Table Of Contents

Appropriation Account Meaning

An Appropriation Account refers to the account that reflects the fund that is kept aside to be distributed to different stakeholders. These stakeholders can be shareholders expecting dividends, partners expecting their share of profit, or employees expecting their wages and salaries.

In short, the appropriation account lets entities calculate the way in which the net profit should be divided to pay those involved in helping yield that profit. On the contrary, when it comes to government records, this account is said to record the funds the government is credited with.

Appropriation Account Explained

An appropriation account shows how an entity divides the firm’s net profit to calculate how much is used to pay income tax, paid as a dividend to shareholders, and set aside as retained earnings. It is mainly prepared by the partnership firm Limited liability Company (LLC), and the government.

The appropriation account is prepared after preparing the Profit & Loss A/c. In the case of partnership firms, it is prepared to show how profits are distributed among the partners involved in the partnership.

In the case of LLC, the purpose of preparing this account is the same, but the format is different. They start with the year's profit before the taxation figure, from which they subtract corporate taxes and dividends to find the retained earnings for the year.

In the government's case, the appropriation account is used to show the funds allocated to a specific project. Any expenses are reduced from the funds allocated.

P&L Appropriation Account is prepared to show how the company appropriates or distributes the profit earned during the year. It is an extension of Profit and loss a/c. It is prepared after the preparation of profit and loss a/c at the end of every financial year.

The purpose is to allow the adjustments to be made to the profits so that the final income can be divided among the partners per the agreed terms.

It is a nominal account, which means all the expense items of the firm are debited, and income items are credited. The companies that prepare these accounts make sure to have a clear picture of the profits, out of which the distribution is to happen among stakeholders. In short, keeping things organized and noticeable is easier.

How To Prepare?

When it comes to preparing appropriation accounts, it is important to know which transactions to include and which ones to exclude. Along with that, it is vital to understand the features that make these accounts more reliable and useful.

Let us check some of the features that make these accounts one of a kind:

- It is prepared post the preparation of the profit and loss account.

- It is normally created by LLCs and partnership firms.

- The appropriation account is considered as a nominal account.

- Clears the distribution of profits among stakeholders.

- The obligations associated with the firm type must be followed.

However, there are records that do not fit into this account. These include entries like commission to managers, rent of the property paid to partners interest on loans for partners, etc.

In the appropriation account, salary and commission to partners, dividend payments, reserve payments, interest on capital, distribution, and transfer of the profits, are debited. On the contrary, interest on withdrawals and net profit getting transferred from profit and loss accounts, are credited to these accounts.

Format

Below is the format of the profit and loss appropriation account.

P&L Appropriation A/C for the Year Ended 31/12/XXXX

| Particulars | Debit Amount ($) | Particulars | Credit Amount ($) |

|---|---|---|---|

| Transfer to Reserves | XXXX | Net Profit (P&L) | XXXX |

| Interest on Capital | Interest on Drawings | ||

| - Partner A | XXXX | - Partner A | XXXX |

| - Partner B | XXXX | - Partner B | XXXX |

| Salary to Partner | XXXX | ||

| Commission to Partner | XXXX | ||

| Net Profit Transferred to Partner's Account | |||

| - Partner A | XXXX | ||

| - Partner B | XXXX | ||

| Total | Total |

Following are the adjustments/items included in this account:

- Net Profit: This is the opening balance of appropriation a/c. This balance is taken from Profit & Loss a/c after making all the necessary adjustments for the period.

- Interest on Capital: The expense for the company as a partner will be paid interest on the amount of capital invested in the business.

- Interest on Drawings: It is an income for the company. The company will charge interest from the partner on any amount of capital withdrawn during the year.

- Partner’s Salary: It is pre-agreed as per the partnership deed and is an expense for the business.

- Partner’s Commission: It is pre-agreed as per the partnership deed and is an expense for the business.

- Net Profit transferred to Partner’s Account: After making all the above adjustments, this is the final profit amount.

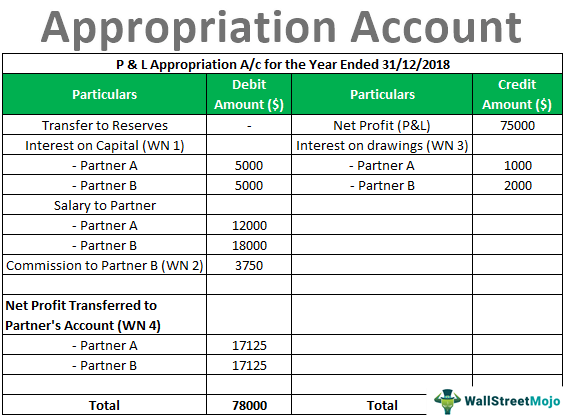

Example

A & B started a partnership firm on 01.01.2017. They contributed $50,000 each as their capital. The terms of a partnership are as under:

- A& B to get monthly salary of $1,000 & $1,500 respectively

- B is allowed a commission at the rate of 5% of Net profit

- Interest on capital & drawings will be 10% p.a.

- Sharing of profit & Loss will be in the ratio of capital sharing.

Before making the above appropriations, the profit for the year ending 31.12.2018 is $75,000. Drawings of A & B were $10,000 & $20,000 respectively. Prepare Profit & Loss Appropriation Account.

Solution

Working

WN 1 Interest on Capital @10% of the Capital Invested

- Partner A = 50000*10% = 5000

- Partner B = 50000*10% = 5000

WN2 Commission @5% of Net Profits

- Partner B = 75000*10% = 3750

WN3 Interest on Drawings @ 10% of Amount of Drawings

- Partner A = 10000*10% = 1000

- Partner B = 20000*10% = 2000

WN4 Net Profit divided among partners in ratio of their capital i.e 50% each

Partner A = (78000-(5000+5000+12000+18000+3750))/2

=17125

Partner B =(78000-(5000+5000+12000+18000+3750))/2

=17125

Importance

An appropriation account has a significant role to play in providing an entity a clear picture of how much money is the profit and how it is to be divided among all. Let us check the importance of this account below:

- This account shows the number of profits divided among various heads.

- It shows the number of profits transferred to reserves and distributed as dividends.

- It gives information on how the profits are divided among partners and how the various adjustments are made during the year.

Recommended Articles

This article has been a guide to Appropriation Account and its meaning. Here, we explain the concept along with the format, example, how to prepare it & importance. You can learn more about financing from the following articles –