Table Of Contents

What Is Depreciation For Cars

Depreciation for cars means a reduction in the value of the cars throughout their life; the depreciation rate is very high for new cars and may be different for each model. In the first year, a car may suffer a decrease of about 10 percent, and the decrease in value increases yearly. On average, most of the car's value is lost in five years, and a nominal scrap value is left.

Depreciation rates may differ for various models and types of cars. Also, the rate at which a car depreciates depends on numerous factors, as described above. Further, the car's value is reduced, starting from the first day of purchase, and such reduction continues over its life.

Depreciation Of Cars Explained

The concept of depreciation refers to a fall in the value of an asset due to wear and tear or continuous usage. Since the working capacity and efficiency of the asset gradually fall, its value falls in the market. This happens for cars, too. The more the car runs and the greater the number of years it covers, its value decreases.

Depreciation can occur not only because of usage or wear and tear but also due to change in market condition and demand, lack of availability of latest machinery parts for upgrading its condition, better innovation and technological advancement. Rate of depreciation for cars is not a man-made reduction in value but will naturally occur in a car as days pass by. Eventually, the value decreases to a point where the vehicle is considered scrap and cannot be used further. In such cases, services like National Car Parts offer a reliable solution by helping vehicle owners recycle or sell their scrap cars efficiently.

In a car, this is a significant factor that determines its resale value after using it for a certain period. Therefore, it has to be taken into account while purchasing it. Car owners utilize a total loss car value calculator to determine accurate depreciation rates and potential resale values before purchasing. It should be noted that cars may depreciate model, brand name, the types of parts used, the demand of that particular brand and model in the market, etc. It is not the same for all cars. There are various methods that help in calculating it accurately so that the real market value can be determined.

In the study of depreciation value for cars, the difference between the amount that a person pays when they buy the car and its value that they may get when they try to sell it later is a huge cost that the owner of the vehicle has to bear along with its maintenance and fuel charges. As per the concept of depreciation related to cars, a used car incurs less depreciation cost compared to a new car.

Car Depreciation Rate Table

Let us have a look at a rate of depreciation table for a car whose details are as follows:

Purchase Value = $40,000

Estimated years after which car will be sold = 5 years

Refer to the following table -

| Year | Depreciation Rate | Loss in Car Value | Value of Car |

|---|---|---|---|

| 1 | 25.00% | $10,000.00 | $30,000.00 |

| 2 | 15.60% | $14,680.00 | $25,320.00 |

| 3 | 15.60% | $18,629.92 | $21,370.08 |

| 4 | 15.60% | $21,963.65 | $18,036.35 |

| 5 | 15.60% | $24,777.32 | $15,222.68 |

Thus, the value of the car after five years is expected to be $15,222.68.

How To Calculate?

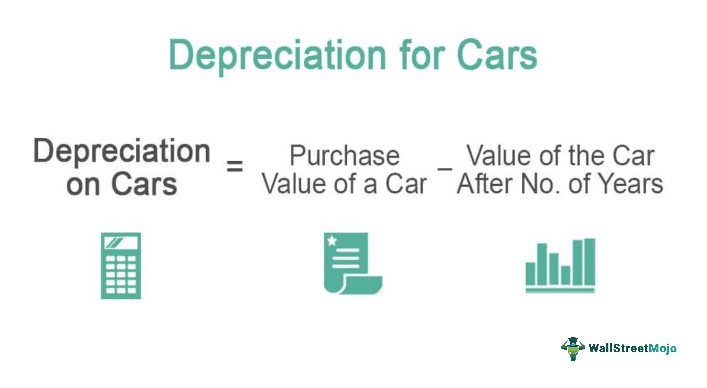

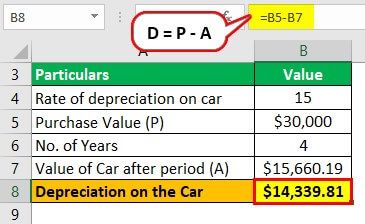

From the below given calculation and formula, we can understand the rate of depreciation for cars and how it is calculated.

Depreciation of a car can be calculated on the following formula:

A = P * (1 - R / 100)n

D = P - A

Where,

- A = Value of the car after a period or n number of years

- P = Purchase value of a car

- R = Rate of depreciation

- N = number of years after the purchase of the car

- D = Depreciation

Example

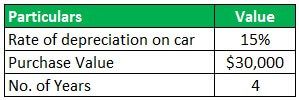

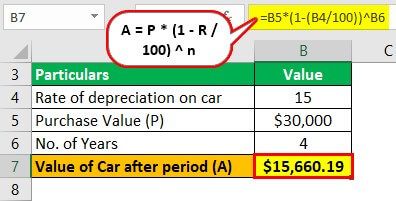

Let us understand the calculation by way of the following example.

A car depreciates at a rate of 15% per annum. The car is purchased for $30,000. What will be the value of the car after four years?

Solution:

Calculate the value of a car after four years:

Value of car after 4 years is A = $15,660.19

Now Calculate the depreciation after 4 years:

- = $30,000 – $15,660.19

- = $14,339.81

Thus, from the above example, we can understand how the rate of depreciation value for cars is calculated and applied for finding out the depreciation value and finally the current resale value or market price of the car. This is very important to understand whether the car is worth buying or not. However, there are many other factors to consider, as given below which will help in taking purchase decisions.

Factors Affecting Car Depreciation

Here are some of the common factors that are affecting depreciation of cars. Let us study them in details, as given below:

- Several ownerships: The greater the number of previous ownerships, the greater the depreciation rate. Thus, it is always advisable to check for previous owners in case you plan to buy a used car.

- Mileage: A car with higher mileage will lower the value of your car, and the resale value will be less. This is because due to higher mileage, the car can be used more to cover long distances. This leads to more wear and tear resulting in higher depreciation.

- Service and Maintenance: The value of a car will be better if the same is well maintained and service is done timely. If maintenance is done properly, the parts remain in good condition for a longer period which increases its life. Thus depreciation for cars used in business comes down.

- Warranty: A car with a longer warranty will attract more resale value. This is because if it is within a warranty period, the owner is sure to get proper compensation for any kind of defect or damage that they may face during usage period. Thus, its value increases, leading to lower depreciation.

- Popularity: Let’s say a car is popular and is desired by people for a longer period. Then the car resale will be more than those cars which go out of demand in a few years.

- Car size: The cost of running is higher in luxury cars or big cars, and hence, they depreciate faster than smaller cars. They have higher maintenance cost and incur more charges if there is any part replacement to be done. In case of damage too, the charges for mending or servicing is much higher than normal cars which do not have much luxury facility.

- Maintenance: If the cars are not maintained regularly, then the cars will tend to depreciate faster.

- Condition of Car: The car which has been damaged due to an accident or any other reason, its value will start to diminish. Since the new owner will have to incur charges for fixing it or maybe use it in that condition itself, it reflects the look or feel of an old car that is not in a proper condition. Thus, it reduces in value.

Thus, the above factors are responsible for raising or controlling the depreciation for cars used in business to a great extent. It is advisable to look into the above matters is details before purchasing a car so that the new owner does not face any unnecessary financial problem after buying it.