Table of Contents

What Is Asset Tracing?

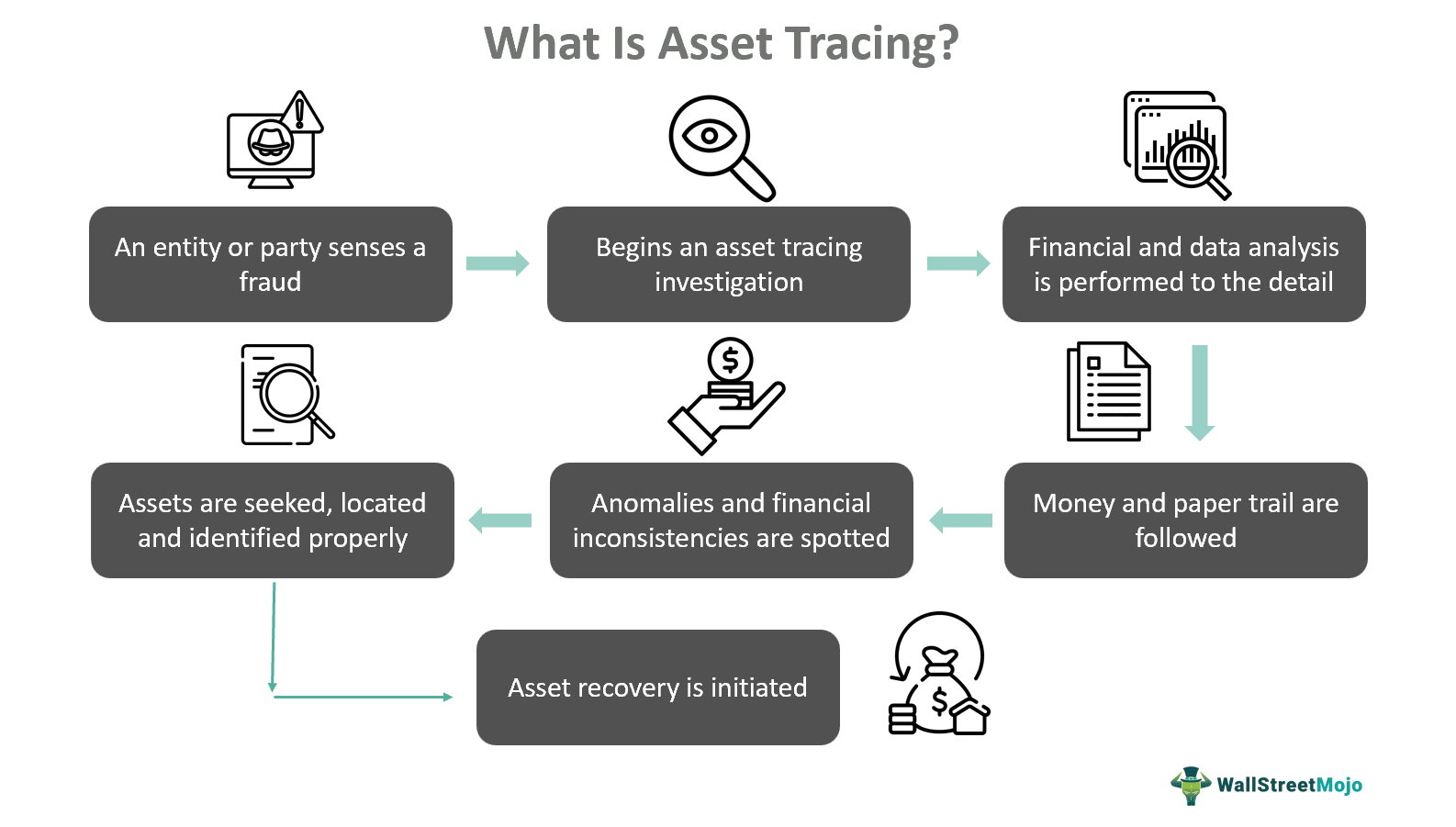

Asset tracing is the complex process of following the money by conducting a financial investigation. The outcome of such investigations leads to the identification of the subject's assets and benefits in white-collar cases. It is crucial because assets transform into other assets, and there is also a shift of ownership because assets are transmissible.

It is a legal concept to study the chain of command in case of financial fraud. Legal jurisdictions adopt the process to test the transmission chain. Through asset tracing, investigations help collect valuable evidence, identify new witnesses, and generate leads for investigation. It can be done through different techniques to identify the culprit and make up for the financial losses.

Key Takeaways

- Asset tracing is the investigation of following the money to seek and identify hidden assets. It is a legal concept to catch the culprit and recover assets.

- The four main techniques used in this tracing are digital forensics, open-source intelligence, financial analysis, and intelligence gathering.

- The asset tracing and recovery process involves information gathering, identification, analysis, tracking, confirmation, seizure, and recovery.

- It is a complex process, requiring multiple support and assistance from high court, law enforcement, and jurisdictions to ensure proper identification and recovery.

Asset Tracing Explained

Asset tracing refers to using tools and techniques to seek and locate lost assets, including those that are bought or hidden from an entity's money in the process of financial fraud, scams, and other activities of corruption. When a company, government office, firm, or any other entity senses or faces a financial fraud or scam, it technically refers to the manipulation of documents, financial statements, and accounting records and the creation of a fake paper trail to hide it. In such scenarios, the entity decides to conduct the tracing, which itself is a financial investigation and allows management or the investigators to follow the money.

