Table Of Contents

What is Cash and Cash Equivalents?

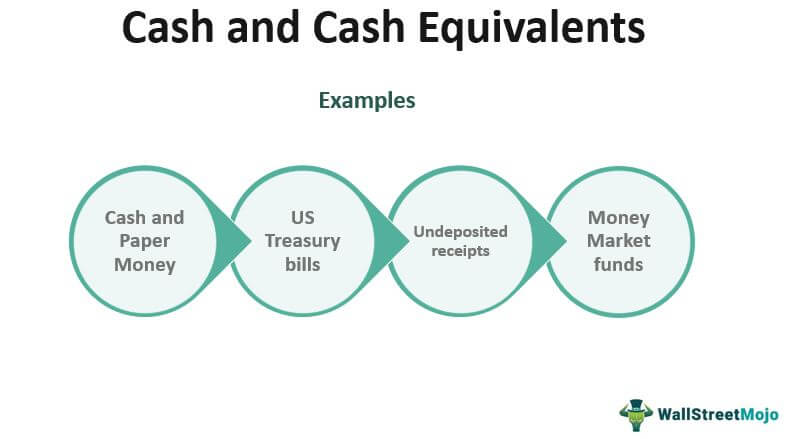

Cash and Cash Equivalents, usually found as a line item on the top of the balance sheet asset, are those sets of assets that are short-term and highly liquid investments that can be readily convertible into cash and are subject to low risk of price change. Examples include Cash and Paper Money, US Treasury bills, undeposited receipts, Money Market funds, etc.

When a company is not using its cash balance, it may invest its cash in low-risk liquid (easily sold) securities to generate interest income. Therefore, very liquid securities are sometimes called cash equivalents. The total cash and cash equivalents, therefore, are used to pay off short-term debt and preserve capital for long-term obligations of the company.

Cash and Cash Equivalents Explained

Cash and cash equivalents, often referred to as "cash and equivalents" in financial circles, represent a crucial aspect of a company's financial health. In essence, they encompass readily accessible assets that can be quickly converted into cash within a short period, usually three months or less.

Examples of cash equivalents typically include short-term investments, such as treasury bills or money market funds, which are highly liquid and low-risk. These assets serve as a financial safety net, enabling a company to meet its immediate financial obligations, such as paying off debts, covering operational expenses, or seizing attractive investment opportunities.

For investors and analysts, the level of cash and cash equivalents on a company's balance sheet provides valuable insights into its liquidity and ability to weather financial storms. A healthy cash position signifies stability and flexibility, while insufficient cash reserves may signal financial vulnerability.

Therefore, cash and cash equivalents notes are the lifeblood of any business, offering a financial cushion to navigate unexpected challenges and capitalize on emerging opportunities. Keeping a close eye on these assets is vital for both businesses and investors seeking to make informed financial decisions.

Cash and Cash Equivalents Explained in Video

Formula

The total cash and cash equivalents indicate how much immediately accessible financial resources a company possesses. This figure is vital for assessing a company's liquidity, its ability to meet short-term obligations, and its capacity to capitalize on sudden opportunities or weather financial setbacks.

CCE = Cash + Cash Equivalents

Cash: This represents the physical currency a company holds, such as coins and bills.

Cash Equivalents: These are highly liquid, short-term investments that can be swiftly converted into cash, like Treasury bills or money market funds.

List

Let us understand the items in a cash and cash equivalents notes in a list through the detailed explanation below.

- Cash equivalents are securities (e.g., US Treasury bills) that have less than or equal to 90 days.

- Stocks (Equity Investments) are not included here as the stock prices fluctuate daily and can lead to a significant amount of risk.

- Preferred stocks can be included within three months of the redemption date.

Why Firms hold Cash?

There are different reasons why a firm may want to keep reasonable levels of total CCE.

