Table Of Contents

Gross Profit Percentage Definition

Gross profit percentage is a measure of profitability that calculates how much of every dollar of revenue remains after paying off the Cost of Goods Sold (COGS). In other words, it measures the efficiency of a company utilizing its input costs of production, such as raw materials and labor, to produce and sell its products profitably.

It can be seen as the percentage of sales that exceeds the direct costs associated with manufacturing the product. These direct costs or COGS primarily consist of raw materials and direct labor. Therefore, calculating the gross profit percentage formula is done by dividing the gross profit by the total sales expressed in percentage terms.

Table of contents

- Gross profit percentage is the formula management, investors, and financial analysts may utilize to understand the company's economic health and profitability after accounting for the cost of sales.

- Using this formula, one may calculate the company's gross profit by net sales.

- The percentage of sales exceeds the direct costs associated with manufacturing the product. These direct costs consist of raw materials and direct labor. Therefore, one must consider the gross profit percentage formula.

Gross Profit Percentage Explained

Gross profit percentage refers to the percentage of profit generated for each dollar spent on the manufacturing or production. This profit figure is derived after deducting the additional expenses incurred for that dollar during the production. Thus, this unit profit calculated for a product helps firms assess how effective their expenditure is when it comes to the production of goods and items.

When this figure is obtained, firms learn about their effective or ineffective allocation of resources. Based on the interpretation, they either improve their resource allocation strategy or continue with the same if they seem effective. In short, this percentage becomes a valuation metric for every business that wants to know how efficient its allocation of resources and expenditure towards the production of items is.

The gross profit percentage is the measure of the rate at which firms utilize their Cost of Goods Sold (COGS), including the expenses related to everything that supports and leads to successful production. Such expenses include the cost of raw materials, labor, etc.

Summing up, it can be said that the gross profit in its percentage form enables organizations to figure out the part of their earnings that are available to bear the overhead costs of the company along with helping the firms to compute the taxes applicable on the profits after the COGS is deducted from it. In addition, the result obtained can also be used to calculate the net profit, which is also known as bottom line.

Formula

Gross profit percentage equation is used by the management, investors, and financial analysts to know the economic health and profitability of the company after accounting for the cost of sales. One may calculate it by dividing the company’s gross profit by net sales.

The formula on which the gross profit percentage calculator works is represented as:

Gross Profit / Total Sales * 100%

One can further expand it as,

Gross profit percentage formula = (Total sales – Cost of goods sold) / Total sales * 100%

After covering the cost of goods sold, the remaining money is used to service other operating expenses like selling/commission expenses, general, and administrative expenses, research and development, marketing expenses, and interest expense that appears further below in the income statement. The higher it is, the better it is for a company to pay off the business's operating expenses.

Gross Profit Percentage Explained in Video

How To Calculate?

One can do the calculation by using the following steps: -

- Firstly, note the company's total sales, easily available as a line item in the income statement.

- Next, gather the cost of goods sold directly from the income statement or compute the cost of goods sold by adding the direct manufacturing costs, such as raw materials, labor wages, etc.

- The gross profit is calculated by deducting the cost of goods sold from the total sales.

Gross profit = Total sales - COGS - Finally, it is calculated by dividing the gross profit by the total sales, as shown below. It is expressed in percentage, as the name suggests.

Gross profit percentage formula = (Total sales - Cost of goods sold) / Total sales * 100%

Examples

Let us understand the concept with the help of a simple example to understand it better.

Example #1

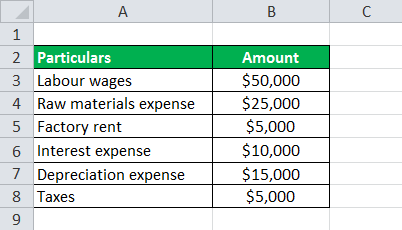

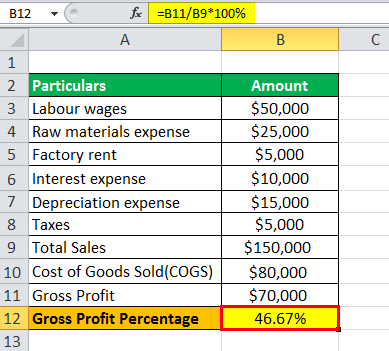

Let us consider an example of XYZ Ltd. for calculating gross profit. XYZ Ltd. is in the business of manufacturing customized roller skates for both professional and amateur skaters. At the end of the financial year, XYZ Ltd. had earned $150,000 in total net sales and the following expenses.

