Table Of Contents

What Is An Accounting Convention?

Accounting conventions are certain guidelines for complicated and unclear business transactions. While standardizing the financial reporting process, these conventions consider comparison, relevance, full disclosure of transactions, and application in financial statements.

Though it is not compulsory or legally binding, these generally accepted principles maintain consistency in financial statements.

Accountants face specific problems while making financial statements regarding certain business transactions, which are not entirely specified by accounting standards that are addressed by accounting conventions. It is referred to when; there is uncertainty in business transactions and when accounting standards fail to address such issues.

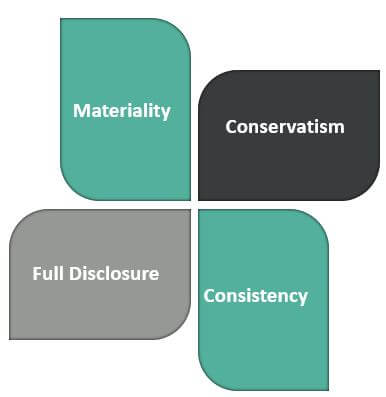

Types of Accounting Convention

#1 - Conservatism

The accountant has to follow the conservatism principle of "playing safe" while preparing financial statements, considering all possible loss scenarios while recording transactions. There are specific points used for criticizing such a principle. Two values occurred while logging assets, i.e., Market value and Book Value. A lower value is generally considered since these conventions consider the worst-case scenario. In some instances, it’s observed that private reserves are being created by showing excess provision for bad debt and doubtful debts, depreciation, etc. And this affects the principle of ‘true and fair status of financial conditions.’

#2 - Consistency

Once a particular method is selected by the business while reporting, it should be followed consistently in the ensuing years. This principle is helpful for investors and analysts to read, understand, and compare the company's financial statements. If the company wants to change the method, it should do so only with good reasons to make specific changes. Certain points criticize this principle, like considering certain items on a cost basis while others at market value void the principle of consistency in accounting. Still, accounting convention considers consistency in reporting methods over the years and not consistency with line items in comparison.

#3 - Full Disclosure

Relevant and important information regarding the company's financial status must be revealed in financial statements even after applying the accounting convention. E.g. Contingent Liabilities, and Law Suits against a business should be reported in adjoined notes in the company's financial statements.

#4 - Materiality

Materiality Concept includes the impact of an event or item and its relevance in financial statements. It means materiality allows an accountant to ignore certain principles when items are not material. The accountant must report all such events and items that might influence the decision of investors or analysts. However, the information should be worthy of investigation and should have a higher value than the cost of preparation of statements. E.g., Low-cost assets like stationery and cleaning supplies are charged under expense account instead of regular depreciating assets. Such issues have very little importance..

Examples

- If Company built a plant worth $250,000 10 years ago, it should remain as per book value even today.

- Revenues for the firm are recorded only after realization while Expense, loss, a contingent liability, is recorded as soon as it occurred.

