Balance Sheet vs Consolidated Balance Sheet | Top 9 Differences

Table Of Contents

Balance Sheet vs. Consolidated Balance Sheet

There's a subtle difference between the balance sheet and the consolidated balance sheet. It is in the way both are prepared. All companies prepare the balance sheet since it is one major financial statement. However, the consolidated balance sheet isn't prepared by all companies; rather, companies with shares in other companies (subsidiaries) prepare a consolidated balance sheet.

Knowing about both of them is important since both are prepared differently. For example, preparing a balance sheet is easy, and all you need to do is put in your company's assets, liabilities, and shareholders’ equity. But in the case of a consolidated balance sheet, you need to include other items like minority interest.

In this article, we discuss the following -

Table of contents

- Balance Sheet vs. Consolidated Balance Sheet

- Balance Sheet vs. Consolidated Balance Sheet

- What is the Balance Sheet?

- What is the Consolidated Balance Sheet?

- Key differences - Balance Sheet vs. Consolidated Balance Sheet

- Balance Sheet vs. Consolidated Balance Sheet (Comparison Table)

- Conclusion - Balance Sheet vs. Consolidated Balance Sheet

Balance Sheet vs. Consolidated Balance Sheet [Infographics]

Balance sheet vs. Consolidated balances sheet differences are as follows –

Balance Sheet vs. Consolidated Balance Sheet Video Explanation

What is the Balance Sheet?

In simple terms, a balance sheet is a sheet that balances two sides – assets and liabilities.

For example, if ABC Company takes a loan of $10,000 from the bank, in the balance sheet, ABC Company will put it in the following manner –

- First, on the “asset” side, the inclusion of “Cash” of $10,000.

- Second, on the “liability” side, there will be “Debt” of $10,000.

So, you can see that one transaction has two-fold consequences which balance each other. And that's what the balance sheet does.

Though this is the most surface-level understanding of the balance sheet, we can develop this understanding once you understand it.

Assets

Let’s understand assets first.

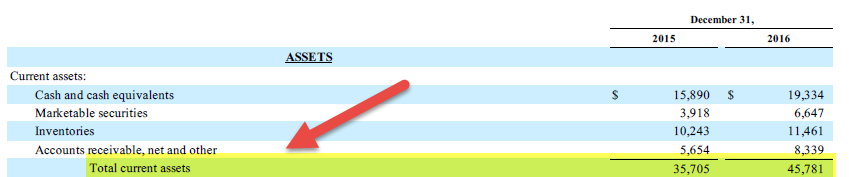

In the assets section, we will first include “current assets.”

Current assets are assets that can be quickly liquidated into cash. Here are the items we will consider under "current assets" –

- Cash & Cash Equivalents

- Short-term investments

- Inventories

- Trade & Other Receivables

- Prepayments & Accrued Income

- Derivative Assets

- Current Income Tax Assets

- Assets Held for Sale

- Foreign Currency

- Prepaid Expenses

Have a look at the example of Amazon's current assets –

source: Amazon SEC Filings

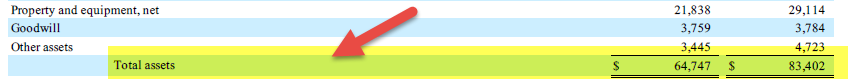

Non-currents assets are assets that pay off more than a year, and these assets can’t be liquidated in cash easily. Non-current assets are also called fixed assets. After “current assets,” we will include “non-current assets.”

source: Amazon SEC Filings

Under “non-current assets,” we would include the following items –

- Property, plant, and equipment

- Goodwill

- Intangible assets

- Investments in associates & joint ventures

- Financial assets

- Employee benefits assets

- Deferred tax assets

If we add up “current assets” and “non-current assets,” we will get “total assets.”

Liabilities

Again in liabilities, we will have separate sections.

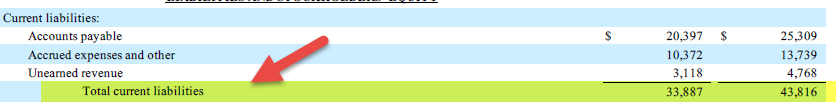

First, we will talk about “current liabilities.”

source: Amazon SEC Filings

Current liabilities are liabilities that you can pay off in the short term. Current liabilities include –

- Financial Debt (Short term)

- Trade & Other Payables

- Provisions

- Accruals & Deferred Income

- Current Income Tax Liabilities

- Derivative Liabilities

- Accounts Payable

- Sales Taxes Payable

- Interests Payable

- Short Term Loan

- Current maturities of long term debt

- Customer deposits in advance

- Liabilities directly associated with assets held for sale

Let’s have a look at the current liabilities of Amazon.com.