As per the question, based on the below information, we will calculate the percentage for gross profit for XYZ Ltd.

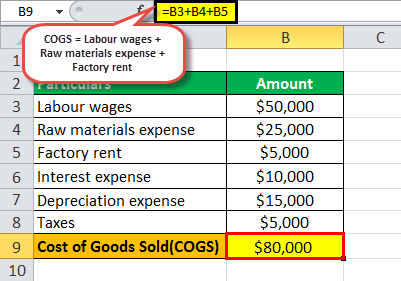

We will first use the above data to calculate the Cost of Goods Sold (COGS).

- COGS = Labour wages + Raw materials expense + Factory rent

- = $50,000 + $25,000 + $5,000

Cost of Goods Sold= $80,000.

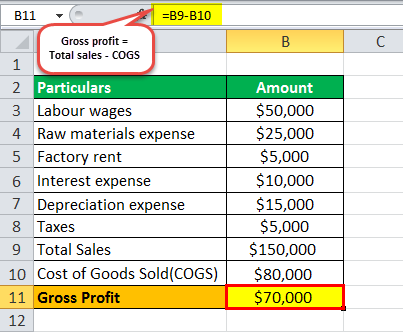

Now, we will calculate the gross profit by using the data given:

- Gross profit = Total sales – COGS

- = $150,000 - $80,000

Gross profit = $70,000

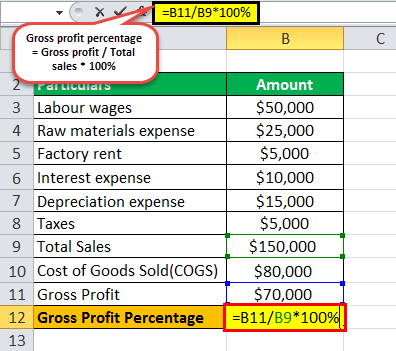

Therefore, the calculation of the gross profit percentage for XYZ Ltd. will be: -

- Gross Profit Percentage Formula = Gross Profit / Total Sales * 100%

- = $70,000 / $150,000 * 100%

XYZ Ltd.’s gross profit percentage for the year is as follows: -

XYZ Ltd.’s gross profit percentage for the year stood at 46.67%.

Example 2

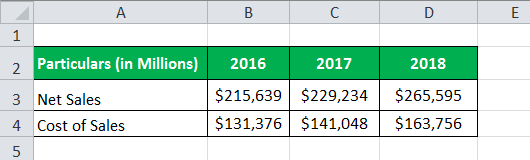

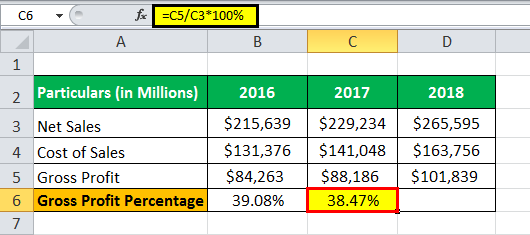

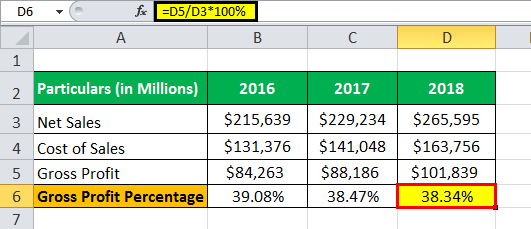

Let us take the example of Apple Inc. For the gross profit percentage calculation of the fiscal year 2016, 2017, and 2018.

As per the annual reports, the following information is available: -

Based on the information below, we will calculate Apple Inc. for 2016, 2017, and 2018.

