Table Of Contents

What is Compounding?

Compounding is a method of calculating total interest on the principal where the interest earned is reinvested. For the investors, it results in exponential growth of assets or capital.

Similarly, when compound interest is applied to liabilities like debt, it becomes a considerable burden for debtors. The principal amount can be compounded monthly, quarterly, annually, or even daily. Contemporarily, most investment vehicles yield compound interest.

Key Takeaways

- Compounding allows interest on the overall amount, i.e., the principal sum and the accumulated interest.

- The amount increases exponentially because the interest is not withdrawn; it is reinvested to generate additional returns.

- The compound interest provides a higher return than simple interest. The simple interest yields interest only on the principal sum.

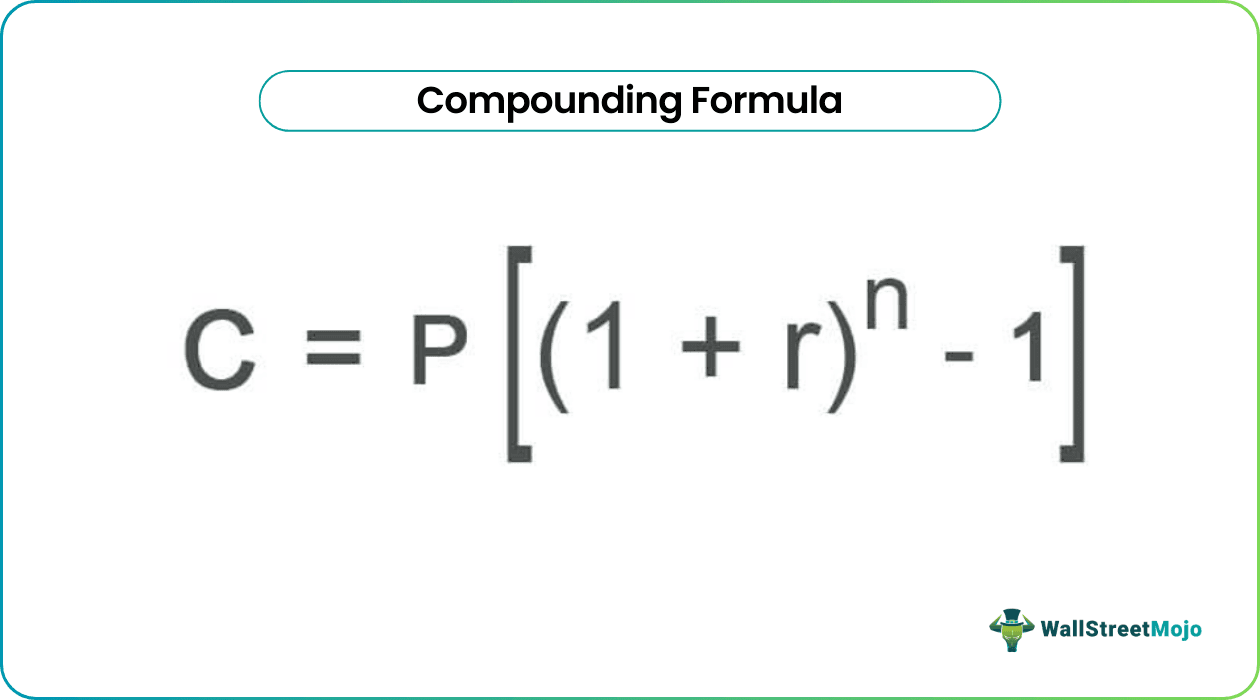

- The compound interest formula is as follows:

- Compound Interest = Principal.

How does compounding work?

Compounding considers the principal amount, the rate of interest, and the frequency of interest payments. In compound interest also known as CI, the interest amount is reinvested—a multiplication effect is triggered. Therefore, over the years, compound interest growth is steeper than simple interest. Simple interest only pays the same amount of interest every year.

The Continuous Compounding Formula can be applied to assets and liabilities as well. Investors earn maximum when the interest on assets gets compounded. The mutual fund is a good example of CI. Similarly, when CI is applied to liabilities like debt, it becomes a considerable burden for debtors. The impact of CI can be described as "making money out of money."

Compounding Formula & Calculation

CI is the total interest on the principal earned—inclusive of the reinvested interest amount.

The compounding formula is as follows:

C=P

Here C is the compound interest,

P is the principal amount,

r is the rate of interest,

n is the number of periods.

The calculation of CI involves the following steps:

- Ascertain the principal amount.

- Determine 'r'; if the interest rate is given in percentage, convert it into decimal value by dividing it by 100. Also, if the annual rate of interest is available but compounding is done periodically, divide the decimal value by the number of periods.

- Next, determine n, if the compounding is done annually, then directly put the number of years of investment. But, if the compounding is done periodically, multiply the number of years by the number of periods. Remember, the interest can be compounded quarterly. Alternatively, CI could be computed on a monthly, or weekly basis as well.

- Now that you have all the values, put these in the formula to determine the CI.

Examples

Let us look at some examples to better understand the practical application of the concept.

Example #1

Shane and Mark both decided to invest $100,000, but Shane opted for simple interest, and Mark went with CI. Both invested for ten years and received 10% interest. So, what will happen after ten years?

Solution:

Given below is the computation of Shane's investment:

Shane's total earnings = $200,000 after ten years.

Following is the calculation of Mark's investment:

Mark's total Earnings = $2,59,374

Due to CI, Mark makes $59,374 more than Shane—in the same number of years, at the same interest rate.

Example #2 (Weekly)

Simon saves $7500 for his son's college fund—who will attend college after 15 years. Simon invests in US Savings Bonds. The annual coupon rate for the US saving bond is 6%. What is the Future Value of Simon's money after 15 years if the amount is compounded weekly?

Solution:

Given,

Principal = $7500

Rate = 6% or 0.06

Time Period = 15 years.

Number of times the sum compounded in one year, n = 52 Weeks

Future value =?

The calculation of future value is as follows:

The Formula of Future Value is applied to CI every week:

F = P(1+r/n) ^n*t

F = $7500(1+0.06/52) ^52*15

F = $7500(1+0.001153846) ^780

F = $18,437.45

Thus, by investing $7500, Simon will get a lumpsum amount of $18,437.45 in 15 years.

Example #3 (Effective Annualized Yield)

Let us assume XYZ limited bank provides a 10% interest every annum on fixed deposits—to senior citizens. We assume that CI is computed every quarter. Now, calculate the effective annualized yield for 5, 7, and 10 years.

Solution:

#1 A = Annualized Yield for 5 Years

t = 5 years

n = 4 (CI applied every quarter)

I = 10% per annum

So, A = (1+10%/100/4) ^ (5*4)

A = (1+0.025) ^20

A = 1.6386

I = 0.6386 in 5 Years

Effective Interest = 0.6386/5 = 12.772% per annum

#2 A = Annualized Yield for 7 Years

t = 7 years

n = 4 (CI applied every quarter)

I = 10% per annum

So, A = (1+10%/100/4) ^ (7*4)

A = (1+0.025) ^28

A = 1.9965

I = 1.9965 in 7 Years

Effective Interest = 0.9965/7 = 14.236% per annum

#3 A = Annualized Yield for 10 Years

t = 10 years

n = 4 (CI applied every quarter)

I = 10% per annum

So, A = (1+10%/100/4) ^ (10*4)

A = (1+0.025) ^40

A = 2.685

I = 1.685 in 10 Years

Effective Interest = 1.685/10 = 16.85% per annum

The above example shows the power of CI. Longer the investment horizon, greater the exponential growth.