on Buildings = Rs. 20,00,000

- Accumulated Depreciation on Vehicles = Rs. 6,00,000

- Accumulated Depreciation on Machinery = Rs. 3,50,000

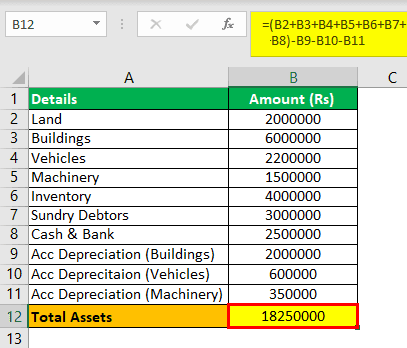

So, the calculation of total assets can be done as follows –

Total Assets = Land + Buildings – Acc. Depreciation on Buildings + Vehicles – Acc. Depreciation on Vehicles + Machinery – Acc. Depreciation on Machinery + Inventory + Sundry Debtors + Cash & Bank

Total Assets = 2000000+6000000-2000000+2200000-600000+1500000-350000+4000000+3000000+2500000

Total Assets will be -

Total Assets = 18250000

Hence, the total assets would be calculated as Rs. 1,82,50,000.

In this example, we observe the concept of Gross vs. Net Book Value. While calculating total assets, it is important to note that the fixed assets should be stated at Net Value (Gross Value – Accumulated depreciation). It is assumed that the building, vehicle, and machinery value provided is gross (at cost).

Hence, In the above total assets equation – Accumulated depreciation(Building, Vehicles, machinery) are subtracted from the gross value.

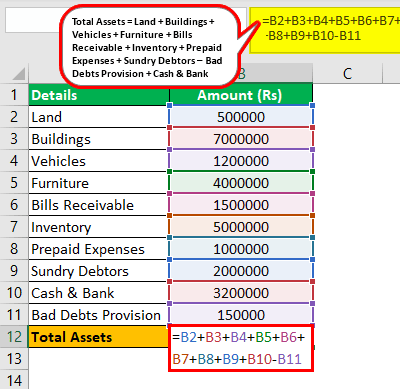

Example #3

The following are the asset details of a large company for the year ended 31st March 2019.

- Land =Rs.5,00,000

- Inventory =Rs. 50,00,000

- Buildings =Rs.70,00,000

- Sundry Debtors =Rs. 20,00,000

- Vehicles =Rs.12,00,000

- Cash & Bank =Rs. 32,00,000

- Furniture =Rs.40,00,000

- Prepaid Expenses =Rs. 10,00,000

- Bills Receivable =Rs.15,00,000

- Bad Debts Provision =Rs. 1,50,000

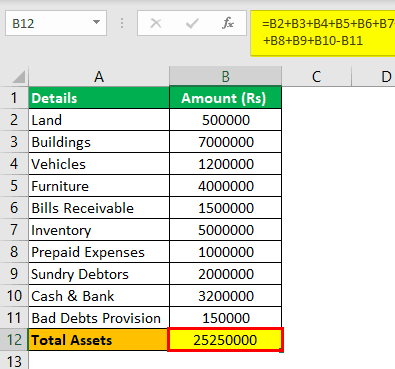

So, the calculation of total assets can be done as follows –

Total Assets = Land + Buildings + Vehicles + Furniture + Bills Receivable + Inventory + Prepaid Expenses + Sundry Debtors – Bad Debts Provision + Cash & Bank

Total Assets = 500000+7000000+1200000+4000000+1500000+5000000+1000000+2000000+3200000-150000

Total Assets will be -

In the above total assets equation, current assets are Bills Receivable, Inventory, Prepaid Expense, Sundry Debtors, and Cash & Bank.

Total Assets = 25250000

Hence, the total assets would be calculated as Rs. 2,52,50,000.

In the above example, it is important to note the following distinctive assets:-

- Bills receivable are bills of exchange against which the company will receive payment in the future. Generally, these are issued when the company has provided a credit sale (i.e., with no inflow of cash on sales).

