Table Of Contents

What is Unit of Production Depreciation?

Unit of production depreciation, also called the activity method, calculates depreciation based on the unit of production and ignores the passage of time over the useful life of an asset; in other words, a unit of production depreciation is directly proportional to production. It is mainly used in the manufacturing sector.

The value of the same asset may be different due to its usage. The unit of production depreciation method is primarily used for assets that are prone to wear and tear to a higher degree. Therefore, it allows companies to report higher depreciation in highly productive years which can be offset by reporting lesser during the off-season.

Unit of Production Depreciation Explained

The unit of production depreciation considers the usage of the asset instead of other conventional methods that are calculated purely based on time. This works well for manufacturing units and their machinery and production units.

Especially for businesses with seasonal business or a cyclical industry where some years are more productive than others, they can report higher depreciation during productive years and offset them in the years with lesser production and overall productivity.

Depreciations are not only used for bookkeeping but also for tax deductions. Using this method could help companies report higher depreciation to get higher tax deductions that can help them reduce the increased costs due to higher levels of productivity.

The unit of production depreciation method applies to manufacturing assets where idle time is less and production is efficient. Nowadays, this method is more popular in determining the efficiency of an asset.

It provides depreciation for each asset based on its production efficiency. This method's selection is critical because we need to keep track of each asset and its production. So before selecting this method, please ensure everything is in control; otherwise, it will be challenging to use.

Formula

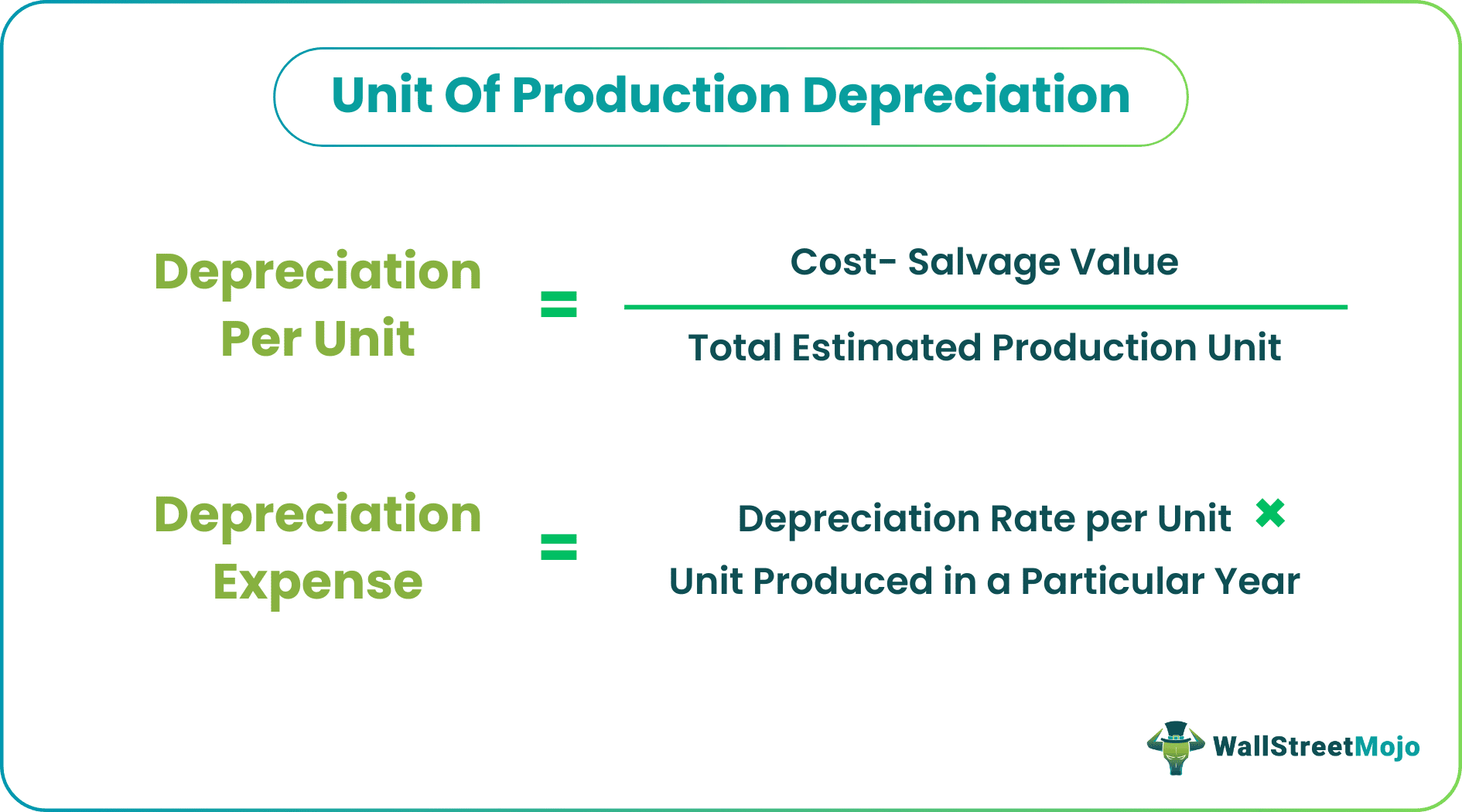

We will segregate formula into two parts to understand it in detail. The usage of a unit of production depreciation calculator can act as a basis for understanding other related factors to the concept as well.

Step #1: The depreciation per unit formula is represented as below,

Depreciation per Unit = (Cost- Salvage Value) / Total Estimated Production Unit

Step #2: The depreciation Expense formula is represented as below,

Depreciation Expense = Depreciation Rate per Unit × unit Produced in a Particular Year.