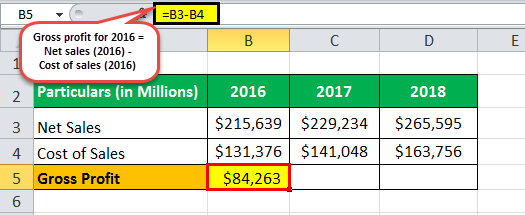

By using the above data, we will first calculate the gross profit of Apple Inc. for 2016,

- Gross Profit for 2016 = Net Sales (2016) - Cost of Sales (2016)

- = $215,639 - $131,376

- Gross Profit for 2016 = $84,263

- Gross Profit for 2017 = $229,234 - $141,048

- Gross Profit For 2017= $88,186

- Gross Profit for 2018 = $265,595 - $163,756

Gross Profit for 2018= $101,839

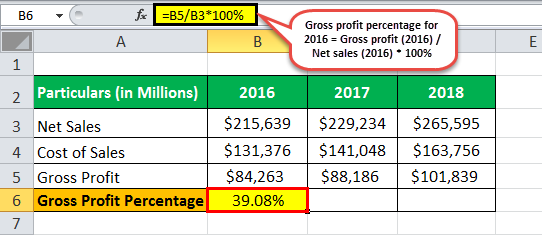

Now, we will calculate the percentage for gross profitof Apple Inc. for 2016.

- Gross Profit Percentage for 2016 = Gross Profit (2016) / Net Sales (2016) * 100%

- = $84,263 / $215,639 * 100%

Gross Profit Percentage for 2016= 39.08%.

Therefore, the calculation of the percentage of gross profit of Apple Inc. for 2017 will be: -

- Gross Profit Percentage for 2017 = $88,186 / $229,234 * 100%

Gross Profit Percentage for 2017= 38.47%.

Therefore, the calculation of the gross profit percentage of Apple Inc. for 2018 will be: -

- Gross Profit Percentage for 2018 = $101,839 / $265,595 * 100%

Gross Profit Percentage for 2018 = 38.34%.

Therefore, the calculation of the gross profit percentage of Apple Inc. for 2016, 2017, and 2018 stood at 39.08%, 38.47%, and 38.34%, respectively.

Relevance and Uses

Calculating the sales gross profit percentage has many benefits. This is because it acts as an important valuation metric for any business in various ways. Let us check below how this percentage is used by different entities:

- Understanding it is very important for an investor because it shows how profitable the company's core business activities are without considering the indirect costs. An analyst can use this ratio to compare a company's operating performance with other players within the same industry and sector, especially as an assessment metric. Also, companies use this ratio to indicate the financial benefit and viability of a particular product or service.

- Any money left after covering the cost of goods sold is used to pay off other operating expenses. The higher it is, the more the company saves on each dollar sales to service its additional operating costs and business obligations.

- Suppose a company can sustain higher gross profit margins than most of its peers. In that case, it has more efficient processes and more efficient operations, making it a safe long-term investment.

- On the other hand, if a company cannot earn an adequate gross profit percentage, it may be difficult for such a company to pay for its operating expenses. As such, the gross profit percentage of a company should be stable unless and until some major changes are made to the business model.

Gross Profit Percentage vs Gross Margin

Gross profit and gross margin are the two terms that are widely used in the financial sector. While gross profit is the total revenue generated by a firm, gross margin is the COGS being subtracted from the net sales.

As both the figures are likely to be converted into percentages for providing a better picture of the financial position of the firms, understanding the difference between gross profit percentage and gross margin in the form of percentage.

- While the percentage form of gross profit shows the profit generated by every dollar spent on the production, the percentage form of gross margin reflects the profit figure in percentage that remains with the business after the COGS is subtracted from the net sales.

- The gross profit percentage help firms to assess the effectiveness of their own resource allocation. On the other hand, gross margin percentage becomes the valuation metric for companies to assess themselves against the profit that their competitors generate and record.

Frequently Asked Questions (FAQs)

gross profit percentage can decrease for several reasons:

a Increased cost of goods sold

b Pricing pressure or discounts

c Inefficient production or operations

d Shift in product mix

e Pricing or costing error

f external factors

A company with high gross margin ratios means the company has more money for operating expenses like salaries, utilities, and rent. As the ratio determines the profits from selling the inventories, it also estimates the percentage of sales that one can use to help fund other business parts.

A decrease in the cost of goods sold may cause an increase in the gross profit margin. Searching for lower-priced suppliers, inexpensive raw materials, utilizing labor-saving technology, and outsourcing are some ways to lower the cost of goods sold.

What is an excellent gross profit percentage?

A gross profit margin ratio of 50 to 70% is good. It would be for many businesses, like retailers, restaurants, manufacturers, and other goods producers.

Recommended Articles

This article has been a guide to Gross Profit Percentage and its definition. We explain it along with its formula, how to calculate, vs gross margin, and examples. You may learn more about our articles below on accounting: -