Table Of Contents

What Are Cash Equivalents?

Cash equivalents, in general, are highly liquid investments in an entity’s balance sheet. They have a maturity of three months or less with high credit quality, and are unrestricted so that it is available for immediate use. They help the business meet immediate expenses or make short-term investments.

Such assets include items like treasury bills, commercial papers, accounts receivable, marketable securities, etc, and is usually used to purchase inventory and meet operational expenses. A business records the cash inflow and outflow in the cash flow statement, which is actually the cash equivalents.

Table of contents

- Cash equivalents generally are highly liquid investments with a three-month or shorter maturity, good credit quality, and unrestricted availability for immediate use.

- Equivalents do not include equity assets like stocks, bonds, and derivatives unless they are, in fact, cash equivalents, such as preference shares bought close to their maturity with a set redemption date.

- Instead of investing in them or using them for other things, businesses keep these to fulfill short-term cash needs. However, it is a crucial source of liquidity.

- Depending on the state of the market, businesses occasionally set aside more equivalents than what was required to pay immediate liabilities.

Cash Equivalents Explained

Cash equivalents in accounting are the current assets appearing in any business's balance sheet that are liquid. They are used for meeting short-term expenses of investing. The list of cash equivalents a company holds has implications for the company’s overall operating strategy. Many theories exist about how much companies should keep. However, the same depends on the industry and the stage of growth. The current and quick ratios help investors and analysts compare company cash levels with certain expenses.

Types

Let’s discuss the following types of cash equivalents on balance sheet.

- Banker acceptance: A banker’s acceptance (BA) is a short-term debt instrument issued by a company that is guaranteed by a commercial bank.

- Commercial paper: An unsecured source of funding issued by a corporation and is generally short-term in nature. These are typically used for the financing of short-term business requirements such as accounts receivable, inventories, and short-term liabilities.

- Treasury bills: A T-Bill is a short-term debt obligation backed by the Treasury Dept.of the U.S. government. T-bills generally have a maturity of less than one year and are sold in denominations of $1,000 up to a maximum purchase of $5 million.

Equity investments such as stocks, bonds, and derivatives are excluded from equivalents unless they are, in substance, cash equivalents on balance sheet, for example, preference shares acquired within a short period of their maturity and with a specified redemption date.

Suppose the T-bills can’t be converted to cash because of debt covenants or other agreements. In that case, the restricted T-bills must be reported in a separate investment account from the non-restricted T-bills on the balance sheet, or a note to the account mentioning the same should be included in the account notes. Thus, the above shows a list of cash equivalents.

Examples

Let us look at some examples to understand the concept.

Example #1

Brown Woods is a furniture manufacturing company that caters to the office furniture market. Its products have a good demand, and the company often gets bulk orders for furniture supply. However, it suddenly got a very high-value order but had to supply within a concise time. To meet the order it had to purchase raw material, for which enough cash was not available. But it had some stocks of good companies in its balance sheet that could be readily converted to cash, which the company used for this purpose. Thus it is clear that marketable securities are considered cash equivalents in accounting.

Example #2

Tesco example from the 2017 annual report – Included in cash is £777m that has been set aside for completion of the merger with Booker Group Plc. This cash is not available to the Group and must be held in ring-fenced accounts until released jointly by the Group and its advisors on the satisfaction of the complete terms of the merger.

Accounting entry: The balance sheet shows the amount of cash and cash equivalents at a given time. The cash flow statement explains the change in cash over time. E.g., if a business spends $200 to purchase raw materials, it will record an increase of $200 in its raw material and a corresponding decrease in its cash and its equivalents.

Importance

#1 - Liquidity Source

Companies try to maintain an increase in cash and cash equivalents for the purpose of meeting short-term cash commitments rather than for investment, or other purposes. It is an important source of liquidity. Thus companies want a cash cushion to weather unexpected situations such as a shortfall in revenue, repair or replacement of machinery, or other unforeseen circumstances not in the budget.

Liquidity ratio calculations are important to determine the speed with which a company can pay off its short-term debt. Various liquidity ratio includes cash ratio, current ratio quick ratio.

- Cash ratio: (Cash and equivalents + Marketable securities) ÷ Current liabilities

- Current ratio: Current assets ÷ Current liabilities;

- Quick ratio: (Current asset - inventory) ÷ Current liabilities;

Let us say that if there is a company XYZ with Current ratio: 2.3x, Quick ratio: 1.1x, and Cash ratio: 0.6x. Can you comment on the liquidity of the company?