#1 - Overall Operating Strategy

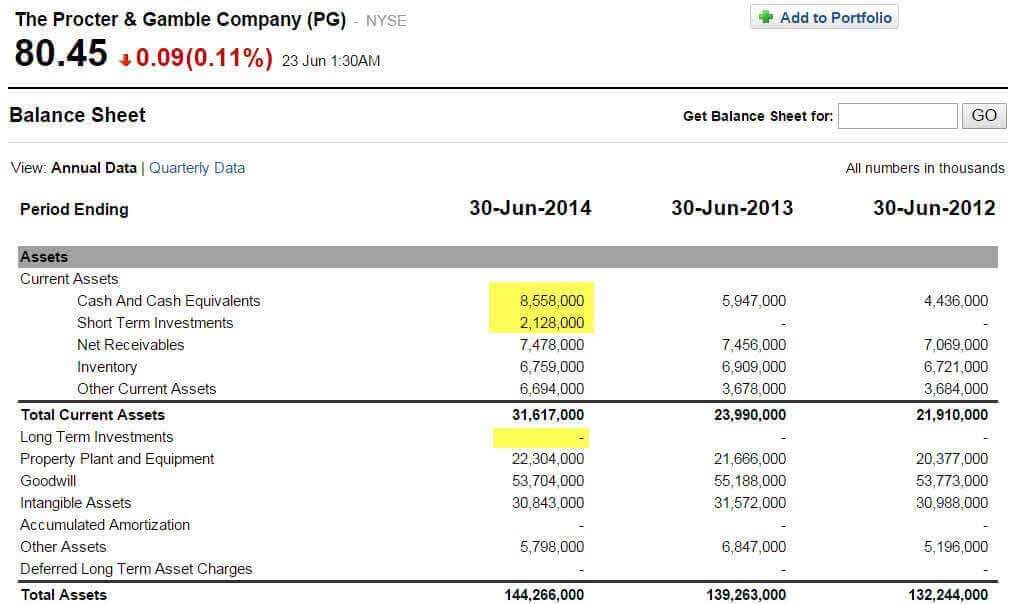

Most companies try to keep a small amount of cash compared to the overall turnover. The company must have enough cash to run its day-to-day operations without running to the bank now and then. Let us look at Procter and Gamble's example –

source: Yahoo Finance

- PG Cash = $8.558 billion

- PG Total Assets = $144.266 billions

- Cash as % of Total Assets = 8.558 / 144.266 ~ 6%

- PG Total Sales in 2014 = $83.062

- Cash as % of Total Sales = 8.558 / 83.062 ~ 10.3%

#2 - Speculative Acquisition Strategy

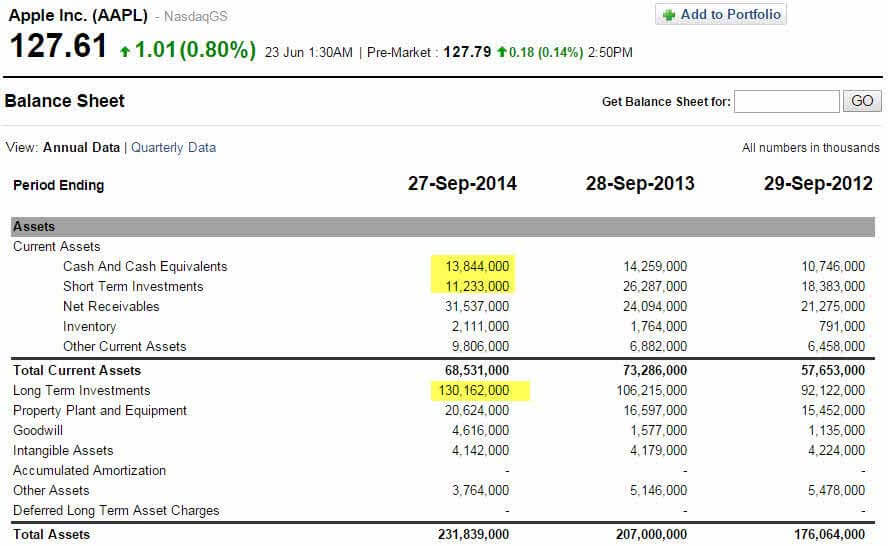

Another thought could be to pile up cash for a speculative or planned acquisition. But, again, if we note Apple's example, we will get some insights into the same.

source: Yahoo Finance

- Apple Inc Cash = $13.844 billion

- Apple Inc Total Assets = $231.839 billions

- Cash as % of Total Assets = 13.844 / 231.839 ~ 6%

- Apple Inc Total Sales in 2014 = $182.795

- Cash as % of Total Sales = 13.844 / 182.795 ~ 7.5%

Though we see that there is nothing too exciting about the cash here, if we closely look at all the Investments, we note that Apple Inc has a huge pile of $13.844 bn (cash & cash equivalent) + $11.233 bn (short term investments) + $130.162 bn (long term investments) = $155.2 bn. So is this for a suitable acquisition target?

#3 - No Good Reason

Some companies may have high cash for no good reasons. For example, maybe the management has not figured out the best way to deploy cash. In this case, one of the strategies could be to provide a return to the shareholders by buying back shares.

In another case, a huge pile of up cash for capital-intensive firms would imply an investment in a big project or machinery.

Examples

Now that we understand the basics, formula, and list, let us apply that knowledge into practical application through the examples below.

Example #1

ABC Electronics operates a chain of electronics stores, and they need to manage their finances wisely. At the end of the fiscal year, the company reports $100,000 in cash and $50,000 in cash equivalents on its balance sheet.