Cost: It includes purchased price, installation, delivery charge, incidental expenses.

Salvage Value: It is the value that will receive at the end of the life of an asset.

Estimated Unit of Production: It estimates the unit produced by the asset over its useful life.

Examples

Let's discuss a couple of examples of unit of production depreciation method. These examples shall give us a practical overview of the concept and help us understand its ebbs and flows.

Example #1

An asset acquired on 5th Jan at the cost of $ 50000 has estimated the use of 20000 hours. During the first year, the said equipment was used for 4000 hours. Therefore, the estimated salvage value is $ 4000.

Solution:

Step #1: First, we need to calculate the depreciation rate per unit; the calculation will be as below.

- Depreciation per Unit = ($50000 - $4000) / 20000 Hours

- Rate per Unit = $ 2.3 per Hour

Step #2: Then, we need to calculate depreciation for the particular year based on the monthly depreciation rate; the calculation will be as below.

- Depreciation Expense = 4000 Hours × 2.3 per Hour

- Depreciation Expense (Total Depreciation) = $ 9200

- Value of Asset after Depreciation = ($ 50000-$9200) = $ 40800

- Suppose in 2nd year the said equipment used 8000 hours then the depreciation amount will be -

- Total Depreciation = 8000 hours × 2.3 per Hour = $ 18400

- Value of Asset after Depreciation = ($40800-$18400) = $22400

- As we can see, the depreciation amount is increasing due to an increase in the production unit.

Example #2

In 2018, The US oil and gas industry reached record highs in terms of output. As a result, the country, net petroleum imports shrunk to their lowest levels since 1970. However, it is important to consider the fact that this boom in the industry came at a financial cost.

Even though the oil prices were at their highest in 2014, companies spent billions of dollars on drilling and excavation in 2018, creating a condition called negative free cash flow. Due to the poor results, the stocks in this sector plummeted and the energy sector was placed last on S&P500. In fact, oil and gas companies reported a staggering $280 billion in negative free cash flow from 2007 to 2017.

What conspired this was that multiple large refineries overestimated their well’s lifetime value and underreported their depreciation. As a result, they could artificially create a scenario by using the unit of production depreciation method and maximize their profits in turbulent times like these in the industry.

Changes

There have been changes in the regulations for using a unit of production depreciation calculator. Let us understand then through the discussion below.

- As per old accounting standards change in depreciation method is treated as a change in accounting policy, and depreciation is charged retrospectively;

- As per the new accounting standard, a change in the depreciation method will be treated as a change in accounting estimate and depreciation charge prospectively over the useful life of an asset.

- The difference arising due to change in the unit of production method charges to profit and loss a/c. Suppose, as per the old method, the depreciation amount is $ 1000, but as per the new method, the depreciation amount is 2000.

- In this case, extra depreciation arises due to a change in a new method, and we will debit ($2000-$1000) $ 1000 additional amount to profit and loss a/c.

- Suppose the old method depreciation amount is $ 4000, but the new method depreciation amount is $ 3000.In this case($4000-$3000), $ 1000 will be credited to profit and loss a/c.

Advantages

Let us understand the advantages of using a unit to production depreciation through the points below.

- It is charged based on usage of the asset and avoids charging unnecessary depreciation. For example, machinery produced 5000 units in 340 days. Under this method, depreciation will be charged based on 5000 units for 340 days rather than full-year hence it provides a matching concept of revenue and cost.

- It is beneficial in determining the efficiency of an asset.

- Under this method, cost, i.e., depreciation, matches with revenue, i.e., production.

- Under this method, the business can track its profit and loss more accurately than the straight-line method. For example, 1000 units were produced by the machinery in 320 days, and in the remaining days, the machinery was idle.

- Under this method, depreciation is charged based on 320 instead of the full year. But under the straight-line method, depreciation will charge for the full year; therefore, as you can see, the unit production method is more accurate in deriving profit and loss than the straight line.

- Larger depreciation in most productive years can help offset the higher costs associated with higher production levels because depreciation is directly proportional to unit production. More the production, the higher the depreciation.

- For example, suppose in the first-year assets produced 1000 units and 2nd year 2000 units, then production cost in 2nd year will be higher, and the amount depreciation will also be higher as compared to 1 year.

- This method is useful in manufacturing because depreciation is charged based on units produced instead of full-year or part-year.

Disadvantages

Despite the various advantages mentioned above and through different sections of the article, there are a few factors of incorporating the unit of production depreciation method that prove to be a hassle for companies. Let us understand the disadvantages through the discussion below.

- This method provided depreciation based only on usage, but in reality, an end number of factors cause a reduction in the value of an asset.

- For example, depreciation also arises due to the efflux of time. Sometimes manufacturing assets remain idle in a factory. Still, in this method, depreciation cannot be charged when a machine is idle in the factory, due to which the asset's true value cannot be derived.

- It is challenging to calculate depreciation under this method due to its complexity. For example, there are multiple assets, and each asset produces different units in a particular year. Keeping track of each asset is very difficult, primarily when goods are produced in multiple processes.

- Under this method, the value of the two same assets may differ because of their usage.

- This method cannot be used for tax purposes because, in this case, depreciation is not considered based on the unit produced; instead, they charge depreciation, which is followed under the tax regime.

- This method can not apply to assets other than manufacturing assets, such as buildings and furniture.

- It is difficult to derive the correct value of depreciation under this method because it applies only to users and ignores the efflux of time.

- This method can not be used by all businesses such as trading companies and service industries because, under this business, depreciation is not calculated based on units produced; rather, they follow the straight-line method or WDV method.