Table Of Contents

What Is Trend Analysis?

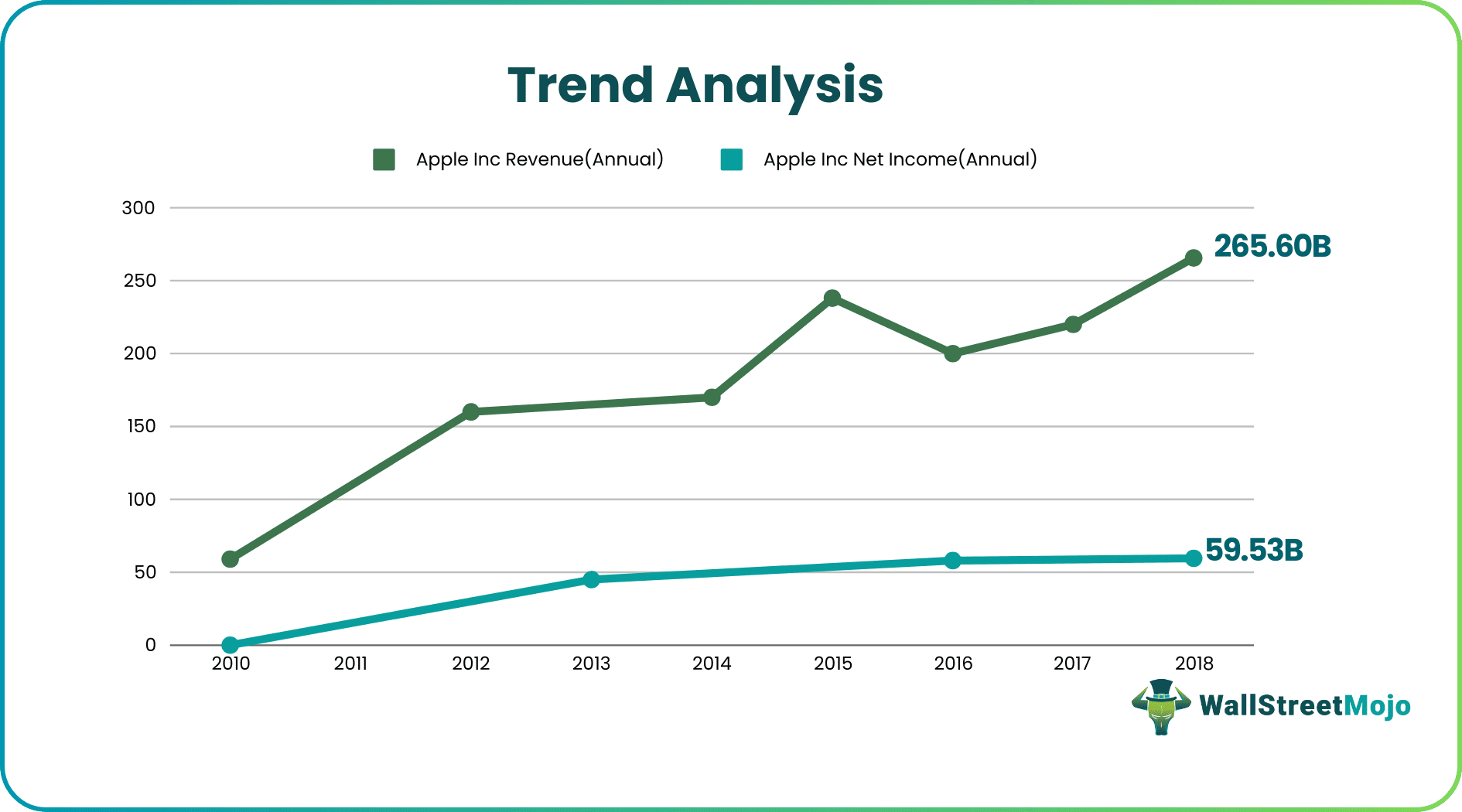

Trend analysis is an analysis of the trend of the company by comparing its financial statements to analyze the trend of the market or analysis of the future based on past performance results, and it's an attempt to make the best decisions based on the results of the analysis done.

