Table Of Contents

Formula to Calculate Depreciation Expense

The formula of Depreciation Expense is used to find how much asset value can be deducted as an expense through the income statement. Depreciation may be defined as the decrease in the asset's value due to wear and tear over time. It is a non-cash expense forming part of profit and loss statements. E.g., depreciation on plant and machinery, furniture and fixture, motor vehicles, and other tangible fixed assets.

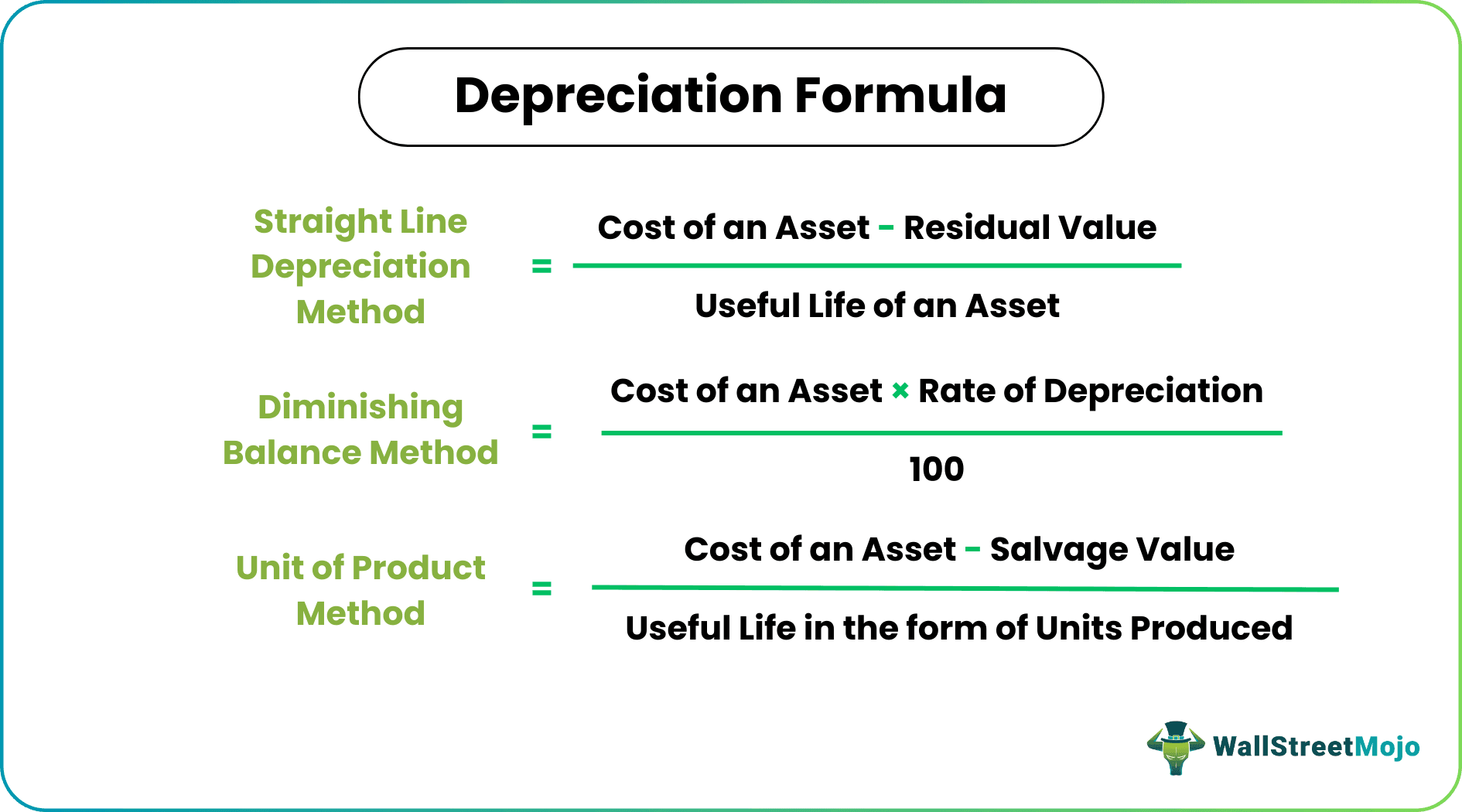

There are primarily 4 different formulas to calculate the depreciation amount. Let's discuss each one of them -

Straight Line Depreciation Method = (Cost of an Asset - Residual Value)/Useful life of an Asset.

Diminishing Balance Method = (Cost of an Asset * Rate of Depreciation/100)

Unit of Product Method =(Cost of an Asset - Salvage Value)/ Useful life in the form of Units Produced.

Double Declining Balance Method = 2*(Beginning Value – Salvage Value)/Useful life

Explanation

Depreciation is an indirect expense systematically charged on tangible fixed assets to provide the actual cost of an asset over its useful life is proportional to benefits derived from such assets. The calculation of the depreciation equation requires knowledge of some factors. These factors are:

- Cost of an Asset: Asset cost includes the amount paid to purchase such assets and other related expenses to bring such assets into a usable position, such as transportation, installation, taxes paid, etc.

