Table Of Contents

Capital Account Definition

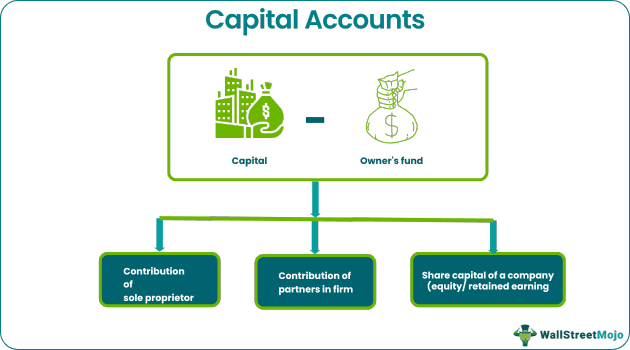

The capital account in accounting refers to the general ledger that records the transactions related to owners' funds, i.e., their contributions and earnings earned by the business after reducing any distributions such as dividends. It is reported in the balance sheet under the equity side as "shareholders' equity" in the case of a company.

However, it is represented as owner's equity for a sole proprietorship or the entity’s net worth as on a particular day. Thus, it is the assets of a business. In case of a public limited company, it is the amount of funds contributed by investors whereas for a private limited company, it shows the fund given by each member.

Key Takeaways

- The Capital Account records all the transactions related to the capital invested in an organization. It maintains all the transactions of capital reinvestment, the balance of money, and any withdrawal or adjustment.

- The sum in this account for a sole proprietorship would be the proprietor's payments less any sums taken or draws and current earnings.

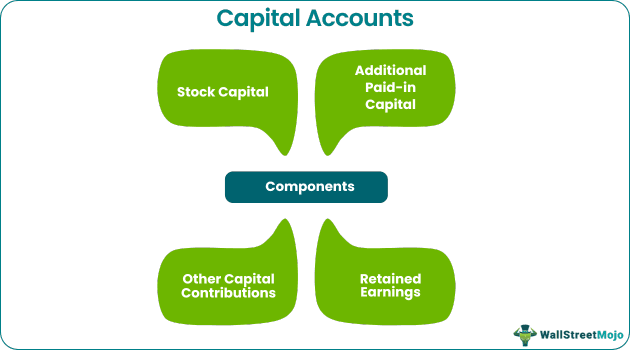

- The capital account of a business organization consists of the stock capital, additional paid-in capital, other capital contributions, and retained earnings.

- Moreover, this account is essential to identify the number of assets funded with capital and the number of investments in debt finances.

Capital Account Explained

For a sole proprietorship, the amount in this account would consist of the proprietor's contributions net of any amounts withdrawn, i.e., drawings and accumulated profits to date.

Similarly, for a capital account in partnership, this account would include the outstanding balances of capital contributions of the partners after accounting for drawings made by them and profit distributions done to them by the profit-sharing ratio. While drawings would reduce the capital balance, the profit appropriation to partners would increase their capital account components.

Talking about the company, it includes share capital (both equity and preference capital), additional paid-in capital, retained earnings and any equity reserve.

Formula

The formula for a capital account balance can easily be derived using the accounting equation. So let us first have a look at the accounting equation.

Assets = Liabilities + Capital

As we can see, the amount of assets in any business at any point in time is the sum of its liabilities and capital. Thus, if we want to calculate the amount in the capital account on balance sheet, we need to use the below formula:

Capital = Assets – Liabilities

We can derive the amount of capital by reducing the number of liabilities from the number of assets reflected on the balance sheet of any business.

Examples

Let us look at the extracts of the balance sheet of a company, ABC Ltd. First; we will try to understand what the capital account on balance sheet of a company looks like:

As seen in the above balance sheet extracts, this company's account is reflected as "Equity" in the balance sheet. The total equity includes different equity components, such as share capital, share premium, retained earnings, and so on.

Components

- Stock Capital: This includes the amount of equity and preference stock. It represents the amount invested by the stockholders against which they have been issued units of stocks.

- Additional Paid-in Capital: It represents the amount received from the stockholders over face value. It is also known as "stock premium."

- Other Capital Contributions: For sole proprietors and capital account in partnership, they would include the owners' capital account, i.e., the capital balance of the sole proprietor and the partners, respectively.

- Retained Earnings: This represents the accumulated profits of a business on a particular date. Also, any reserves created out of such accumulated profits shall also be taken into account.

Importance

- The capital account balance becomes an essential part of the financial statements of any business because it represents the amount that remains invested in the business by the owners on a particular day.

- We can use this amount to identify how much assets have been financed with capital, i.e., owners and how much portion is debt-financed.

- This account can be used to calculate different financial ratios such as debt-equity ratio, and so on.

- It helps the banks and other financial institutions decide whether to grant further loans to such a business or not.

Limitations

- This account alone is not decisive for reaching any conclusion; if investors want to analyze the financial position of a business, they need to look at the entire balance sheet.

- The calculation of capital account components can vary slightly from one business form to another.

Capital Account Vs Current Account

- The former records all the owner’s capital contributed by owners less any drawings, whereas a current account shows the revenue income and expenses.

- The former records the investments heavy expenditure but the latter records inflow and outfow of funds related the the operations of the enterprize.

- The amount in the capital account is usually larger than the current account.