Trend analysis involves collecting the information from multiple periods and plotting the collected information on a horizontal line to find actionable patterns from the given information. In Finance, Trend Analysis is used for Technical analysis and Accounting analysis of stocks.

Table of contents

- What Is Trend Analysis?

- Trend analysis helps companies make informed decisions by comparing financial statements to understand market trends and predict future performance.

- There are three types of trends: uptrend, downtrend, and sideways/horizontal trend.

- This tool serves the purpose of accounting and technical analysis for traders. It enables them to earn profits by observing market trends. However, to make the most of it, traders must pay attention to detail and understand the market well. Additionally, it can assist in projecting future financial statements.

Trend Analysis Explained

Trend analysis is an analytical method that is commonly used to interpret any pattern in a set of data. It is widely used in the field of economics, finance, marketing, etc. In this method, analysts the direction and amount change that takes place in order to take informed decisions or make predictions.

The market trend analysis is a friend, is a well-known quote in the trader’s fraternity. The trader makes a good profit by following the trend, and trend analysis is not an easy task. It required eyes on details and an understanding of the market dynamics.

The trend analysis in accounting can be used by management or the analyst to forecast future financial statements. Following blindly can be dangerous if a proper analysis of the past event is not done.

Historical pattern of any data set in a market trend analysis gives a lot off information by using trend analysis. Companies, analysts and investors can use this process for financial decisions or design investment strategies.

Types

#1 - Uptrend

An uptrend or bull market is when financial markets and assets – as with the broader economy-level – move upward and keep increasing prices of the stock or the assets or even the size of the economy over the period. It is a booming time where jobs get created, the economy moves into a positive market, sentiments in the markets are favorable, and the investment cycle has started.

#2 - Downtrend

Companies shut down their operation or shrank the production due to a slump in sales. A downtrend or bear market in a stock market trend analysis is when financial markets and asset prices – as with the broader economy-level – move downward, and prices of the stock or the assets or even the size of the economy keep decreasing over time. Jobs are lost, asset prices start declining, sentiment in the market is not favorable for further investment, and investors run for the haven of the investment.

#3 - Sideways / horizontal Trend

A sideways/horizontal trend means asset prices or share prices – as with the broader economy level – are not moving in any direction; they are moving sideways, up for some time, then down for some time. The direction of the trend cannot be decided. It is the trend where investors are worried about their investment, and the government is trying to push the economy in an uptrend. Generally, the sideways or horizontal trend is considered risky because when sentiments will be turned against cannot be predicted; hence investors try to keep away in such a situation.

Trend Analysis Explained in Video

Uses

It is used by both – Accounting analysis and technical analysis.

#1 - Use in Accounting

Sales and cost information of the organization’s profit and loss statement can be arranged on a horizontal line for multiple periods and examine trends and data inconsistencies. For instance, take the example of a sudden spike in the expenses in a particular quarter followed by a sharp decline in the next period, which is an indicator of expenses booked twice in the first quarter. Thus, the trend analysis in accounting is essential for examining the financial statements for inaccuracies to see whether certain heads should be adjusted before the conclusion is drawn from the financial statements.

Trend Analysis in accounting compares the overall growth of key financial statement line item over the years from the base case.

For example, in the case of Colgate, we assume that 2007 is the base case and analyze the sales and net profit performance over the years.

- Sales have increased by 16.3% over eight years (2008-2015).

- We also note that the overall net profit has decreased by 20.3% over the eight years.

For forecasting, estimated financial statements trend analysis is used for the head where no significant changes have happened. For example, suppose employee expense is taken 18 % of the revenue, and considerable changes have not been made in the employees, then for estimated financial statements. In that case, employee expenses can be taken as 18 %.

Internal use of the trend analysis in accounting (the revenue and cost analysis) is one of the most useful management tools for forecasting.