- Residual Value: Residual Value is the amount expected to realize at the end of the useful life of an asset.

- Useful life: Expected life of an asset up to which an organization can derive benefits from it.

- Rate of Depreciation: It is the rate at which an organization should reduce the value of an asset in proportionate to benefits derived from such assets.

Depreciation Expense Calculation Examples

Example #1

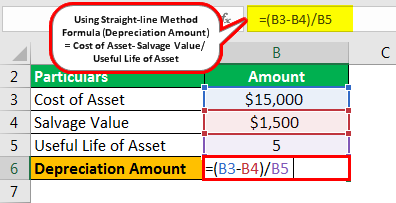

Company XYZ purchased an asset of $15,000 and expected to realize $1,500 at the end of its useful life. The expected useful life of an asset is five years. What amount of Depreciation should the Company charge in its profit and loss statement?

Solution

Below is data for calculation of the depreciation amount

- Cost of Asset: $15,000

- Salvage Value: $1,500

- Useful Life of Asset: 5

Therefore, the calculation of Depreciation Amount using Straight-line Method will be as follows,

Using Straight-line Method = Cost of Asset- Salvage Value/ Useful Life of Asset

- =($15000-$1500)/5

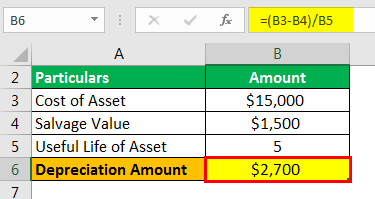

Depreciation Amount will be -

- =$2700

So, the company should charge $2,700 to profit and loss statements and reduce asset value from $2,700 every year.

Example #2

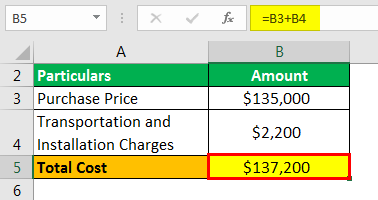

Now let us take an example to understand the diminishing balance method: Mr. X, senior accountant of company ABC Pvt. LTD. The company got a quotation of $ 135,000 for Delta machinery. Company estimated a further expense of $ 2,200 on its transportation and installation. It is estimated that the asset can be sold for $1,200 at the end of its useful life.

Calculate the rate of depreciation is 15%.Mr. X wants to charge depreciation using the diminishing balance method and wants to know the amount of depreciation it should charge in its profit and loss account. Help Mr. X calculate the depreciation and closing value of the machine at the end of each year.

Solution

First of all, we will calculate the actual cost of machine delta to the company:

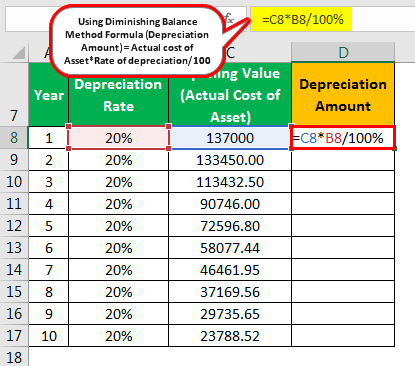

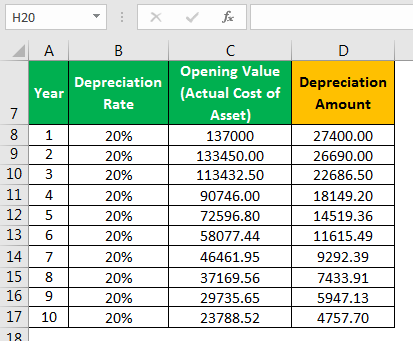

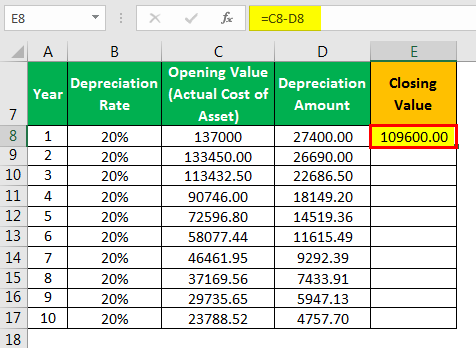

Now, we will calculate the depreciation amount and closing value of the asset using a diminishing balance method:

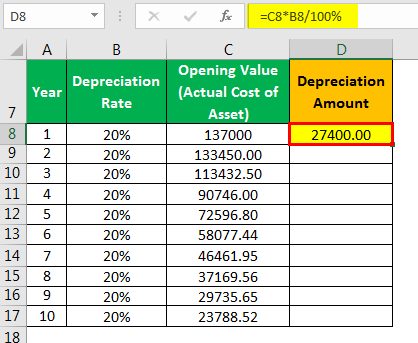

Therefore, the calculation of the Depreciation Amount of 1st year using the diminishing balance method will be as follows,

Diminishing balance Method = Actual cost of Asset*Rate of depreciation/100

- =137000*20%/100%

Depreciation Amount for 1st year will be -

- =27400.00

Similarly, we can calculate the depreciation amount for remaining years

Calculation of Closing Value of 1st year

- =137000-27400

- =109600.00

Similarly, we can calculate the closing value for the remaining years

So after the 10-year book value of the machine is $19030.82.

