The significant differences between the two concepts are as follows:

Table of Contents

What Is Proof Of Cash?

Proof of cash is a bank reconciliation containing balances for the current period and the prior period. It also reconciles the disbursements and book receipts for the respective periods with the bank statements. This serves the purpose of providing evidence.

It is also called two-day reconciliation, as two dates, the beginning and ending periods, are recorded. This method reconciles revenue and expenses apart from recording the beginning and ending cash. One of the advantages of reconciling revenues and expenditures is that it provides room for faster and easier identification of errors. This makes the error-omission and rectification process easier.

Key Takeaways

- Proof of cash is a bank reconciliation containing balances for the current period and the prior period. It also reconciles the disbursements and book receipts for the respective periods with the bank statements.

- The proof can reveal attempts of fraud, and discrepancies in the sums can be due to improper borrowing and repayments recorded.

- POC differs from cash reconciliation as the latter is defined as a statement of accounts that contrasts the cash amounts per book and the cash amounts displayed on the bank statement.

Proof Of Cash Explained

Proof of cash (POC) is a method of reconciliation of the cash balances in the general ledger, recorded at the beginning and end of periods. It works on reconciling checks through cash disbursements and cash receipt journals by reconciling the cash deposited during the period.

It can be described as a roll-forward of line items in a bank reconciliation recorded during one accounting period to the next. The POC records cash receipts and disbursements in separate columns for convenience and is, therefore, more complicated than recording simple bank reconciliation. It provides better attention to detail and thus makes it easier to identify errors than in bank reconciliation. The method, therefore, can be cost-effective and time-efficient while checking for cash-related errors, especially in large numbers over a particular accounting period.

The proof of cash analysis can reveal attempts of fraud. A discrepancy in the sums can be due to improper borrowing and repayments recorded in the period by a single bank statement. The POC is a tool that identifies places where there are inconsistencies when applied to bank reconciliation. It thus helps call for more inquiries and correct entries. Some examples of discrepancies include not recording bank fees, interest income, or expenses. It involves not deleting "insufficient funds" from deposit records, cashing checks voided by clients, making cash disbursements, and recording receipts in the wrong accounts.

Similar to what might be observed in a bank reconciliation, the initial and final balances are almost identical. However, there are differences. In this method, the reconciliation between the client's cash receipt records and the bank's record of deposits is done in the cash receipts column. The cash disbursements column, on the other hand, reconciles the client's cash disbursement records with the bank's paid check records.

Examples

Let us look at some examples to comprehend the concept better:

Example #1

Dave is an accountant at the XYZ firm; he discovered that the company's employee tried to withdraw $50000 from the company's accounts without authorization. The employee withdrew the money for personal use at the beginning of the month and intended to replace the amount by the end of the month. The problem wouldn't show up as a reconciling item in a typical bank reconciliation. However, POC will detect cash withdrawals and returns. The employee did this, knowing that the auditors might catch their actions as part of their year-end procedures, and chose a shorter period to remain undetected. Therefore, if the auditor wants to look for specific fraud cases, they can use POC from the previous month.

Example #2

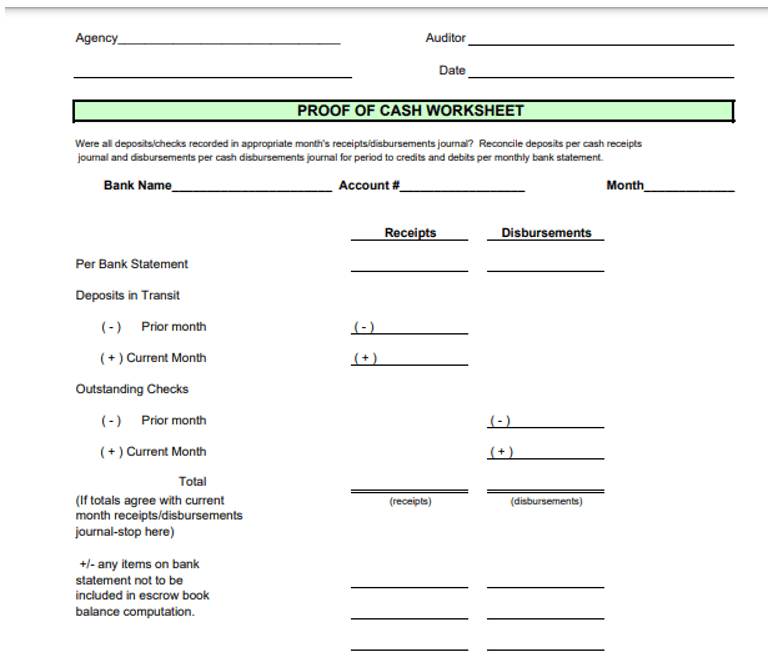

Above is a picture of the Texas government's proof of cash template. The image contains two columns, receipts and disbursements, where deposits and outstanding checks are recorded. Two values are recorded for deposits in the prior and current month; outstanding checks are also recorded for the prior and current month. The simple layout contributes to easy recording and identification of errors.

Proof Of Cash Vs. Bank Reconciliation

| Parameters | Proof Of Cash | Bank Reconciliation |

|---|---|---|

| 1. Concept | A POC is an expansion of the reconciliation that records the initial balance of cash in the bank, the receipts and disbursements for the current period, and the ending balance of cash in the bank. | It is a statement of accounts that compares the cash balances shown on the bank statement with the cash balances per book (the depositor's record). |

| 2. Recording | Although it could take longer, the POC offers more information and makes it simpler to identify mistakes than the typical reconciliation. | Bank reconciliation statements are more detailed than cash proofs. |

| 3. Ease of error detection | POC recording may be time-consuming, but checking it later becomes easy since it is done with so much effort. As a result, it saves time when looking for inconsistencies. | Bank reconciliation statements need more time to find discrepancies. |