Interpretation: Of the three ratios, the cash ratio is the most conservative. It excludes receivables and inventory given that these are not as liquid as cash. In the example above, the quick ratio of 0.6x means that the company only has $0.6 of liquid assets to pay for every one dollar of current liability.

#2 - Speculative acquisition strategy

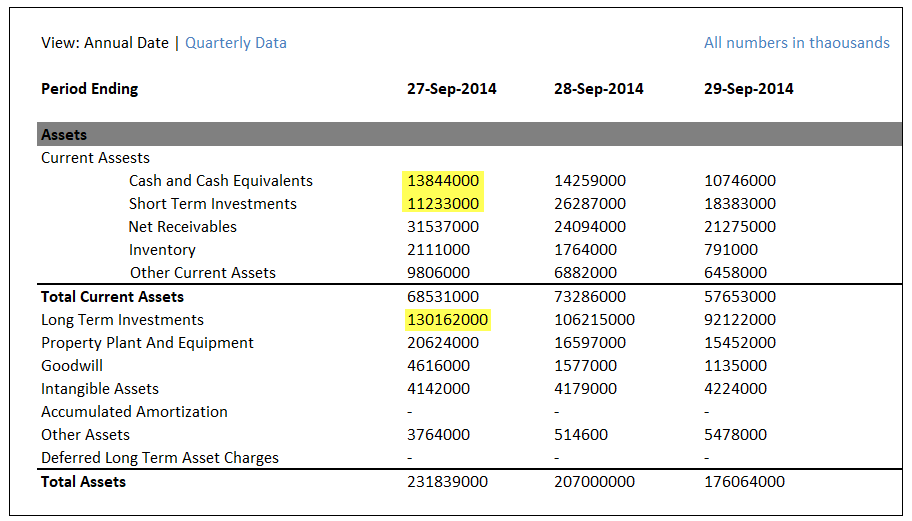

Another good reason for its pile-up is for near-term acquisition. As an example, consider cash balance in the 2014 balance sheet of Apple Inc.

- Cash = $13.844 billion

- Total Assets = $231.839 billions

- Cash as % of Total Assets = 13.844 / 231.839 ~ 6%

- Total Sales in 2014 = $182.795

- Cash as % of Total Sales = 13.844 / 182.795 ~ 7.5%

source: Apple SEC Filings

Interpretation: Investment of $13.844 bn (cash) + $11.233 bn (short-term investments) + $130.162 bn (long-term investments) totals $155.2 bn. Combination of all these indicates that Apple might be looking for some acquisition in the near term.

Cash Equivalents Vs Cash

Here are the key differences -

- Cash: Cash is money in the form of currency. This includes all bills, coins, and currency notes.

- Cash equivalents: For an investment to qualify as an equivalent, it must be readily convertible to cash and be subject to insignificant value risk. Therefore, an investment typically qualifies as a cash equivalent only when it has a short maturity of three months or less. Every business prefers an increase in cash and cash equivalents in the balance sheet.

Good or Bad?

+Maturity and Ease of Conversion: This is advantageous to have this is from the business perspective because a company can use these to meet whatever short-term needs might arise.

+Financial Storage: Unallocated equivalent is as a way to store the money until the business decides what to do with it.

-Loss of Revenue: Sometimes, companies set aside amount in equivalents, which exceeds what was necessary to cover immediate liabilities, depending on market conditions. When this happens, the company loses out on potential revenue, as money that could have produced a higher return elsewhere was committed to the cash account.

-Low Interest: Many equivalents bear interest. However, the interest rate usually is low. The low-interest rate makes sense, given that matches involve low risk. However, it also means that equivalents struggle to keep up with inflation.

Cash Equivalents Video

Frequently Asked Questions (FAQs)

Legal tender, banknotes, coins, cheques that have been cashed but not deposited, and checking and savings accounts are all examples of cash. In addition, any short-term investment security with a maturity of 90 days or less is considered a cash equivalent.

Simply put, no. Petty cash is real money, consisting of bills and coins. Cash equivalents include highly liquid assets such as money market funds, commercial paper, and short-term debt such as Treasury bills that can quickly turn into cash.

Assets that can be swiftly turned into cash are called cash equivalents. The risk associated with cash equivalents is minimal and can be easily converted. Savings accounts, T-bills, and money market products are some examples. Current liabilities are debts with a one-year maturity.

Recommended Articles

This has been a guide to what are Cash Equivalents. We explain them with examples, types, difference with cash, importance, and whether they are good or bad. Here we also discuss its importance and whether it is good or bad. You may also have a look at these articles below to learn more about accounting -