Table Of Contents

Learn Basic Accounting in Less than 1 Hour

Accounting is the formal process in which a company tries to publish its details in an auditable way, and the general public can use it.

I assume that you are visiting this page because you are interested in learning more about finance and basic accounting. Perhaps, you are an engineer, science graduate, or from a non-commerce background struggling to grasp this seemingly complicated finance concept.

Accounting is the heart and soul of finance. Unfortunately, mastering accounting is not an easy task. I had my fair share of struggles with accounting, those debits, and credits I never understood. However, while working at JPMorgan and many other research firms, I was fortunate to develop an intuitive sense of accounting and financial ratio analysis.

This article teaches basic accounting concepts through stories/case studies. It is for those who are new or are struggling with these basic concepts. I assure you will learn the core fundamentals of basic accounting in just an hour and without the usage of debits and credits!

Table of contents

- Learn Basic Accounting in Less than 1 Hour

- The Story of Accounting

- Part 1 - Learn Basic Accounting - Understanding Income Statement

- Part - 2 - Learn Basic Accounting - Balance Sheet

- Consolidated Income Statement

- Consolidated Balance Sheet

- Part 3 - Learn Basic Accounting - Understanding Cash Flows

- Consolidated Cash Flow Statement

- Recommended Articles

The Story of Accounting

If you want to learn basic accounting, it can be best internalized through a story of a person starting a new business. Kartik is a young, dynamic individual who has always wanted to start his own business. Post his graduation in science. He researched the idea of the transportation and logistics market. Kartik is not comfortable with accounting matters because he has a science background and not an accounting background. (Kartik is just like you and me! a non-finance professional)

Kartik named his business FastTrack Movers and Packers. He needs to invest money in the business to kick-start the same. Let us assume that Kartik invests some of his wealth into it. Investing implies Kartik is buying shares of FastTrack logistics common stocks (becomes a shareholder of the firm).

Let us look at FastTrack Movers and Packers Business Cycle

- Kartik infuses capital (money) in FastTrack Movers and Packers (thereby becoming a firm shareholder).

- FastTrack Movers and Packers will buy a sturdy, dependable delivery van and inventory with these investments.

- The business will begin earning fees and billing clients for delivering their parcels.

- The business will be collecting the fees that it earned.

- The business will incur expenses in operating, such as a salary for Kartik, costs associated with the delivery vehicle, advertising, etc.

For a business like above, there will be thousands and thousands of transactions each year. It will be difficult for Kartik to put all these transactions together in a structured format. In such cases, basic accounting software is very beneficial as they help generate invoices to performing basic accounting entries, prepare cheques, update the financial statements without any additional work.

Putting daily all of these entries into the basic accounting software will result in quick and easy access to the desired information. As a result, it will be helpful for the strategic business decision-making process.

Kartik desires to learn basic accounting and keep on top of his new business. His friends recommend Neeraj, an ex Investment Banker and an independent financial consultant who has helped many small business customers. Neeraj promises that he will help him learn basic accounting and the purpose of the three primary financial statements:

Part 1 - Learn Basic Accounting - Understanding Income Statement

Income statements show the profitability of the company during the chosen time frame. Neeraj suggests that the time frame could be a day, a week, a month, or a full year. Profitability primarily takes care of two critical things:

- Revenue earned

- Expenses to earn the revenue

Neeraj point's out that revenue earned is not the same as cash received, and the term expenses are more than the cash outflows.

Download the Case Study Working files here

Case Study 1 – Revenues/Sales

If FastTrack delivers 200 parcels in December for $5 per delivery, Kartik sends invoices to his clients for these fees, and his terms require that his clients pay by 15th Jan ’2008. So how should the revenues/sales be accounted for in December?

Before we look at the solutions, we need to understand some "basic accounting and finance jargon."

Revenues/Sales

FastTrack Movers and Packers earn money for delivering customers' parcels. We must understand here that there are two methods of revenue accounting:

- Accrual method - Revenue is recorded only when they are "earned" (not when the company receives money)

- Cash Method - Revenue is recorded only when cash is received.

It is important to note that generally, the accrual method of accounting is followed.

With the above understanding, let us apply the same in our first Accounting Case Study.

Applying Accrual Basis of Accounting at FastTrack Movers and Packers

If we are looking to record Revenue/Sales figures for December, there are two critical aspects that one should think about -

- The revenue earning process, i.e., delivery of parcels, is completed in December.

- Cash is not received in December. It is only received in January.

What if Kartik followed the cash method of accounting?

The cash method of accounting is no longer followed. However, had the above transaction been recorded on a cash basis, Revenues would have been $0 for December and $1,000 for January.

All non-finance managers, please spend time understanding the above concept. This one is significant.

Case Study 2 – Accounts Receivables

When Kartik receives $1,000 fees from the client on January, 15th, how should he record the entry when the money was received?

Introduction to Accounts Receivables

In December, Kartik did not receive money; "receivables" will be recorded as "assets" for December. However, when Kartik gets the $1,000 worth of payment checks from his customers on the 15th Jan, he may make an accounting entry to show he received the money. This $1,000 of receipts will not be considered January revenues since the revenues were reported as "revenues earned" in December. The received $1,000 will be recorded in January as a reduction in "Accounts Receivable."

We have covered the revenue or sales. Next, let us look at the income statement expenses. Like the accrual method of accounting, Kartik should document the expenses incurred during December regardless of whether the company paid for the expenses or not.

Case Study 3 – Expenses

For delivering the parcels, Kartik hires some laborers on a contract basis and agrees to pay them $300 on 3rd Jan. Also, Kartik bought some packaging and other supporting material for $100 in December. What is the cost to be accounted for in December?

In the case of revenue, we saw the accrual concept of accounting (revenue is recognized when earned). Likewise, for expenses, the actual payment date does not matter. However, it is important to note when one did the work. In this case study, the parcels were delivered (job completed) in December.

Thus, Total Expenses = $300 (labor) + $100 (supporting material = $400

This recording of expenses (irrespective of actual payment made or not) and matching it with the related revenue is known as Matching Principle.

Other examples of expenses that need to be "matched" could be Petrol/Diesel for a delivery van, advertisement costs, and others.

Please note that the accrual basis of accounting and Matching Principles are the two most essential rules of accounting. You should be in a position to intuitively understand these concepts.

To clarify further on these two principles, Neeraj provides another example. This time he uses "Interest Expense" on borrowed loans as an example.

Case Study 4 – Interest Expenses

In addition to Kartik infusing his capital into the business, he borrows an additional $20,000 from a bank to start his business on December 1. Let's assume that the Bank charges 5% in interest to be paid annually at the end of each year. What is the interest expense for December?

Please note that interest expense is paid as a lump sum amount at the end of the year. Kartik pays the total interest expense of $20,000 x 5% = $1,000. Now think about the Matching Principle concept. If Kartik wants to know his business position in December, should he also record one month of interest expenses in his income statement? The answer is YES.

Kartik needs to match the interest expense to each month's revenue.

Interest expense to be recorded for 1 month = $1000/12 = $83

I am now assuming that you are pretty clear on the following concepts -

- The income statement does not report the cash position of the company.

- Sales/revenue is recorded when the revenue earning process is completed (not when the cash is received)

- Expenses are "matched" with the related revenues (not when the cash is paid)

The primary purpose of the income statement is to show the net difference between the Revenues and Expenses, which we refer to as PROFIT or Bottom Line or Net Income/Net Loss.

With this, let us prepare the Income Statement for the four case studies above.

FastTrack Income Statement as per the transaction discussed for December 2007

You may be wondering what income tax is. An income tax is a government levy (tax) imposed on individuals or entities (taxpayers) that varies with the income or profits (taxable income) of the taxpayer. I have assumed that Kartik pays Income Tax at 33%. Whatever comes after deducting the tax is the Net Income or Profit.

I hope you are learning basic accounting, and you are pretty clean with the Income Statement. Let us now move forward to the Balance Sheet.

Part - 2 - Learn Basic Accounting - Balance Sheet

Now that Kartik understood the Income statement, Neeraj moves to explain the Balance Sheet. The balance sheet gives an idea of what the company owns (ASSETS) and owes (LIABILITIES), as we as the amount invested by the Shareholders at a specific point in time.

Please note the keyword "specific point in time." This is different from the Income statement, which is prepared for a period of time (for example, the income statement for December). However, if a balance sheet is dated December 31, the amounts shown on the balance sheet are the balances in the accounts after recording all the transactions of December.

A Typical Balance Sheet

Assets - Assets are a firm's economic resources. They are probable current and future economic benefits obtained or controlled by an entity as a result of past transactions or events. As you can see above, Assets are primarily divided into two types - Current Assets and Long Term Assets. Examples of Assets for Kartik's company could be cash, packaging material, and supplies, Vehicle, etc. Also, note that Accounts receivables are Assets. Kartik has already delivered the parcels. However, he has not been paid immediately for the delivery. Soon, the amount owed to Kartik's Fast Track is an asset known as Accounts Receivables.

Liabilities - Liabilities are obligations owned to others as of the balance sheet date. They arise from the present obligations of a particular entity to transfer assets or provide services to other entities in the future as a result of past transactions or events. For example, Kartik took a loan from the Bank. This loan is a liability that Kartik needs to pay in the future. Also, Kartik hired a few people to deliver the parcels. However, they did not pay them (accounts payable), classified as accounts payable.

Shareholder's Equity - The third section of a balance sheet is Stockholders' Equity. (If the company is a sole proprietorship, it is referred to as Owner's Equity.) The amount of Shareholder Equity is precisely the difference between the asset amounts and the liability amounts.

A = L + E

Within the Shareholder's Equity section, you would primarily find two sections - Common Stock and Retained Earnings.

Common Stock represents the initial amount invested in the company by the shareholder. For example, in this case, if Kartik invests a certain amount in his company, this would come broadly under the Common Stock section.

The second important part is the Retained Earnings. Retained Earnings will increase when the corporation earns a profit. There will be a decrease when the corporation has a net loss. This means that revenues will automatically cause an increase in Stockholders' Equity, and expenses will automatically cause a decrease in Stockholders' Equity. This illustrates a link between a company's balance sheet and income statement.

This is the most crucial LINK between the Balance Sheet and the Income Statement.

Case Study 5 – Cash & Common Stocks

On December 1, 2007, Kartik started his business FastTrack Movers and Packers. The first transaction that Kartik will record for his company is his investment of $20,000 in exchange for 5,000 shares of FastTrack Movers & Packers common Stock. There are no revenues because the company earned no delivery fees on December 1, and there were no expenses. How will this transaction get recorded in the balance sheet?

Cash & Common Stocks

- Common Stock will be increased when the corporation issues shares of Stock in exchange for cash (or some other asset)

- Retained Earnings will increase when the corporation earns a profit, and there will be a decrease when the corporation has a net loss

- Core link between a company's balance sheet and income statement

Case Study 6 – Purchase of Vehicles

On December 2, FastTrack Movers & Packers purchases a truck for $14,000. The two accounts involved are Cash and Vehicles (or Delivery Truck). How does this transaction gets recorded in the Balance Sheet?

Purchase of Vehicle & Depreciation Expenses

Kartik also needs to know that the reported amounts on his balance sheet for assets such as equipment, vehicles, and buildings are routinely reduced by depreciation. Depreciation is required by the basic accounting principle known as the matching principle. Depreciation is used for assets whose life is not indefinite—equipment wears out, vehicles become too old and costly to maintain, buildings age, and some assets (like computers) become obsolete. Depreciation is the allocation of the cost of the asset to Depreciation Expense on the income statement over its useful life.

Fast Track's Truck has a useful life of five years and was purchased at the cost of $14,000. The accountant might match $2,800 ($14,000 ÷ 5 years) of depreciation expenses with each year's revenues for five years. Each year the carrying amount of the van will be reduced by $2,800. (The carrying amount—or "book value"—is reported on the balance sheet, and it is the cost of the van minus the total depreciation since the van was acquired.) This means that after one year, the balance sheet will report the carrying amount of the delivery van as $11,200 (14,000 – 2,800), after two years the carrying amount will be $8,400 (14,000 – 2x2800), etc. After five years—the end of the Truck's expected useful life—its carrying amount is zero.

Case Study 6 - Balance Sheet (as of December 2)

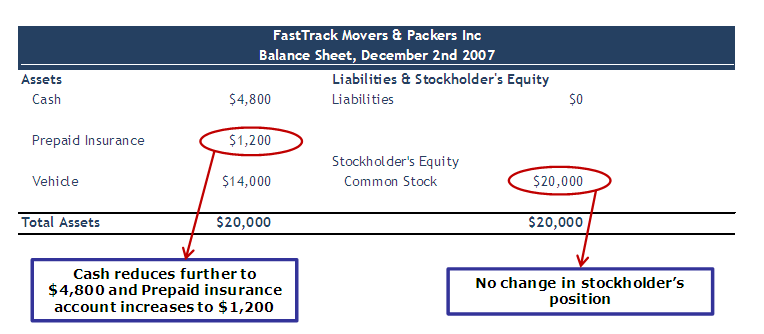

Case Study 7 – Prepaid Expenses

Neeraj brings up another less obvious asset—the unexpired portion of prepaid expenses. Along with the Truck, Kartik takes the insurance coverage for the Truck purchased. The insurance purchase costs him $1,200 for one year. Kartik immediately gives cash of $1,200 to the insurance agent.

Fast Track pays $1,200 on December 1 for a one-year insurance premium on its delivery truck. That divides out to be $100 per month ($1,200 ÷ 12 months). Between December 1 and December 31, $100 worth of insurance premium is "used up" or "expires." The expired amount will be reported as an Insurance Expense on December's income statement. Kartik asks Neeraj where the remaining $1,100 of unexpired insurance premium would be reported. On the December 31 balance sheet, Neeraj tells him, in an asset account called Prepaid Insurance.

Other examples of things that might be paid for before they are used include supplies and annual dues to a trade association. The portion that expires in the current accounting period is listed as an expense on the income statement; the part that has not yet expired is listed as an asset on the balance sheet.

Case Study 4 – Rising Debt (Revisit)

FastTrack Movers and Packers borrowed an additional $20,000 from a bank on December 3 to invest further in business, and the company agrees to pay 5% in interest, or $1,000. The interest is to be paid in a lump sum on December 1 of each year.

As Kartik raises further money through debt, cash (Asset) increases by 20,000. However, Kartik is liable to return the amount after the term, and hence, the debt is termed as a liability. On this debt, Kartik will have to pay Interest Expenses (as discussed earlier)

Case Study 8 – Inventory

Kartik keeps an inventory of packing boxes not only to use for his business but also to earn additional revenues by carrying an inventory of packing boxes to sell. Let's say that FastTrack Movers and Packers purchased 1,000 boxes wholesale for $1.00 each.

Inventory

Kartik learns that each of his company's assets was recorded at its original cost, and even if the fair market value of an item increases, an accountant will not increase the recorded amount of that asset on the balance sheet. This is the result of another basic accounting principle known as the cost principle.

Although accountants generally do not increase the value of an asset, they might decrease its value as a result of a concept known as conservatism.

Scenario 1: Assume that since Kartik bought them, however, the wholesale price of boxes has been cut by 40%, and at today's price, he could purchase them for $0.60 each. Because the replacement cost of his inventory ($600) is less than the original recorded cost ($1000), the principle of conservatism directs the accountant to report the lower amount ($600) as the asset's value on the balance sheet.

Scenario 2: Assume that since Kartik bought them, however, the wholesale price of boxes increase by 20%, and at today's price, he could purchase them for $1.20 each. Because the replacement cost of his inventory ($1,200) is higher than the original recorded cost ($1,000), the principle of cost directs the accountant to report the lower amount at cost ($1,000) as the asset's value on the balance sheet.

In short, the cost principle generally prevents assets from being reported at more than cost, while conservatism might require assets to be reported at less than their cost.

Case Study 9 - Unearned Revenues

Another liability is money received in advance of actually earning money. The client has made an upfront payment of $600 for the delivery of 30 parcels/month for the next six months.

FastTrack Movers and Packers have a cash receipt of $600 on December 1, but it does not have revenues of $600 at this point. It will have revenues only when it earns them by delivering the parcels. On December 1, Fast Track will show its asset. Cash increased by $600, but it will also have to show that it has a liability of $600. (It has the liability to deliver $600 of parcels within six months, or return the money.)

The liability account involved in the $600 received on December 1 is Unearned Revenue. Each month, as the 30 parcels are delivered, Fast Track will be earning $100, and as a result, each month, $100 moves from the account Unearned Revenue to Service Revenues. Each month Fast Track's liability decreases by $100 as it fulfills the agreement by delivering parcels, and each month its revenues on the income statement increase by $100.

Consolidated Balance Sheet

Kartik wants to be confident that he understands what Neeraj is telling him regarding the assets on the balance sheet, so he asks Neeraj if the balance sheet is, in effect, showing what the company's assets are worth. He is surprised to hear Neeraj says that the assets are not reported on the balance sheet at their worth (fair market value). Long-term assets (such as buildings, equipment, and furnishings) are reported at their cost minus the amounts already sent to the income statement as depreciation expenses. The result is that a building's market value may actually have increased since it was acquired. Still, the amount on the balance sheet has been consistently reduced as the accountant moved some of its cost to depreciation expense on the income statement to achieve the matching principle.

Another asset, office equipment, may have a fair market value that is much smaller than the carrying amount reported on the balance sheet. Accountants view depreciation as an allocation process — allocating the cost to expense to match the costs with the revenues generated by the asset. Accountants do not consider depreciation to be a valuation process.) The asset Land is not depreciated, so it will appear at its original cost even if the land is now worth one hundred times more than its cost.

Short-term (current) asset amounts are likely to be close to their market values since they tend to "turn over" in relatively short periods of time.

Neeraj cautions Kartik that the balance sheet reports only the assets acquired and only at the cost reported in the transaction. This means that a company's reputation—as excellent as it might be—will not be listed as an asset. It also means that Bill Gates will not appear as an asset on Microsoft's balance sheet; Nike's logo will not perform as an asset on its balance sheet, etc. Kartik is surprised to hear this since, in his opinion, these items are perhaps the most valuable things those companies have. Neeraj tells Kartik that he has just learned a valuable lesson that he should remember when reading a balance sheet.

So far, in this "Learn Basic Accounting" training, you have understood Income Statements and Balance Sheets. Let us now look at Cash Flow.

Part 3 - Learn Basic Accounting - Understanding Cash Flows

Because the income statement is prepared under the accrual basis of accounting, the revenues reported may not have been collected. Similarly, the expenses reported on the income statement might not have been paid. You could review the balance sheet changes to determine the facts, but the cash flow statement already has integrated all that information. As a result, savvy business people and investors utilize this important financial statement.

The cash flow statement reports the cash generated and used during the time interval specified in its heading. The period that the company chooses the statement covers. For example, the heading may state, "For one month ended December 31, 2007" or "The Fiscal Year Ended September 30, 2009".

The cash flow statement organizes and reports the cash generated and used in the following categories:

- Operating activities: converts the items reported on the income statement from the accrual basis of accounting to cash.

- Investing activities: reports the purchase and sale of long-term investments and property, plant, and equipment.

- Financing activities: Reports the issuance and repurchase of the company's bonds and stock and the payment of dividends.

Cash Provided From or Used By Operating Activities

Learn the basic accounting section of the cash flow statement that reports the company's net income. It then converts it from the accrual basis to the cash basis by using the changes in the balances of current asset and current liability accounts, such as:

- Accounts Receivable

- Inventory

- Supplies

- Prepaid Insurance

- Other Current Assets

- Notes Payable (generally due within one year)

- Accounts Payable

- Wages Payable

- Payroll Taxes Payable

- Interest Payable

- Income Taxes Payable

- Unearned Revenues

- Current Liabilities

In addition to using the changes in current assets and current liabilities, the operating activities section has adjustments for depreciation expenses and the gains and losses on the sale of long-term assets.

Also, check out this detailed note on Cash Flow from Operating Activities.

Cash Provided From or Used By Investing Activities

Learn basic accounting section of the cash flow statement reports changes in the balances of long-term asset accounts, such as:

- Long-term Investments

- Land

- Buildings

- Equipment

- Furniture & Fixtures

- Vehicles

In short, investing activities involve the purchase and/or sale of long-term investments and property, plants, and equipment.

Also, check out this detailed note on Cash Flow from Investments.

Cash Provided From or Used By Financing Activities

Learn basic accounting section of the cash flow statement reports changes in balances of the long-term liability and stockholders' equity accounts, such as:

- Notes Payable (generally due after one year)

- Bonds Payable

- Deferred Income Taxes

- Preferred Stock

- Paid-in Capital in Excess of Par-Preferred Stock

- Common Stock

- Paid-in Capital in Excess of Par-Common Stock

- Paid-in Capital from Treasury Stock

- Retained Earnings

- Treasury Stock

In short, financing activities involve the issuance and/or the repurchase of a company's bonds or Stock. This section also records Dividend payments.

Also, check out this detailed note on Cash Flow from Finance.

Consolidated Cash Flow Statement

Things to note on Cash Flows

The cash from operating activities is compared to the company's net income. If the cash from operating activities is consistently higher than the net income, the company's net income or earnings are said to be of "high quality." If the cash from operating activities is less than net income, a red flag is raised as to why the reported net income is not turning into cash.

Some investors believe that "cash is king." The cash flow statement identifies the cash that is flowing in and out of the company. If a company is consistently generating more cash than it is using, the company will be able to increase its dividend, buy back some of its stock, reduce debt, or acquire another company. All of these are perceived to be good for stockholder value.

What next?

If you learned something new or enjoyed this post, please leave a comment below. Let me know what you think about this Basic Accounting training. Many thanks, and take care. Happy Learning Basic Accounting!