Financial fraud basically involves the diversion of funds, money laundering, and other forms of monetary scams. An individual or group of people can do it. The cash gained is used to buy assets under fake names, fake paperwork, misplaced properties, investments, and bank accounts. It is deliberately covered through a paper trail, making it hard to detect in an investigation.

Asset tracing and recovery helps firms and victim parties catch the culprit through proper investigation, gathering information, data extraction, analysis, and locating and retrieving the assets that are bought through diverted funds and stolen money. Once assets are traced, firms are interested in recovery to make up for the financial losses. It is a legal and legitimate concept. However, during the process of asset tracing investigations, there are many difficulties regarding jurisdiction, contradictory laws, and internal and external conflicts, which makes it a complex, tiring, and time-consuming process.

Techniques

The techniques of this concept are as follows:

- Intelligence Gathering - This method mainly refers to using multiple sources, both traditional and modern, to collect data and information that are required for tracing assets. It includes a network of contacts, reports, insights, minute details, and pieces that are part of paper trails and puzzle documents.

- Digital Forensics - As the name suggests, investigators use modern tools that are technologically advanced to unravel hidden financial transactions, and it also makes it easy to follow the money with the use of different software and programs to extract and evaluate data from digital devices that may have gone unnoticed.

- Open-Source Intelligence - Again, with open-source intelligence, analysts seek and collect information from public platforms, including all the information that is available to people, and use it to locate assets. The common aspects of this include news, website blogs, public databases, social media, corporate filings, and property registry documents.

- Financial Analysis - It is basically the most common and primary technique where bank statements, invoices, suspicious transactions, and other unusual financial activities are traced to detect anomalies and inconsistencies. In the case of large volumes of data, analytic tools are used to make explicit links between the activities of asset concealment and money laundering.

Examples

Here are two examples of the concept to help you understand it better:

Example #1

Suppose Sullivan is an accountant in a financial institution who has managed to manipulate the accounts and has diverted the money from the firm's account to his account. Although Sullivan was brilliant with numbers, he went on to recklessly spend the money he stole from his company on buying cars, buying apartments, and investing in real estate properties.

The director of the firm sensed issues with the company books and adopted asset tracing tools. He wiretaps calls Sullivan and conducts a full financial investigation to find out how Sullivan has manipulated the figures and how he has spent the money on apartments, cars, properties, and so on.

Only through this tracing can the company prove the link between the stolen funds and the assets and run proper legal action to recover the losses. The process of tracing helps the firm's director follow the paper trail and assert rights over all the assets bought by Sullivan through the company's money.

Example #2

In 2021, the Human and Environmental Development Agenda (HEDA) filed a lawsuit against the attorney general of the federation, Abubakar Malami, on account of asset tracing, recovery, and management regulations of 2019. HEDA is a civil society organization and claims that certain sections of the tracing laws are against the Immigration Act, the Nigerian Drug Law Enforcement Agency (NDLEA) Act, and the law on trafficking in persons.

The organization wanted a Federal High Court holding in Lagos and is convinced that the asset tracing law only gives Abubakar Malami arbitrary power and the regulations violate specific provisions of Independent Corrupt Practices and Other Related Offences Commission (ICPC) Acts and Economic and Financial Crimes Commission (EFCC). With this example, it can also be observed that it is crucial and can be used negatively in conflict with other laws, which have their consequences.

Recovery Process

The recovery process associated is as follows:

- Information Gathering - This is the foremost step, which involves gathering information from multiple sources and as much as possible. The more information is available, the better financial investigation and recovery can be done.

- Asset Identification - With the help of gathered information, which consists of location, documents, statements, bank accounts, ownership, and registries, the assets are located and determined.

- Analysis - This part of the process includes a review of financial and legal documents and records to seek the ownership and control of assets.

- Tracking - Again, in this part, different methods are employed to monitor any movement of funds and assets through bank accounts and public records.

- Confirmation - Verification through legal documentation and confirmation with multiple authorities and offices is done.

- Seizure - Since it is a legitimate process, law enforcement and court orders are involved and initiated to seize the assets.

- Recovery - Only after the assets are fully recovered and court orders and settlements are done are the assets distributed accordingly.

Assets itself can be of many types and hence its recovery, such as:

- Financial Asset Recovery - It basically includes bank accounts, pension funds, and investments of companies and people.

- Real Estate Recovery - As the name suggests, it comprises recoveries of land, property, homes, apartment buildings, and so on.

- Personal Property Recovery - It includes personal property such as collectibles, artworks, jewelry, and things of personal value.

- Intellectual Property Recovery - Again, it involves property belonging to companies and entities such as patents, copyrights, and trademarks.

- Cross-Border Asset Recovery - When the process involves assets that are located in foreign lands, and the reclaim process includes abroad and cross-border properties.

Importance

The importance of this concept is as follows:

- It helps in tracing and locating assets and following the money.

- Assists in unraveling the fake paper trail that is left deliberately to hide assets.

- It plays a crucial role in identifying financial fraud, money laundering, and scams.

- It is a legal concept that allows people to conduct a proper financial investigation and assess financial documents, company records, accounting, and bank statements.

- The most important aspect of this tracing resides with asset recovery, which lets parties recover the assets that actually belong to them.

- It formulates legal actions against the fraudulent parties or culprits.

- With it, an investigator will have information, data, and insights to detect anomalies and produce substantial evidence.