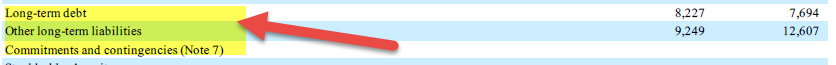

Now, we will look at long term liabilities, which are also called “non-current liabilities.”

Noncurrent liabilities are liabilities which the company will pay off in the long run (in more than 1 year time).

Let’s have a look at what items we will consider under “non-current liabilities” –

- Financial Debt (Long term)

- Provisions

- Employee Benefits Liabilities

- Deferred Tax Liabilities

- Other Payables

Below are the non-current liabilities of Amazon.

source: Amazon SEC Filings

If we total “current liabilities” and “non-current liabilities,” we will get “total liabilities.”

Now, we will talk about “shareholders’ equity,” which will come under Liabilities.

Remember the equation of the balance sheet?

Assets = Liabilities + Shareholders’ Equity

Shareholders’ Equity

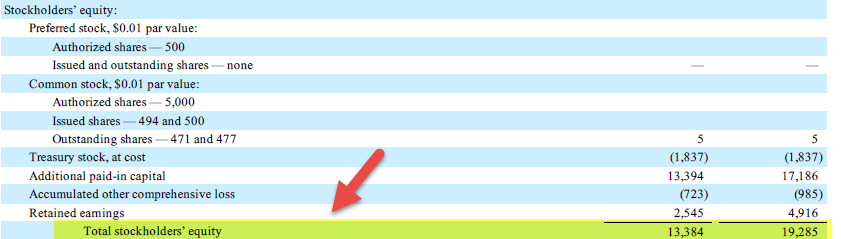

Shareholders’ equity is the statement which talks about the equity capital of the company. Let’s look at the format to get a better understanding of it –

source: Amazon SEC Filings

If we total “shareholders’ equity” and “total liabilities,” we will get a similar balance, we ascertained under “total assets.” If “total assets” and “total liabilities + shareholders’ equity” don’t match, there’s an error somehow in any financial statement.

Also, check out Negative Shareholders Equity.

What is the Consolidated Balance Sheet?

Let's say that you have a full-fledged company, MNC Company. Now you saw a small business, BCA Company, which may help you produce goods for your business. So you decide to buy the company as a subsidiary of MNC Company.

MNC Company now has three options.

- MNC Company can let BCA Company run its operation autonomously.

- MNC Company can absorb BCA Company completely.

- Finally, MNC Company does something in between the first and the second option.

However, generally accepted accounting principles (GAAP) don’t give you an option. According to GAAP, MNC Company needs to treat BCA Company as a single enterprise.

Here you need to realize the value of consolidation. Consolidation means you would put together all the assets. For example, an MNC Company has total assets of $2 million. MNC Company's subsidiary BCA Company has assets of $500,000. So in the consolidated balance sheet, MNC Company will put the total assets of $2.5 million.

This is similar to all sorts of items that will take place on the balance sheet of each company.

Also, check out US GAAP vs. IFRS

Rule of thumb

You may think, how would you decide whether you should prepare a consolidated balance sheet or not? Here’s the rule of thumb you should remember –

If a company owns more than 50% of another company’s share, then the former company should prepare consolidated financial statement for both of these companies as a single enterprise.

Concept of “Minority Interest”

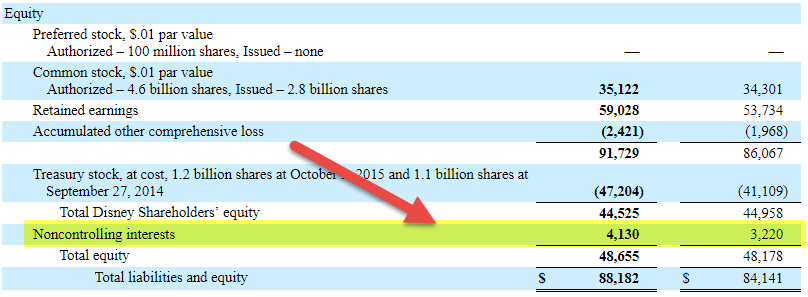

source: Walt Disney SEC Filings

If a company owns 100% of another company, there's no complexity. Instead, the parent company will create a consolidated balance sheet for parent and subsidiary companies.

The problem arises when the parent company kowns less than 100% of the subsidiary company. In this situation, the parent company consolidates the balance sheet as usual, but in shareholders' equity, the parent company includes a small section of "minority interest." The idea is to claim all the assets and liabilities and provide something back in the equity.

For example, if a company owns 55% of another company, a minority interest will be added (in a similar proportion) in the equity section. But all the assets and liabilities will be taken as 100%.

Also, have a look at this detailed guide to Minority Interest.

An alternative to a consolidated balance sheet

What does a parent company do when it owns less than 50% of another company? In that case, the parent company would not create a consolidated balance sheet. Rather, the parent company will only include its assets, liabilities, and shareholders' equity. And the portion of interest in the subsidiary company as "investments" in the assets section.