Example #3

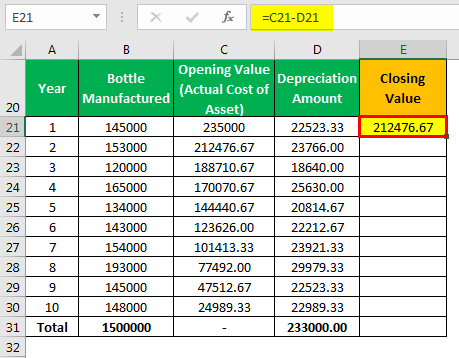

Let us take another example to understand the unit of production method formula. A company called beta limited just started its business of manufacturing empty biodegradable water bottles. After market research, it comes across a fully automated machine that can produce up to 1,500,000 in its complete life cycle.

The company got a quotation of $ 210,000. It also requires $ 25,000 as installation charges, and the company expected to sell this machine after the end of its usable life for $ 2000. Calculate the amount of Deprecation the Company should charge in its books of accounts. Company share with you its annual bottle manufacturing details:

| Year | Bottle Manufactured |

|---|---|

| 1 | 145000 |

| 2 | 153000 |

| 3 | 120000 |

| 4 | 165000 |

| 5 | 134000 |

| 6 | 143000 |

| 7 | 154000 |

| 8 | 193000 |

| 9 | 145000 |

| 10 | 148000 |

Solution

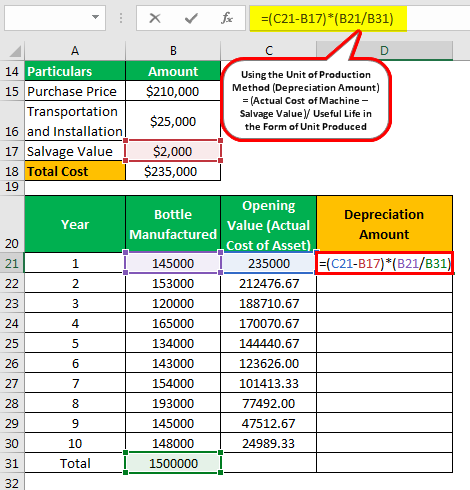

First of all, we will calculate the actual cost of the machine to the company:

- =$210000+$25000

- =$235000

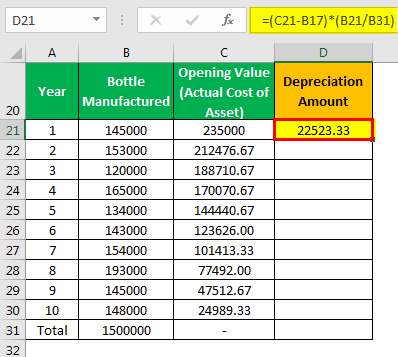

Now we will calculate the amount of depreciation in each year to be charged using the Unit of Production Method,

Using the Unit of Production Method = (Actual Cost of Machine - Salvage Value)/ Useful Life in the Form of Unit Produced

Here useful life in the form of unit produced is the total unit produced in the year divided by total expected units to be produced.

- =(235000-2000)*(145000/1500000)

Amount of Depreciation in each year to be charged will be -

- =22523.33

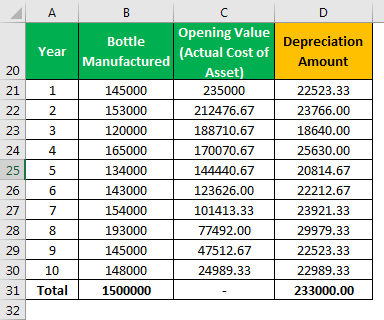

Similarly, we can calculate the depreciation amount for remaining year to be charged -

Calculation of Closing Value of 1st year

- =235000-22523.33

- =212476.67

Similarly, we can calculate the closing value for the remaining years

Relevance and Use

Depreciation is an indirect expense and an important accounting procedure for an organization to estimate the book value of an asset after its usage during the accounting period. The Depreciation formula uses the Deprecation formula to spread the asset's cost over its useful life, thereby reducing the huge expense burden in a single year. Following are the importance of the depreciation formula in accounting:

- Since depreciation is a non-cash expense, it helps entity to reduce its tax liabilities.

- At the time of sale of the asset, the company can estimate its profit/loss on the sale of the asset after considering its usage, which is in the form of depreciation.

- Since the purchase amount of assets is huge, charging it in a profit and loss account in one shot significantly decreases the profit. But by charging expenses proportionate to benefits, the expense burden is distributed over the useful life of the asset.