Table Of Contents

Purpose of Retained Earnings

- For distribution of the dividend at any time in the future, i.e., in the middle of any financial year;

- These earnings are retained for future use to help fund the corporation's expansion.

- One of its uses can be compensated to the shareholders in case of winding up of a corporation.

- An entity can capitalize on the credit balance of the retained earnings by issuing bonus shares to the shareholders.

Examples

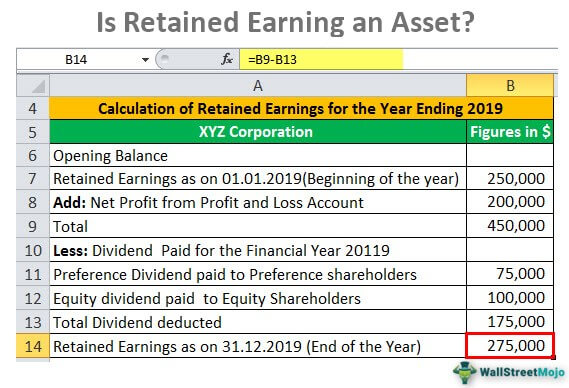

Case #1: In case there is a net profit from profit and loss account for the relevant financial year

XYZ Corporation retained earnings at the beginning of 2019 of $250,000. During the year the company earns a net income of $100,000 after deducting all the expenses. It pays the preference dividend to preference shareholders of $75,000 and equity dividend to the equity shareholders of $100,000. Calculate the retained earnings of the company for the period ending in 2019.

Solution:

Calculation of retained earnings of the company for the period ending in 2019:

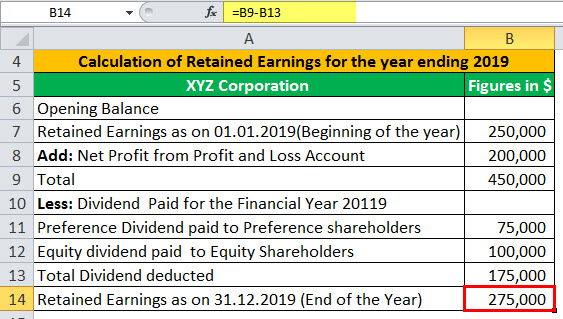

Case #2: In case there is net loss from profit and loss, account for the relevant financial year

ABC Corporation retained earnings at the beginning of 2019 of $350,000. During the year the company incurred a net loss of $120,000 after deducting all the expenses. Since there is a net loss from the profit and loss account, dividends to any shareholders will not be distributed. Calculate the retained earnings of the company for the period ending in 2019.

Solution:

Calculation of Retained Earnings of the company for the period ending in 2019:

Conclusion

- Thus retained earnings are said to be part of net profit after deducting the dividend to be paid to the shareholders. It will accumulate over time to utilize them for Future funding consequences, which may arrive in the corporation at any point in a future date.

- Retained earnings are the entity's net income from various operations held by the company as additional equity shareholder capital. Hence it is considered a shareholders fund and also represents in calculating return on equity invested by the shareholders in the entity.

Recommended Articles

This article has been a guide to Is Retained Earning an Asset? Here we discuss the classification of retained earnings along with its purpose. You can learn more about it from the following articles –