#2 - Use in Technical Analysis

An investor can create his trend line from the historical stock prices in case of stock market trend analysis, and he can use this information to predict the future movement of the stock price. The trend can be associated with the given information. Cause and effect relationships must be studied before concluding the trend analysis.

- Trend analysis also involves finding patterns occurring over time, like a cup and handle pattern, head and shoulder pattern, or reverse head and shoulder pattern.

- It can be used in the foreign exchange market, stock market, or derivative market in technical analysis. With slight changes, the same analysis can be used in all markets.

Examples

- Examining sales patterns to see if sales are declining because of specific customers or products or sales regions;

- Examining expenses report claims for proof of fraudulent claims.

- Examining expense line items to find out if there are any unusual expenditures in a reporting period that require further investigation;

- Forecast revenue and expense line items into the future for budgeting for estimating future results.

Benefits

- The trend is the best friend of the traders is a well-known quote in the market. Trend analysis tries to find a trend like a bull market run and profit from that trend unless and until data shows a trend reversal can happen, such as a bull to bear market. It is most helpful for the traders because moving with trends and not going against them will make a profit for an investor.

- Trends can be both growing and decreasing, relating to bearish and bullish market.

- A trend is nothing but the general direction the market is heading during a specific period. There are no criteria to decide how much time is required to determine the trend; generally, the longer the direction, the more is reliably considered. Based on the experience and some empirical analysis, some indicators are designed, and standard time is kept for such indicators like 14 days moving average, 50 days moving average, and 200 days moving average.

- While no specified minimum amount of time is required for a direction to be considered a trend, the longer the direction is maintained, the more notable the trend.

Limitations

Some limitations of the method are as follows:

- It assumes that the trends identified from the historical data will continue in future, which may not be the real case. Trends keep changing in every field.

- The data used may not be authentic or reliable enough to interpret correctly. The quality issues lead to incorrect conclusion and decision making.

- In case of trend analysis in accounting or any other field predictions are limited to a particular extent. If there are some unforeseen contingencies, the predictions will be useless.

- The analysis just provides some conclusion based in numerical form. It does not provide the reason of the particular trend which may be on the upside or downside. To understand the reason, further analysis is needed.

- Trends are not always in a linear form. It may have a seasonal pattern or cyclical pattern, which is again difficult to interpret and analyse.

- There is always a risk of biasness in the trend analysis methods. Analysts may sometimes interpret the data based on their own assumptions or expectations.

Thus, the above are some important benefits and limitations of the method.

Trend Analysis Vs Ratio Analysis

Let us look at the differences between the two above financial and statistical concepts in detail.

- The former focuses on identifying and analysing historical patterns in data and understand the changes. But the latter focusses on establishing the relation between different variables.

- The trend analysis methods use data for deriving conclusion regarding changes in revenue, sales etc, but the latter uses data for calculating ratios.

- The main purpose of the former is the analyse the trend to understand the improvement or downfall of a situation but the latter helps in evaluation of the financial health of business or economy.

- There is the use of charts or graphs in the former, but this is not the case for the latter.

- The former predicts the future and provides insight into future developments but the latter provides information and analysis for the present or a particular point of time.

Frequently Asked Questions (FAQs)

Trend analysis involves analyzing statistical data and recording market behavior over a specific period to gain valuable insights for future business strategies and forecasting. This method also helps identify dominant market traits and associated consumer behavior.

For a manufacturing company, trend analysis is most beneficial when there is a consistent data pattern over an extended period. However, if the company recently expanded into a new industry, such as mining, trend analysis may be less valuable since more data must be available to record patterns or trends.

Trend analysis is a helpful technique that involves analyzing historical and current data to predict the movements of a particular item. Businesses can effectively improve their operations by using trend data to inform decision-making

Recommended Articles

This article has guide to what is Trend Analysis. We explain it with examples, types, uses, benefits, limitations & its differences with ratio analysis. You can also learn more from the following resources –