Table Of Contents

What is the Average Rate of Return?

Average Rate of Return (ARR) refers to the percentage rate of return expected on investment or asset is the initial investment cost or average investment over the life of the project. The formula for an average rate of return is derived by dividing the average annual net earnings after taxes or return on the investment by the original investment or the average investment during the life of the project and then expressed in terms of percentage.

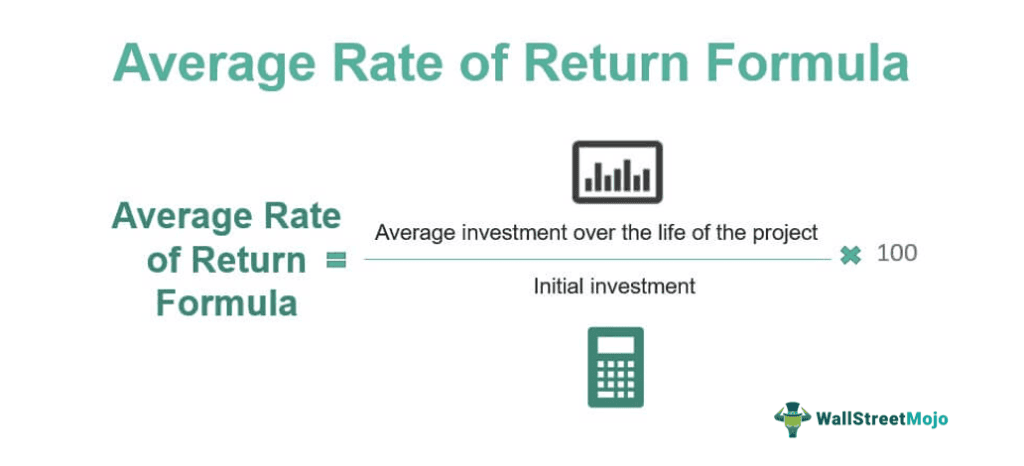

Average Rate of Return Formula

Mathematically, it is represented as,

Average Rate of Return formula = Average Annual Net Earnings After Taxes / Initial investment * 100%

or

Average Rate of Return formula = Average annual net earnings after taxes / Average investment over the life of the project * 100%

Explanation

The formula for the calculation of the average return can be obtained by using the following steps:

- Firstly, determine the earnings from an investment, say stock, options, etc., for a significant time, say five years. Now, calculate the average annual return by dividing the summation of the earnings by the no. of years considered.

- Next, in case of a one-time investment, determine the initial investment in the asset. In the case of regular investments, the average investment over life is captured.

- Finally, the calculation of the average return is done by dividing the average annual return (step 1) by initial investment in the asset (step 2). It can also be derived by dividing the average annual return by average investment in the asset and then expressed in terms of percentage, as shown above.

Examples

Let's see some simple to advanced examples for calculating the Average Return Formula to understand it better.

Example #1

Let us take the example of real estate investment that is likely to generate returns of $25,000 in Year 1, $30,000 in Year 2, and $35,000 in Year 3. The initial investment is $350,000, with a salvage value of $50,000 and estimated life of 3 years. Do the Calculation the Avg rate of return of the investment based on the given information.

Average annual earnings of the real estate investment can be calculated as,

Average annual return = Sum of earnings in Year 1, Year 2 and Year 3 / Estimated life

= ($25,000 + $30,000 + $35,000) / 3

= $30,000

Therefore, the calculation of the average rate of return of the real estate investment will be as follows,

- Average return = = $30,000 / ($350,000 - $50,000) * 100%

- Average return= 10.00%

Therefore, the ARR of the real estate investment is 10.00%.

Example #2

Let us take an example of an investor who is considering two securities of a comparable risk level to include one of them in his portfolio. Determine which security should be selected based on the following information:

Average annual earnings for security A can be calculated as,

Average annual earnings A = Sum of earnings in Year 1, Year 2 and Year 3 / Estimated life

= ($5,000 + $10,000 + $12,000) / 3

= $9,000

The calculation of ARR of Stock A can be done as follows,

- Avg return A = $9,000 / $50,000 * 100%

ARR for Stock A

- Average return = 18.00%

Average annual earnings for security B can be calculated as,

Average annual earnings B = ($7,000 + $12,000 + $14,000) / 3

= $11,000

The calculation of the average rate of return for Stock B can be done as follows,

- Average return B = $11,000 / $65,000 * 100%

Average Return for Stock B will be -

- Average return for security B = 16.92%

Based on the given information, Security A should be preferred for the portfolio because of its higher average return than Security B.

Relevance and Use

It is important to understand the concept of the average rate of return as it is used by investors to make decisions based on the likely amount of return expected from an investment. Based on this, an investor can decide whether to enter into an investment or not. Further, investors use this return for ranking the assets and eventually make the investment as per the ranking and include them in the portfolio.

In projects, an investor uses the metric to check whether or not the average rate of return is higher than the required rate of return, which is a positive signal for the investment. Again, for mutually exclusive projects, an investor accepts the one with the highest return. In short, the higher the return, the better is the asset.