Table Of Contents

List of Assets in Accounting

The asset consists of the resources owned or controlled by the Corporation, individual, or the government as the result of the events of the past with the motive of generating the cash flows in the future. The list of assets includes operating assets, non-operating assets, current assets, non-current assets, physical assets, and intangible assets.

In this article, we discuss the list of Top 10 Assets in Accounting

#1 - Cash and Cash Equivalents

Every business requires cash or bank balance for its operations. With the cash and cash equivalents, one can buy land, buildings, merchandise, etc., and pay for expenses like employees' salaries, utility bills, etc.

When the inflows are from the loan, it increases the liabilities of the company. If the sale of assets, then it decreases the assets. If the inflows are from the profit, it grows the equity value of the company's shareholders, thereby increasing the interest of the investors in the company. If there is a lack of sufficient funds in the business, then the company has to sell off its assets, which will lead to the risk of becoming bankrupt or discontinuation the operations.

Example: The Inflow of cash to the company is in loans, raising share capital, debentures, profits from the business operation, gain on the sale of property or equipment, etc.

#2 - Short Term Investments

Short Term Investments contain those investment assets which are short-term in nature and are liquid investments. These can be in debt or equity markets and have a short-term maturity of less than one year.

source: Microsoft.com

#3 - Inventory

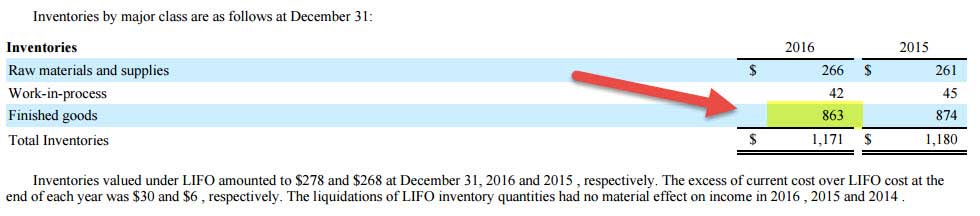

Inventory is a term used for the goods available for sale in the business. The revenue of the business depends upon the sale of its inventory. Higher the sale, Higher is the revenue generated, and vice versa. Inventories are not long-term assets. They are part of current assets lists. In a manufacturing concern, inventories are further classified as

- Raw materials: They are unprocessed materials on which the work is yet to be started. For example, to manufacture a t-shirt, the cloth is a raw material.

- Work-in-progress: When the work on raw material is done partially, and some value addition remains. For example, if the cloth is semi-stitched and still the other side of the t-shirt is yet to be stitched. Then such a semi stitched piece is part of a Work in progress.

- Finished goods: The products are ready for sale as they have completed production. The final product t-shirt, which is properly stitched, is the finished product.

#4 - Accounts and Notes Receivables

It is widespread in the business enterprise to make sales on credit. Due to such sales made on credit, the account receivable or trade receivable is created in the current assets. Accounts receivable represent the money owed to the business enterprise by its debtors.

For example, ABC Company sold goods worth $5,000 to XYZ Company. Now XYZ Company is liable to pay $5,000 to ABC Company. So in the books of ABC Company, XYZ Company is the debtor of $5,000, which is a part of accounts receivable. If the debtors fail to pay the amount, then the amount is written off as bad debts.

Accounts receivable also include bills receivable, which direct the debtors to pay off the amount mentioned within the time specified on the bill. In the above example, if the bill of exchange is issued to XYZ Company, directing him to pay $5,000 within 60 days, instead of reporting XYZ Company as debtors, ABC Company will report $5,000 as bills receivable.

#5 - Prepaid Expenses

Prepaid expenses are paid in advance before they are accrued or when the benefit of such payment will be received in the coming financial years. The unexpired portion of the prepaid expense is reported on the asset side of the balance sheet.

source: Google SEC filings

We note above that Google's Prepaid revenue share, expenses, and other assets have increased from $3,412 million in December 2014 to $37,20 million in March 2015.

#6 - Land

Land is the tangible long-term asset that the business generally holds for greater than one year. The land is bought for or with the place of business like office, plant, etc., or for housing and commercial developments.

The land is shown at the purchase price by the company until the same is sold. Any change in value during the holding period is not recorded, and only the gain or loss at the time of land sale is reflected as the increase or decrease in cash or equity account. The balance sheet shows the purchase price until it is sold. There is no wear and tear in the land, so no depreciation benefit is allowed as per the income tax.

#7 -Property, Plant & Equipment

Properties, Plant & Equipment, are tangible assets that are physical. They are part of the company's fixed assets because they are used for a long-term period. These assets are reported in the balance sheet at a cost less than the amount of depreciation. Capital intensive industries have a more significant amount of fixed assets, such as manufacturers, oil companies, automobile companies, etc.

Examples of plants & machinery are Machinery, office furniture, Motor Vehicles, etc.

#8 - Intangible Assets

source: Google SEC Filings

Valuation of these assets is generally tricky because they are unique and are not readily available for sale. Intangible assets cannot be touched, or we can say they are not physical. These assets carry their importance. For instance, the brand name promotes sales. If one buys a franchisee of KFC, then surely, we will have a good base of the consumer. But if one opens his own business with a new brand name.

The list of intangible assets is goodwill, trademark, copyrights, patent, brand names, etc.

#9 - Goodwill

Goodwill is recorded on the balance sheet when one company buys another company and pays a premium over the fair market value of the assets.

source: Amazon SEC Filings

#10 – Long Term Investments

Long Term Investment assets include those investments in debt or equity which the company intends to hold for a long-term basis.

source: Alphabet SEC Filings

Alphabet's non-current asset example of long-term investments includes non-marketable investments of $5,183 million and 5,878 million in 2015 and 2016, respectively.

Recommended Articles

This article has been a guide to the list of Assets in Accounting. Here we discuss the list of Top 10 types of assets, including cash & cash equivalents, prepaid expense, inventory, receivables, PPE, Goodwill, intangible assets, long term investments, etc. You can learn more about accounting with the following articles –