Net Tangible Assets | Calculate Net Tangible Assets Per Share

Table Of Contents

What Are Net Tangible Assets (NTA)?

Net tangible assets are an accounting term also known as net asset value or book value. It can be calculated by taking the total assets of a business and subtracting any intangible assets like goodwill, patents or trademarks, par value of preferred stocks, and removing all liabilities to arrive at the figure.

Table of contents

- What are Net Tangible Assets (NTA)?

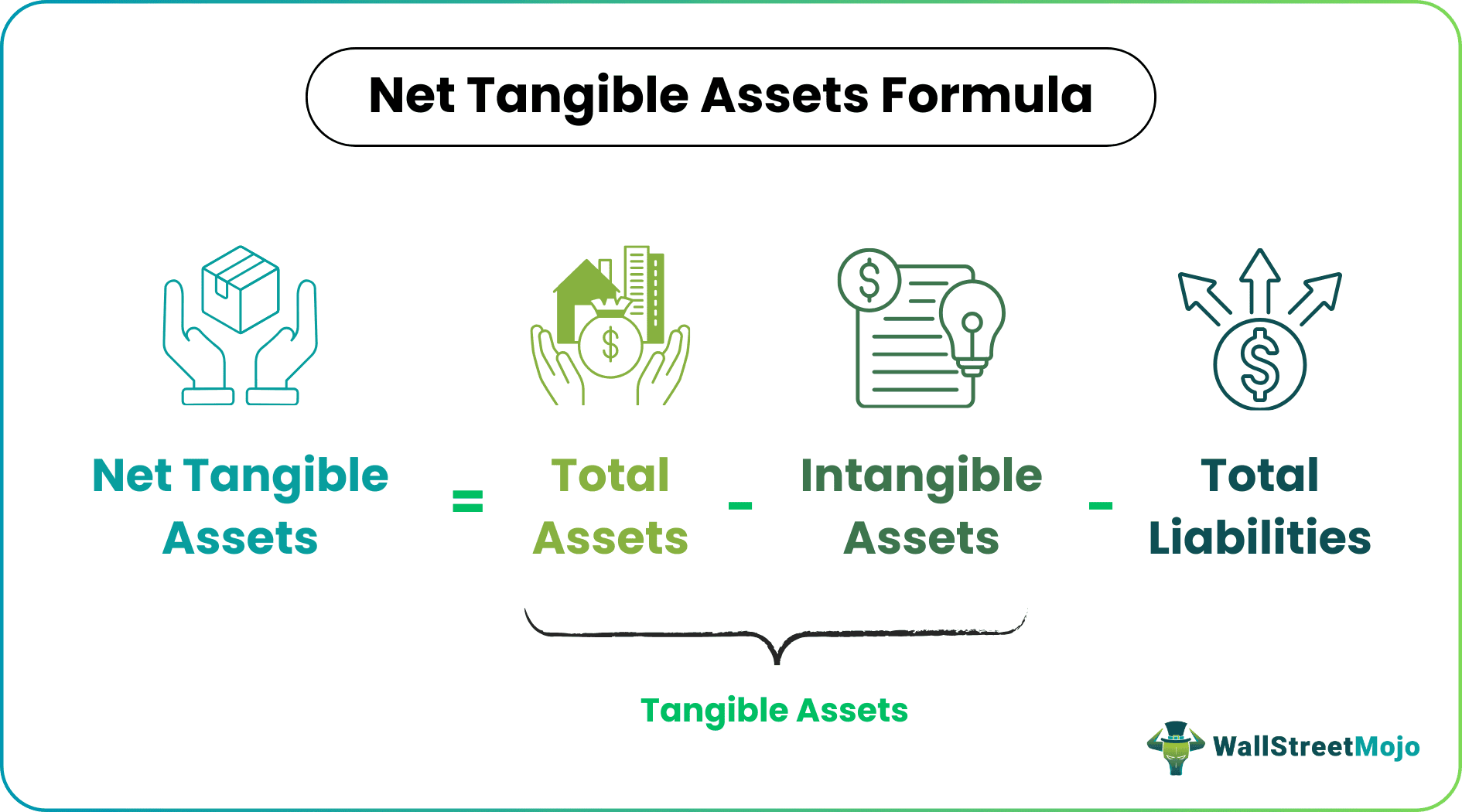

Net Tangible Assets Formula

Net Tangible Assets Formula = Total Assets - Intangible Assets - Total Liabilities

where,

- Total Assets = Total assets are the total of the asset side of the balance sheet. It includes all current assets, long-term tangible assets, as well as intangible assets and goodwill.

- Intangible Assets = These assets are those which we can't touch or feel, for example, goodwill, trademark, copyrights, or patents. Please note that most balance sheet reports goodwill separately from intangible assets. In our Net tangible asset formula, do not forget to take the sum total of both.

- Total Liabilities = These include current liabilities, long-term debt, and other long-term liabilities.

Net Tangible Assets Example

Suppose Company A has total assets worth $1.5 million on its books, has total liabilities worth$200 million, and intangible assets worth $500 million. After subtracting both of them from total assets, net assets would come to $800 million.

Net Tangible Assets Video

Starbucks Net Tangible Assets Calculation

Now that we calculate NTA of Starbucks.

source: Starbucks SEC Filings

Starbucks (2017)

- The Total Assets (2017) = $14,365.6

- Total Intangible Assets (2017) = $516.3 + $1539.2 = $1980.6

- Total Liabilities (2017) = $8,908.6

- NTA Formula (2017) = Total Assets (2017) - Total Intangible Assets (2017) - Total Liabilities (2017)

- = $14,365.6 - $1980.6 - $8,908.6 = $3,476.4

Starbucks (2016)

- The Total Assets (2016) = $14,312.5

- Total Intangible Assets (2016) = $441.4 + $1,719.6 = $2161.0

- Total Liabilities (2016) = $8,421.8

- NTA Formula (2016) = Total Assets (2016) - Total Intangible Assets (2016) - Total Liabilities (2016)

- = $14,365.6 - $1980.6 - $8,908.6 = $3,729.7

Significance and Use of NTA

This measure is considered very useful in analyzing a company’s assets, but their level of relevance might be different for any industry one might be dealing with. The relevance of NTA is largely dependent on how important intangible assets are for a specific industry since they are taken away while calculating this measure.

- In the case of Oil & Gas companies or car manufacturers, NTAs are very high. They can secure debt financing relatively easily by pledging their tangible assets.

- In technology companies, however, intangible assets are pretty large. This results in a lower amount of NTAs.

Recommended Articles

This has been a guide to Net Tangible Assets, its formula, example, and calculations. Here we also discuss Net Tangible Assets Per Share and why it is important? You may also go through the recommended articles on basic accounting –