Table Of Contents

What is 2/10 Net 30?

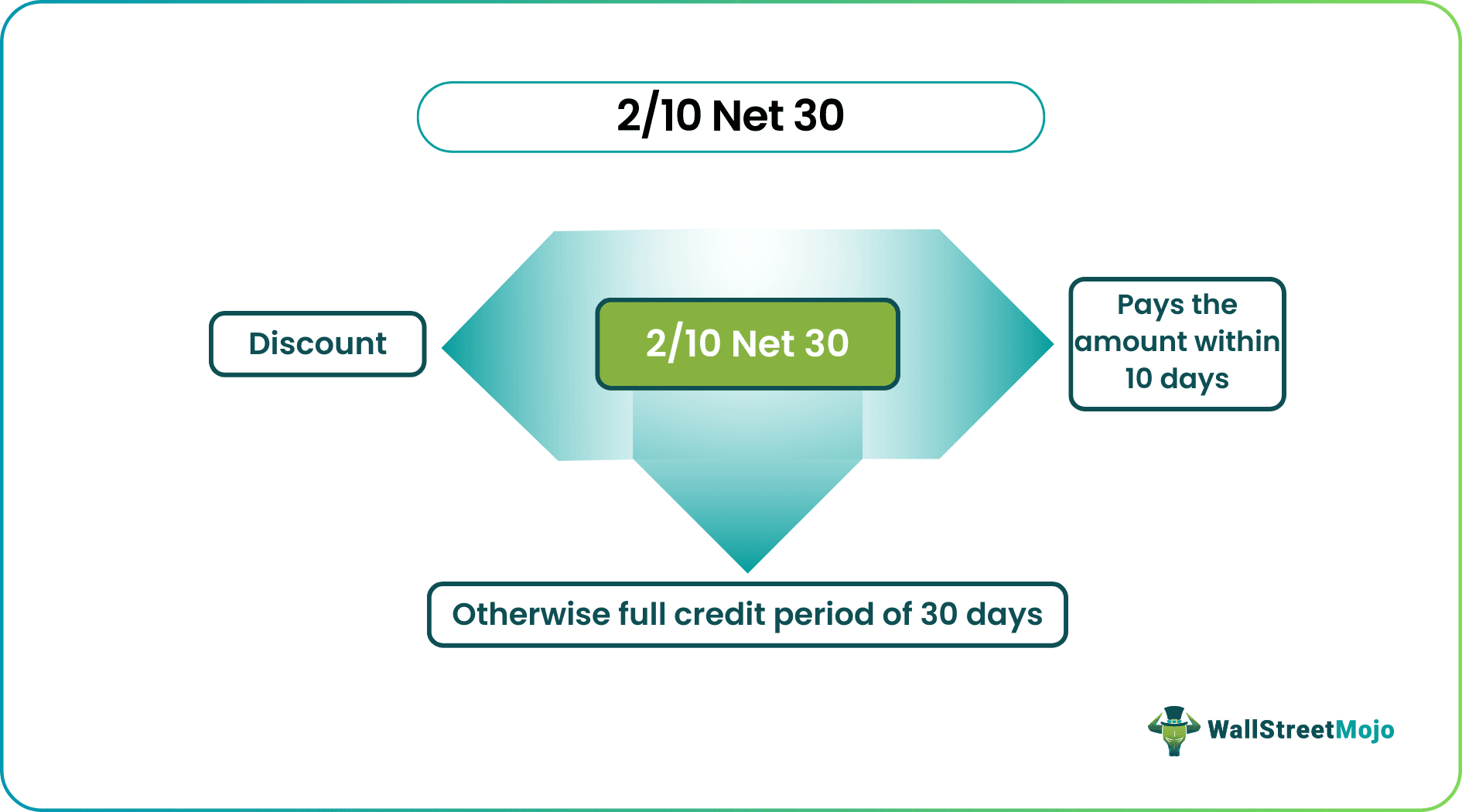

The term 2/10 net 30 means the supplier or seller will give an additional 2% discount to the purchaser if the purchaser pays the due amount within 10 days from the date of purchase instead of taking a full credit period of 30 days. For example, if someone has purchased goods costing $100 from a store and paid within 10 days of purchase, he has to pay only $98. Else, he is liable to pay $100 within a total period of 30 days.

