Table Of Contents

What is Net Change Formula?

Net Change formula is used in order to calculate the change in the value of anything from its previous values. It is mainly used for calculating the change in the closing price of the stocks, mutual funds, bonds, etc. from its closing price on the previous day.

The term “Net Change ” is used as the measure to calculate the difference between the current closing prices with the previous period's closing price over the given period. If required, the user can also calculate it in percentage terms.

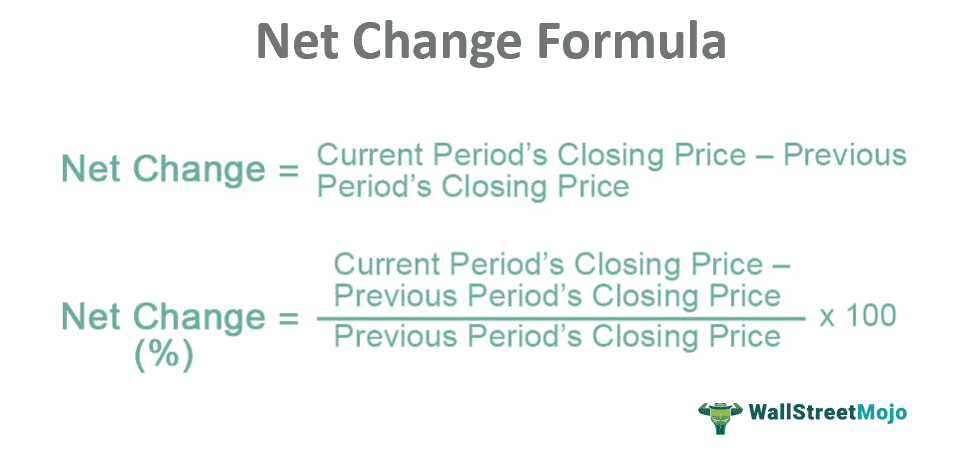

The formula is represented as below:

Net Change Formula = Current Period’s Closing Price - Previous Period’s Closing Price

Also, in percentage terms, the formula is mathematically represented as below:

Net Change (%) = * 100

Here,

- Current Period’s Closing Prices = Closing price at the end of the period when the analysis is done.

- Previous Period’s Closing Price = Price at the beginning of the period for which analysis is to be done.

Key Takeaways

- The net change formula calculates the difference in value between two values. It is mainly used to compute the change in the closing price of stocks, mutual funds, bonds, etc., from the previous day's closing price.

- It determines the difference between the current closing price and the prior period's price over a particular period and computes it in percentage terms if necessary.

- It shows the difference between specific items' current and previous closing prices. It is used by investors while analyzing equities. It aids in determining the difference between the current and previous closing prices of various items.

Explanation

You can calculate net change by using the following steps:

Step 1: Firstly, determine the Closing price at the end of the period for which the analysis is conducted.

Step 2: In the next step, determine the closing price of the previous period or price at the beginning of the period for which the analysis is conducted.

Step 3: Finally, deducting the values arrived in step 2 from step 1.

Step 4: Also, if a net change is to be calculated in percentage terms, than the values arrived in step 3 is divided with step 2 values.

How to Calculate Net Change (with Excel Template)

Let’s see some simple to advanced examples to understand it better.

Example #1 - Positive Net Change

Let's take an example of the prices of the stock of a company AB. At the end of the current session, the prices of the stock closed at $50.55. The stock prices of the same company closed at $49.50 at the end of the prior trading session. What is the net change in the company's stock prices during the period?

Solution:

Use the given data for the calculation of net change.

Calculation of net change can be done as follows:

Net Change = $50.55 - $49.50

Net Change will be -

Net Change = $1.05

Thus the net change in the stock price from prior trading session end to a current trading session at is $1.05.

Example #2 - Negative Net Change

Let's take another example of the prices of a company's stock, Info ltd. The prices of the company's stock at the end of the current session closed at $150.00, but the prices of the same company closed at $165.50 at the end of the prior trading session. What is the net change in the company's stock prices during the period?

Solution:

Use the given data for the calculation of net change.

Calculation of net change can be done as follows:

Since the prior trading session price was greater than that of the current session's closing price, there will be a negative net change in the stock prices of the company during the period.

Net Change = $150.00- $165.50

Net Change will be -

Net Change = -$15.50

Thus the net change in the stock price from the prior trading session end to the current trading session is -$15.50.

Example #3

Let's take another example of a company. One of the technical analysts wants to research the prices of the stock of the company. He wants to know the value of the change in the company's prices after one month. For this, he got the following information:

- Current session’s closing price of the stock of the company: $1,100

- Prior session’s closing price of the stock of the company (one month before): $1,000

What is the net change in the prices of the stock of the company during the period in value and in percentage terms?

Solution:

Calculation of net change can be done as follows:

Net Change = $1,100- $1,000

Net Change will be -

Net Change = $100

Calculation of Net change (%) can be done as follows:

Net Change (%) = * 100

Net Change (%) will be -

Net Change (%) = 10%

Thus the net change in the stock price from the prior trading session end to the current trading session is $100 or 10%.

Net Change Formula Calculator

You can use this calculator.

Relevance and Uses

Net Change helps in knowing the difference between the current closing price and the previous closing price of different items. It is of great importance and used in the case of investors analyzing stocks,Net Change helps in knowing the difference between the current closing price and the previous closing price of different items. It is of great importance and uses in case of the investors making the analysis of stocks, mutual funds, bonds, etc., as it is one of the most commonly reported data that forms the basis of investor’s opinion., etc., as it is one of the most commonly reported data that forms the basis of an investor's opinion.

Almost all technical analysts also use it to analyze the prices of these securities as their analysis charts are prepared considering these data. Thus it measures the performance of the different securities for any time frame as required by the analyzer, be it daily, monthly, or annually.