Having a substantial amount of cash and cash equivalents is vital for ABC Electronics. It allows them to cover daily operational expenses, such as paying salaries, restocking inventory, and maintaining their stores. If an unexpected opportunity arises, like securing a limited-time discount on popular electronics, having cash on hand enables ABC Electronics to act swiftly, potentially increasing their profits.

Additionally, in times of economic uncertainty or unexpected downturns, a healthy cash and cash equivalents position provides a financial cushion, helping ABC Electronics weather the storm without resorting to debt or liquidating long-term assets.

Example #2

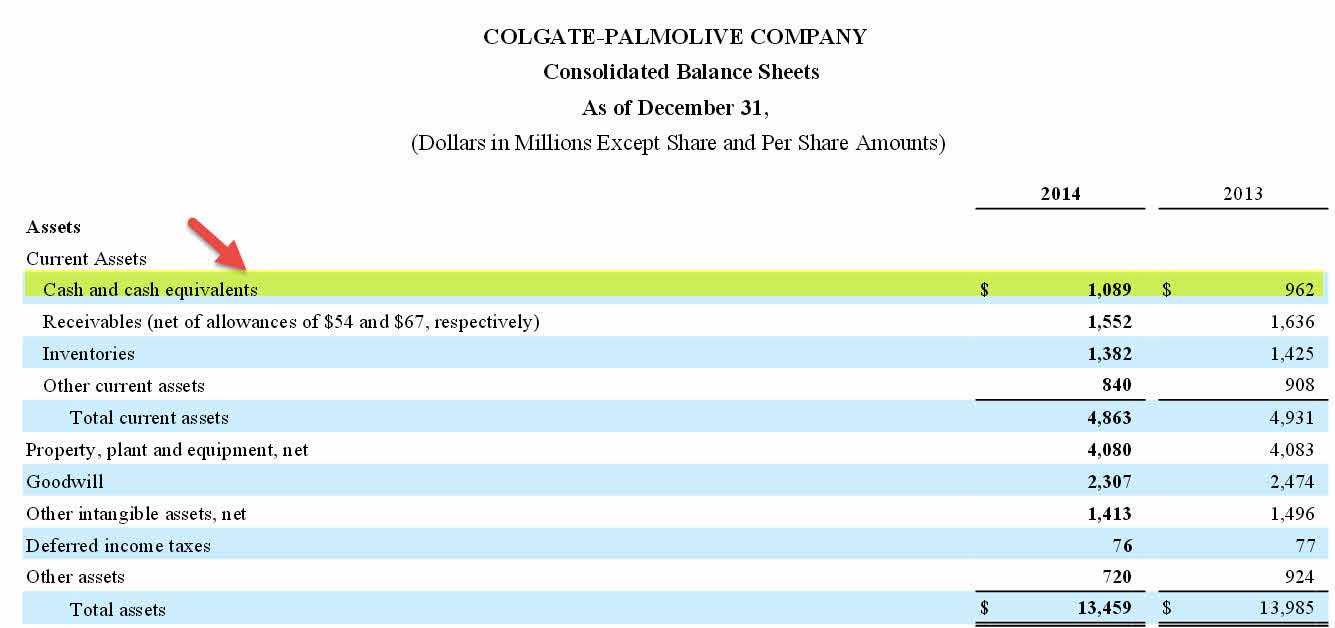

You can download Colgate's 10K report from here

Where is Colgate's CCE found?

Colgate's CCE is found in the balance sheet.

How much CCE Colgate has in 2013 and 2014?

Colgate has $0.962 bn and $1.089 billion of CCE in 2013 and 2014, respectively.

Is this a large or small amount compared with total sales?

- Colgate's Cash (2014) = $1.089 bn

- Colgate's Total Sales in 2014 = $17.277 bn

- Cash % of Total Sales (2014) = 1.089/17.277 = 6.3%

- Colgate's Cash (2013) = $ 0.962 billion

- Colgate's Total Sales in 2013 = $ 17.420

- Cash as % of Total Sales (2013) = 0.962 / 17.420 = 5.5%

It is in line if we compare this with the PG (Proctor and Gamble) discussed above. It looks like 6% is normal (neither small nor large)

Do you think Colgate is planning to use this cash for an acquisition?

Cash for Colgate is around (which is not very high) ~6%. Also, if we look at Colgate's short-term and long-term investments, they are pretty much nonexistent. So, most likely, we can deduct from the above that Colgate is not looking to pursue any major acquisition strategy. Also, note that cash and cash equivalents improve the Current Ratio.

How does Colgate define this in Accounting Policies?

Colgate defines Cash as per below.

Recommended Articles

This has been a guide to what is Cash and Cash Equivalents. Here we explain its formula, examples, list, and why firms should hold cash in detail. You can learn more about finance through: