Table Of Contents

Return on Total Assets Definition

Return on total assets (ROTA) is one of the profitability indicators that measures how efficiently the firm manages its assets to earn profits. Its formula is a simple ratio of the Operating Profit to the Average Assets of the return on total assets ratio determines companies that are using their assets more efficiently in comparison to their earnings.

ROTA is widely used when comparing firms or companies in the same industry as several industries use assets differently. For example, construction companies will use expensive equipment, which is large, while software firms or companies shall use servers and computers. However, the only concern regarding this metric is that it uses book value instead of market value.

Return on Total Assets Explained

The return on assets ratio formula will measure how effectively the firm or the organization can earn a return on its investment made in assets. In other words, ROTA depicts how efficiently the firm or the company or the organization can convert the amount or the money used to purchase those assets into operating profits or operating income.

Since all assets can be funded either by debt or equity, the ratio must be calculated by adding back interest expense in the formula above. Operating income has to be computed for the numerator. Then one needs to take average assets in the denominator since the firm keeps running a business, an asset keeps changing in the entire year, and hence taking one total asset will result in the perhaps biased figure.

If the return on total assets ratio is higher, it is considered more favorable to the stakeholders or the investors as it depicts that the firm or the company is more effectively and efficiently managing its assets to earn or produce greater amounts of profit or income.

Video Explanation of Return on Total Assets Formula

Formula

Let us understand the formula that acts as a basis for the calculation of the return on total assets equation through the discussion below.

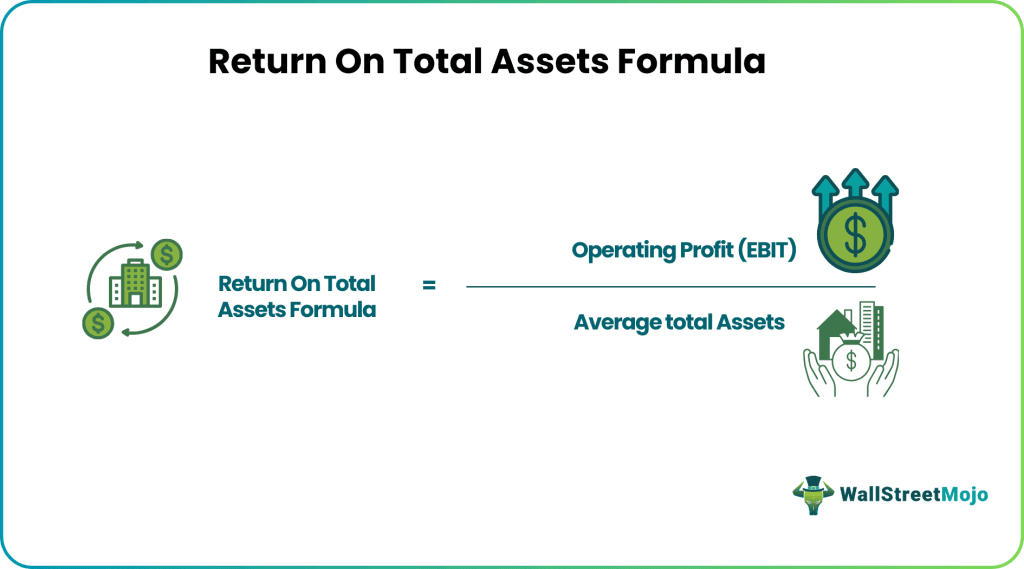

Return on Total Assets Formula = Operating Profit (EBIT) /Average Total Assets

Where,

EBIT will stand for Earnings Before Interest and Tax

How To Calculate?

The following steps can be used to calculate the return on total assets equation.

- First, gather the necessary financial data from the company's income statement and balance sheet for the specific period you want to analyze, typically a fiscal year. Ensure you have the net income and total assets figures.

- Next, calculate the Net Income, which can be found on the income statement. Net Income is the company's profit after deducting all expenses, taxes, and interest payments.

- Obtain the Total Assets figure from the balance sheet, which represents all the assets a company owns, both tangible and intangible.

- Calculate ROTA using this formula- ROTA = (Net Income / Total Assets) * 100. This formula expresses ROTA as a percentage, allowing you to assess how effectively a company generates profit from its total asset base.

Examples

Now that understand the basics, formula, and how to calculate the return on total assets ratio, let us apply the theoretical knowledge into practical application through the examples below. These examples shall give us an in-depth understanding of the concept and its intricacies.

Example #1

HBK limited has provided you with the following details from their financial statements. You are required to do the calculation of ROTA.

- Operating Income (EBIT): 100000.00

- Total assets during the start of the year: 1000000.00

- Total assets during the end of the year: 1500000.00

Solution

We are given operating income, also called EBIT, which is 1,00,000.

Secondly, we need to calculate average assets, and total assets during the start of the year and the end of the year, and then divide it by 2, which would be 12,50,000.

Therefore, the calculation of return on total assets (ROTA) can be made as,

ROTA will be –

= 100,000 /12,50,000

ROTA = 8.00%

Example #2

GMP Inc. is one of the hot stocks in the market due to its outstanding brand recognition, and investors believe it will outperform the market over the coming years. John is considering investing in the stock. He heard in a seminar that the profitability ratio of GMP Inc. is not up to the mark, and shareholders and debt holders aren’t happy about the same. He knows that if the ratio is less than 8%, then the company's return is indeed poor. John decides to calculate the Return on total assets to confirm what he learned in the seminar is indeed true.

You must calculate the return on total assets based on the information below and conclude if the company's profitability ratio (return on total asset) is indeed poor?

- Sales: 50050000

- Cost of goods sold: 37537500

- Selling Expenses: 202000

- Administrative Expenses: 1001000

- Depreciation: 4004000

- Income Tax: 2502500

- Total Expenses: 44544500

- Total Average Assets: 101000000

The average assets of the company were 101 million.

Solution

We are not given operating income, which we will calculate below.

Operating Profit

Secondly, we need average assets, which are given as 101 million.

Therefore, the calculation of return on total assets (ROTA) can be made as,

ROTA will be -

=55,05,500 x 100 /10,10,00,000

ROTA will be = 5.45%

Example #3

Common people are limited to incorporated as an NGO and as a not-for-profit organization. The management presented the below summary and stated that they are incurring an operating loss. The trustee believes that the management is secretly making a profit, and that is not getting revealed in the books of accounts.

- Sales: 37537500

- Cost of goods sold: 28153125

- Selling Expenses: 1501500

- Administrative Expenses: 750750

- Depreciation: 3003000

- Interest: 4504500

- Total Expenses: 33408375

The Trustee found that interest expense was unduly stated higher and is not considered while calculating operating profit. Hence, he investigated and found out that interest expenses were 10% of sales.

You must calculate the return on total assets based on the above figures and assume total assets as 9,79,70,000.

Solution:

To calculate operating profit, interest needs to be avoided in the calculation.

Below is the calculation of operating income (EBIT)

Therefore, the calculation of return on total assets (ROTA) can be made as,

ROTA will be -

=41,29,125.00 /9,79,70,000.00

ROTA =4.21%

Hence, the claim made by management is incorrect, and they are making a profit in an NGO.

How To Improve?

To improve the return on total assets equation, a company can take several active measures to enhance its financial performance and efficiency.

- Increase Revenue: Focus on revenue growth through strategies such as expanding market share, developing new products or services, or entering new markets. Higher revenues can lead to a better ROTA.

- Cost Management: Implement cost-saving measures by optimizing operations, negotiating better supplier contracts, and reducing unnecessary expenses. Lowering costs can boost net income and, in turn, ROTA.

- Asset Efficiency: Optimize asset utilization by reducing excess inventory, improving production processes, and minimizing idle assets. Efficient asset management enhances ROTA by generating more income from the same asset base.

- Debt Reduction: Pay down high-interest debt to lower interest expenses. Reducing debt can increase net income, as less profit is allocated to servicing debt, thereby improving ROTA.

- Asset Allocation: Allocate resources strategically to higher-performing assets or divisions within the company. Prioritize investments that generate better returns to maximize ROTA.

- Asset Turnover: Accelerate the turnover of assets by selling or disposing of underperforming or non-core assets. This action can free up capital and improve ROTA by focusing on more productive assets.

- Invest in Efficiency: Invest in technology, automation, and employee training to enhance productivity and reduce waste, leading to increased profitability and ROTA.

- Improve Working Capital Management: Efficiently manage accounts receivable, accounts payable, and inventory turnover to optimize the use of current assets and reduce the need for additional capital.