For example, MNC Company owns a 35% stake in BCA Company. Now, MNC Company will prepare a balance sheet that is not consolidated. And at the same time, there will be no change in the assets, liabilities, and shareholders' equity. But there will be a 35% stake of investment (the amount would be similar) in the assets section.

Key differences - Balance Sheet vs. Consolidated Balance Sheet

There are few key differences between balance sheet and consolidated balance sheet –

- A Balance Sheet is a statement that balances assets and liabilities. On the other hand, a consolidated balance sheet extends a balance sheet. In the consolidated balance sheet, the assets and liabilities of subsidiary companies are also included in the assets and liabilities of a parent company.

- The Balance Sheet is the easiest statement of all four statements in financial accounting. On the other hand, the consolidated balance sheet is the most complex.

- To prepare a balance sheet, one needs to look at the trial balance, income statement, cash flow statement, and then can easily sum up two sides of the sheet to balance assets and liabilities. The consolidated balance sheet takes a lot of time because it involves the parent company's balance sheet and the items in the subsidiary company’s balance sheet. Depending on the percentage of the stake, the consolidated balance sheet is made. If the stake is 100%, the parent company prepares a full, consolidated balance sheet. If it's less than 100% but more than 50%, the parent company prepares the balance sheet differently by including "minority interest."

- A balance sheet is mandatory. If you own an organization, you must produce a balance sheet at the end of a financial period. On the other hand, the consolidated balance sheet isn't mandatory for every company. Even the parent company, which owns less than 50% stake in any other company, doesn't need to prepare a consolidated balance sheet. Only the parent company that owns more than 50% stake in other companies needs to prepare a consolidated balance sheet.

- If you can understand the balance sheet concept, learning a consolidated balance sheet wouldn’t take much time. The consolidated balance sheet is just an extension of a balance sheet.

- According to GAAP's accounting principles, balance sheets and consolidated balance sheets are prepared. The objective is to protect investors from any hassle. Balance sheets and consolidated balance sheets are prepared to disclose the right information to potential investors to make a prudent choice about whether to invest in a particular company.

Balance Sheet vs. Consolidated Balance Sheet (Comparison Table)

| Basis for Comparison | Balance Sheet | Consolidated Balance Sheet |

|---|---|---|

| 1. Definition - balance sheet vs. consolidated balances sheet | Balance Sheet is an important financial statement of assets, liabilities, and capital for a particular period. | Consolidated Balance Sheet summarizes the financial affairs of parent & subsidiary company. |

| 2. Objective | The main objective is to showcase an accurate financial position to external stakeholders. | The main objective is to reflect the accurate financial picture of an organization and its subsidiary. |

| 3. Scope | The scope of the balance sheet is limited and narrow. | The scope of the consolidated balance sheet is much broader. |

| 4. Equation | Assets = Liabilities + Shareholders’ Equity | Assets of (Parent + Subsidiary) = Liabilities ((Parent + Subsidiary) + Shareholders’ Equity + Minority Interest |

| 5. Complexity | The preparation of the balance sheet is very easy. | The preparation of the consolidated balance sheet is much complex. |

| 6. Time consumption - balance sheet vs. consolidated balances sheet | The balance sheet doesn’t need a lot of time to prepare. | The consolidated balance sheet takes a lot of time to prepare. |

| 7. Key concepts | Assets, Liabilities, & Shareholders’ Equity. | Assets, Liabilities, Shareholders’ Equity, & Minority Interest. |

| 8. Adjustment | The balance sheet only balances the asset and the liability side of a single company since there’s no subsidiary. | The consolidates balance sheet balances both parent & its subsidiary company. |

| 9. Pre-requisite | Every company needs to prepare a balance sheet. | A company that owns more than 50% share in any other company needs to prepare a consolidated balance sheet. |

Also, check out - Learn Basic Accounting in less than 1 hour.

Conclusion - Balance Sheet vs. Consolidated Balance Sheet

The basic difference between the balance sheet and a consolidated balance sheet is the inclusion of another company (which we call a subsidiary) in a consolidated balance sheet. And that's why the whole process gets complicated.

As a parent company, you may decide otherwise (for example, not preparing the consolidated balance sheet and letting the subsidiary company operate its own business). Still, the accounting principles of GAAP bind you. And that's why you need to prepare a consolidated balance sheet if you own a stake of more than 50% in the subsidiary company.

What Next?

I hope you understood the key differences between the balance sheet and the consolidated balance sheet. Which companies did you come across where you analyzed the two types of balance sheets separately? Do tell me about it in the comments!

Recommended Articles

This has been a guide to the Balance Sheet vs. Consolidated Balance Sheet. Here we discuss the top difference between balance sheet and consolidated balance sheet, infographics, and a comparison table. You may also have a look at the following articles –