In other words, generally can be seen that the supplier gives some credit period to the purchaser to pay the dues. So, to recover those dues earlier, this scheme came to light, and the supplier may offer an additional 2% discount to the purchaser for early payment of dues.

Key Takeaways

- 2/10 net 30 are trade conditions where the buyer receives a 2% discount from the seller on the net amount if they make the payment in full within 10 days of the bill date.

- Net 30 concepts do not have the same privilege as 2/10 net 30.

- Established and recognized organizations use the net 30 concepts and fear losing customers. It provides an additional 2% for increasing the customer base.

- It makes it difficult for business operations to survive and manage during economic crises.

How to Calculate 2/10 Net 30?

Calculate the total amount of receivables on which we want to calculate the amount of discount to be given.

Calculate the amount of discount to be given using the below-mentioned formula if the payment is made within 10 days by the purchaser:

Discount = Total amount of receivables * Percentage of discount, i.e., 2%Finally, the formula for 2/10 net 30 is as follows: -

Amount to be received if paid within 10 days = Total amount of receivables calculated in step 1 above – the discount amount to be given as calculated in step 2 above. Mathematically, it is represented as:

2/10 Net 30 = Total Receivables – Total Discount

Examples of 2/10 net 30

Example #1

ABC Inc. sold materials costing $100,000 on 2/10 net 30 on April 1, 2020, to Mr. X. Now, ABC Inc. wants to know the difference in the number of receivables in both the situations, i.e., exercising the option of payment within 10 days and not exercising the possibility of early payment discount. The calculation of both the cases using the steps mentioned above is as follows: -

Solution:

Step 1: Calculate the total amount of receivables, i.e., the cost of materials of $100,000.

Step 2: Calculate the amount of discount if the payment is made within 10 days by the purchaser:

Discount = $100,000 * 2 = $2,000.

Step 3: Amount to be received if paid within 10 days:

- = $(100,000 less 2% of 100,000)

- = $(100,000 – 2,000)

- = $98,000.

If the purchaser utilizes a full credit period of 30 days, the purchaser must pay $100,000 within 30 days from the date of purchase to the entity.

Example #2

PQR Inc. sold materials costing $1,500,000, other goods costing $532,500, and some other amounts of receivables of $1,117,500 are also due on 2/10 net 30 on October 1, 2020, to RST Inc. Now, PQR Inc. wants to know the difference in the number of receivables in both the situations, i.e., exercising the option of payment within 10 days and not exercising the chance of early payment discount.

Solution:

The calculation of both cases is as follows: -

Step 1: Calculate the total amount of receivables i.e.

- Cost of materials of $1,500,000

- Other goods of $532,500

- Other receivables of $1,117,500

- Total receivables = $(1,500,000 + 532,500 + 1,117,500) =$3,150,000

Step 2: Calculating the amount of discount if the payment is made within 10 days by the purchaser:

Discount = $3,150,000 * 2 = $63,000.

Step 3: Amount to be received if paid within 10 days:

- = Total receivables – Total discount

- = $3,150,000 – $63,000

- = $3,087,000.

Difference between 2/10 Net 30 and Net 30

- In 2/10 net 30, the purchaser has been provided with an option to pay within 10 days and enjoy an additional 2% discount, but on the other hand, there is no such privilege in the net 30 concepts.

- The concept of net 30 is used by established and renowned organizations that fear losing customers. Still, on the other hand, the additional advantage of 2% is provided to increase the customer base.

Advantages

- The liquid funds of the business are available with the entity for a longer period, so they may easily manage the working capital requirement.

- The entity can also invest and earn short-term returns.

- It helps set new credit standards for the industry in which an entity operates.

Disadvantages

- It creates difficulty for the business to survive or manage its operations when an economy is in a cash crisis.

- Sometimes, the new entrants use this technique to grab potential customers by providing higher early payment discounts without analyzing the long-term impact.

- Sometimes, it gives a bad impression of an entity in the customer's mind that they are in the position of a liquidity crunch or want to liquidate their business very soon by recovering all the outstanding from the market.

Conclusion

2/10 net 30 is a concept generally used in industry where the working capital requirement is usually high, and the funds are required daily to manage the day-to-day operations. It is used to recover trade payables at the earliest by giving early payment discounts, which generally cost less than the cost of funds otherwise used by an entity to manage its working capital requirement.