Table Of Contents

What Are Accounting Rules?

Accounting rules refer to the set of regulations to follow while recording day-to-day transactions for accurate accounting process. These guidelines help keep the accounting format uniform and help businesses have their data stored and presented in a proper structure. This makes locating information and retrieving the required accounting information easier, saving a lot of time.

The basic accounting rules are different from the accounting principles, which comprise a set of rules to follow while reporting financial data to internal and external stakeholders. When the accounting principle and rules are obeyed, the presentation of the financial information related to an organization is up to the mark, helping the management make better decisions. With the rise of AI in accounting, these practices are becoming more streamlined and efficient. Speaking of AI in accounting, another integration that you can consider is an AI business card generator to refresh your accounting business cards as a physical touchpoint with your clients and business partners.

- Accounting rules refer to the set of guidelines that companies must follow to record transactions, making them easy to read and access for effective decision-making.

- When the rules are followed for proper accounting, the accounts maintained remain uniform and consistent.

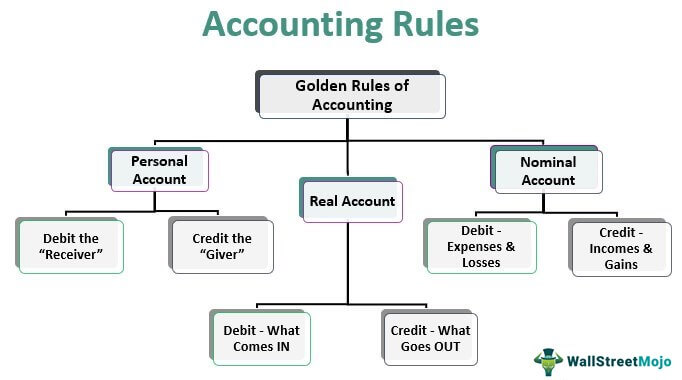

- The traditional rule of accounting revolves around debiting and crediting three accounts – real, personal, and nominal.

- The modern accounting rule revolves around debiting and crediting six accounts –asset, liability, revenue, expense, capital, and withdrawal.

Understanding Accounting Rules

Commonly known as golden accounting rules, these revolve around two accounting concepts – debit and credit. In a double-entry accounting system, both these sides are equally and oppositely affected. When the rules are followed for proper accounting—whether in a corporate setting or an accounting firm—the accounts maintained remain uniform and consistent.

A debit is an entry made on the left side of an account, while credit is an entry made on the right side for effective accounting and finance analytics. The former witnesses an increase in an asset or expense account while a decrease in revenue, liability, and equity accounts. Credits, on the other hand, are complete opposites, i.e., a decrease in an asset or expense account while an increase in revenue, liability, and equity accounts.

Before elaborating on the accounting rules, it is vital to explore the types of accounts that build the foundation of these golden guidelines. These include real accounts, personal accounts, and nominal accounts. A real account is a general ledger account involving data related to assets and liability. These accounts do not close at the end of the year and are carried forward. A bank account is a form of a real account.

Next is the personal account, which is a personal depository for individuals, companies, and other associations. A creditor account is an example of this type of account. On the other hand, there is a nominal account, the third type of account. It is related to recording all income, gains, losses, and expenses. An interest account is an example of this form of account.

Golden Rules of Accounting

For any amateur to start with accounting, there are three golden accounting rules that they must be aware of. Each connects with specific types of accounts mentioned above. So, let’s have a look at them:

Rule No. 1

The first applies or is linked to personal accounts. The personal accounting rules say:

- Debit the receiver

- Credit the giver

Rule No. 2

The second one applies or is linked to real accounts. The real accounting rules state:

- Debit what comes in

- Credit what goes out

Rule No. 3

The third rule is for the nominal accounts. The nominal accounting guideline says:

- Debit all expenses and losses

- Credit all incomes and gains

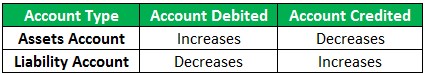

Modern Accounting Rules

While traditional rules revolved around three accounts – real, personal, and nominal, the modern version classifies the accounts into six types, making the transactions split into these categories, affecting the debit and credit sides. These accounts include asset, liability, revenue, expense, capital, and withdrawal.

The table below shows how it works:

| Account Type | Debit | Credit |

| Asset | Increases | Decreases |

| Liability | Decreases | Increases |

| Revenue | Decreases | Increases |

| Expense | Increases | Decreases |

| Capital | Decreases | Increases |

| Withdrawal | Increases | Decreases |

Examples

Let us consider the following examples to see how the concept works:

Example 1 – Golden Rules

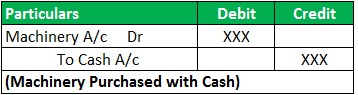

X purchases machinery using cash. Two accounts are involved in this transaction – an asset (machinery) account and a cash account, which fall under the real account. Therefore, the journal entry will be made based on the following rule:

Debit – What Comes IN – Machinery (asset)

Credit – What Goes OUT – Cash

Journal Entry

Example 2 – Modern Rules

Let us consider a different scenario for the same example and assume X purchases the machinery using a bank loan. Here, the machinery is an asset, and a loan is a liability. Thus, the journal entry will follow the modern law of accounting:

Modern Rule

Journal Entry

Importance

One of the major objectives of following these rules is to offer organizations around the world a uniform format to define and store transactions, making it easier for businesses to have a ready reference available for effective decision making. In addition, these guidelines let users know how to treat their accounts and financial information. Of course, uniformity and consistency are maintained while recording transactional data.

The uniform structure makes the financial data presentable, making it easy to read and understand. As a result, any mistake or error is quickly identified and rectified.

Frequently Asked Questions (FAQs)

Golden Rules of Accounting comprise a set of regulations for recording day-to-day transactions in the double-entry accounting system. Here, each transaction affects two sides (debit and credit sides) equally and oppositely. These rules help organizations maintain uniformity and consistency when it comes to recording, storing, and referring to transactional data.

The rule to be applied is decided based on the type of account being handled. For example, if it is a personal account, the receiver is debited, and the giver is credited. On the other hand, if it is a real account, something that comes in is recorded on the debit side, and something that goes out is recorded on the credit side.

The guidelines that are traditionally followed are referred to as the golden rule of accounting or UK rules. On the other hand, modern rules are synonymous with American rules.

Recommended Articles

This is a guide to what are the Accounting Rules and their importance. Here, we also explain the golden and modern accounting rules with examples. You can learn more about financial analysis from the following articles –