- Prepaid expenses reported as a current asset represent the prepaid expense amount that will be used up within one (current) financial year. This represents the payment made by the company for goods or services to be received in the future.

- Debtors are to be stated at 'net value' after subtracting the provision for bad and doubtful debts. This provision indicates the extent of receivables that the company is not confident of retrieving from the debtors.

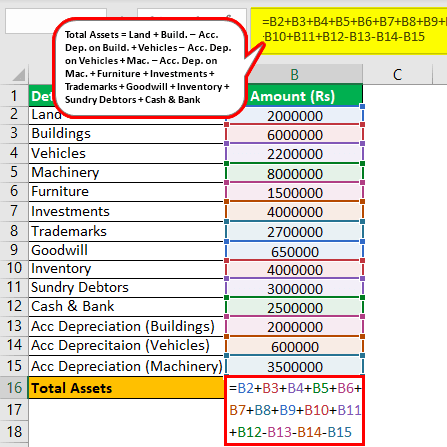

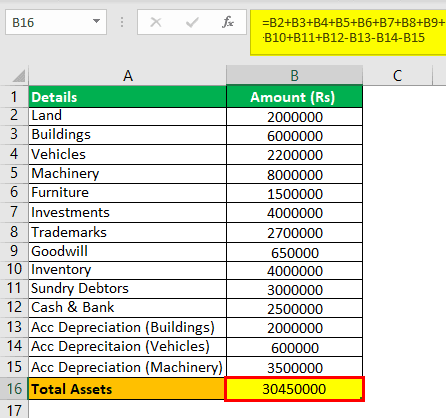

Example #4

The following are the asset details of a large manufacturing company for the year ended 31st March 2019.

- Land = Rs20,00,000

- Inventory = Rs. 40,00,000

- Buildings = Rs60,00,000

- Sundry Debtors = Rs. 30,00,000

- Vehicles = Rs22,00,000

- Cash & Bank = Rs. 25,00,000

- Furniture = Rs15,00,000

- Trademarks = Rs. 27,00,000

- Investments = Rs40,00,000

- Goodwill= Rs. 6,50,000

- Machinery = Rs80,00,000

Note:

- Accumulated Depreciation on Buildings = Rs. 20,00,000

- Accumulated Depreciation on Vehicles = Rs. 6,00,000

- Accumulated Depreciation on Machinery = Rs. 3,50,000

- Furniture was purchased on the last day of the financial year.

Solution:

So, the formula of total assets and calculation can be done as follows –

Total Assets = Land + Buildings – Acc. Depreciation on Buildings + Vehicles – Acc. Depreciation on Vehicles + Machinery – Acc. Depreciation on Machinery + Furniture + Investments + Trademarks + Goodwill + Inventory + Sundry Debtors + Cash & Bank

Total Assets = 2000000 + 6000000 + 2200000 +8000000 + 1500000 + 4000000 + 2700000 +650000 + 4000000 + 3000000 + 2500000 - 2000000 - 600000 - 3500000

Total Assets will be -

Total Assets = 30450000

Hence, the total assets would be calculated as Rs. 3,04,50,000.

In the above example, it is important to note the following distinctive assets:-

- Since the furniture was purchased on the last day of the financial year, there was no depreciation.

- Investments may be considered long-term since no specification is made regarding the same. This indicates they are assets that a company intends to hold for more than a year, i.e., securities, real estate, etc.

- Trademarks are intangible assets representing the legal right to use a name, logo, or other identifiers in business. When a trademark is assigned a value, as in this example, it is usually the fair value of the same when purchased from someone else.

- Goodwill is also an intangible asset that represents the difference between the market value of the company and book value of assets (as per Balance Sheet).

Conclusion

The various types of assets can be categorized into Non-Current and Current. This would depend on their usage and significance to the company's operations. Broadly, however, total assets are calculated by the summation of all current and noncurrent assets value after adjusting for accumulated depreciation and any write-off or provision of receivables. Other variations are dependent on the applicability of accounting standards.