Table Of Contents

Formula to Calculate Reserve Ratio

Reserve Ratio refers to the portion of total deposits that the commercial banks are obligated to maintain with the central bank in cash reserve, and it will not be available for any commercial lending. The requirement for the reserve ratio is decided by the central bank of the country, such as the Federal Reserve in the case of the United States. The calculation for a bank can be derived by dividing the cash reserve maintained with the central bank by the bank deposits, and it is expressed in percentage.

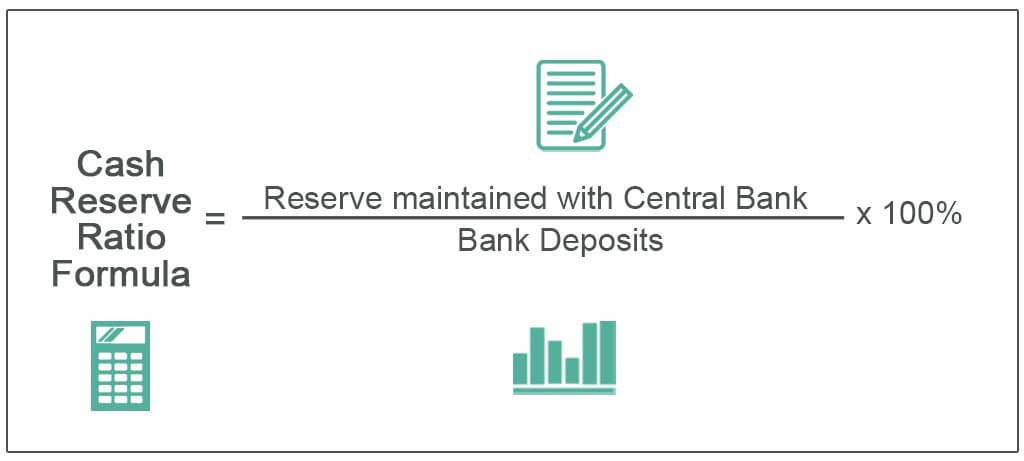

Reserve Ratio Formula is represented as,

Reserve Ratio = Reserve maintained with Central Bank / Bank Deposits * 100%

Explanation of the Reserve Ratio Formula

The calculation of the reserve ratio can be done by using the following steps:

Determine the reserve amount

Firstly, determine the reserve amount maintained by the bank with the central bank, and it will be easily available in the disclosure published by the bank.

Determine the bank deposits

Next, determine the bank deposits borrowed by the bank. It is also known as the net demand and time liabilities.

The calculation for a bank

Finally, the calculation for a bank is derived by dividing the cash reserve maintained with the central bank (step 1) by the net demand and time liabilities (step 2) and then multiplying by 100%, as shown below.

Reserve Ratio Formula = Reserve maintained with central bank / Bank deposits * 100%

The Hargreaves Lansdown provides access to a range of investment products and services for UK investors.

Examples of Reserve Ratio Formula (with Excel Template)

Let’s see some simple to advanced examples to understand them better.

Example #1

Let us take the example of XYZ Bank Ltd, which has recently registered as a bank with the central bank. The bank wants to determine the cash reserve requirement if the current regulated reserve ratio is 4%. The bank has net demand and time liabilities of $2 billion.

- Given, reserve ratio = 4%

- Bank deposits = $2,000,000,000

Therefore, the reserve to be maintained by XYZ Bank Ltd can be calculated using the above formula as,

= 4% * $2,000,000,000

Reserve to be maintained = $80,000,000 or $80 million

Therefore, XYZ Bank Ltd must maintain a cash reserve of $80 million as per the central bank regulations.

Example #2

Let us take an example where the central bank has decided to curb the money supply to the public by raising the reserve ratio from 4% to 5%. But, first, determine the additional reserve that XYZ Bank Ltd will be required to maintain per the new regime.

- Given, New reserve ratio = 5%

- Bank deposits = $2,000,000,000

Therefore, the revised reserve to be maintained by XYZ Bank Ltd can be calculated using the above formula as,

= 5% * $2,000,000,000

Reserve to be maintained = $100,000,000 or $100 million

Therefore, as the central bank focuses on contractionary monetary policy, XYZ bank ltd. is obligated to maintain an additional $20 million (= $100 million – $80 million) of cash reserve to comply with the new regime.

Example #3

Let us take the example of Bank of America’s annual report for 2018. As per the annual report, the bank had total deposits of $1,381.48 billion as of December 31, 2018. Although Bank of America is subjected to a reserve requirement of various regions, for ease of calculation, we will consider the reserve requirement of the Federal Reserve in this case, i.e., 10%. Determine the cash reserve requirement of the bank for the year 2018.

- Given, reserve ratio = 10%

- Bank deposits = $1,381.48 billion

Therefore, the reserve to be maintained by Bank of America for the year 2018 can be calculated using the above formula as,

= 10% * $1,381.48 billion

Reserve to be maintained= $138.15 billion

Therefore, Bank of America must maintain a cash reserve of $138.15 billion for the year 2018 as per the central bank regulations. This is quite in line with the Interest-bearing deposits with the Federal Reserve, non-U.S. central banks, and other banks of $148.34 billion under the cash & cash equivalent section of Bank of America’s balance sheet.

Relevance and Use

From the perspective of banking economics, it is important to understand the concept of reserve ratio because it is used to maintain the reserve to prevent any shortage of funds in case many depositors decide to withdraw their deposits, popularly known as a bank run. The amount of reserve to be maintained is determined by the central banks of each region based on their experience regarding cash demand during a bank run. The central bank uses the reserve ratio to manage the money supply in the economy.

For instance, when a central bank thinks that a Contractionary Monetary Policy is appropriate for the economy, it will raise the reserve ratio to reduce bank lending and curb the money supply from the market. On the other hand, when a central bank thinks that the economy demands an Expansionary Monetary Policy, it will cut down the reserve ratio to increase market liquidity. As such, the reserve ratio is an important factor in defining the economic condition and monetary policy.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.