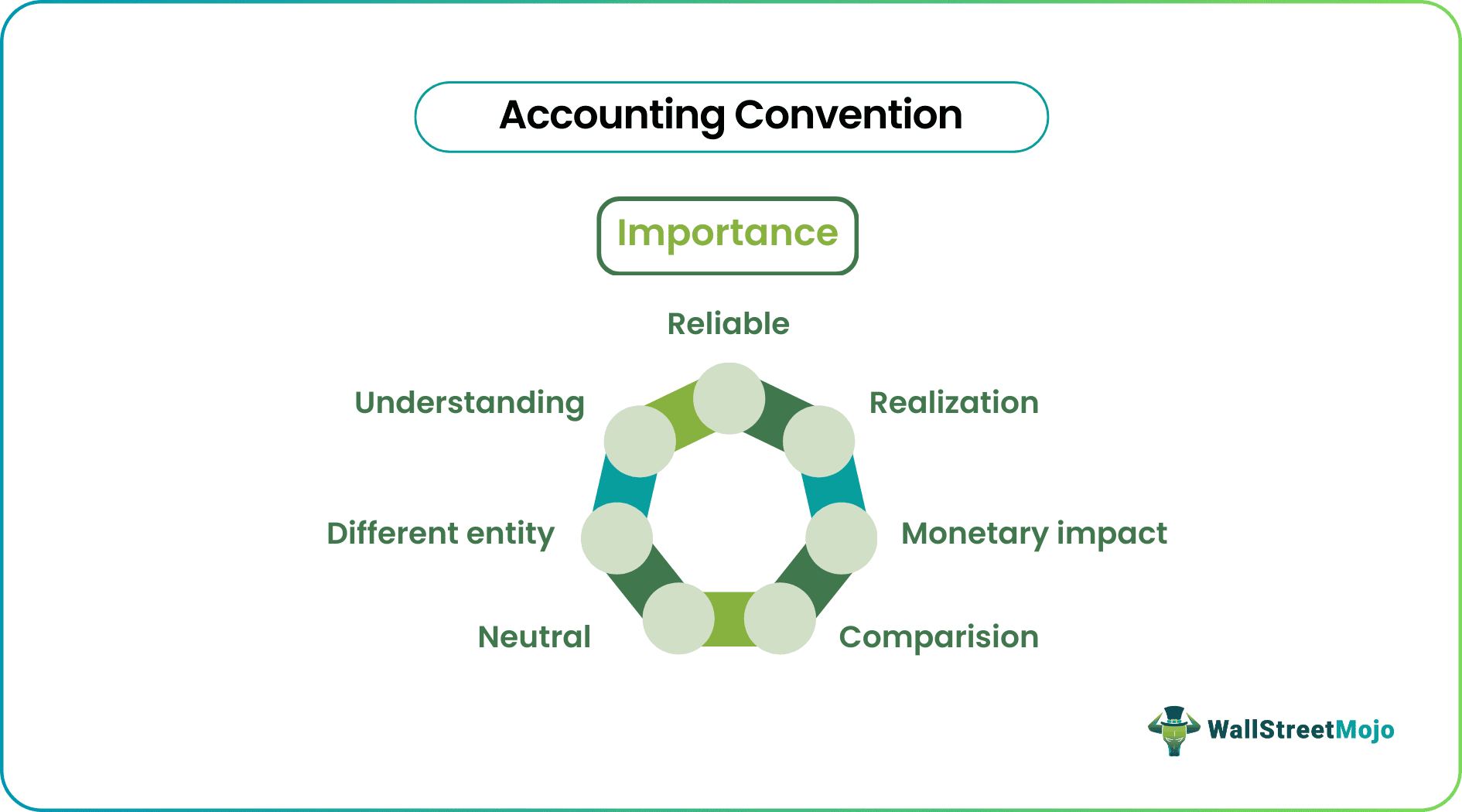

Importance

- Monetary Impact: Accounting considers only items and events with monetary value. Items such as Market leadership, management efficiency, skills are not considered in accounting as it does not directly reflect the financial impact on business.

- Different Entity: Accounting convention ensures that owners' private transactions should not interfere with business transactions. Since businesses and owners are treated as two separate legal entities by law, this should be followed in business.

- Realization: Convention concentrates on the completed transaction. Transfer of ownership or sale of an asset or product should not be considered at the point of contract but when the entire process completes.

- Understanding: There should be clarity of information in financial statements so that investors or analysts who read them must understand such data.

- Comparison: Many Investors and analysts compare the company's financial statements with their peers to analyze performance over a period. They make sure any information reported is in a way that will make it easy for investors.

- Reliable: They ensure reliable information is segregated and reported in financial statements.

- Neutral: They state that the accountant should make financial statements with no stake in a company or a biased opinion.

Advantages

- Credibility: Financial Statements prepared according to accounting standards and conventions are much more reliable and accurate. It increases the confidence of investors. The following specific methods disclose relevant information.

- Planning and Decision: It provides enough information regarding financial data.

- Easy to Compare: Accounting conventions ensure that multiple companies report the transaction in the same manner as described. Thus making it easy for investors, creditors, and analysts to compare the performance of peer groups of companies.

- Efficiency: Accounting standards and conventions provide efficiency in the reporting process, making it easier for an accountant. Even users of such financial statements benefitted as such standards are applicable and followed by all companies.

- Management Decisions: They help management make important decisions that affect business. E.g., the Prudence concept makes sure revenues are recorded when realized, but liabilities and expenses are recorded as soon as they occurred.

- Reduce Fraud: It is guidelines for certain business transactions, which are fully explained by accounting standards. Although not legally binding, accounting conventions make sure that financial statements provide relevant information in a particular manner.

- Reduce Wastage and Save Time: Accounting conventions like materiality makes sure that financial statements record all items and events worth value. This convention helps the accountant to ignore certain principles and concentrate on relevant items.

Disadvantages

- Uncertainty: Many accounting conventions don’t wholly explain concepts or transactions recorded in financial statements. They are thus making it easy for management to manipulate specific figures through the accountant, e.g., Provisions for bad debt and depreciation.

- Lacks Consistency in Different Line Items: Assets and income are recorded at cost and when a transaction completes, while liability and expenses are recorded as soon as it occurs. They operate with worst-case scenarios, which might not reflect actual information about the company.

- Manipulation: Although they are designed to avoid manipulation, many times, these conventions help the management of the business to manipulate specific financial data through the reporting process, which shows a different picture of a company’s financial status.

- Estimates: Certain accounting estimate might not show a clear picture of the financial data of the company.

Conclusion

Accounting conventions are designed to resolve the issue of certain transactions through guidelines that are not adequately addressed by accounting standards. These conventions help many companies efficiently report their financial data. At the same time, it makes certain financial statements have all relevant information for the benefit of investors.

Though this convention helps management to manipulate specific figures in financial statements, it also helps in the smoothening reporting process of a company. It makes sure relevant information is disclosed in financial data or adjoined notes. For an investor, it is essential to go through all the information before making any decision. Usage of these conventions reduces as accounting standards are developed over time and increase the level of details and answers to questions.